Software and TECHnology

Unlock faster growth with an end-to-end payment solution

Collect recurring payments, attract new customers, and streamline your revenue operations, all on one powerful unified platform.

Accept payments from customers around the world

Improve checkout rates with a localised experience that supports 180+ currencies and 160+ local payment methods.

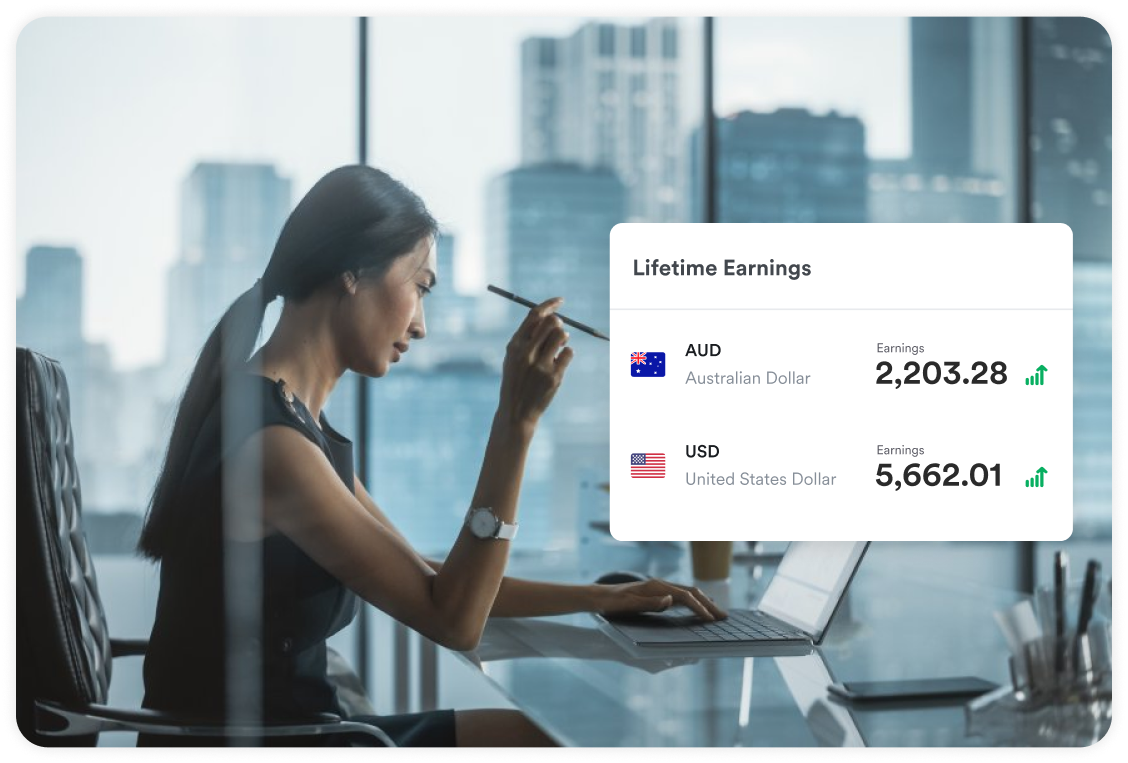

Smartly manage funds and eliminate costly FX fees

Easily collect, hold, convert, and pay out funds worldwide. Save with like-for-like settlement and interbank FX rates.

Manage all your financial operations on one platform

Access Airwallex's full suite of financial services, from multi-currency accounts to corporate cards and spend management tools.

Control and optimise company spending

Manage expenses with built-in spend controls, automate bill payments, and do away with unnecessary FX fees on ad spend.

Modern payments and finance solutions for fast-growing software and technology businesses

With Airwallex, it's easy to accept one-time and recurring payments securely from global customers. Our multi-currency solutions and local payment options can boost your sales, while saving you costly FX conversion fees. Pay global suppliers and fund business expenses in local currencies, and keep your business growing.

open a BUSINESS ACCOUNT

Manage currencies and FX, make high-speed international transfers, and earn competitive rates on your funds

Manage multi-currency funds easily and with less fees

Open an Airwallex Business Account to manage your domestic and international finance needs and avoid unnecessary FX conversions.

Collect funds in multiple currencies

Set up multi-currency collection accounts with local bank details in multiple countries, allowing you to deposit funds in 20+ currencies.

