6 benefits of virtual debit and credit cards in 2024

Virtual payment cards can revolutionalise the way your businesses manage and make payments, saving teams around the world hours in admin as well as excessive fees. Let's review the core benefits of virtual debit cards and the impact they can have on your business.

What are virtual payment cards?

As the name suggests, virtual payment cards are debit or credit cards that are created entirely online and are not issued as a physical card that you can hold in your hand. They’re randomly-generated 16-digit numbers, complete with a card verification number and expiry date. They act in the same way traditional credit and debit cards do—without the need for a physical card. They’re issued by Mastercard, Visa, or American Express, and are accepted anywhere credit cards are usually accepted.

But how these cards differ is in their operation, and ease of use.

Instead of relying on your bank, you’re in control. You’re able to choose the currency you need, set a spending limit for the card, and define the merchant types where the card can be used.

Virtual cards are streamlining the way payments are made for both suppliers and vendors, and there are a number of compelling benefits for your business.

Six big ways virtual cards benefit your business in 2022

Staff empowerment

Virtual cards can be issued to multiple team members who are required to make payments for their business on a daily basis. So instead of hounding your manager or accounts department for access to the one single physical card to make a payment (or going through the onerous paperwork to get a corporate card yourself), staff can be issued with individual virtual payment cards that are unique to them.

As a manager, you can set the spending limits on each virtual card, which means you keep a firm hold on your budget when making business payments, and your teams know exactly how much they have available to spend.

Eliminating payment bottlenecks means your business can move at a much faster pace by allowing the purchasing of new software and equipment without delays. When executed correctly, purchase requests no longer need to sit in pending for weeks while your staff sit idle awaiting the green light to make the purchase. With their own virtual payment card, they can do so instantly, while you maintain full control.

Access new debit cards instantly

One of the biggest pain points with opening new card accounts is waiting for them to arrive in the mail. You usually need to wait for the physical card to arrive which could take weeks, especially with the shipping delays in a post-pandemic world. For businesses with remote teams, this normally means then having to mail the card back out to your employees. Virtual cards on the other hand can be activated and used for online purchases pretty much instantaneously, meaning you can get access to your funds faster.

For those of us that require in-person purchases, most card issuers enable virtual cards to be linked via Google Pay & Apple Pay, enabling contactless purchases by linking your card to a mobile device. Handy for getting new cards out to employees instantly!

Improved accountability

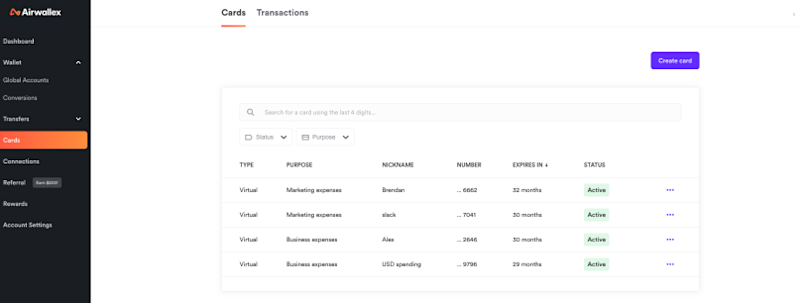

Another virtual debit card benefit is the improved oversight and accountability you receive over your business’ money. As you’re able to assign virtual payment cards to specific suppliers or vendors, you always know exactly where your money is going, and why. Purchases made against this card are then automatically logged into your card management system. Everything is neatly processed, labelled, and accounted for—no more mystery payments.

There's a huge opportunity here to also reduce the number of hours spent chasing expense receipts by your accounts department. With each payment being allocated to the exact staff member who made the purchase, it's easy to trace back and reconcile the transaction. Your accounts team can go back to what they do best, forecasting and providing financial advice on the future of your business.

Added security

Perhaps the biggest virtual debit card benefit is the improved level of security you receive. Virtual payment cards are ideal for making safe, secure online payments.

As virtual payment cards aren’t physical things, this makes them practically impossible to be cloned. There’s no physical item to be stolen. They can even be set as single-use cards, so they expire directly after they’re used, and there’s no issue with future fraudulent payments from your card.

However, while the online nature of these payments has boosted their security, it’s important to treat virtual card payments with the same level of rigour as a physical card payment. Although the virtual vs physical card can feel considerably different, it is still real money, and so the appropriate security measures should be taken just as if it was a physical payment card.

