ACH Direct Debit

ACH Direct Debit is available for selected customers and use cases. Please contact your Airwallex Account Manager or email [email protected] to get started.

ACH Direct Debit is a popular payment method used in the United States as an alternative to credit and debit cards. The payments are processed via the Automated Clearing House (ACH) which is an electronic network for processing financial transactions operated by Nacha.

Both one-off and recurring payments are supported by ACH Direct Debit. Due to the risk of chargebacks, we only recommend using ACH Direct Debit for recurring scenarios where the payer is a business.

Payment method properties

| Features | ACH Direct Debit |

|---|---|

| Payment method type | Direct Debit |

| Available for businesses registered in | US |

| Activation time for onboarding | Instant |

| Shopper regions (typically used by payers from) | US |

| Processing currencies | USD |

| Settlement currencies | USD or in your default settlement currency if your account does not support USD settlement |

| Settlement schedule | T+2 business days, subject to reserve plans |

| Minimum transaction amount | 1 USD |

| Maximum transaction amount* | 100,000 USD, subject to risk approval |

| Session timeout | NA |

| Recurring Payment | ✅ |

| Refunds | ✅ |

| Partial Refunds | ✅ |

| Disputes (chargebacks) | ✅ |

| Placing a hold (delayed/manual capture) | ⛔ |

| Descriptor (what the payer will see in their transaction history) | Airwallex |

| Payments for Platforms support | ✅ |

* Support for increasing the maximum transaction amount is available on a case by case basis upon risk approval.

Choose the integration method that best suits your needs

Airwallex has built a range of client-side integration methods that allow you to manage your UI, minimize your implementation effort, and allow you to get to market quickly.

| Online payments via your own website/app | Online payments via ecommerce plugins | Payment links & Invoice Integrations |

|---|---|---|

| ✅ Hosted Payment Page ✅ Drop-in Element ⛔ Embedded Elements ⛔ Mobile SDK ✅ Native API ⛔ Subscription APIs | ⛔ Shopify ⛔ WooCommerce ⛔ SHOPLINE ⛔ Shoplazza ⛔ Magento | ⛔ Payment Links ⛔ Xero Invoice (Currently, ACH Direct Debit on Payment Links and Xero Invoices is limited to one-time payments and does not support recurring billing.) |

