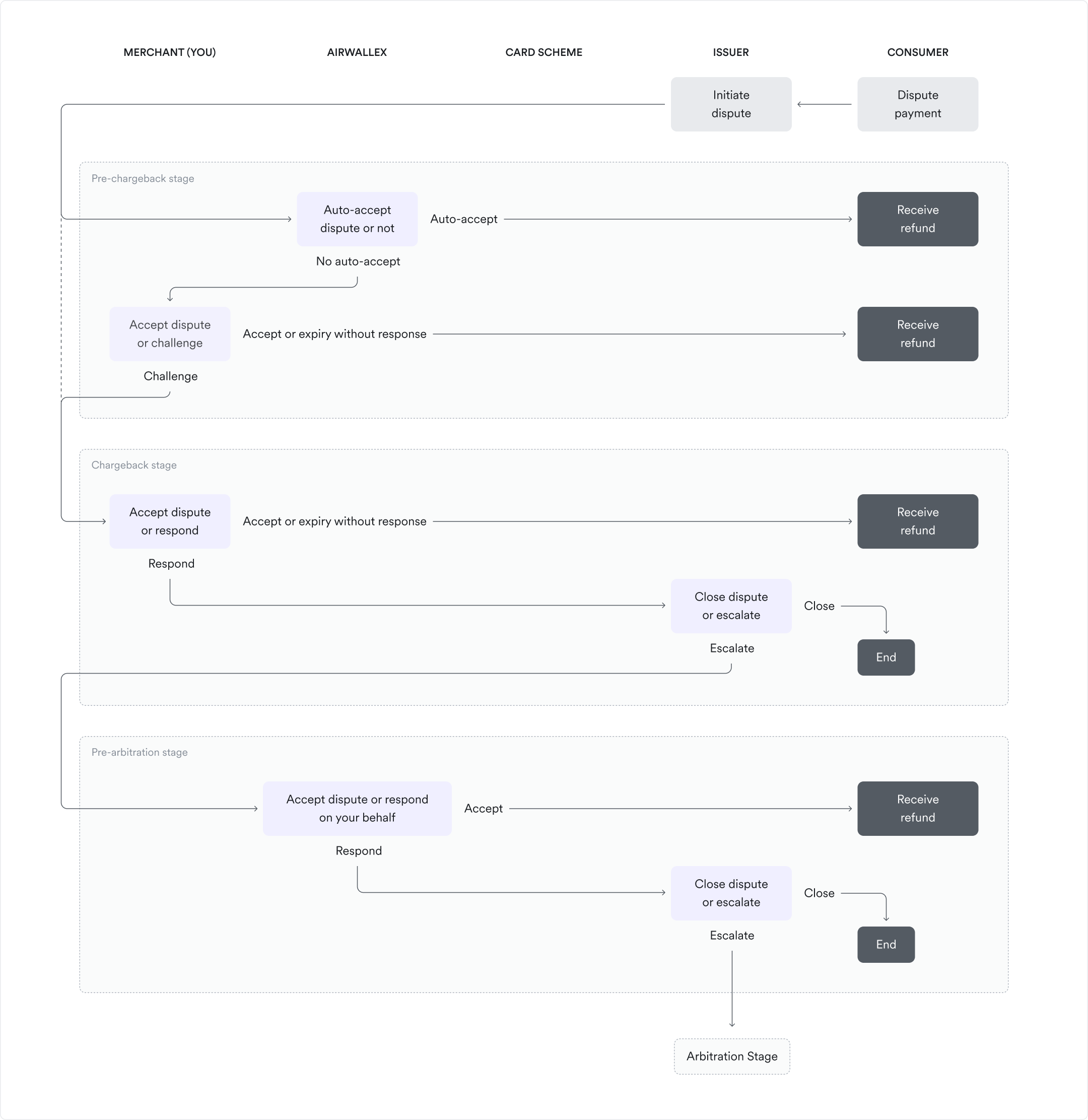

Dispute flow

Disputes on card based payment methods can go through different stages and statuses. The process can vary slightly for different card schemes or scenarios, but most commonly will follow the standard flow below.

