Get started

Before you can process PSP settlement transactions, you must set up various accounts to manage the funds flow. You can also optionally set up a database for internal reconciliation.

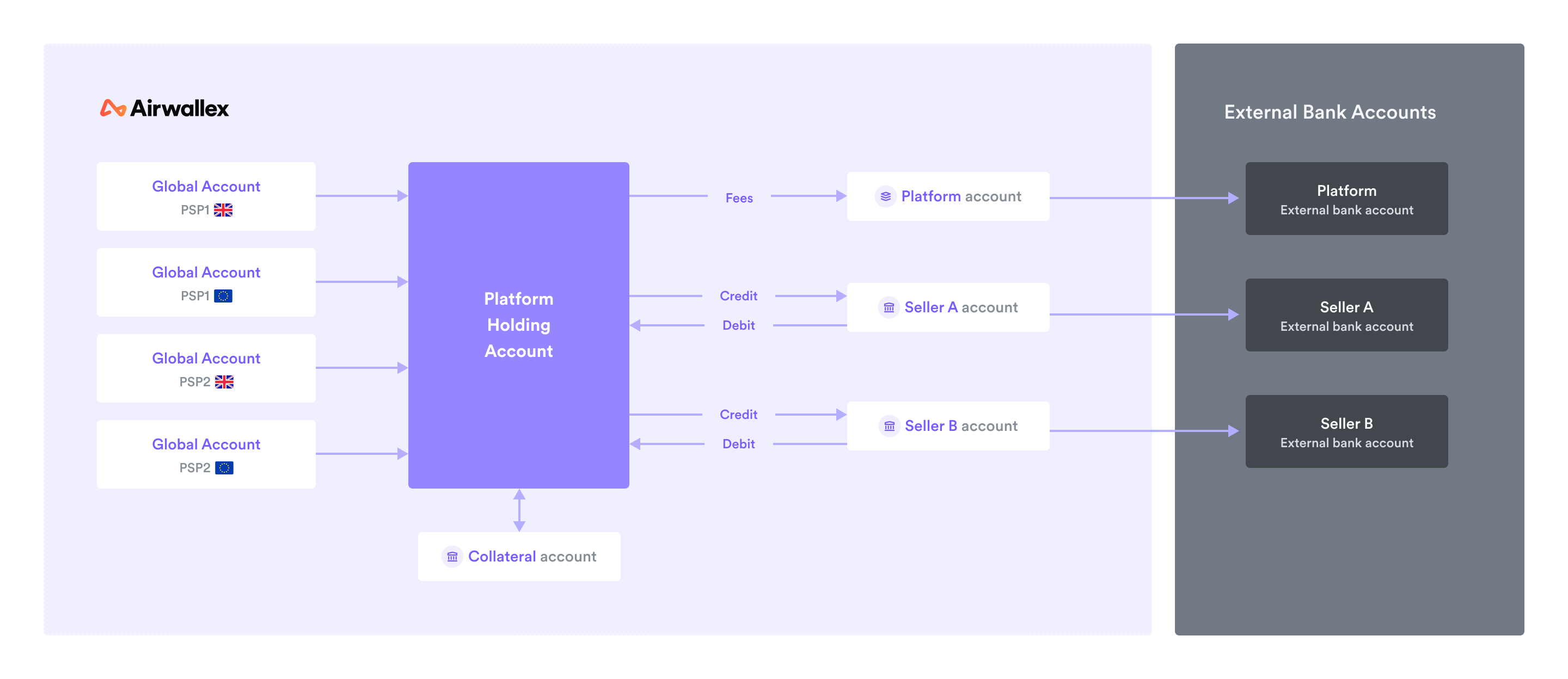

Accounts structure

Platform account

The platform account is the account of the Airwallex customer that wishes to implement the PSP-agnostic solution. A platform account is needed in order to use Airwallex's API. The platform account can onboard marketplaces and sellers. For more information, see Set up your platform account.

