How to transfer money to India from Australia

- •What’s the best way to send money to India from Australia?

- •SWIFT payments

- •International payment providers

- •Airwallex makes it easy to transfer money to India from Australia

- •The documentation and details you need to transfer send to India from Australia

- •Do I need an IBAN to transfer money to India?

- •Get started by setting up your Airwallex account in minutes

We are often asked by our clients about the best ways to send money to India, especially directly in Indian Rupee. Whether the payment is used to pay suppliers or paying remote staff, there is often confusion about the quickest and cheapest way to make payment.

As a growing business, you might also be opening an office in India. In which case you might be paying business expenses to get your operation set up. This may include technical services for setting up your offices or warehouses, construction costs, and loan or credit repayments.

If you’re operating a business branch in India, then you’ll be needing to pay wages, salaries, and living expenses to your employees and team members stationed overseas.

Now, this isn’t just a random musing on the nature of why you want to send money to India. We’ll touch back on this later.

But for now, let’s look at the best way to send money to India from Australia.

What’s the best way to send money to India from Australia?

There are a few different ways to send money to India from Australia. As always, some methods cost more, and some take more time, so it’s important to weigh the different methods up against your needs.

SWIFT payments

The SWIFT payment network is the international money transfer method that you’re likely most familiar with.

But while this network makes up the infrastructure that facilitates your international bank transfers, it doesn’t actually transfer your money. No cash is changing hands. Instead, the network transfers the information of your payment, in the form of an international money order.

This information is then transferred from your bank through the SWIFT payment route until it reaches your supplier’s bank. This bank-to-bank transfer is one of the reasons that your international payments can take so long.

As such, you can expect to send money to India within 1-3 business days.

While this transfer can come with a $10 SWIFT fee, there are no limits to the amount you can send.

International payment providers

Quality international payment providers use local clearing systems to make payments to India from Australia. These include:

National Electronic Fund Transfer (NEFT), a national electronic clearing house maintained by the Reserve Bank of India

Real Time Gross Settlement (RTGS)

Electronic Clearing Services system (ECS), which can include ECS debit and ECS credit,

Immediate Payment Service (IMPS)

There are typically $0 payment fees when sending money to India via one of these systems, as it’s essentially a local bank to bank transfer within India. They’re also reasonably quick and have the ability to send INR to India in 1-2 business days.

However, there is a limit to the amount you can send. The current limit is 1,500,000 INR, the equivalent of around $27,000 AUD.

Without an international payment provider, you usually need a local INR bank account. These can be quite tough to open from Australia, particularly without the right documentation. Be wary of local Australian banks offering to complete this payment for you, they usually attract high fees either upfront or baked into the FX rate you’ll receive when converting AUD into INR.

Airwallex makes it easy to transfer money to India from Australia

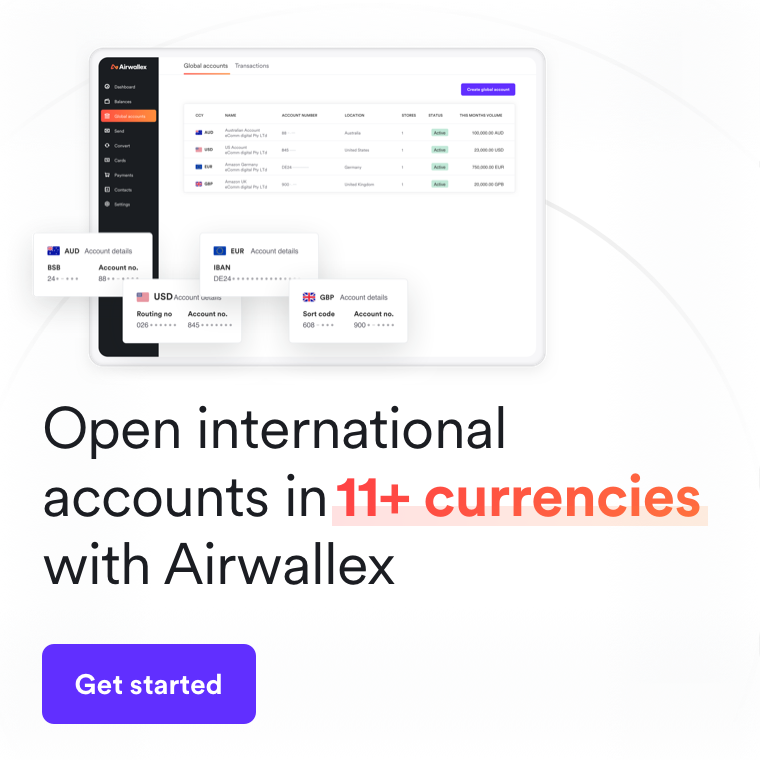

An Airwallex Business Account makes things simple to get your money where you need it to go using the faster and cheaper local clearing method instead of SWIFT. All without needing to set up a local INR bank account, just using your local Australian business details.

Here’s how it works:

Set up and verify your Airwallex Foreign Currency Account

Add funds to your Airwallex wallet for your transfer

Collect your recipient details and set up your contact

Book and confirm your transfer, including the amount and date

It’s that easy. You load your money into your Airwallex wallet, convert it into INR, and send. And because Airwallex allows you to send Indian Rupee locally, you can bypass the SWIFT network altogether and have your money transferred within one business day.

Airwallex is designed to keep more of your money in your wallet, so we charge a flat 0.6% fee above the transparent interbank exchange rate. That’s it. You’ve already exchanged your money, so you’re paying in the local currency. There are no transaction fees, no intermediary bank fees cutting into your payment.

You can even convert your AUD into INR ahead of time and lock in a rate you’re happy with, and keep it in your Airwallex wallet until it’s time to send your money to India.

The documentation and details you need to transfer send to India from Australia

Here’s everything you’ll need to get started transferring funds from Australia to India.

Their personal details

Full name of the receiving party

Their country

Their address

But while obvious, their name has to be in full—no initials—and it has to be to an actual street address, it can’t just be a postbox address.

Their bank details

SWIFT code. This is the 8 or 11 digit/character SWIFT code used to identify the particular bank to which you’re sending the funds. It’s a unique code that identifies their particular bank out of all the banks worldwide. To understand it, you can break it down like this:

4-digit or character bank code

2-digit or character country code

2-digit or character location code

3-digit or character branch code

IFSC. IFSC is the Indian Financial System Code. The IFSC is the major clearing system used in India. The code itself the 11-digit/character code that identifies the specific bank that participates in the IFS. It can be broken down like this:

First 4 digits or characters represents the English bank code

Next digit is 0

Last six characters or digits are the branch code

Bank account number. The 9-18 character or digit number of the receiver’s account

Bank name

Account name for the receiver

Reason for transfer. See? It wasn’t just a random musing on the nature of sending money to India. You’ve got to supply a proper reason on your transfer as to why you’re sending the money. This can include things like goods purchased, wages or salary, business expenses, education cost, investment capital or more.

Do I need an IBAN to transfer money to India?

IBAN stands for International Bank Account Number and is an international standard numbering system that can be used to identify banks all over the world. But, interestingly, it’s an international standard that the country needs to be a member of. In this case, India isn’t an IBAN member, so you don’t need an IBAN to transfer money to India.

Get started by setting up your Airwallex account in minutes

Book a demo with us today to set up your account, and see why Airwallex really is the best way to send money to India from Australia.

Related article: What is a telegraphic transfer?

Share

Related Posts

WorldRemit Account Review (2025): Features and fees

•4 minutes

BIN sponsorship | How it can help your business

•9 minutes