Standard flow

Pre-chargeback stage

Airwallex auto-accepts the dispute on your behalf before they enter the chargeback stage. You can read more about pre-chargeback programs here.

Note

This is only relevant if your account is enrolled in pre-chargeback programs.

Please note that not all disputes go through the pre-chargeback stage. You may find disputes directly entering the chargeback stage, such as Visa disputes above a predefined threshold value (the auto-accept threshold) or disputes from card schemes or issuing banks who don't support pre-chargeback programs. During the pre-chargeback stage, a dispute can have one of the following statuses:

- Requires response

- Accepted

- Challenged

- Reversed

Requires response

In this status, you can decide whether to accept or challenge the dispute. Available actions:

- Accept the dispute - The disputed amount will be deducted from your next settlement batch and will be refunded to the shopper. You will incur a pre-chargeback resolution fee, but avoid other chargeback fees (which are typically higher).

- Challenge the dispute - We will let the issuing bank know that you'd like to challenge the case. The issuing bank will escalate to the chargeback stage in the following days, at which time you will see this case re-appear in your dispute response queue and will be able to submit supporting evidence. Please note that you will at that point also incur a chargeback fee.

Timeframe You have 65 hours after the dispute was received to take one of the actions above. If no action has been taken within 65 hours, the dispute will automatically be accepted.

Accepted

In this status the dispute has been accepted and the payment will be refunded to the shopper. You may find a dispute in this status if:

- You accepted the dispute via web app or API

- Airwallex auto-accepted the dispute on your behalf, based on pre-chargeback thresholds configured for your account.

- In such case the dispute will have ‘Auto-accepted by Airwallex'' noted as the accept reason

- The dispute expired (i.e. you did not make a decision within the given timeframe). In such case, the dispute will have "Expired” noted as the accept reason.

Please note that this status is final and you won't be able to overturn the dispute.

Challenged

In this status, we have informed the issuing bank that you would like to challenge the dispute. The issuing bank will escalate to the chargeback stage in the following days, at which time you will see this case re-appear in your dispute response queue and will be able to submit supporting evidence.

Reversed

In this status, the pre-chargeback has been reversed by the issuing bank. No further action is required.

Chargeback stage

When a dispute enters chargeback stage, the card scheme will immediately debit Airwallex for the disputed amount and related dispute fees. Airwallex in turn will deduct the disputed amount, plus a chargeback fee, from your next settlement. You can then choose to accept the dispute or challenge it by responding with supporting evidence.

During the chargeback stage, a dispute can have one of the following statuses:

- Requires response

- Accepted

- Challenged

- Won

- Reversed

Requires response

In this status, you can decide whether to accept or challenge the dispute. Available actions:

- Accept the dispute - The disputed amount will be refunded to the shopper.

- Challenge the dispute with supporting evidence - We will submit the supporting evidence to the payer's issuing bank for their review. The disputed transaction amount will be credited back to your wallet with your next settlement.

Please note, that the payer's issuing bank may escalate the dispute to pre-arbitration stage if it is not convinced of the legitimacy of the payment based on your evidence. In that case, the disputed amount will again be deducted from your next settlement and you will incur a pre-arbitration fee.

In some cases responding to a dispute in chargeback stage will directly escalate it to pre-arbitration stage. In such cases the disputed amount will only be credited back if the dispute is won and you will only be charged a pre-arbitration fee if the dispute is lost. You can find more details on this in the section Pre-arbitration initiated through response in chargeback stage below.

Timeframe You have 15 days after the dispute was escalated to the chargeback stage to take one of the actions above. If no action has been taken within 15 days, the dispute will automatically be accepted.

Accepted

In this status the dispute has been accepted and the payment will be refunded to the shopper. You may find a dispute in this status if:

- You accepted the dispute via web app or API

- The dispute expired (i.e. you did not make a decision within the given timeframe).

In such case, the dispute will have "Expired” noted as the accept reason.

Please note that this status is final and you won't be able to overturn the dispute.

Challenged

In this status, we will respond to the issuing bank with evidence provided by you. The issuing bank will review your submitted evidence and decide whether to further escalate the dispute or not.

Timeframe The issuing bank has up to 115 days after your response to escalate the dispute.

