US tax reporting

Overview

Airwallex Transfers allows you to move funds across the globe easily to your suppliers, employees, contractors and/or own bank accounts. This service may come with certain tax filing and reporting responsibilities.

Airwallex supports customers on 1099-NEC filing to report non-employee compensation:

- Made to recipients who are based in the US or US taxpayers (W-9 forms); and

- Of US$600 or more within a tax year

- With no withholding

This guide outlines the steps required to use Airwallex's all-in-one solution that streamlines the process of generating, filing, and distributing 1099-NEC tax forms to your contractors, saving you time and effort during tax season.

Note: It is recommended to consult a tax advisor to determine your tax filing and reporting requirements. If you require this capability, please contact your Account Manager to discuss your use case and eligibility.

Who is required to file a 1099-NEC form?

Companies or business owners who have made more than US$600 in payments to recipients (i.e. contractors for their services) within a tax year are required to:

- Report to the IRS by filing a 1099-NEC form;

- Send a copy of the 1099-NEC form to the contractor.

Deadlines

The deadline to report 1099-NEC is usually January 31 in the following year. Please refer to the IRS website for official dates to avoid late penalties from the IRS.

State filing considerations

Airwallex supports 1099-NEC filing under the Combined Federal/State Filing Program (CF/SF); however, some states may not participate in this program and require direct reporting. It is recommended to consult a tax advisor to determine your state filing requirements.

Before you begin

- Obtain your access token by authenticating to Airwallex using your unique Client ID and API key. You will need the access token to make API calls.

- Integrate with Transfers API and/or Beneficiaries API API endpoints including the

external_identifierfield

Step 1: Collect recipient tax information

Before creating transfers to recipients, it is recommended to collect tax information to ensure all reportable transactions are recorded accurately for 1099-NEC filing.

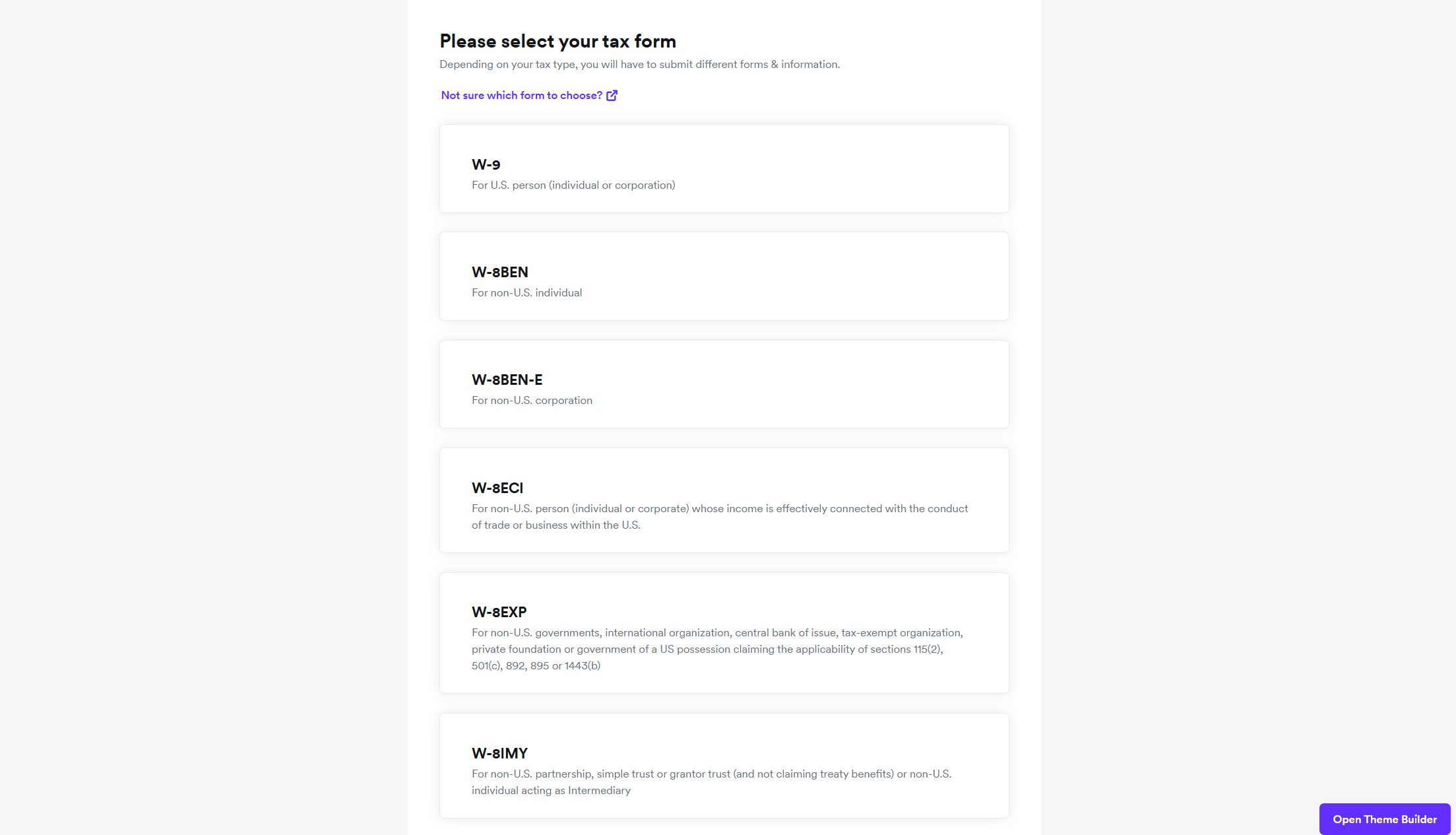

Our Embedded Tax Form component is a pre-built UI element for you to integrate into your own flow for recipient tax information collection. You will also be able to customise the colour themes and font to your requirements to ensure a consistent experience with your product. To view and interact with the component, go to the demo site .

