December release notes: Introducing Global Entity Management, streamlined payouts, and smarter payment insights

In this release, we’re delivering key updates to help you manage your payments and financial operations with greater efficiency and ease. From smarter payment insights and faster onboarding to centralised entity management and optimised marketplace payouts, these enhancements are designed to support your growth and streamline your financial workflows.

Payments

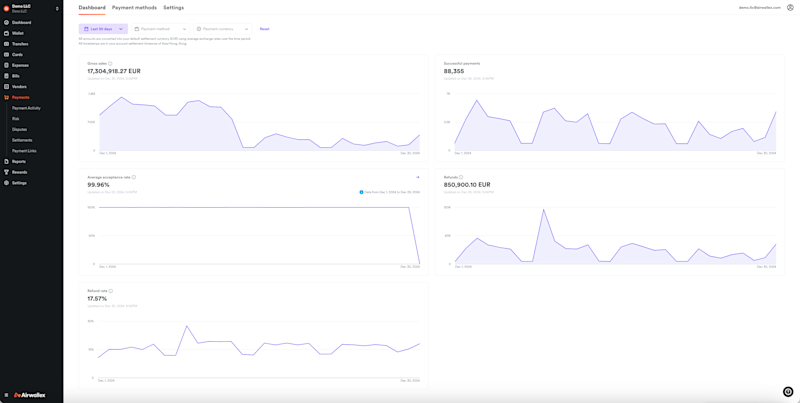

Enhanced Payments dashboard: smarter insights, better decisions 📊

The updated Payments dashboard is now available to all merchants, providing a clearer, more organised way to track payment acceptance rates, sales trends and other critical metrics. We’ve introduced detailed analytics pages grouped within use cases like Risk and Disputes, and grouped decline reasons in Payment analytics to make it easier for merchants to understand payment issues and resolve them quickly.

AI-powered onboarding for Local Payment Methods 🤖

We’ve introduced AI-powered Local Payment Method (LPM) website requirement checks, speeding up payment activation by automating the validation of LPM-specific website requirements. This feature reduces manual processing time and gives merchants real-time prompts during onboarding to ensure they meet necessary requirements. Plus, if a payment method is rejected, merchants can now easily reapply through the web app with clear instructions on what needs to be updated.

Visa and Mastercard for New Zealand customers 🌍

We’re thrilled to announce that Visa and Mastercard are available as payment methods for customers with a New Zealand entity. This expansion will unlock new opportunities for local businesses and those expanding into New Zealand, providing smoother transactions and broader access to payment methods.

Stay tuned for more details - AMEX will be launching soon, bringing even more payment options for New Zealand customers.

Get started with online payments.

Spend

Centralise financial operations with Global Entity Management 🌐

We’re excited to announce that Global Entity Management is now available for all customers using NetSuite. With this feature, customers will be able to centrally manage their financial operations across multiple entities and accounts - all from within the Airwallex web app. With Global Entity Management, customers can centrally manage their financial operations across multiple entities, enabling benefits like:

Control and manage global spend: Create and maintain a global set of approval policies rather than redundant policies for each account. Review and approve all expenses, reimbursements, and bills in one place

Single source of truth for financial information: View aggregated financial information in one place across all of their entities and accounts, including account balances, payments, and reports

Simplified user management: Centrally manage and invite users across all entities and accounts

Central integration management: View and manage all external integrations in a single place

Watch this space for additional releases related to Global Entity Management, including support for Xero customers coming soon. To activate this feature, contact your customer support rep or account manager.

Netsuite support for custom segments and fields 🔗

Elevate your financial management with our enhanced Netsuite integration. Import all desired custom fields and segments from Netsuite to code expenses and bills more efficiently. Transactions will sync seamlessly with this custom segment or field data, providing greater control and speeding up your month end close. This initial release supports single-select list type custom fields and segments, with multi-select compatibility coming in early 2025. This feature is exclusively available to Netsuite customers using the Global Entity Management feature. To activate both features, reach out to your customer support rep or account manager.

Expense & Bill UX improvements 📈

Enhance your workflow with two new features designed to improve ease-of-use:

Find expenses fast: Quickly locate specific transactions by searching your full list of expenses by description.

Resync bills in bulk: Easily resolve sync errors by retrying multiple bills at once with our new bulk resync functionality.

These updates are available by default to all customers, requiring no additional action.

Easily request a replacement card 💳

If your card is ever lost, stolen, or compromised, you can now easily request a replacement card directly through the Cards page on the web app. This self-service option allows users to request a new virtual or physical card with a new card number, so you can keep your card details secure. Virtual card replacements are available instantly, and replacement physical cards can be shipped to the cardholder’s address within 7-12 business days.

Core API and Embedded Finance

Ledger accounts for marketplace payouts: streamlining global payouts 🚀

For Marketplaces, we’re excited to announce that we will soon launch Ledger accounts for marketplace payouts, designed to simplify and streamline the payout process. With this new account type, you can benefit from an account type with light screening (as opposed to full KYC of the seller) for sellers in 150+ countries. Marketplaces can in this way benefit from Airwallex’s robust multi-currency ledgering system to easily manage seller balances & payouts. Marketplaces using ledger accounts maintain ownership of funds prior to payout (remittance model). Enjoy a faster go-to-market for your marketplace payouts needs, built-in risk controls, and a seamless experience for sellers.

Learn more about the Airwallex Business Account.

Share

Vanessa is a business finance writer for Airwallex. With experience working at leading B2B technology companies, Vanessa is passionate about helping Aussie businesses, large and small, grow through cutting-edge tech. In her day-to-day, she breaks down complex tech jargon to help businesses streamline their end-to-end financial operations.

View this article in another region:Canada - EnglishCanada - undefinedEurope - EnglishEurope - NederlandsHong Kong SAR - EnglishHong Kong SAR - 繁體中文IsraelNew ZealandSingaporeUnited KingdomUnited StatesGlobal

Related Posts

WorldRemit Account Review (2025): Features and fees

•4 minutes

BIN sponsorship | How it can help your business

•9 minutes