Card data migration

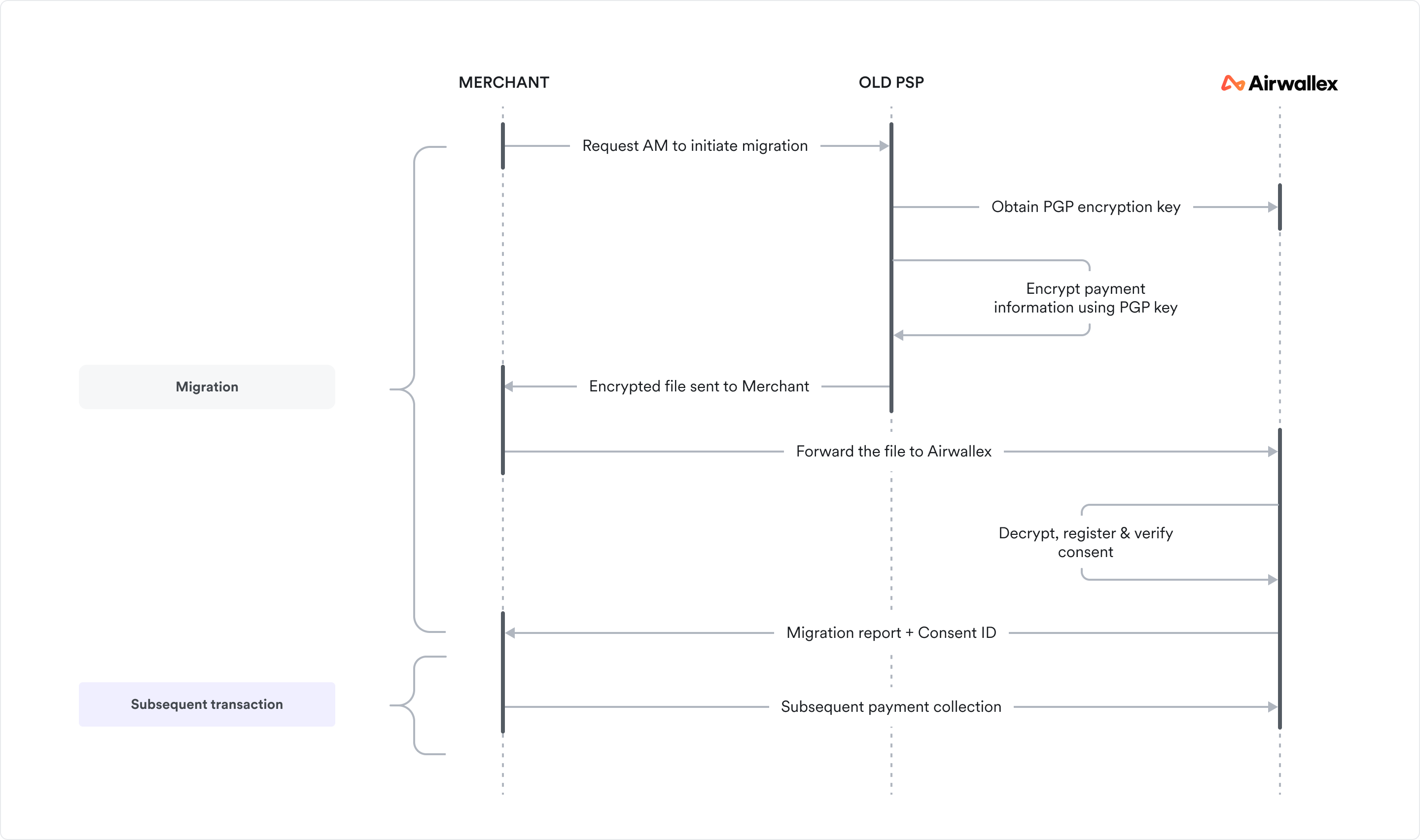

If you are a merchant collecting payments with stored credentials then it is possible that these details are stored with your previous processor. Merchants can easily continue to collect payments following these steps with Airwallex as their new processor:

- Notify current processor

- Receive encrypted file from current processor and share with Airwallex to start migration

- Receive output report from Airwallex (post completion of Migration)

- Continue with subsequent payments collection

Support Matrix

| Card brands | Supported | Region |

|---|---|---|

| VISA | ✅ | Global |

| MasterCard | ✅ | Global |

| AMEX | ✅ | Global |

| DISCOVER / DINERS | ✅ | Global |

| UnionPay | ✅ | Global |

| JCB | ✅ | Global |

Detailed migration steps

- Notify current processor

As a merchant you need to initiate the migration process with your current processor. It is recommended to get in touch with your Account manager directly to ensure that your request is promptly acted upon.