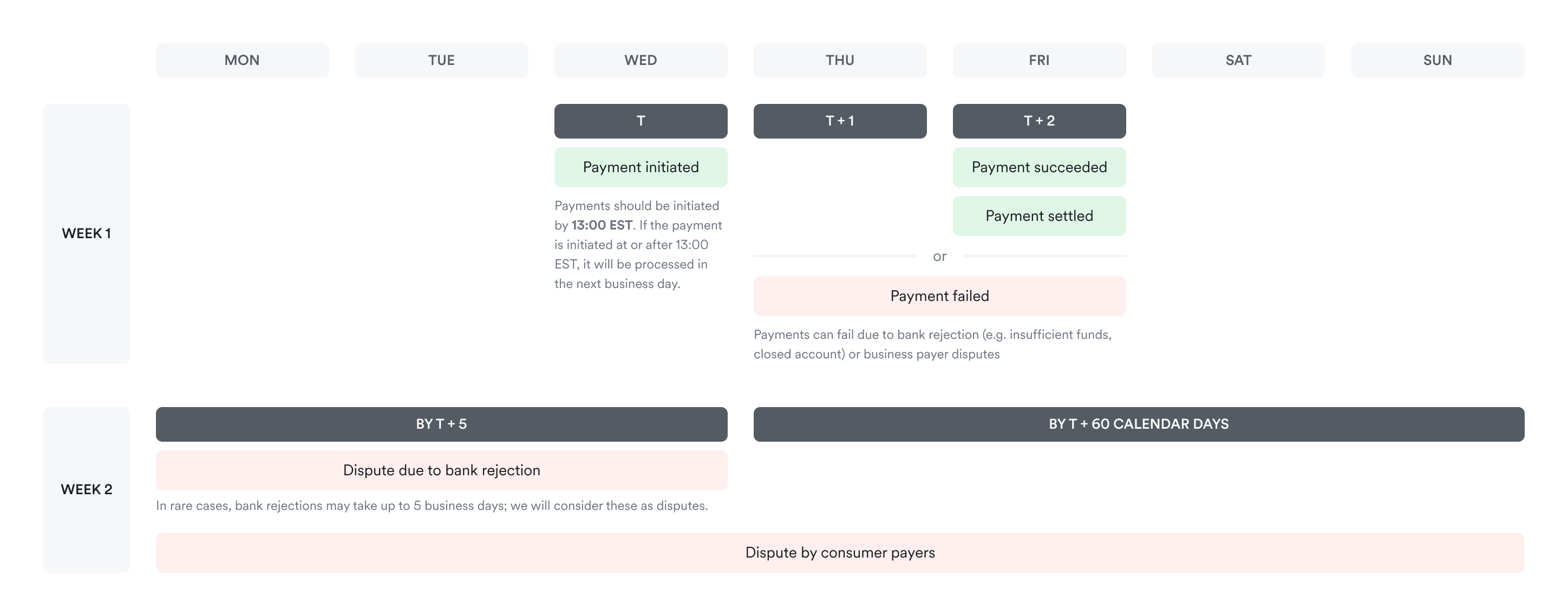

ACH direct debit timing

ACH Direct Debit provides delayed notifications, which means transactions cannot be confirmed immediately.

When you initiate a payment with an active authorization, a 2-business-day period is required to confirm the payment's success:

- During this 2-day window, a payment can fail due to two reasons: bank rejection (e.g. insufficient funds, inactive bank account) or business payer disputes.

- If there are no bank rejections or business disputes, the payment is considered successful and settled on the 2nd day.

After a payment is considered successful, there's still a possibility of bank rejection or dispute by consumer payer. Both are considered disputes.

- Bank rejection: this typically occurs within the 1st or 2nd day. However, in rare instances, a successful debit payment can be reversed up to the 5th day, subject to the decision of the banks involved.

- Dispute by consumer payer: consumers have up to 60 calendar days to reject the payment without providing a reason.

The following diagram describes the timing of ACH direct debit payment. For information on how we keep you informed about these events, see notifications from Airwallex.

ACH direct debit authorization

In accordance with the NACHA scheme rules, you MUST be authorized by the owner of an external bank account before processing ACH debits from (or credits to) that bank account. You are solely responsible for verifying the identity of customers, determining their eligibility to purchase products and services, and acquiring appropriate authorization to initiate ACH debits from customers' external bank accounts.

It is suggested that you display the exact authorization terms below for your customer on the checkout form. Only upon your customer's authorization will you be able to initiate debits from your customer's bank account.

By providing your bank account details and confirming this payment, you authorize Airwallex US, LLC to electronically debit your account via ACH for the total payment amount specified on this page, and, if necessary, electronically credit your account to correct erroneous debits. You certify that you are either the holder of, or an authorized signatory on, the bank account.

If you integrate through Hosted Payment Page (HPP) or Drop-in, Airwallex will display the authorization terms for you.