Won

In this status, the issuing bank has accepted your response by not further escalating the dispute within 115 days. No further action is needed, as this status is final for all participants.

Please note that the chargeback fee remains non-refundable in such cases.

Reversed

In this status, the chargeback has been reversed by the issuing bank. No further action is required. Transaction amount will be credited back to you in the next settlement batch if you hadn't previously responded to the dispute.

Pre-arbitration stage

When a dispute enters pre-arbitration stage, card schemes will debit Airwallex when Pre-arbitration is accepted with the exception of JCB, JCB will immediately debit acquirer and related dispute fees. Airwallex in turn will deduct the disputed amount, plus a pre-arbitration fee, from your next settlement.

During the pre-arbitration stage, a dispute can have one of the following statuses:

- Pending Closure

- Accepted

- Challenged

- Won

- Reversed

Pending Closure

In this status, the issuing bank has escalated the dispute to pre-arbitration stage and Airwallex is reviewing the dispute. Airwallex will decide whether to accept the dispute or respond to it on your behalf and may reach out to you for more information. In most cases, Airwallex will accept the dispute on your behalf in order to help you avoid further fees that can reach up to 500 USD.

No funds movement at this point.

Payments using JCB If a payment is processed with card brand JCB and the issuer escalates to a second chargeback then it will be handled as Pre-arbitration at Airwallex.

Accepted

In this status, the dispute has been accepted by Airwallex on your behalf and the payment will be refunded to the shopper.

Please note that this status is final and you won't be able to overturn the dispute.

Funds will be debited from your wallet in the next settlement batch

Challenged

In this status, Airwallex has responded to the dispute with additional evidence on your behalf. The issuing bank will review the evidence and decide whether to accept the response or not.

Won

In this status, the issuing bank has accepted the response provided. The disputed transaction amount will be credited back to your wallet with your next settlement.

No further action is needed, as this status is final for all participants.

Please note that the pre-arbitration fee remains non-refundable in such cases.

Reversed

In this status, the pre-arbitration has been reversed by the issuing bank. The disputed amount will be credited back to your wallet with the next settlement. No further action is required.