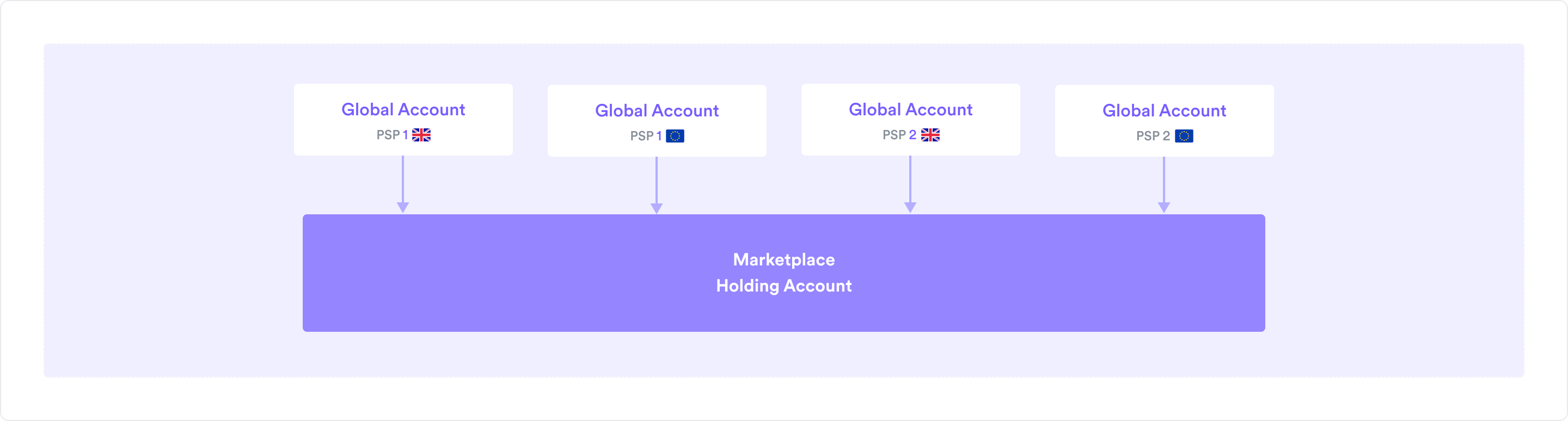

Holding Account and its Global Accounts

A platform Holding Account serves the purpose of holding funds received from PSPs. The funds are distributed from the Holding Account to the different sellers and to the platform itself, whenever the platform chooses.

After the platform sets up a Holding Account, the next step is to set up associated Global Accounts , to which PSPs will send the funds. The platform will provide PSPs with these Global Account details -- note that a separate Global Account should be set up for each PSP/currency combination that the platform anticipates needing. All funds sent by PSPs to these Global Accounts will be deposited into the Holding Account's multi-currency wallet to await disbursement. Learn more about how a Global Account differs from a Wallet.

Seller accounts

The platform will set up a connected account for each of the marketplace's sellers, to hold any funds received from a settlement, and to fund any refunds/chargebacks that the seller owes. The seller account can never have a negative balance. See Onboarding connected accounts for more details on how to set up connected accounts.

The funds in this account belong to the seller. The platform needs to link each seller account to the seller's external bank account, in order to process payouts to the seller.

A key benefit of using Airwallex's PSP-agnostic solution is that the sellers are onboarded to Airwallex once as connected accounts but don't need to be onboarded to the acquiring PSPs. The platform/marketplace is the Merchant of Record for acquiring PSPs.

Marketplace fee accounts

In the marketplace model, all fees distributed to the marketplace can be split to the platform account's Wallet. This Wallet should therefore be linked to an external bank account for payouts, just as with any seller account. Note: In the case of the MTP model, a separate marketplace fee account should be set up for each marketplace.