Pay global suppliers from multi-currency balances

Pay suppliers and developers in 200+ countries from your multi-currency balances. Convert funds at interbank rates when needed.

Earn returns with a high-rate savings solution

Grow your USD and AUD balances faster than with traditional banks — no minimum lock up period required.

ACCEPT PAYMENTS

Optimise recurring payments from customers in all your markets

Eliminate costly FX fees

Collect and settle funds in the same currency to save on unnecessary conversion fees. Reduce FX risk with Multi-currency Pricing.

Build custom subscription plans

Offer multiple subscription plans with trial periods, upgrades, and downgrades. Seamlessly manage these via app or API.

Never leave revenue on the table

Benefit from smart retry logic, missed payment reminders, customisable risk thresholds, and more to improve conversions and reduce churn.

Accept payments like a local

Support 160+ payment methods, including cards, wallets, and direct debit. Display prices in local currency at checkout.

Create tailored subscription plans

Set up and manage multiple software plans. Allow your customers to subscribe with ease and track recurring revenue.

Manage Spend

Take charge of your corporate spending

Save time and gain greater visibility across your entire business. Manage, track, and control company spend, from invoices to team expenses.

Gain real-time visibility of company spend

See a complete view of team expenses in one place and easily explore details of individual transactions. Design multi-layer approval workflows and instantly review and approve expenses via mobile.

Empower employees with corporate cards

Issue multi-currency corporate cards in minutes and stay in control of all purchases from a single dashboard. Create unique virtual cards to keep budgets in check for ad spend and software subscriptions.

Automate your bill payments

Upload, approve, and pay domestic and international invoices, and sync all your data with your accounting software for easy reconciliation.

Software and Technology Case Studies

JobAdder puts Airwallex’s borderless cards and international payments to work

The Challenge

JobAdder is a multi-functional recruitment platform, bringing together Applicant Tracking System (ATS) and Customer Relationship Management (CRM) capabilities to create a streamlined hiring process for recruiters and applicants. Over time, the business has grown internationally, leading their finance team to seek a financial platform that could fit their changing needs.

The Solution

Using Airwallex's multi-currency cards, administrators now have greater visibility over spending, allowing them to set limits, freeze cards if necessary, and monitor transactions in real time. Furthermore, customer payments received via their Airwallex Global Accounts are now more cost effective than ever before, with a tangible impact on JobAdder's bottom line. Best of all, powerful cards, international payments, overseas transfers, helpful integrations with platforms like Xero - and everything else Airwallex has to offer - is accessible from one intuitive platform.

Dovetail regained visibility and control of team spend with Airwallex virtual cards

The Challenge

Dovetail is a full-service digital agency with offices across Melbourne, Sydney, and Auckland. With their fast-growing teams, Dovetail needed a better, streamlined way to take back control of their team expenses, avoid inefficient SaaS subscription management, and minimise security risks associated with a common corporate card.

The Solution

Dovetail now empowers their teams with Airwallex Borderless cards. By offering dedicated virtual cards for each team with flexible spend limits and real-time visibility, team leaders no longer need to spend 2 - 3 hours each week chasing up receipts. Dovetail has also saved up to 15% on their monthly SaaS spend. With a dedicated card for each SaaS subscriptions, it was easy for the team to manage and eliminate any unwanted purchases. Airwallex's 0% international card transaction fees also provided instant savings on USD-priced SaaS offerings like Figma, Github, and Slack.

Tracksuit’s meteoric global growth supported by Airwallex Borderless Cards and Expenses

The Challenge

Started in Auckland to track brand impact data, Tracksuit has expanded rapidly - but their existing technology was struggling to keep up. As a high-growth company, they had unique needs for flexibility, and their previous solutions were quite limiting especially when it came to tracking corporate spend and card usage.

The Solution

Airwallex Corporate Cards allow for flexible controls over spending limits, and make tracking spend across categories like subscription management much easier for finance administrators. Reconciliation is much easier now, and Tracksuit can also integrate with their existing providers like Xero for a fully synced and streamlined experience.

EMBEDDED FINANCE

Unlock new revenue streams with your own financial products

Create more loyal customers and gain a competitive advantage by building your own global payments and financial products on top of Airwallex’s financial infrastructure and APIs. Offer your customers the ability to accept payments, manage funds, pay bills, issue cards, and more.