Less common dispute stages

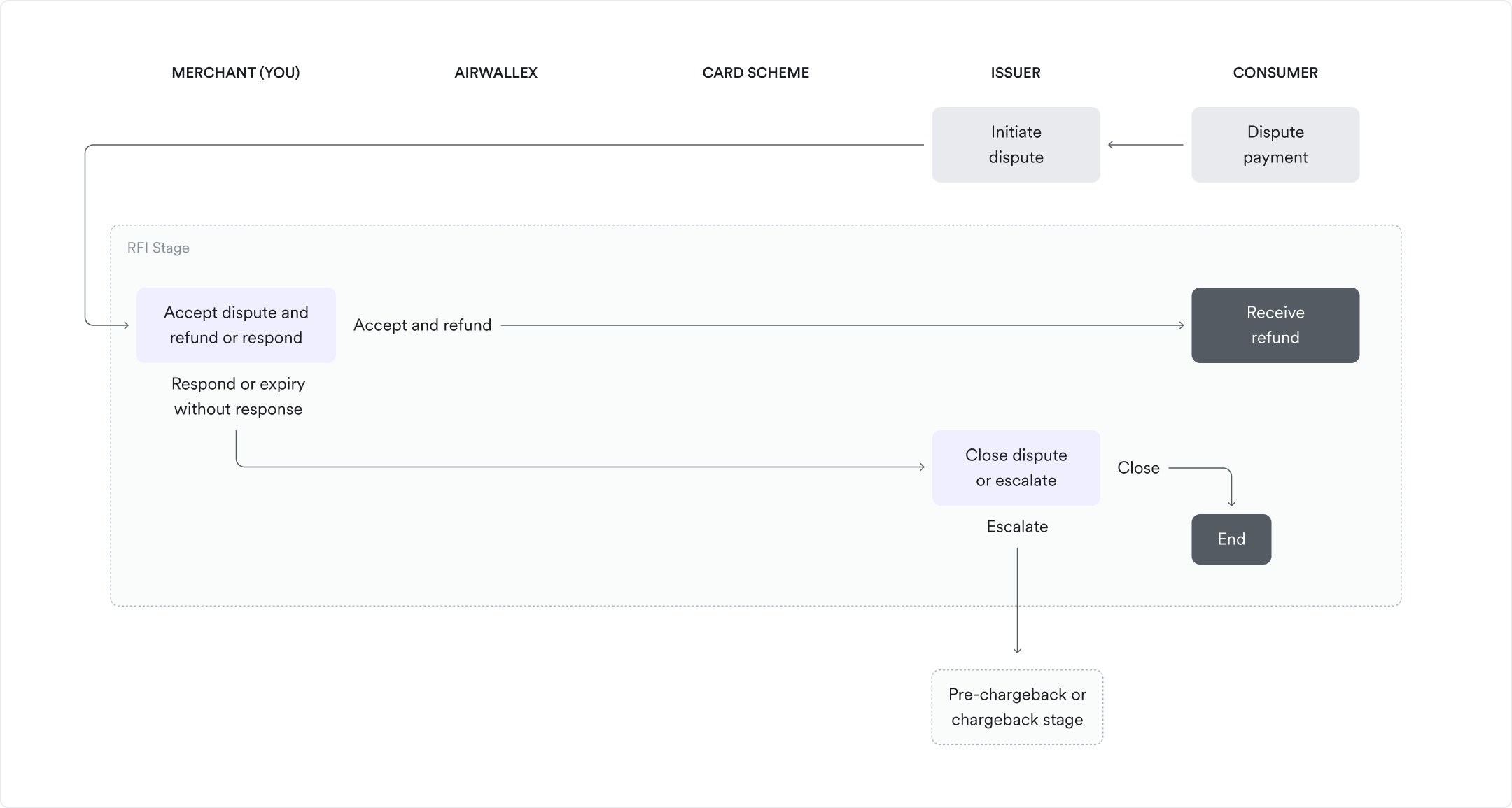

Request for Information (RFI) stage

The RFI stage precedes the pre-chargeback/chargeback stages. It is no longer used by Visa/ MasterCard, but for transactions on other card brands you may still receive RFIs.

You will receive an RFI when the shopper cannot recognize the payment or does not agree to be charged, seeking further information about this payment. In order to help the shopper recognize the payment and avoid further disputes, you should provide sufficient information about this payment to claim the legitimacy of the payment.

During the RFI stage, a dispute can have one of the following statuses:

- Requires response

- Challenged

- Accepted

- Expired

Requires response

In this status, you can decide whether to accept and refund the payment transaction or provide the issuer with complete detail of the transaction to avoid further escalation into pre-chargeback or chargeback.

Available actions

- Accept the dispute - We will let the issuing bank know that you will refund the transaction. Please note that the transaction is not automatically refunded and that you will need to initiate the refund yourself. If the refund is not completed or only a partial amount is refunded, the issuing bank may still escalate the dispute to pre-chargeback or chargeback stage. You will be charged a refund fee when initiating the refund, but no dispute related fee.

- Respond to the dispute - We will submit the supporting evidence to the payer's issuing bank for their review.

Please note, that the payer's issuing bank may escalate the dispute to pre-chargeback or chargeback stage if it is not convinced of the legitimacy of the payment based on your evidence.

Timeframe You have 15 days after the dispute was received to take one of the actions above. If no action has been taken within 15 days, the request for information will expire and the issuing bank may escalate to pre-chargeback or chargeback stage.

Challenged

In this status, we will respond to the issuing bank with evidence provided by you. The issuing bank will review your submitted evidence and decide whether to escalate the dispute or not.

Accepted

In this status, we will let the issuing bank know that you will refund the transaction. Please note that the transaction is not automatically refunded and that you will need to initiate the refund yourself. If the refund is not completed or only a partial amount is refunded, the issuing bank may still escalate the dispute to pre-chargeback or chargeback stage.

Expired

In this status, the RFI event has expired as you have not responded to the request within 15 days.