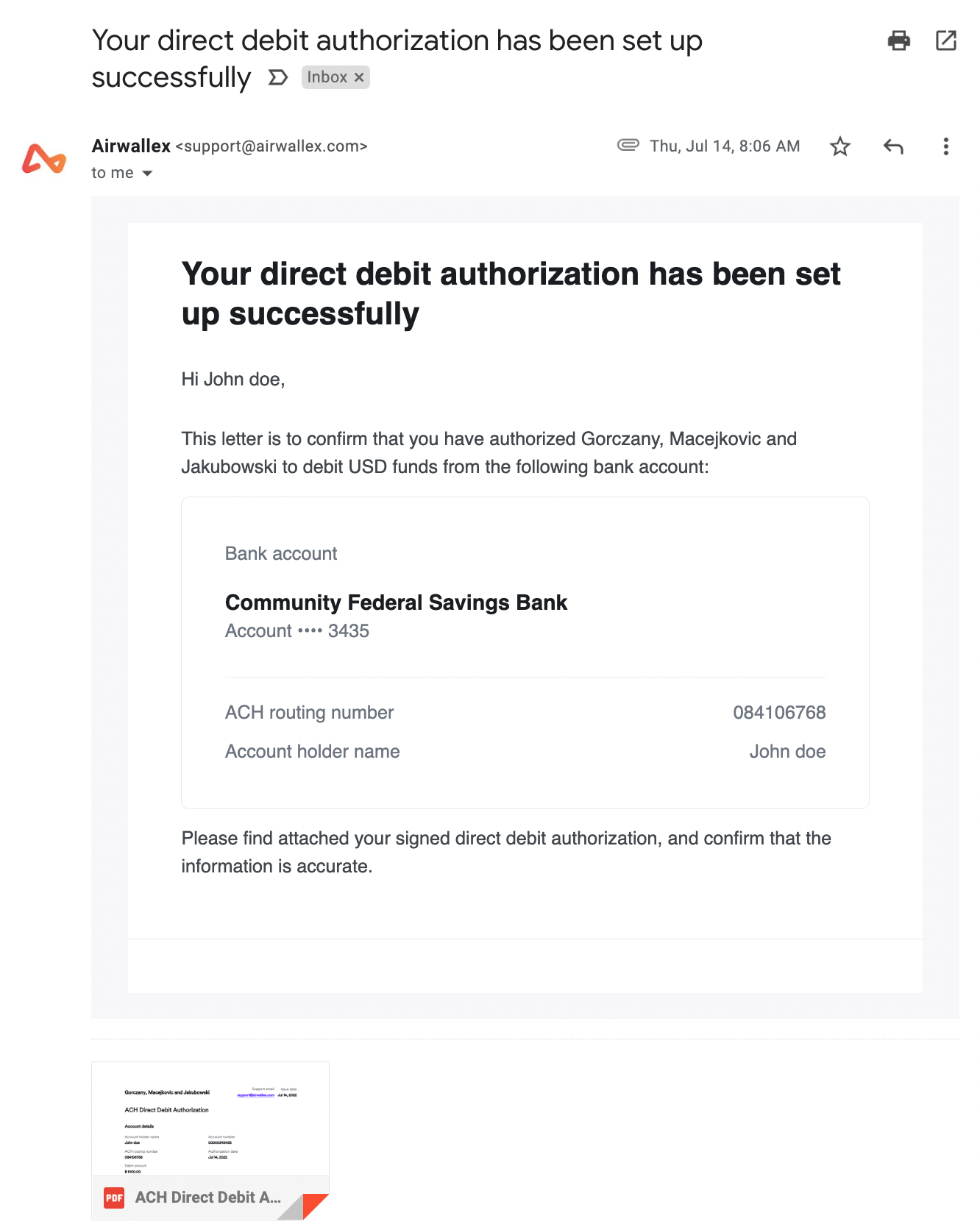

Airwallex will send an authorization email to your customers automatically when they authorize the payment. See a sample as below:

If you want to customise the email, contact our support team to add your corporate logo on this email. You can also turn off Airwallex confirmation email and send your own copy. You should provide the customer a confirmation for the mandate setup, either via email or as a downloadable copy on your website.

You should include wording advising of the content and purpose of this email and wording advising the recipient should check all the details and to contact support using a provided contact method if anything is incorrect. You should also include below information in your email:

| Attributes | Sample |

|---|---|

| Account holder name | John Smith |

| Routing number | 123456789 |

| Account number | xxxx0123 |

| Direct Debit amount | 100 USD |

| Schedule of future debits (if any) | 1st Aug |

| Contact information | [email protected] |

By providing your bank account details and confirming this payment, you authorize Airwallex US, LLC to electronically debit your account via ACH for the total payment amount specified on this page, and, if necessary, electronically credit your account to correct erroneous debits. You certify that you are either the holder of, or an authorized signatory on, the bank account.

ACH direct debit verification

According to NACHA rule, you must conduct account verification for the first use of an external bank account number, or changes to the account number.