Collateral Accounts

Using Collateral Accounts is optional but recommended. Without a Collateral Account, some funds distributions to sellers can be blocked. As a prerequisite, familiarize yourself with Handling settlements before reading about Collateral Accounts.

A settlement from a PSP will include the net cash balance of all sales (positive) and refunds/chargebacks (negative) across all sellers. Within a settlement, some sellers will be due for a credit split, that is, a "net positive” amount (sales exceeding refunds/chargebacks) transferred from the Holding Account to the seller account, and other sellers may be due for a debit split, that is, a "net negative” amount (refunds/chargebacks exceeding sales), transferred from the seller account to the Holding Account.

This means that sometimes there may not be sufficient funds in the Holding Account to release funds to sellers. This could happen if a platform releases the credit splits to sellers first, before releasing the debit splits from sellers; or if a seller account doesn't have enough funds to cover a debit. Without adding funds from the debits into the Holding Account, there won't be enough money to cover all the credits. (See illustration below for more details). As a result, some credit releases to sellers won't be processed.

The Collateral Account solves this problem. By setting up a Collateral Account for each platform Holding Account, if there are insufficient funds in the Holding Account, the Holding Account will be allowed to go negative, as long as there are enough funds in the Collateral Account to cover the shortfall. In this way, the dispersal of funds to sellers will not be blocked. The money that covers a negative Holding Account balance will remain in the Collateral Account, but will be classified as reserved and cannot be withdrawn. Aside from the reserved amount, a platform can add and withdraw funds from a Collateral Account whenever they wish. Note that a negative balance in the Holding Account for each currency must be covered by a separate Collateral Account balance in that same currency.

Without a Collateral Account

Without a Collateral Account, releases to other sellers may be blocked. In the example illustrated below, one seller has a large refund (a PSP settlement split of type "debit”) causing this problem, which continues until a subsequent release cycle when that seller generates sufficient sales revenue to cover the refund.

Definitions of terms used in this example:

- Credit split: Funds moving to the seller from the Holding Account.

- Debit split: Funds returned from the seller to the Holding Account.

Let's assume three PSP settlement intents, each comprising two PSP settlement splits for two sellers A and B, as shown in this table:

| Airwallex PSP Settlement Intent ID | Airwallex PSP Settlement Split ID | Seller ID | PSP Settlement Split Amount | PSP Settlement Split Type |

|---|---|---|---|---|

| psi_1 | pss_10 | A | 10 | Credit |

| psi_1 | pss_11 | B | 100 | Credit |

| psi_2 | pss_12 | A | 30 | Debit |

| psi_2 | pss_13 | B | 100 | Credit |

| psi_3 | pss_14 | A | 50 | Credit |

| psi_3 | pss_15 | B | 100 | Credit |

Now consider this series of events:

| # | Date | Event | Split status | Holding Account Balance | Seller A Balance | Seller B Balance |

|---|---|---|---|---|---|---|

| 1 | May 1 | Deposit €110 to the Holding Account | - | €110 | €0 | €0 |

| 2 | May 1 | Release pss_10 Credit split of €10 to A | Settled | €100 | €10 | €0 |

| 3 | May 1 | Release pss_11 Credit split of €100 to B | Settled | €0 | €10 | €100 |

| 4 | May 2 | Deposit €70 to the Holding Account | - | €70 | €10 | €100 |

| 5 | May 2 | Release pss_12 Debit split of €30 to A: insufficient funds in Seller A's Wallet | Failed | €70 | €10 | €100 |

| 6 | May 2 | Release pss_13 Credit split of €100 to B: insufficient funds in Holding Account | Failed | €70 | €10 | €100 |

| 7 | May 3 | Deposit €150 to the Holding Account | - | €220 | €10 | €100 |

| 8 | May 3 | Release pss_14 Credit split of €50 to A | Settled | €170 | €60 | €100 |

| 9 | May 3 | Release pss_15 Credit split of €100 to B | Settled | €70 | €60 | €200 |

| 10 | May 3 | Release pss_12 (try again) Debit split of €30 to A | Settled | €100 | €30 | €200 |

| 11 | May 3 | Release pss_13 (try again) Credit split of €100 to B | Settled | €0 | €30 | €300 |

With a Collateral Account

With a Collateral Account, releases to other sellers will not be blocked as long as the Collateral Account has sufficient balance that can be reserved to cover the Holding Account shortfall.