The identity field serves as the linkage between tax information and both beneficiaries and transfers, and therefore should be the same as the external_identifier field when calling our Beneficiaries and Transfers API. Generally it can be an unique identifier for each recipient as recorded on your system (e.g. Customer ID).

Note that you will need your recipients to complete the tax information submission process before being able to generate a 1099-NEC form for filing. You will be able to view the W-9/W-8 form completion status on the Airwallex Webapp.

Step 2: Create or update beneficiaries

While transfers can be created without beneficiaries, it is strongly recommended to create a beneficiary with the external_identifier included beforehand, which will establish the linkage to the tax information collected via the Embedded Tax Form component. All subsequent transfers using this beneficiary will be automatically associated with the recipient.

Call Create a new beneficiary API to save and manage beneficiaries that you can use for creating payouts using beneficiary_id, as well as linking to the tax information collected.

Example request

JavaScript1curl --request POST \2--url 'https://api-demo.airwallex.com/api/v1/beneficiaries/create' \3--header 'Content-Type: application/json' \4--header 'Authorization: Bearer <your_bearer_token>' \5--data '{6 "beneficiary": {7 "additional_info": {8 "external_identifier": "089cc0ec-0a6f-4150-90351232"9 },10 "address": {11 "city": "Seattle",12 "country_code": "US",13 "postcode": "98104",14 "state": "Washington",15 "street_address": "412 5th Avenue"16 },17 "bank_details": {18 "account_currency": "USD",19 "account_name": "John Walker",20 "account_number": "50001121",21 "account_routing_type1": "aba",22 "account_routing_value1": "021000021",23 "bank_country_code": "US",24 "local_clearing_system": "ACH"25 },26 "company_name": "Complete Concrete Pty Ltd",27 "entity_type": "COMPANY"28 },29 "nickname": "Complete Concrete Pty Ltd",30 "transfer_methods": [31 "LOCAL"32 ]33}'

For existing beneficiaries, you can call Update existing beneficiary API to add/edit the external_identifier field. The same schema validation and response body as in Create a new beneficiary will apply.

Example request

JavaScript1curl --request POST \2--url 'https://api-demo.airwallex.com/api/v1/beneficiaries/8365ea88-2946-4877-abe1-e02a1015288d/update' \3--header 'Content-Type: application/json' \4--header 'Authorization: Bearer eyJhbGciOiJIUzI1NiJ9.eyJzdWIiOiJ0b20iLCJyb2xlcyI6WyJ1c2VyIl0sImlhdCI6MTQ4ODQxNTI1NywiZXhwIjoxNDg4NDE1MjY3fQ.UHqau03y5kEk5lFbTp7J4a-U6LXsfxIVNEsux85hj-Q' \5--data '{6 "beneficiary": {7 "additional_info": {8 "external_identifier": "089cc0ec-0a6f-4150-90351232"9 },10 "address": {11 "city": "Seattle",12 "country_code": "US",13 "postcode": "98104",14 "state": "Washington",15 "street_address": "412 5th Avenue"16 },17 "bank_details": {18 "account_currency": "USD",19 "account_name": "John Walker",20 "account_number": "50001121",21 "account_routing_type1": "aba",22 "account_routing_value1": "021000021",23 "bank_country_code": "US",24 "local_clearing_system": "ACH"25 },26 "company_name": "Complete Concrete Pty Ltd",27 "entity_type": "COMPANY"28 },29 "nickname": "Complete Concrete Pty Ltd",30 "transfer_methods": [31 "LOCAL"32 ]33}'

Note that only future transfers will be automatically associated with the corresponding recipient when external_identifier is added/updated for an existing beneficiary. In other words, historical transfers will remain to be either unlinked or linked to the previous recipient. Additionally, in the event that you delete the beneficiary, historical transfers will remain to be linked to the recipient.

As part of initial setup, Airwallex will be able to support one-off backfilling/update of historical transfers to support your first year of tax filing. Please contact your Account Manager for more details.

Step 3: Create transfers

Call Create a new transfer API with the required beneficiary and transaction information (currency, amount, date, reference) to create a transfer.

Beneficiary information can be specified within the request in two ways:

- Beneficiary ID

As mentioned above, it is strongly recommended to create a beneficiary (including external_identifier) to simplify the transfer creation and tax filing process. You can call Create a new beneficiary, and a unique beneficiary_id will be returned. This can be used in place of the beneficiary object to create the transfer subsequently.

- Directly within the request

If you prefer to manage all beneficiary information outside of Airwallex, you can provide beneficiary information (including external_identifier) directly under the beneficiary object each time when calling Create a new transfer API. Transfers created will be automatically associated with the corresponding recipient. Note that once a transfer is created, you can no longer add/edit the external_identifier value.

