CommBank Foreign Currency Account: a comparison

CommBank’s foreign currency account offering was created to provide a straightforward banking option for businesses that regularly send and receive foreign currencies.

Whether you’re a global business with a large international presence, you’re an up-and-coming eCommerce company with your eyes on the horizon, or you’ve taken advantage of exploring the potential for international suppliers and contractors, here’s what you can expect from a CBA foreign currency account.

A detailed look at CommBank foreign currency accounts

Key features

Offers 19 foreign currency options

No conversion costs when sending and receiving payments in these currencies

No minimum balance required to be kept in the account

Access to CommBank’s netbanking function through the CommBiz app, with free transfers between your existing CommBank AUD accounts

Holding money in a specific currency means it stays resilient against FX fluctuations, and you can convert to AUD at a time that suits you

Limitations of your account

As your CBA foreign currency account is held in Australia, this means that all international payments made to and from the account are operated via the SWIFT network. This may deliver slower transfer times when compared against newer international transfer networks.

As well as the standard payment fees highlighted below, you may also be required to pay extra fees to cover charges included from international banks within the network. This may make it more expensive for the sender than other options.

CommBank doesn’t issue cards that pay in foreign currencies. All transfers must be made either via the CommBank app, or in person at a branch.

Fees and rates

While there are no monthly account fees for holding a CommBank foreign currency account, you can expect to pay fees on each transaction you make. These may include:

$11 fee per received international payment

Fees for making transactions, ranging from $6 (for payments made via netbanking) to $30 (payments made in-branch)

$25 fee plus overseas banking cost where there are amendments to your payment instructions, cancellations or request for funds to be returned

Current FX rates are available on the CBA website or via your Commbiz app. However, these are most likely not the interbank exchange rate, which isn’t likely to be the rate that you receive in your transaction. On top of these rates, there may be further costs incurred when transferring currency to and from AUD.

Opening a CommBank foreign currency account

The first step to opening a CBA foreign currency account is to have an eligible CommBank AUD account to link it to.

To ensure you can open this account you’ll need to provide the following identification details:

Personal ID, such as a passport or drivers licence, or birth certificate

Business details, including:

Business name (if you have it)

Full name of the company, as registered by ASIC

Address of your registered office, and your company’s principal place of business

ACN

Industry type

Tax residency and identification information

Full names of all directors, and identification for at least one of these people

Identification for all people operating the account

Notification if your company earns over 50% of your income from investing

Once you’ve got all this information, head to the CommBiz website to apply for your CBA foreign currency account.

The website itself will guide you through the steps to open your account, which will then be submitted for review and approval. Alternatively, a foreign currency account can be opened directly through the CommBiz app.

Looking to open a business bank account? Check out our easy guide, here.

Receiving an international payment

There are a number of key pieces of information you’ll need in order to receive an international payment with your Commbank foreign currency account. Keep in mind that bank details differ all over the world. So while this will all be familiar to an Australian audience, you may need to provide further explanation of what it all means to your international contacts.

This information includes:

The Commonwealth Bank’s BIC or SWIFT code

Your BSB and account number

Name of the account

Your home address

One important thing to remember is that there will be fees involved with the transfer. So to avoid any awkward conversations down the track, it’s crucial that you and the sender agree ahead of time who will bear this cost.

Supported currencies

CommBank foreign currency accounts support the following international currencies :