Quality virtual cards are usually issued by trusted card providers like Visa and Mastercard, so payments are offered the same fraud checks and security features as the rest of their card network as well.

Easy to create and use

Typically virtual cards were only available to large enterprises, but with the recent advances in fintech, these products are now available to everyday businesses as well. Companies like fintech unicorn Airwallex allow businesses to create virtual cards within seconds. All you need to do is set up an account (which you can do completely online) and you can start creating them for your business.

New virtual cards can be created instantly from within your Airwallex. No need to wait for a physical card - you can start using our cards right away on Apple Pay or Google Pay™️.

Ease of reconciliation

Let’s face it: No one in finance enjoys chasing up multiple people to know why a purchase was made. But reconciling expenses to the right account is a must for any business. With virtual payment cards, you can assign ownership to a specific person, department or expense code to make month-end a breeze.

Some cards (like ours) come loaded with expense management software to turn the back-and-forth into one accurate, zero-touch accounting experience. Custom rules and spend limits add an extra layer of control over your card spending, letting you review and approve purchases in real-time. Plus, with our handy AI receipt matching, automatic categorisation and accounting software integrations, you’ll never have to chase a missing receipt again.

Try Airwallex virtual cards for your business

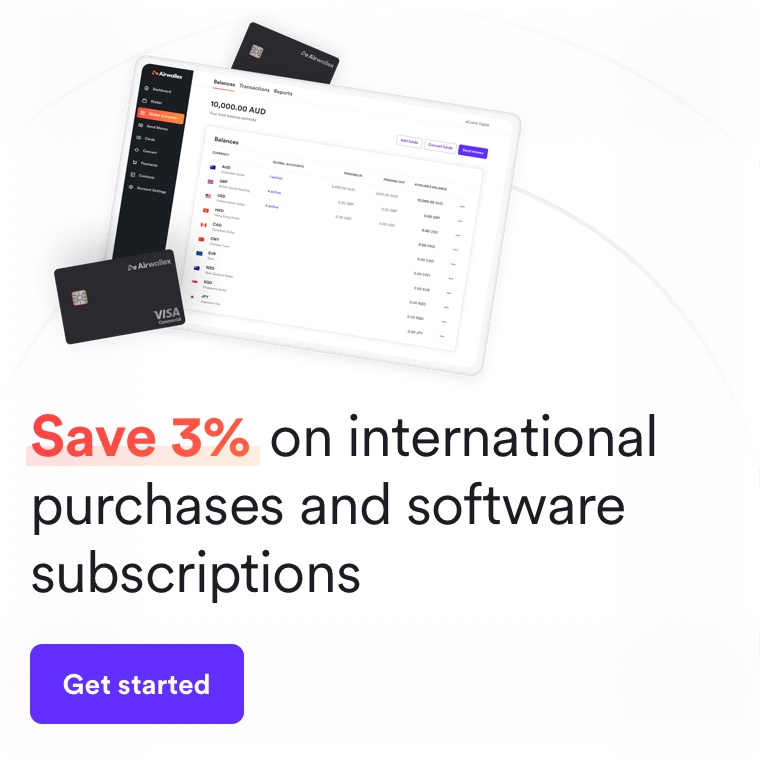

Airwallex is an Australian fintech that gives everyday businesses access to these virtual cards (and more). Best of all, Airwallex’s international business debit cards also have zero international transaction fees, so you can use these for all types of payments. There are no monthly fees and a business account can be set up online in a matter of minutes.

Borderless cards for simplified spending.

Related articles about banking:

Our products and services in Australia are provided by Airwallex Pty Ltd ABN 37 609 653 312 who holds AFSL 487221. Any information provided is for general information purposes only and does not take into account your objectives, financial situation or needs. You should consider the appropriateness of the information in light of your own objectives, financial situation or needs. Please read and consider the Product Disclosure Statement available on our website before using our service.

Share

Joe Romeo is responsible for scaling our Airwallex's product adoption in the UK and the world. An all-around growth enthusiast, Joe's speciality lies in SEO, organic acquisition and making lasagna.

View this article in another region:United Kingdom

Related Posts

WorldRemit Account Review (2025): Features and fees

•4 minutes

BIN sponsorship | How it can help your business

•9 minutes