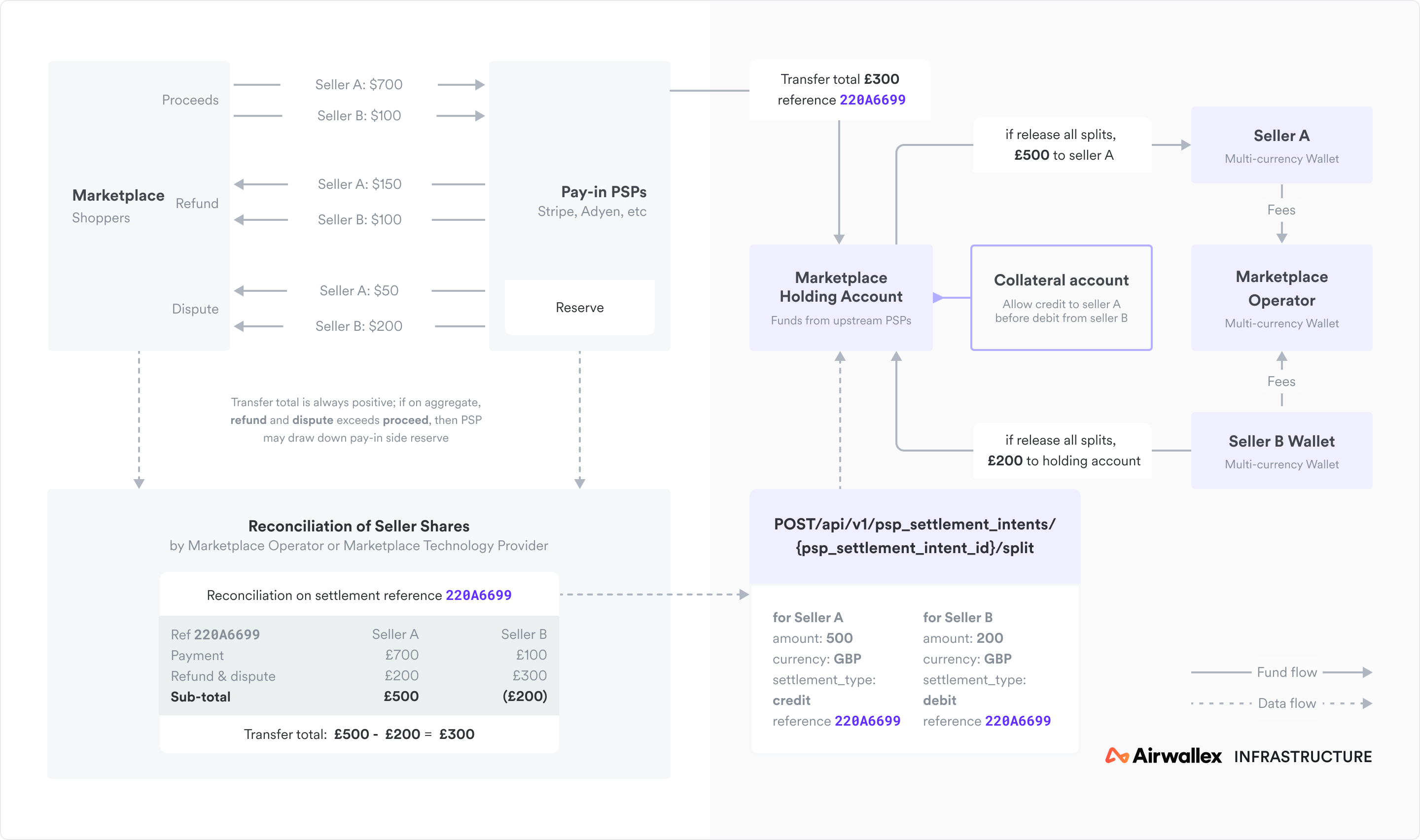

Funds and data flows

To deploy a PSP-agnostic solution, Platforms:

- maintain an integration with pay-in PSPs (or 'acquiring' providers)

- instruct pay-in PSPs to settle to Airwallex at a frequency they may specify (in an aggregate settlement, with funds for all sellers grouped into one settlement)

- pass split instructions to Airwallex for the respective sellers to be paid out

Funds & data flows

-

PSPs generate settlement reports for the transactions that they acquire (including sale/proceeds, refunds and disputes)

-

Platforms should ingest these settlement reports passed to them by their pay-in PSPs. Deposit split data is then shared to Airwallex via API

-

PSPs typically attach a settlement reference with the report that is generated. This reference will also be passed through the banking rails when the funds deposited to AWX

-

The Platform conducts data sharing to Airwallex with information on how the deposit should be split between the sellers by creating deposit intents with Create new PSP settlement intent API and splitting these intents with Split a PSP settlement intent API. The settlement reference is included as part of this deposit splits data, for Airwallex to be able to match the data shared with the incoming funds

-

Platform specifies when a deposit split should be released with Release split API when its required conditions have been met (e.g. when shopper has received the goods). the Platform controls the timing of release, although an upper bound may be specified to each Platform for how long funds may remain in the holding account

-

Platforms may add funds to a collateral account in order to prevent negative seller balances in a holding account impacting the payouts of other sellers. Given holding account balances cannot be negative, if a particular seller has disputes and refunds exceeding sales in a given period, without a collateral there would be insufficient funds in the holding account to pay out all other sellers