Your current processor will need the details of the new processor to be able to encrypt the export file and validate PCI certifications as per standards, Please share this link with your current Acquirer.

This process can take some time to complete, please ensure to plan your steps to avoid any problems with payments collection during a billing period (Merchant initiated transactions) or with payment processing for consumer initiated transactions.

Refer this link to understand how Stripe enables merchants to migrate their payment information to other processors.

- Receive encrypted file and start with migration

Your current processor will encrypt the payment information using the PGP public key published by Airwallex, export this information into a file format and share it with you. Forward this file to Airwallex for further processing.

Airwallex will decrypt the payment information in the provided file, register payment consent information against the merchant account (merchant should complete KYB process with Airwallex) and verify the card details to complete the migration process.

Airwallex will validate the file for key fields which are required to process subsequent payments without any problems. Below is the list of fields, please ensure that your current processor can provide this information in the export file.

- Customer Identifier : Identified by merchant, it will be used as link with Airwallex generated payment consent ID

- Card identifier : A unique identifier for the card, it will be used to identify specific cards if a customer has more than one stored with you.

- Transaction triggered by : Merchant (MIT) / Consumer (CIT)

- Parent Transaction ID : Initial / previous transaction identifier to establish relationship

- Merchant trigger reason : Scheduled / Unscheduled (Only when MIT)

- Receive migration output from Airwallex

You have two ways to know the status of a card / customer you have requested to be migrated:

Listen to Payment Consent web hooks You can listen to Payment Consent web hooks to be notified when a migration is completed on your customer or card. We will include the key details from input file (referred in step#2), customer_id (as external_customer_id) & card_id (as external_card_id) in the web-hook payload. Please refer this link to understand how to setup web hooks.

- payment_consent.verified You will be notified via this web hook when Airwallex has successfully migrated the card & customer combination. You should use this information to update your billing systems to be able to invoke subsequent payments using Payment consent ID & customer ID generated by Airwallex and provided in this file. Sample payload:

- payment_consent.verification_failed : You will be notified via this web hook when Airwallex was unable to migrate the card & customer successfully. The request was declined by the issuer bank due to invalid / expired card details. You can reach out to your customer for updated payment method details. Sample payload:

Process migration output report Airwallex will share the output report detailing the status of each payment record post completion of the migration process. You should use this file to update your billing systems to be able to invoke subsequent payments using Payment consent ID & customer ID generated by Airwallex and provided in this file.

Format of this output file along with a sample record

| Airwallex consent ID | Airwallex customer ID | Airwallex payment method ID | External Card ID | External customer ID | Migration failure reason | Migration finish time | Is verified |

|---|---|---|---|---|---|---|---|

| cst_nlstxp77zgixdp80oc0 | cus_nlstxp77zgixdp5w78u | mtd_nlsthlzv9gixdp68joz | card_edf214abc789 | cus_abc123def456 | NULL | 2023-03-09T09:45:39 | TRUE |

| cst_nlsthlzv9gixdpg198e | cus_nlstxp77zgixdp5w78u | mtd_nlstxp77zgixdpfy3sq | card_edf214abc222 | cus_abc123def456 | issuer_declined | 2023-03-09T09:45:42 | FALSE |

Any errors or exceptions in the payment details should be managed by the merchant. Example: Account verification failed during the migration process due to expiry of the card. Merchant in this case will find the payment record with status : Verification failed in the output report. Merchant should then reach out to the consumer for updated payment details to be able to continue billing.

- Initiate subsequent payment collection

You can now initiate subsequent payments collection using the key identifiers provided in the output report : Customer ID & Payment Consent ID.

You can find more details on steps to be followed here based on your integration with Airwallex.

FAQs

- Are there any additional charges for this service? Airwallex doesn’t charge merchants using this service.

- How does this migration impact 3DS processing? If you are using Airwallex to process 3DS authentication then there is no impact. 3DS authentication can be triggered based on transaction type (CIT) + Risk assessment result or due to PSD2 SCA mandate (when applicable)

- As a merchant, can we use an external 3DS service provider or an external risk service provider? Yes, this is possible. Please discuss this with your account manager.