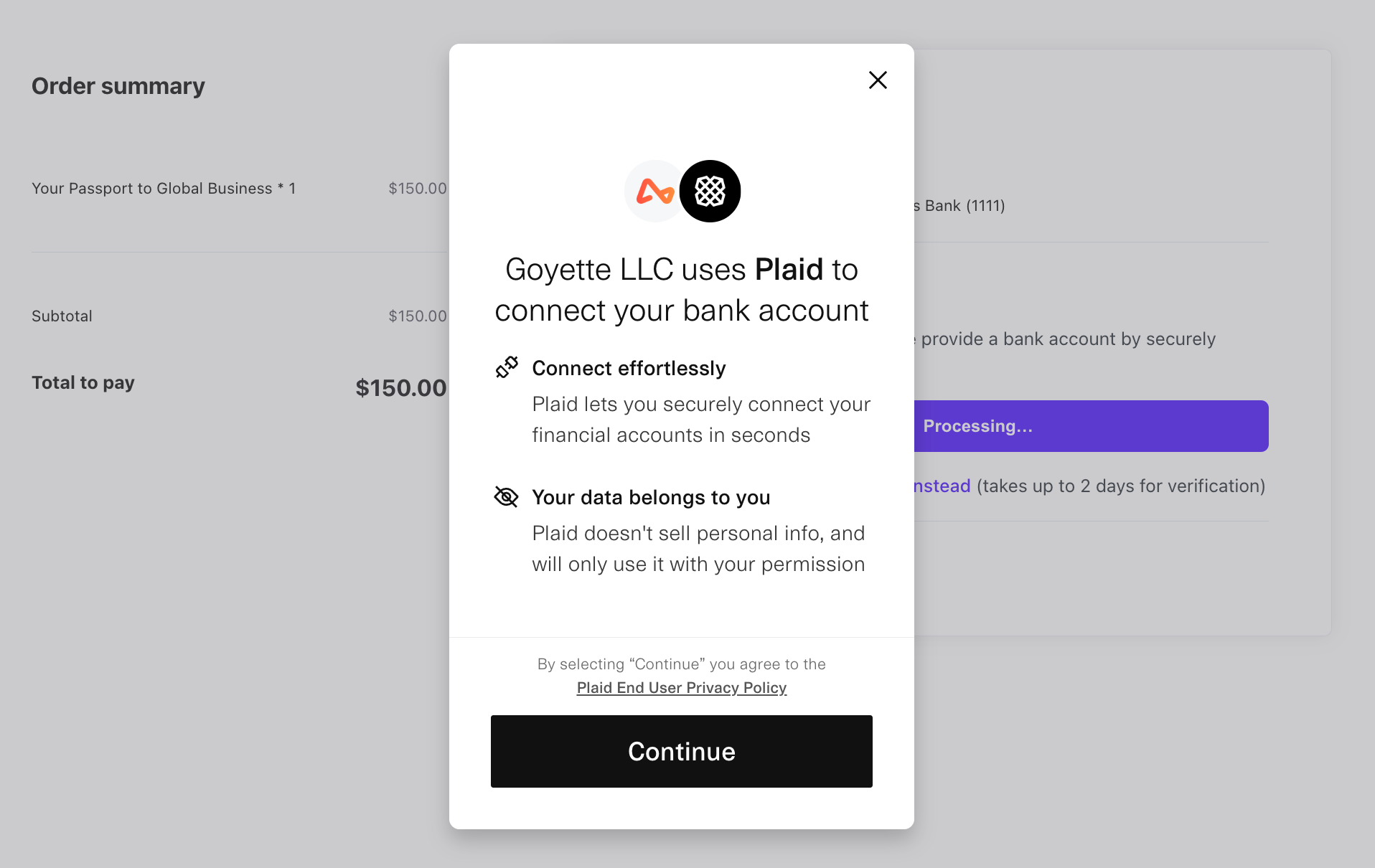

Airwallex offers Plaid to help you verify the bank accounts. Plaid is an open banking solution that helps you verify the banks account instantly and securely.

In some cases, we also offer verification via micro-deposit. For micro-deposit verification, Airwallex will send 2 micro deposits to the owner's bank account and an email with the verification link to the shopper. The 2 micro deposits may take up to 2 days to arrive. After the shopper receives the micro deposits, they can enter the 2 amounts on verification link to get the account verified. Click here to learn more about micro-deposit verification.

Plaid will be set as the default verification option. If your wish to use micro deposits or skip verification please reach out to your account manager or [email protected]

ACH direct debit disputes

For ACH direct debit, the chargeback process gives significant consumer rights to the shopper. They can:

Disputes within the rejection window:

Consumer payers can reject direct debits without providing a reason within 60 calendar days, while business payers have a 2-working-day window. You will not be able to challenge the rejection and the funds will be returned to the shopper.

If a dispute gets created during this window, Airwallex sends the payment_disputes.accepted webhook event, and deducts the amount of the dispute and associated dispute fee from your pending settlement amount.

Disputes after the rejection window:

Disputing an unauthorized or incorrect ACH direct debit can occur within 2-3 years, varying by state law. For such disputes, Airwallex will reach out to you via email. Please note, that you are liable for any dispute outcome and associated fees.

Risk of double-crediting with refunds and disputes

Please note the risk of double crediting with refunds and disputes. If you proactively issue your shopper a refund while their bank also initiates the dispute process, they may receive two credits for the same transaction.

When issuing a refund, you should notify your customer immediately that you're issuing the refund and that it may take 3-4 business days for the funds to arrive in their bank account.