When funds are added to the Holding Account, they free up any reserved amounts in the Collateral Account.

| # | Date | Event | Split status | Holding Account Balance | Collateral Account Balance | Collateral Account Reserve | Seller A Balance | Seller B Balance |

|---|---|---|---|---|---|---|---|---|

| 1 | - | Top up Collateral Account with €1000 | - | €0 | €1000 | €0 | €0 | €0 |

| 2 | May 1 | Deposit €110 to the Holding Account | - | €110 | €1000 | €0 | €0 | €0 |

| 3 | May 1 | Release pss_10 Credit split of €10 to A | Settled | €100 | €1000 | €0 | €10 | €0 |

| 4 | May 1 | Release pss_11 Credit split of €100 to B | Settled | €0 | €1000 | €0 | €10 | €100 |

| 5 | May 2 | Deposit €70 to the Holding Account | - | €70 | €1000 | €0 | €10 | €100 |

| 6 | May 2 | Release pss_12 Debit split of €30 to A: insufficient funds in Seller A's Wallet | Failed | €70 | €1000 | €0 | €10 | €100 |

| 7 | May 2 | Release pss_13 Credit split of €100 to B | Settled | -€30 | €970 | €30 | €10 | €200 |

| 8 | May 3 | Deposit €150 to the Holding Account | - | €120 | €1000 | €0 | €10 | €200 |

| 9 | May 3 | Release pss_14 Credit split of €50 to A | Settled | €70 | €1000 | €0 | €60 | €200 |

| 10 | May 3 | Release pss_15 Credit split of €100 to B | Settled | -€30 | €970 | €30 | €60 | €300 |

| 11 | May 3 | Release pss_12 (try again) Debit split of €30 to A | Settled | €0 | €1000 | €0 | €30 | €300 |

Database for internal reconciliation

It is recommended (not required) that the platform stores PSP settlement split information in its own database for internal reconciliation. In this example, each PSP settlement split is stored as a record with status PLANNED before the information is shared with Airwallex, and the status is changed to the one provided by Airwallex after a psp_settlement_split.created webhook notification is received.

| Internal ID | Airwallex Split ID | Airwallex Intent ID | Client Identifier | Seller ID | Split Amount | Split Type | Split Status | Last modified date |

|---|---|---|---|---|---|---|---|---|

| 1 | pss_10 | psi_1 | 13_as | A | 10 | Credit | SETTLED | 2023-05-01 |

| 2 | pss_11 | psi_1 | 42_dd | B | 30 | Debit | FAILED | 2023-05-01 |

| 3 | pss_12 | psi_2 | 49_tt | A | 50 | Credit | MATCHED | 2023-05-02 |

| 4 | pss_13 | psi_2 | 66_as | B | 100 | Credit | SETTLED | 2023-05-02 |

| 5 | pss_14 | psi_3 | 99_ye | A | 100 | Credit | FAILED | 2023-05-03 |

| 6 | pss_15 | psi_3 | 23_et | B | 100 | Credit | MATCHED | 2023-05-03 |

| 7 | pss_16 | psi_4 | 83_12 | C | 500 | Credit | PLANNED | 2023-05-04 |

| 8 | pss_17 | psi_4 | 32_rr | D | 500 | Credit | PLANNED | 2023-05-04 |

| 9 | pss_18 | psi_4 | 24_fq | E | 500 | Credit | PLANNED | 2023-05-05 |