The issuing bank may escalate the dispute to the pre-chargeback / chargeback stage. In such case, you will see this case re-appear in your dispute response queue

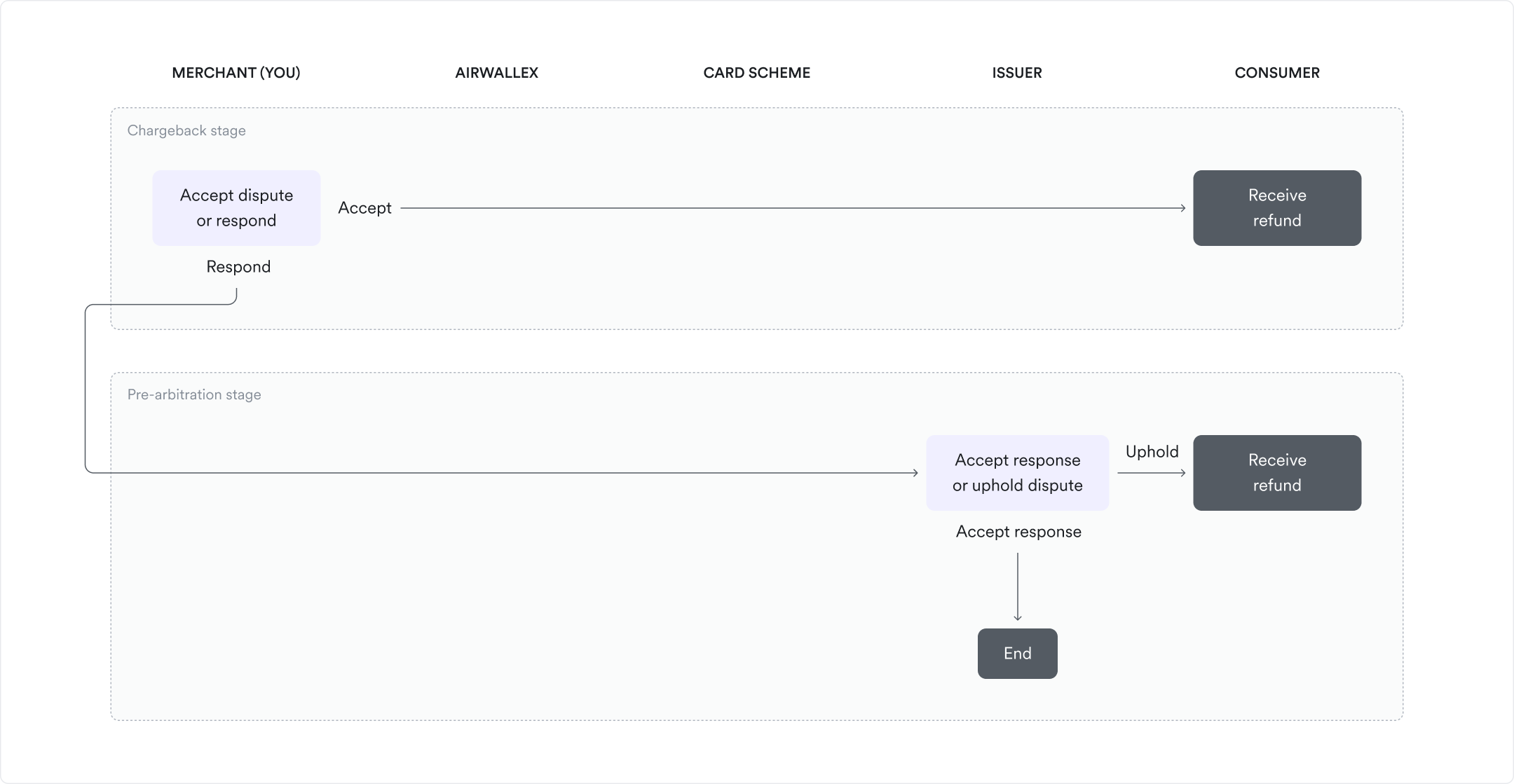

Pre-arbitration stage initiated through chargeback response

In some cases, responding to a dispute in chargeback stage may directly escalate the dispute into pre-arbitration stage. This is applicable to disputes where:

- The card scheme is Visa and the dispute reason is fraud / authorization related

- The card scheme is AMEX

- The card scheme is UPI

In such cases, when you respond to the chargeback we will not immediately credit the disputed amount back to your wallet, but instead wait for the response of the issuing bank to the pre-arbitration. You will also only incur a pre-arbitration fee if you lose the dispute during this stage.