Example request

JavaScript1curl --request POST \2--url 'https://api-demo.airwallex.com/api/v1/transfers/create' \3--header 'Content-Type: application/json' \4--header 'Authorization: Bearer <your_bearer_token>' \5--data '{6 "beneficiary": {7 "additional_info": {8 "external_identifier": "089cc0ec-0a6f-4150-90351232"9 },10 "address": {11 "city": "Seattle",12 "country_code": "US",13 "postcode": "98104",14 "state": "Washington",15 "street_address": "412 5th Avenue"16 },17 "bank_details": {18 "account_currency": "USD",19 "account_name": "John Walker",20 "account_number": "50001121",21 "account_routing_type1": "aba",22 "account_routing_value1": "021000021",23 "bank_country_code": "US",24 "local_clearing_system": "ACH"25 },26 "entity_type": "COMPANY"27 },28 "transfer_amount": "50",29 "transfer_currency": "USD",30 "transfer_method": "LOCAL",31 "quote_id": "string",32 "reason": "travel",33 "reference": "PMT1936398",34 "remarks": "",35 "request_id": "c02d2e3c-dedd-410b-a1cc-9b7e58444fa2",36 "source_currency": "CNY"37}'

Step 4: Manage recipients for tax filing

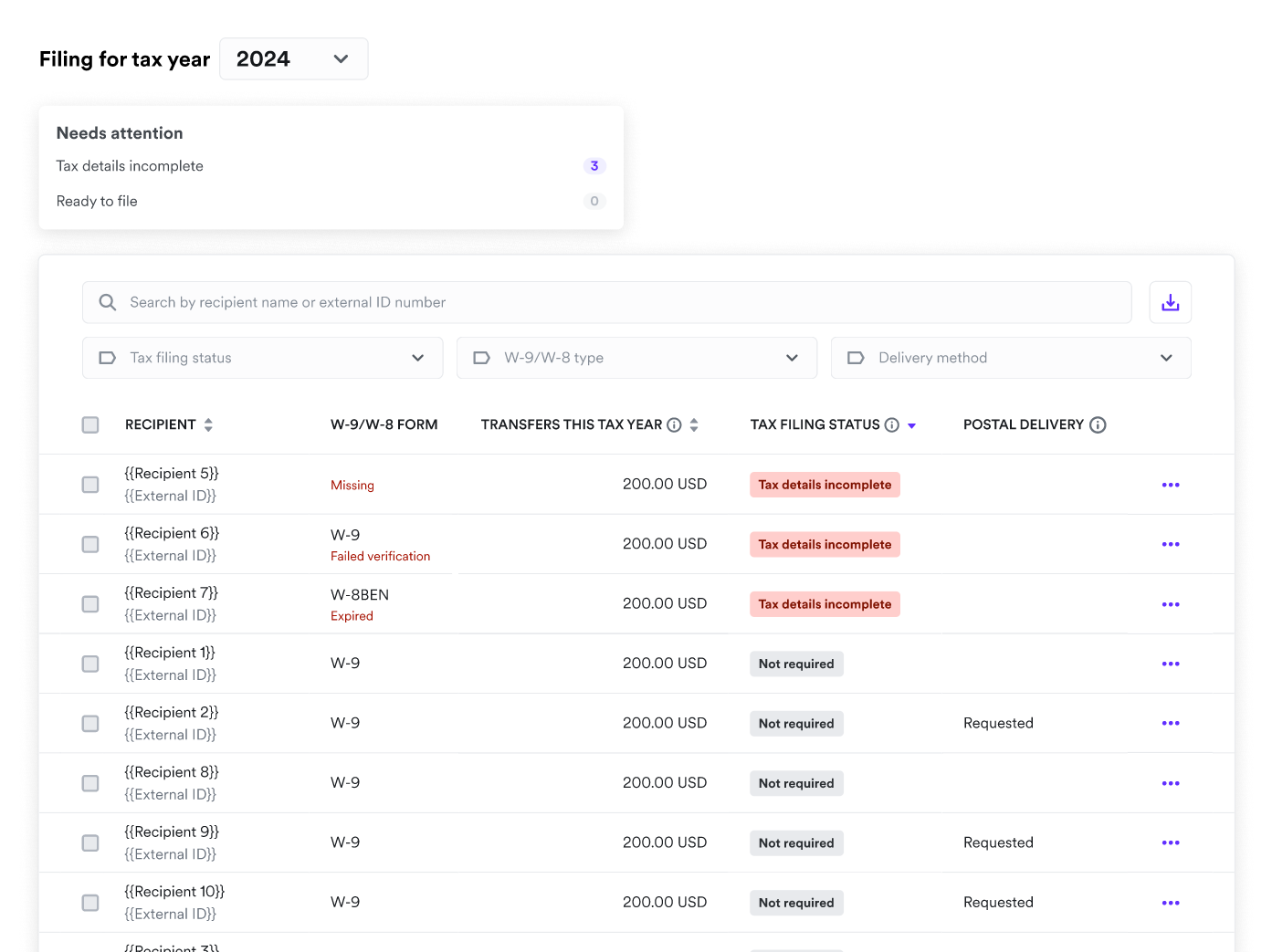

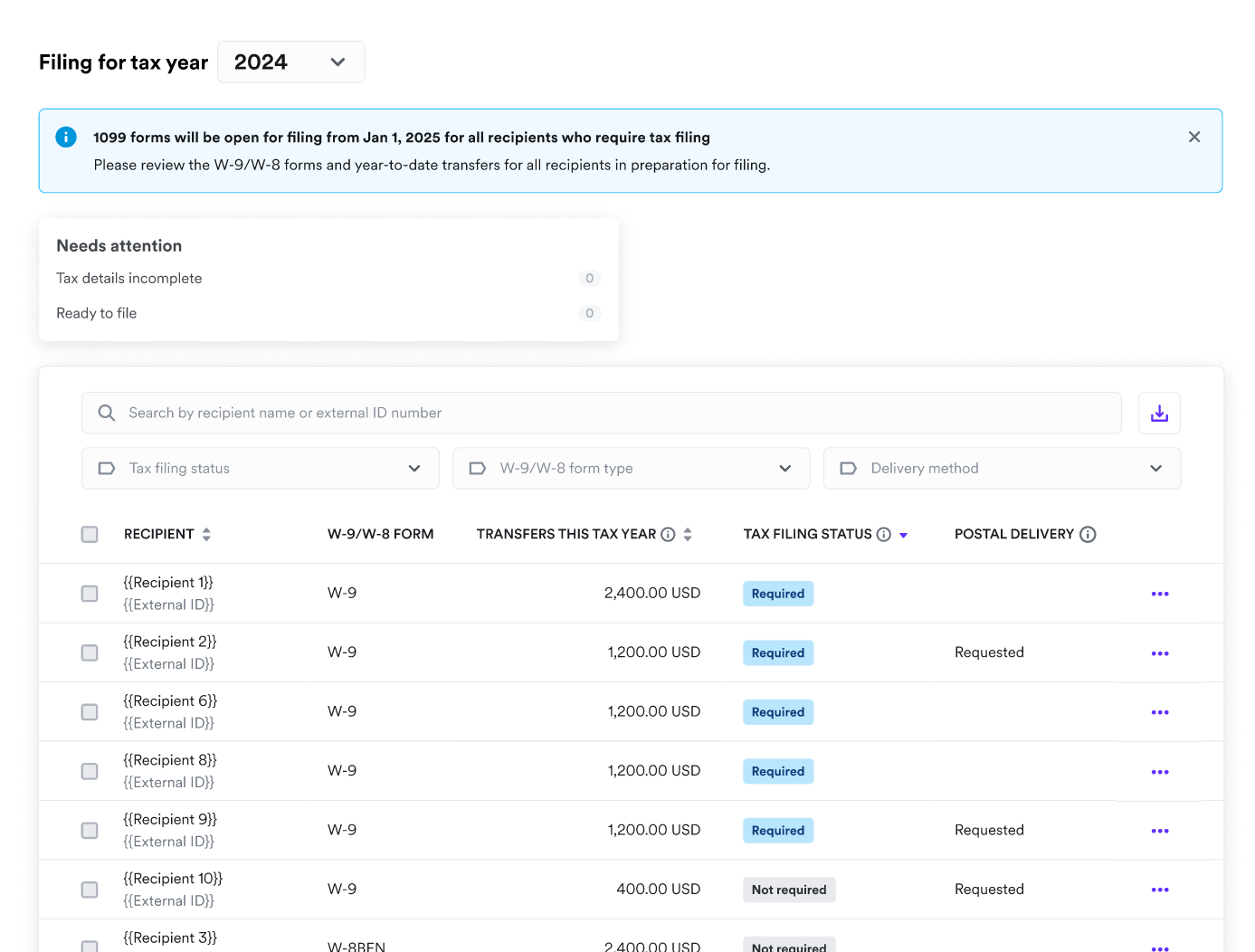

Airwallex provides a Tax Filing module on the Webapp to help you manage your tax reporting obligations.

Log in to your Airwallex account and navigate to Tax Filing under Transfers, where you can:

- View summary of recipients including W-9/W-8 completion status, total transfers in the tax year, tax filing status and whether they requested for postal delivery.

- Download recipient list, W-9/W-8 forms, transfers list and 1099-NEC forms.

- File 1099-NEC forms electronically to the IRS.

View summary of recipients

The summary table will display details for recipients when either tax information is submitted on the Embedded Tax Form component; or beneficiaries/transfers with external_identifier are created:

- W-9/W-8 form: Status of W-9/W-8 form submitted. You can refer to the following abnormal statuses to ensure that the recipients have valid tax information before the 1099-NEC filing deadline.

| STATUS | DESCRIPTION | NEXT STEP |

|---|---|---|

| MISSING | No tax form has been submitted. | Ask the recipient to submit tax information. |

| FAILED VERIFICATION | Tax form has failed TIN matching. | Ask the recipient to resubmit valid tax information. |

| EXPIRED | W-8 forms expire after 3 years. | Ask the recipient to resubmit valid tax information. |

- Transfers this tax year: Total year-to-date transfers made to this recipient (in USD). Multiple beneficiaries can be associated to the same

external_identifier, and this field will be the summation of all transfers to all beneficiaries.

