How to set up online payments for your business

Key takeaways:

Online payments help businesses accept digital transactions through digital channels from customers.

Offering online payment options expands your customer reach and boosts customer satisfaction when a preferred payment method is available.

Airwallex’s payment gateway is easy to set up and supports over 160 different payment methods.

Consumer preferences are shifting rapidly toward digital payments and global online shopping for convenience, and businesses need to expand their payment options if they want to keep up with demand.

In fact, 93% of consumers say that seeing products priced in their local currency directly influences their purchasing decision, according to Airwallex’s Cross-border eCommerce Report.

In this guide, we’ll walk through what online payment processing entails and how to set up online payments.

What is online payment processing?

Online payment processing is a system that helps businesses accept digital payments from customers. This process can help you expand your customer reach, and can increase conversions when those customers can pay in their preferred currency and payment method.

Online payment processing works with the help of several components, including:

Payment gateways are responsible for transmitting digital payments to the payment processor.

Payment processors are third-party companies that facilitate digital transactions between the customer’s bank and the merchant.

Merchant’s accounts receive approved payments from the customer’s bank.

Learn how these elements work together below.

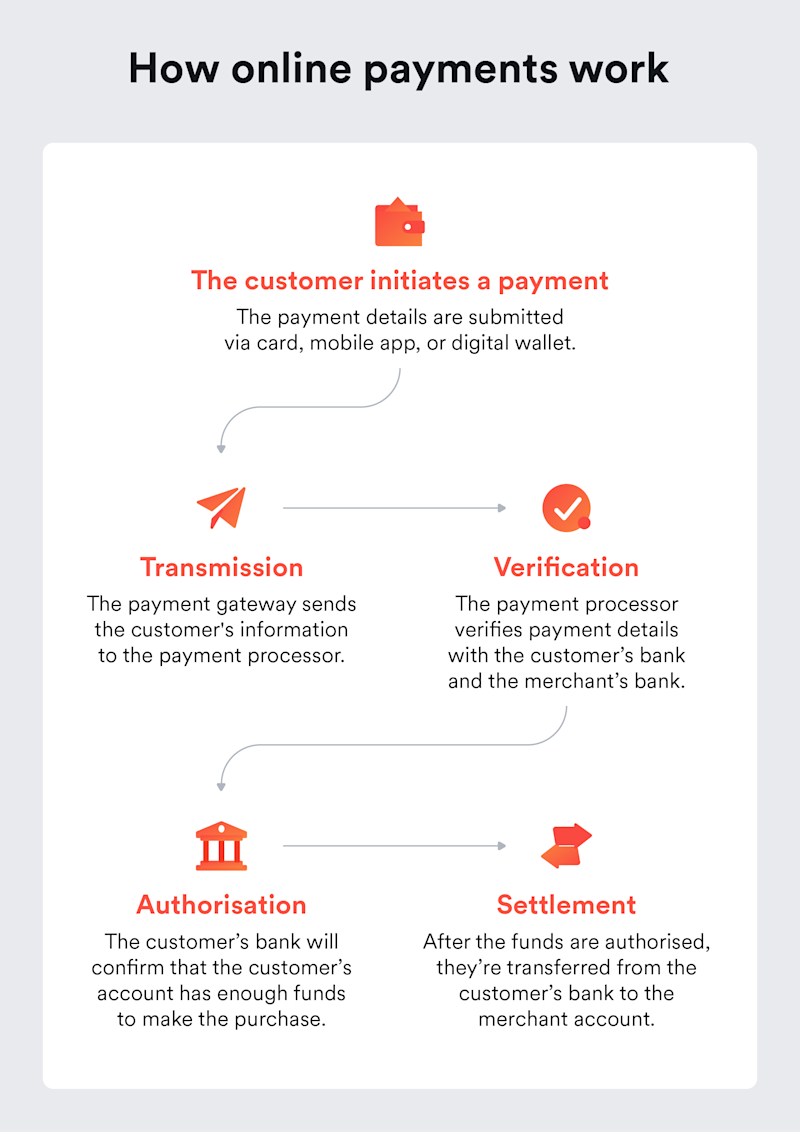

How do online payments work?