CAD: Canadian Dollar

CNY: Chinese Renminbi

CZK: Czech Koruna

DKK: Danish Kroner

EUR: Euro

GBP: Great British Pound

HKD: Hong Kong Dollar

HUF: Hungarian Forint

ILS: Israeli New Shekel

JPY: Japanese Yen

NZD: New Zealand Dollar

NOK: Norwegian Kroner

SGD: Singapore Dollar

ZAR: South African Rand

SEK: Swedish Kronor

CHF: Swiss Franc

THB: Thailand Baht

AED: United Arab Emirates Dirham

USD: United States Dollar

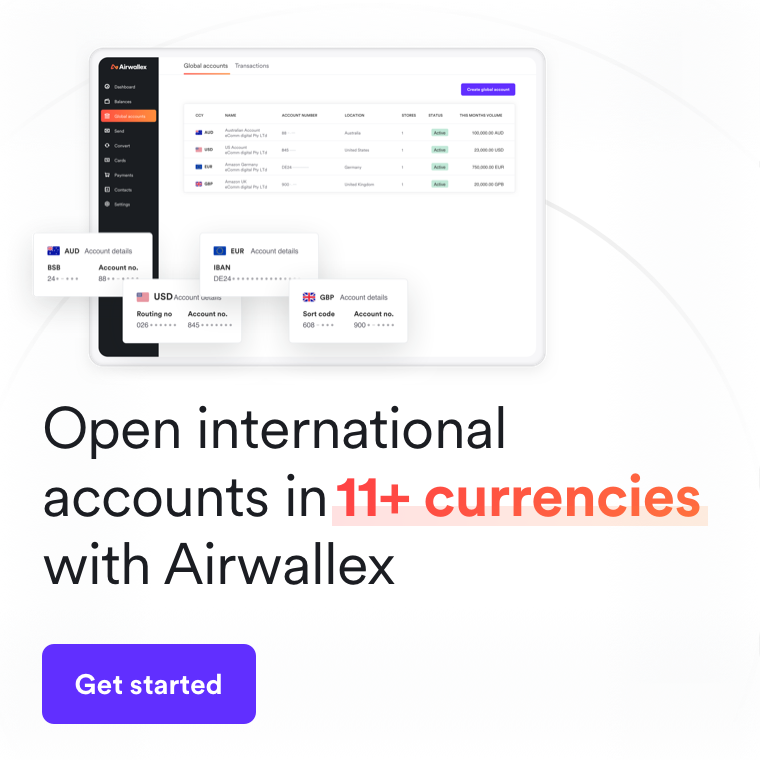

Airwallex global accounts offer a competitive alternative

Airwallex business accounts are created to power international business growth, providing you with all the benefits of a foreign currency account, but with greater functionality in receiving payments with lower fees and faster.

Key features

Global Accounts: Create multiple global accounts within minutes to receive 11+ currencies, complete with local bank account details that are familiar to the locals. Whether it’s AU, US, UK, EU or HK - your Global Account acts like a local bank account. This means that your international customers and clients can make payments to you as easily as if they were making a local bank transfer in their home currency.

FX & International Payments: Send money overseas to 130 countries, in over 34 different currencies with no minimum transfer fees.

Multi-currency virtual Visa cards: A multi-currency debit card allows you to access and use your multi-currency funds immediately, with no additional FX fees. You can pay in these currencies anywhere VISA is accepted.

Xero integration: We make your bookkeeping easy with a plug and play multi-currency Xero integration. This allows you to set up each individual currency as its own bank feed, and get easy, streamlined reconciliation directly to your Xero account that syncs on the hour.

Fees and rates

Airwallex doesn’t charge monthly fees, and no minimum balance or minimum transfer amount is required, so you’re free to use each local account that you create as little or as much as you like. However, other fees and charges may apply, which you can find on our website.

When you do need to exchange funds, you gain access to wholesale FX rates on your payments, allowing you to access rates that are only 0.3% or 0.6% above the interbank FX rate. We also provide you with transparent FX rates that you can check before you book in your payment.

Supported currencies

As well as AUD, Airwallex Global Accounts support the following international currencies:

CAD: Canadian Dollar

CNH: Chinese Yuan

EUR: Euro

GBP: Great British Pound

HKD: Hong Kong Dollar

JPY: Japanese Yen

NZD: New Zealand Dollar

SGD: Singapore Dollar

CHF: Swiss Franc

USD: United States Dollar

Open a business account that’s built for international growth

Airwallex global accounts make it easier to send and receive foreign currencies. Get in touch with us to book a demo and find out how a Global Account can help your business grow in an international market.

Related article:

Source: https://www.commbank.com.au/business/international/international-payments/foreign-currency-accounts.html

---

Last updated as of January 2021

Our products and services are provided by Airwallex Pty Ltd ABN 37 609 653 312 who holds AFSL 487221 (Airwallex). This article is provided for general information purposes only and is correct at the time of publication but may change. This article does not take into account your objectives, financial situation or needs. Airwallex is not providing you with any legal, financial or tax advice. You should consider the appropriateness of the information in light of your own objectives, financial situation or needs and obtain your own legal, financial or tax advice. Please read and consider the Product Disclosure Statement available on our website before using our service.

Airwallex provides third-party links for general informational purposes only. Airwallex does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Airwallex accepts no responsibility for the accuracy, legality, or content on these sites.

Share

Related Posts

WorldRemit Account Review (2025): Features and fees

•4 minutes

ERP integration: everything a business needs to know

•8 minutes