Reduce Google, Facebook and LinkedIn ad spend with this one hack

Tilly Michell

Content Marketing Manager

If you advertise on Google, Facebook and LinkedIn, you probably spend a lot of time thinking about how to improve your conversion metrics and make your ad budget spread further. But did you know that you can spend less on online adverts just by changing the way you pay for them?

Because Google, Facebook and LinkedIn adverts are billed internationally, companies can incur additional charges when paying their bills. Unless they examine their bank statements carefully, businesses might not know they’re being charged, or that there’s a way to avoid the fees.

Why it pays to avoid Google and Facebook billing fees

When Google and Facebook adverts perform well, they can become the bedrock of your marketing strategy. But online adverts can also be a budget sink. Finding the right target audience and ad creative takes time, and businesses can easily spend thousands of pounds before seeing tangible results.

For that reason, marketing teams feel the pressure to make every penny count, and will agonise over minute copy changes in order to move the dial. For businesses with tight marketing budgets, the pressure is even greater, and having a little extra to spend can make all the difference.

Why UK businesses are charged additional fees when paying for Google and Facebook ads

Because Google, Facebook and LinkedIn adverts are billed in Ireland, UK advertisers are charged an international transaction fee when paying for online ads via bank transfer. These fees range from £15 — £17 per transaction, depending on who you bank with.

If you have online ad accounts across several platforms and pay for each one with a monthly bank transfer, you could end up throwing away around £100 each month on unnecessary foreign transaction fees.

How to get around Google and Facebook bank transfer fees

The best way to avoid bank transfer fees is to pay for your online ads via a card.

Upload your card details directly into your Google or Facebook account and you will not be charged any transfer fees, whether you choose to ‘pay as you go’ or pay periodically.

However, whilst this may seem like an obvious solution, it doesn’t suit all businesses. Putting ad spend directly on a company card can make it harder to keep track of expenditure and most companies prefer to manage outgoings via a centralised accounts system. Ultimately, many businesses decide to go with a monthly bank transfer despite the fees incurred.

Airwallex provides a solution to this problem. When you sign up for a business account with us, you can issue virtual debit cards to your employees or projects, set limits for each card and track spend in real-time from a centralised account. Marketing teams can add their Airwallex card details to their online ad accounts and avoid transfer fees.

Paying for online adverts in different currencies

In some cases, businesses may wish to pay for online adverts in a foreign currency. For example, if your customers are based in the US and you mainly collect money in USD, you might also prefer to use USD as your billing currency.

Here’s where things can get expensive. Banks charge up to 2.95% of the converted amount when you pay for Google, Facebook or LinkedIn adverts in alternative currencies. This charge is levied whether you pay by bank transfer or with a traditional payment card. So if you spend $20,000 a month on online advertising, you’ll pay $590 per month just in international payment service charges!

To make things worse, once you’ve set your preferred billing currency in Google and Facebook, you can’t change it. So, if you chose USD when you set up your account, you will be stuck paying in USD whether you like it or not.

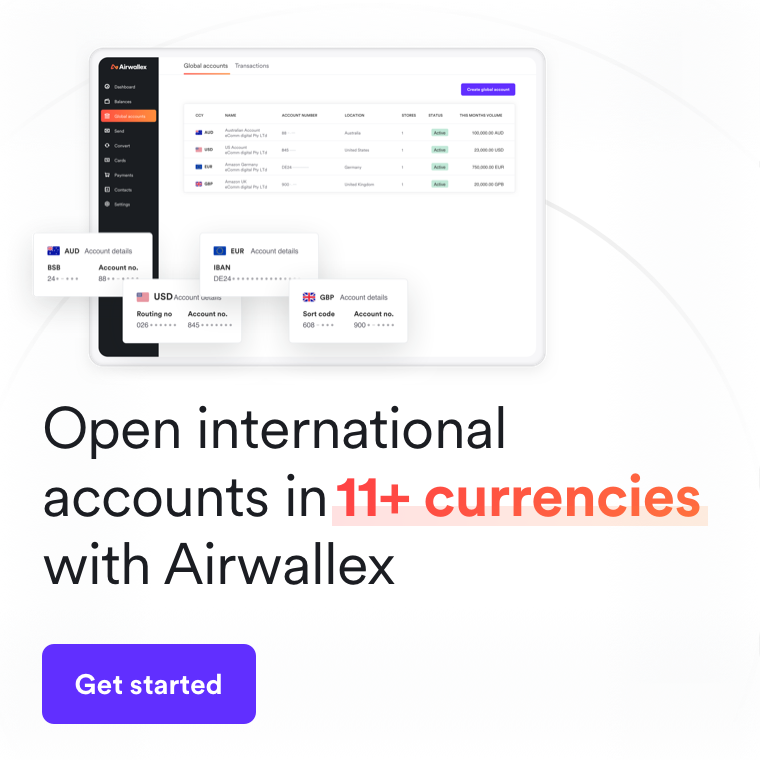

Fortunately, you can get around this problem by setting up a multi-currency business account. With a multi-currency account, you can pay for Google and Facebook adverts in the currency of your choice at no additional charge.

Keeping track of expenses in a borderless business

An upwards trend in online shopping has made it easier than ever before for eCommerce businesses to expand internationally. Being a borderless business comes with countless advantages, but it pays to be vigilant.

Online advertising is just one of the ways you can be stung by currency exchange fees. There are many other areas—from purchasing stock to payment collection—where you can be charged for sending and collecting money.

To avoid unnecessary fees, apply for an Airwallex multi-currency business account. You won’t be charged any set up or account fees, and can start saving money on international transactions immediately. You can make international money transfers in multiple currencies, in one business day or less.

Related article: What's the Difference Between CHAPS and BACS Payments?

View this article in another region:Global

Tilly Michell

Content Marketing Manager

Tilly manages the content strategy for Airwallex. She specialises in content that supports businesses in their growth trajectory.

Posted in:

Expense management