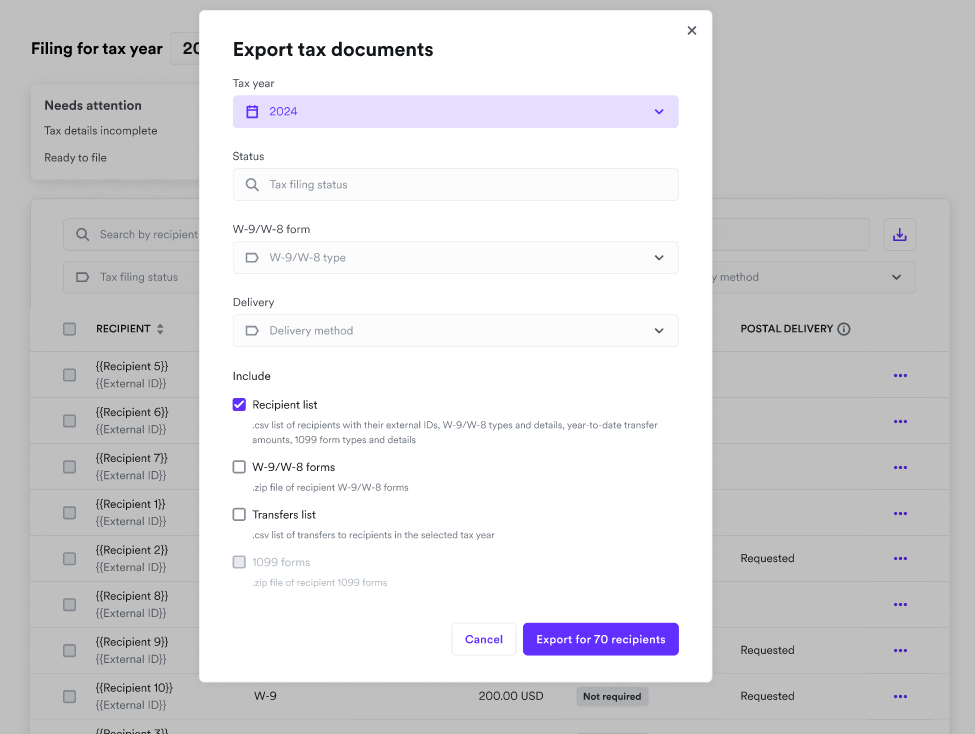

Download recipient information

To retrieve recipient tax filing information, you can filter based on various parameters and download detailed information:

- Recipient list: recipients with their external IDs, W-9/W-8 types and details, year-to-date transfer amounts, 1099 form types and details in .csv format

- W-9/W-8 forms: recipient W-9/W-9 forms in .zip format

- Transfers list: transfers made to recipients in the selected tax year in .csv format