Please find below the details of different statuses of this flow:

- Pending Decision

- Won

- Lost

Pending decision

In this status, we have responded to the issuing bank with evidence provided by you during the chargeback stage or Pre-arbitration stage (applicable only when card scheme is AMEX) . The issuing bank will review your submitted evidence and decide whether to accept the dispute or not.

Timeframe The issuing bank has up to 15 days after your response to decide.

Won

In this status, the issuing bank has accepted the dispute based on the evidence you provided. The disputed amount will be credited back to your wallet with the next settlement.

No further action is needed, as this status is final for all participants with exception of payments collected with AMEX card. In case of AMEX card scheme, a dispute can be reopened upon further feedback from the shopper. Dispute will then move to Requires response status.

Lost

In this status, the issuing bank has not accepted the evidence provided by you. The payment will be refunded to the shopper. You will be charged a pre-arbitration fee.

Please note that this status is final and you won't be able to overturn the dispute.

Requires response

This status is applicable only when the card scheme is AMEX. In this status, the issuing bank has not accepted the evidence provided by you in the chargeback stage. The payment amount will be debited again in the next settlement batch.

- Accept the dispute - The disputed amount will be refunded to the shopper.

- Challenge the dispute with supporting evidence - We will submit the supporting evidence to the payer's issuing bank for their review. The disputed transaction amount will not be credited at this point, we need to wait till the issuer bank review is complete.

