Airwallex FX facts to help business’ master their money movement

Making the perfect decision around FX for business requires a balanced formula of need, timing and tools. While there can be a hundred variables with every transfer – with the right strategies, you can minimise costs, reduce risks, and streamline your international money movement.

We often talk about how amazing our international payment rails are (with over 130 currencies available) or how fast they can transfer funds (generally within one to two business days). While these facts are very impressive, they don’t uncover the deeper knowledge that can really make a master of FX.

FX Rate Alerts can create optimal conversion opportunities

Everyone knows that FX rates are always in flux. Big and small world events can have an impact, and sometimes you don’t realise that you’re in a favourable position before the tables have turned again.

Let us stay vigilant for you when it comes to optimal FX times. Airwallex’s FX Rate Alerts will follow the market for you, and notify you when your currency pair reaches your target rate. What’s even better is that there is no limit to the amount of alerts that you can set up, so we’ll watch as many currency pairs as you like.

If you already have an Airwallex account, setting up Rate Alerts only takes two seconds.

Set your target rate: Select the rate you’d like to monitor for a currency pair

Receive instant alerts: Get notified via email or push notification when your target rate is reached

Convert with ease: Follow the link in the alert to make your conversion quickly and securely

Access fast international transfers at a low cost.

Our three types of FX fit different conversion needs

Did you know that Airwallex has three types of FX?

Depending on what kind of account you have with us, you might have access to either a pre-funding or post-funding workflow. Your funding mode will dictate the timing of when you fund Airwallex and when Airwallex will settle your conversions. You may also be able to take advantage of settlement timing – but more on that in a minute!

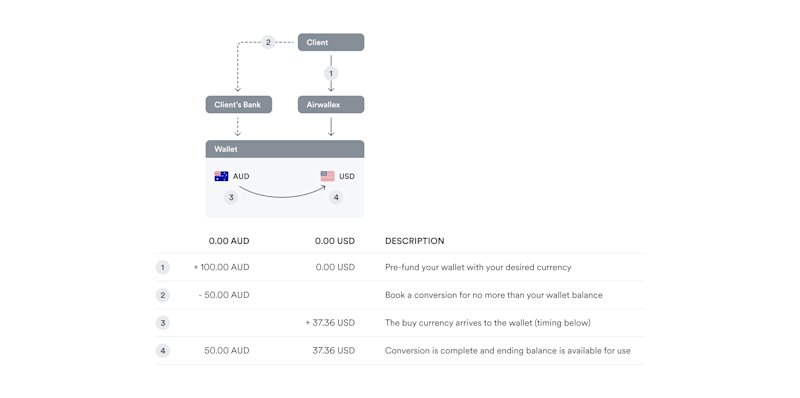

1. Pre-funding workflow

For Airwallex customers on this kind of workflow, currency conversions and payouts will come straight from your wallet balance. This means that before you fire off those conversions or payouts, you’ll need to add funds to your Airwallex Wallet first.

This type of workflow makes it easy to make sure that your transactions are always funded, keeping things running smoothly and seamlessly. Super straightforward!

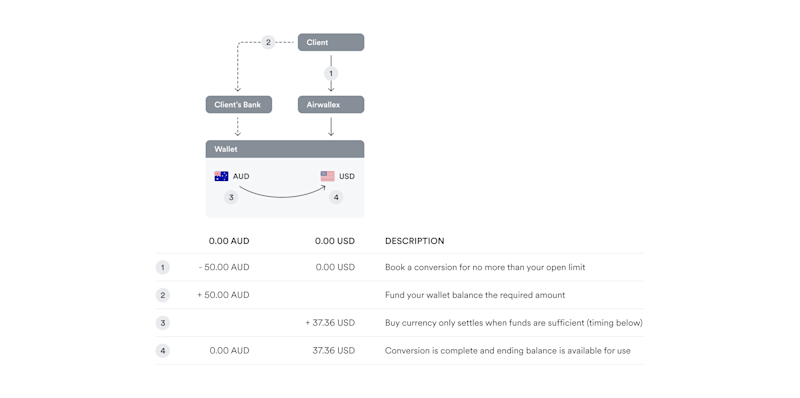

2. Post-funding workflow

The post-funding workflow is a little different. As the name suggests, you can schedule conversions and payouts to occur even if you don’t have enough funds in your wallet at that very moment. You'll have a specific limit for unfunded transactions, so keep that in mind. For same-day conversions, if you're a bit short on your open position limit, we'll just use your available balance in the sell currency.

This is a great workflow for those who are looking for a bit more flexibility in their conversions, or who are scheduling in a large volume of conversions at different times.

3. Settlement timings

In both pre-funding and post-funding models, you can take advantage of settlement timings. When you schedule a conversion or payout with Airwallex, you get to choose the date you want the transaction to happen. This date, along with your funding setup, will determine when the money moves in and out of your wallet.

If you don't pick a date, we'll choose one for you. If you're in pre-funding mode, it'll always be the same day for quick settlement. If you're in post-funding mode, it depends on your wallet balance. If you've got enough funds, it'll be the same day. If not, it'll be the next business day, skipping any holidays.

What if you’re a post-funding client and there’s an overdue balance by the time the conversion date comes around? Our team will reach out to let you know. We'll settle conversions in order, starting with the earliest conversion date and sufficient balance, then moving to the earliest created date. We'll try to settle every 30 minutes in batches. Please note that this might come with a fee to cover the overdue transaction.

FX mastery in your pocket

Although Airwallex is your complete tool for all things business financial operations, we’re particularly famous for our FX capabilities for a reason. Our clients around the world love our FX tools that are designed specifically for businesses, and have a truly global mindset when it comes to business potential.

If you’re not yet an Airwallex customer, it could be worth discovering the FX excellence that can be unlocked when you sign up for a Business Account. Start exploring today.

Open a business account in minutes.

Disclaimer: This information doesn’t take into account your objectives, financial situation, or needs. If you are a customer of Airwallex Pty Ltd (AFSL No. 487221) read the Product Disclosure Statement (PDS) for the Direct Services available here.

Share

Izzy is a business finance writer for Airwallex, specialising in thought leadership that empowers businesses to grow without boundaries. Izzy has more than four years of experience working alongside Aussie startups and SMEs, having previously worked at one of the country’s leading HR tech companies. Izzy’s diverse experience across business operations, from people to finance, brings a unique perspective to her current role.

Related Posts

WorldRemit Account Review (2025): Features and fees

•4 minutes

ERP integration: everything a business needs to know

•8 minutes