Step 5: Complete tax filing

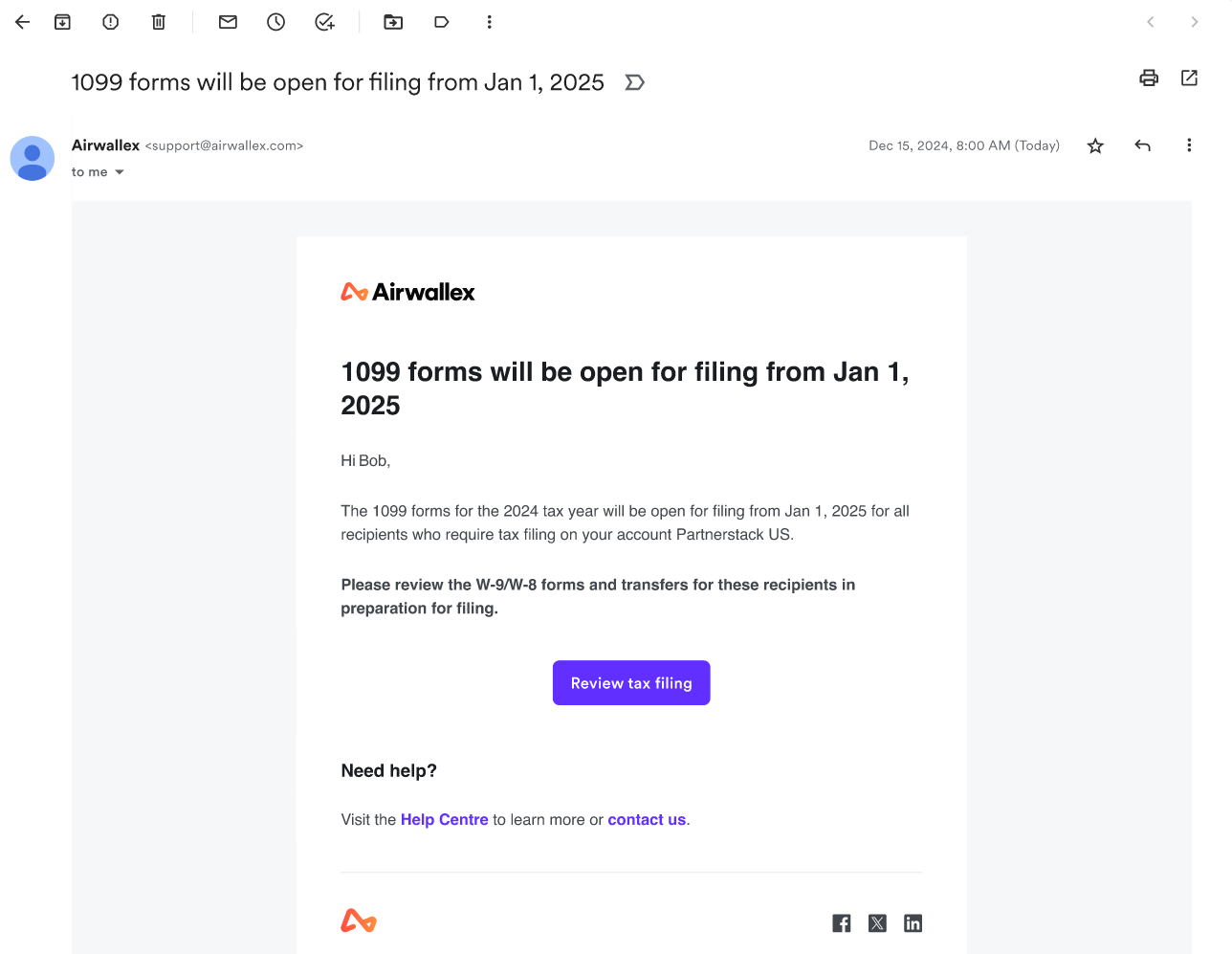

Towards the end of the tax year, Airwallex will issue email notifications regarding dates when 1099-NEC forms will be open for filing. You are recommended to begin reviewing the W-9/W-9 forms and transfers for your recipients in preparation.

1099-NEC filing requirements

1099-NEC filing is required when a recipient:

- Has a verified W-9 form and is therefore a US person/entity i.e. the SSN/EIN and name provided has been matched against records in the IRS database.

- Since TIN matching is not an IRS requirement, you may request to turn this verification service off by contacting your Account Manager.

- Is cumulatively paid over US$600 in the calendar year.

Status of the 1099-NEC filing

| STATUS | DESCRIPTION | NEXT STEP |

|---|---|---|

| Tax Details Incomplete | Recipient has not submitted verified W-9/W-8 form, or W-8 form has expired. | Ask the recipient to submit/resubmit tax information. |

| Not Required | 1099-NEC filing is not required for this recipient i.e. W-8 or < US$600 paid. | No action needed. |

| Required | 1099-NEC filing is required for this recipient i.e. W-9 and > US$600 paid. | Wait until filing is open, usually starting from January 1 of the following year. |

| Ready to file | Recipient is ready for 1099-NEC filing. | File 1099-NEC forms before IRS deadline. |

| Filed | 1099-NEC form submitted to the IRS electronically. | Wait for the IRS result on whether filing is accepted or rejected. |

| Accepted | 1099-NEC form accepted by the IRS. | No action needed. |

| Rejected | 1099-NEC form rejected by the IRS. | Update recipient tax information and resubmit 1099-NEC filing. |

| Corrected | 1099-NEC form resubmitted to the IRS. | Wait for the IRS result on whether filing is accepted or rejected. |

| Not filed | 1099-NEC form no longer available for filing. | No action needed. |

Postal delivery

Whether a recipient requests specifically for postal delivery. Recipients are by default opted in for only e-delivery of the 1099-NEC forms via the Embedded Tax Form component. Note that you will be responsible for mailing the 1099-NEC forms to recipients.