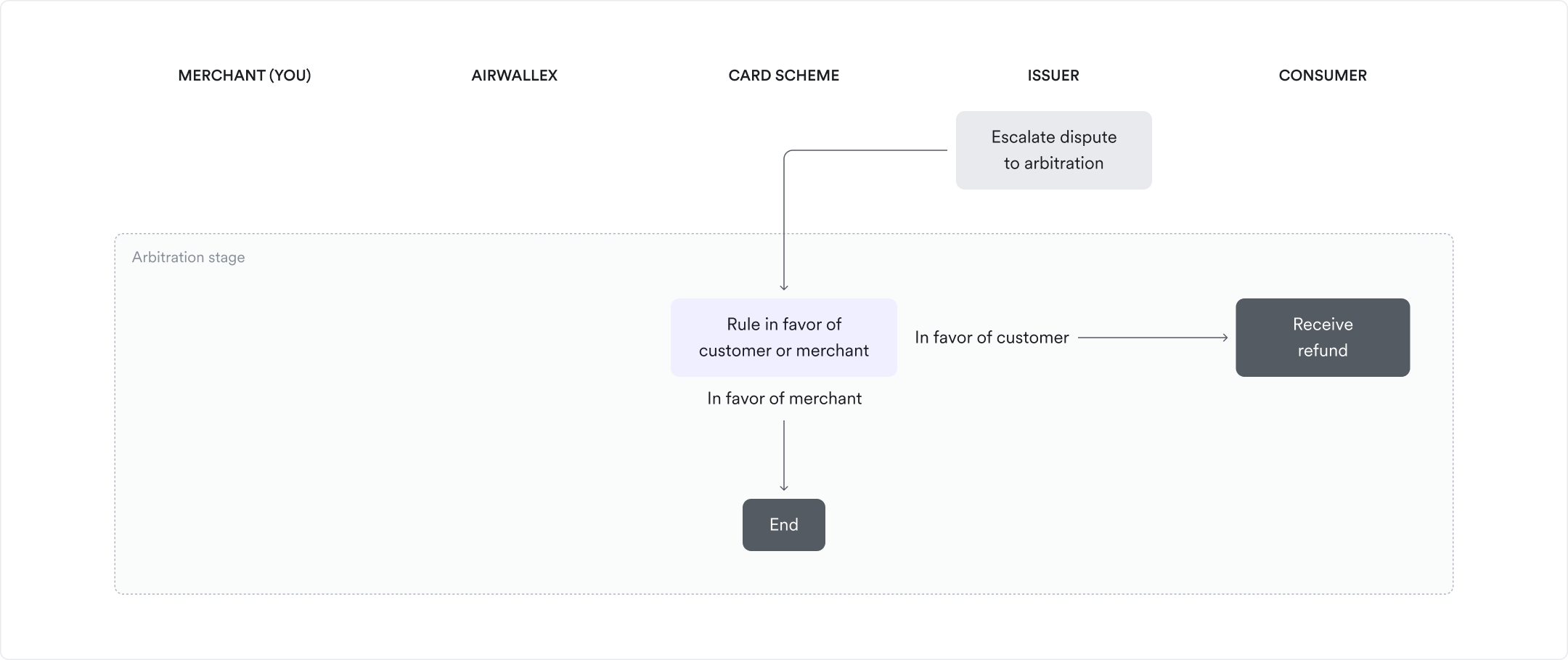

Arbitration stage

A dispute may enter arbitration stage if the issuing bank decides to escalate the dispute despite the evidence provided during chargeback and pre-arbitration stage. At this stage, the card schemes will evaluate all the evidence provided in the dispute exchanges and arrive at a ruling which has to be followed by all parties.

Generally Airwallex will help you avoid this stage, as fees charged to the losing party can go up to 500 USD.

Please find below details on status a dispute can have in this stage:

- Pending Decision

- Won

- Lost

Pending decision

In this status, you are notified that the issuing bank has escalated the dispute to arbitration stage.

No further action is required from your side, the card schemes will decide based on the information that was previously provided.

Won

In this status, card schemes have ruled the dispute decision in your favor. You will receive the principal amount in the next settlement batch.

No further fees will be charged to your account.

Lost

In this status, card schemes have ruled the dispute decision in Issuer's favor.

Airwallex will pass on the arbitration fees charged by the card schemes to you. These can be up to 500 USD.

Financial impact of a dispute

As previously discussed, a dispute can go through a series of transitions due to different combinations of stages and statuses. The financial impact on your wallet may vary depending on the dispute stage and status combination. Please refer to the table below to quickly understand when your wallet will be debited/ credited for the principal amount & various dispute fees

| Stage | Status | Dispute amount | Fees |

|---|---|---|---|

| RFI | Accepted | Your wallet will be debited with the amount specified for refund. When accepting a dispute during the RFI stage, you can specify the amount to be refunded | N/A |

| RFI | All other statuses | No financial impact on your wallet` | N/A |

| Pre-chargeback | Accepted | Your wallet will be debited with the dispute amount | Your wallet will be debited with the Pre-chargeback fee |

| Pre-chargeback | Reversed | Your wallet will be credited with the dispute amount | N/A (Please note that pre-chargeback fees will not be reversed) |

| Pre-chargeback | All other statuses | N/A | N/A |

| Chargeback | Requires response | Your wallet will be debited with the dispute amount | Your wallet will be debited for the chargeback fee. Visa will charge an additional un-secure fraud fee on Visa dispute if the dispute reason is "Fraudulent”, which will be debited from your wallet |

| Chargeback | Challenged | Your wallet will be credited with the dispute amount | N/A |

| Chargeback | Reversed | Your wallet will be credited with the dispute amount | N/A (Please note that chargeback fees will not be reversed) |

| Chargeback | All other statuses | No financial impact on your wallet | N/A |

| Pre-arbitration | Accepted | Your wallet will be debited for the dispute amount | Visa/ AMEX/JCB/ UPI: N/A MasterCard: MasterCard charges an additional pre-arbitration fee, which will be debited from your wallet |

| Pre-arbitration | Won | Your wallet will be credited with the dispute amount | N/A |

| Pre-arbitration | Requires response | Your wallet will be debited for the dispute amount. This status is applicable for AMEX card scheme only | N/A |

| Pre-arbitration | All other statuses | N/A | N/A |

| Arbitration | Won | If the dispute amount wasn't credited back to your wallet when you challenged the dispute (e.g. because pre-arbitration was initiated by your response), then your wallet will be credited with the dispute amount. | N/A |

| Arbitration | Lost | Your wallet will be debited with the dispute amount, if the dispute amount was previously credited back to your wallet when you challenged the dispute | Your wallet will be debited with the arbitration fee |

| Arbitration (collaboration mode) | All other statuses | N/A | N/A |