The benefits of a digital business bank account

In an increasingly digital world, how we bank is evolving.

You might have heard about digital banks. In this article, we look at what these innovative new platforms are, and how they can help you with your business’ finances.

What is a digital bank?

A digital bank isn’t just an online bank account. It’s a banking organisation that operates solely online. There are no branch locations in the real world, no physical presence, and no physical banking infrastructure.

All your account management and banking activities are done purely online, either in-browser or via the digital bank’s app.

Digital banks are capitalising on the rise of technology made for the digital world, and are doing a good job of disrupting the banking industry through customer-first feature releases, competitive pricing and industry-leading technology.

How do digital business bank accounts differ from traditional business bank accounts?

As a member of a digital bank, your bank account exists entirely online. All of it. From your data trail to your paperwork, and your money. Your relationship with your digital banks starts online, and stays online.

This also means that you access self-service for your account online, too. You usually don’t need to check things off with a person in the real world or provide hard copies of documents (a bonus of which enables you to bank paper-free).

Discover our complete Business Account.

The top 5 benefits of a digital business bank account

There are plenty of things to love about a digital business bank account. We’ve ranked the 5 key benefits that make digital business bank accounts an outstanding choice for your finances.

1. It’s quick and easy to open an online bank account

You don’t need to visit a branch, speak to an advisor, or have physical copies of your identification checked. Opening an online bank account with a digital bank is a completely online process. You don’t need to go into a branch during the not-quite-business hours that traditional banks operate under, or interact with another human being in any manner.

Once you’ve signed up to your digital bank, you can open a digital business account directly through their app, using nothing but your smartphone. All it takes is a few taps, entering some personal information, and your online bank account will be up and running.

2. 24/7 banking, with more self-service functionality

A digital business account means you can do your banking 24/7. No waiting until the banks open, no ducking out during work hours. You can access your account when you need it.

And, as digital banks are designed to be used online, they’ve made the user experience easier, too. All the functionalities you need from a bank will be laid out clearly and concisely in their app or browser interface—including customer service.

3. Enjoy lower costs all round

Digital banks cut out a lot of things that traditional banks require to run. As such, digital banks are paying a lot less overheads. Less, or no, rent, fewer staff salaries, less costs on office equipment and utilities—all the costs of existing in the physical world.

The fact that all your money transfers, bill payments, and general financial transactions are completed digitally removes the human element, while also removing the cost of human labour.

And, as cheesy as it sounds, they’re able to pass these savings on to you, the customer, in the form of lower account fees. Or in some cases, no account fees at all.

4. Enhanced security

Digital banks are built with digital needs in mind, so they take extra care with their digital security. Tools like two-factor authentication provide an added layer of safety around your banking, so you’ll always know when someone unwarranted is trying to access your account. And, as you’ll likely be banking via an app on your smartphone, two-factor authentication will be a breeze.

5. Better visibility and easier reconciliation

Because digital banks are, well, digital, they run purely on code. This code can be integrated into the code of other platforms. Platforms like cloud accounting software such as Xero, digital signature and contract management systems, or money lending and international trading platforms.

Digital banks are streamlining how we do banking, and creating opportunities to merge financial worlds for one easier process. You get better visibility across all your financials, and as your integrations are synced to one another, your reconciliation process can happen automatically.

How to make the most out of a digital business bank account?

It pays to set your online bank accounts up correctly in the first instance, to avoid any future hassles, try the following if it makes sense:

1. Set up two-factor authentication, and ensure a secure password

Much like your Gmail or ATO online portal identification, your digital business bank will likely have the option to set up two-factor authentication. This simple process enables you to control who accesses your account. The authentication might be sent to your smartphone via text, delivered in an email, go directly to your app, or to a specific authentication app on your phone.

And it shouldn’t be something we need to reiterate, but it is: be sure to set a secure password for your online bank accounts. Use a unique password across all your accounts, making use of numbers, symbols, and different cases.

You can condense all your passwords into a password manager app if you need. But taking the time to create a secure password is one of the first lines of defence against fraud; it’s a no-brainer.

2. Invest the time upfront to set up your account

Make your digital business bank account work for you by taking the time upfront to set up all the necessary users, with the corresponding levels of authority.

Then, determine which banking integrations you already use, and which ones you should be using, and ensure they can integrate with your digital bank account.

This will make your digital business account run smoothly from the get-go.

But if you want an even better way to manage your digital banking, Airwallex has you covered.

3. Try Airwallex Global Business Account as a better banking alternative

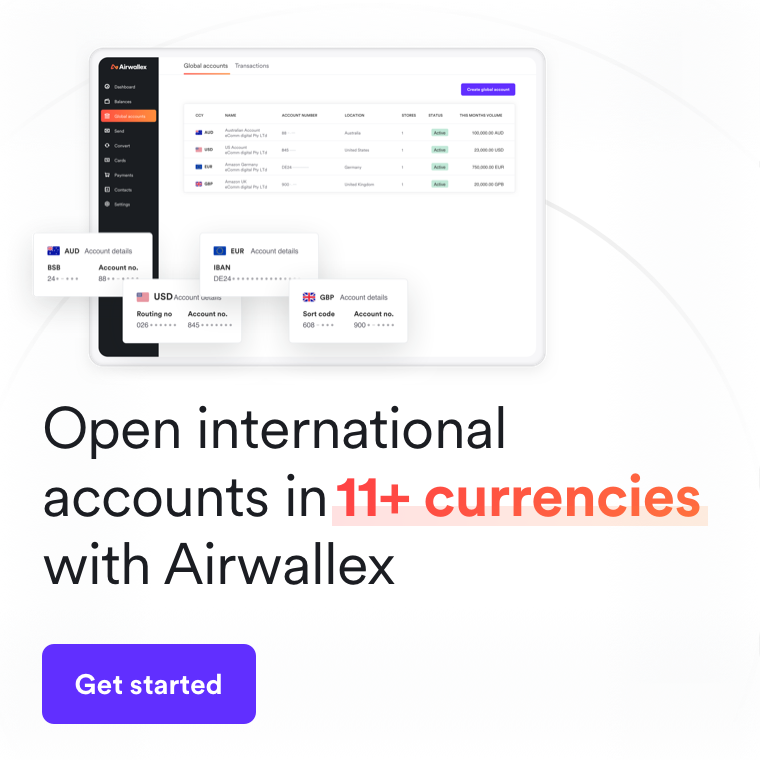

Airwallex is making digital business banking easy with our Global Business Account.

You get all the benefits of a digital business account, but with the added benefits and features that are built for a global scale.

With Airwallex, businesses can:

Create a digital business account, and get up and running on the same day

Open an account for international business payments for up to 23 currencies

Make same-day international payments and transfers

Save on FX with low, transparent pricing. You pay only 0.3% or 0.6% margin on top of the interbank transfer rate—far better than you receive from the big banks

Use multi-currency virtual cards to empower your team to make purchasing decisions while maintaining control

Switch on expense management software features to save their employees hours of admin and improve accounting accuracy

Streamline your purchasing and accounting, by integrating your payments with global online marketplaces like Amazon, eBay, Shopify, and Paypal, or directly to your Xero account, in multiple currencies

Ready to see the benefits of digital banking, without the digital bank? Open an Airwallex account today to get started.

Related articles about business banking:

Share

View this article in another region:SingaporeGlobal

Related Posts

WorldRemit Account Review (2025): Features and fees

•4 minutes

ERP integration: everything a business needs to know

•8 minutes