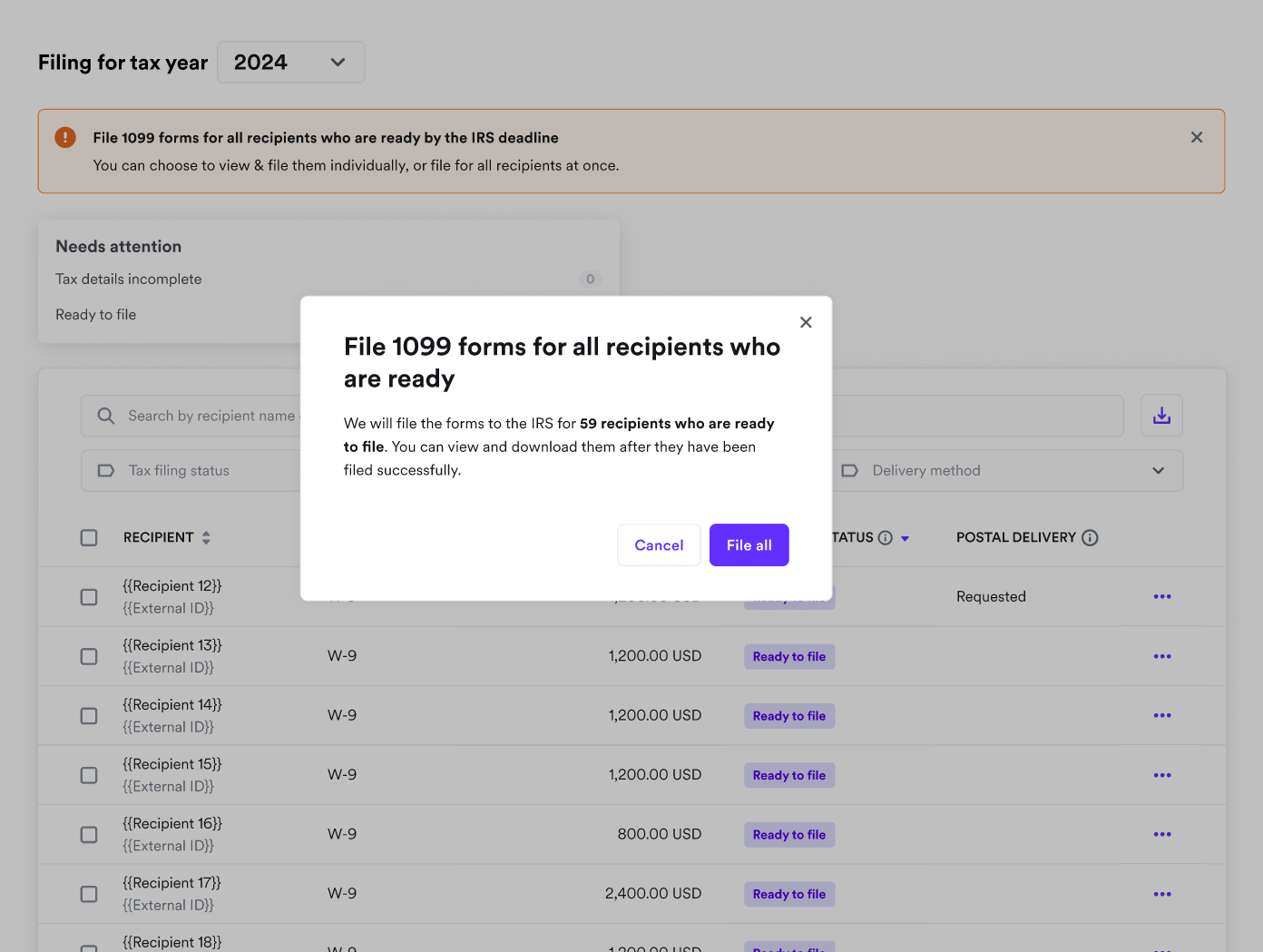

1099-NEC filing with the IRS

Once 1099-NEC forms are open for filing, you will be able to file electronically to the IRS via the Airwallex Webapp for all eligible recipients:

- File for each recipient separately

- File for multiple recipients selected

- File for all recipients at once

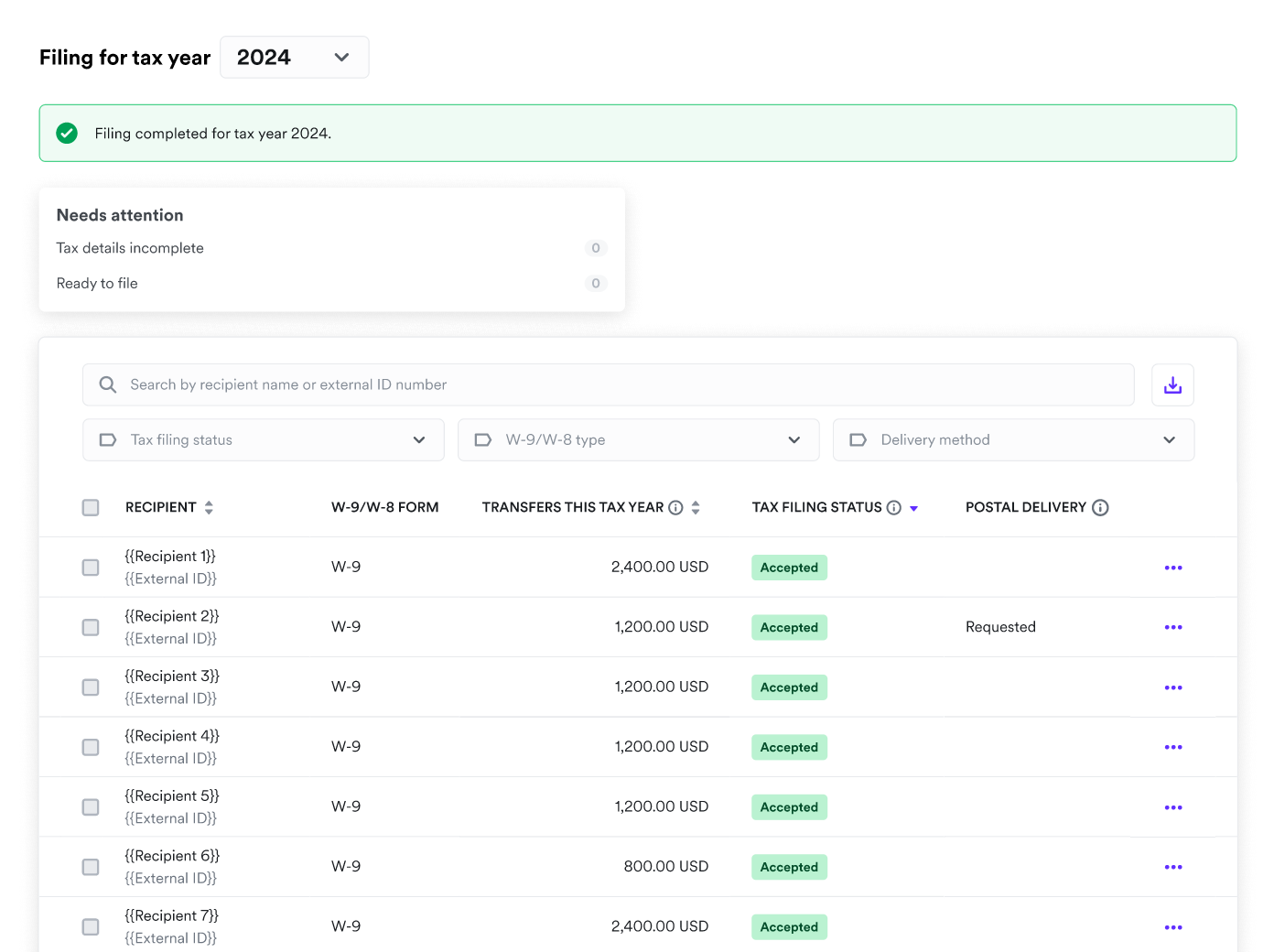

After filing

Once filed, you will be able to download 1099-NEC forms for recipients in .pdf format for retention or postal delivery purposes.

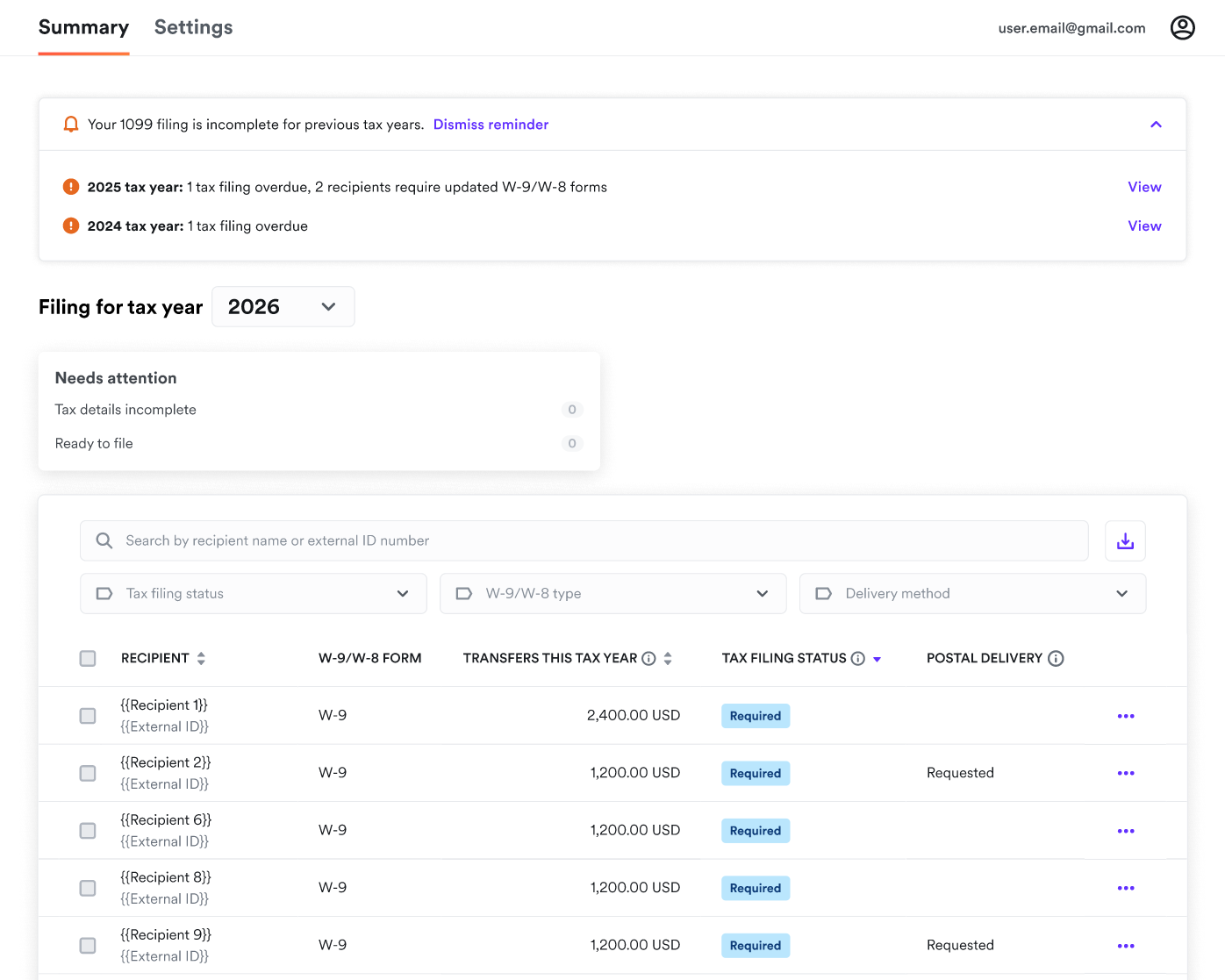

Late filing considerations

While it is strongly recommended to file 1099-NEC forms before the IRS deadline (usually January 31 in the following year), Airwallex can support late filing to a certain extent.

After the IRS deadline, you will receive reminders on the Airwallex web app, as well as email notifications, for overdue 1099-NEC filings:

- For recipients with complete tax forms: you will be able to file for the past 3 tax years

- For recipients with missing tax forms: they must provide complete W-9 forms by Apr 15 of the following year to be eligible for filing