Online payments work by securely transmitting a customer’s payment details through a payment gateway to a bank, which authorises the transaction and transfers funds to the merchant’s account.

Here’s a breakdown of the process:

Customer initiates payment: Your customer submits their card details or uses a one-click checkout or digital wallet to initiate the payment.

Transmission: The payment gateway securely transmits the customer’s information to the payment processor.

Verification: The payment processor verifies the information with the customer’s bank.

Authorisation: The customer’s bank authorises the transaction if the customer’s account has enough funds to complete the purchase.

Settlement: After the transaction is authorised, the funds are transferred from the customer’s bank to the merchant’s account.

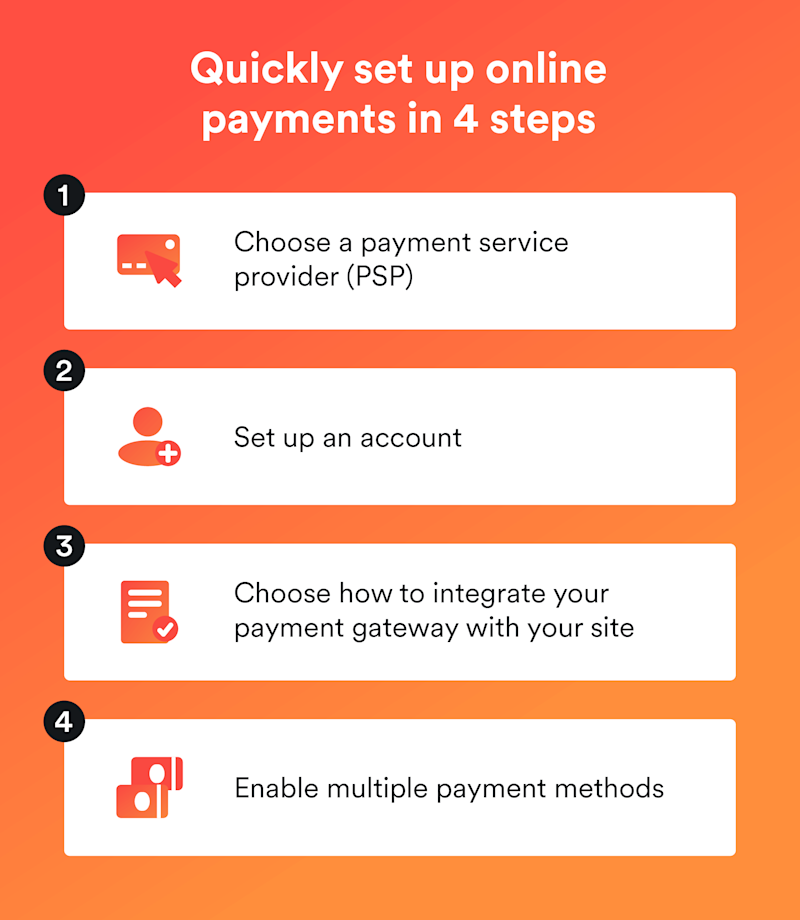

How to set up online payments in four steps

Secure online payments are quick and easy to set up and only require five steps. Learn how to set up online payments in just a few easy steps.

1. Choose a payment service provider

You’ll need to choose a payment service provider (PSP) to start accepting online payments. A PSP helps merchants with online payment processing and includes top-notch security features, streamlined integrations, and cross-border support.

2. Set up your account

Next, you’ll want to set up your account. You’ll need to provide the necessary business information, such as your company name, address, and a tax identification number. Your chosen PSPs will likely also ask you to submit a KYB or Know Your Business application. A KYB helps us ensure that we’re working with legitimate businesses.

3. Integrate your payment provider with your website

You’ll need to integrate your payment gateway with your platform so customers can enter their payment information. A well integrated payment gateway ensures that the checkout process is smooth and intuitive. Customers are less likely to abandon their carts if they can complete their purchases without encountering confusing or length steps.

4. Set up payment methods

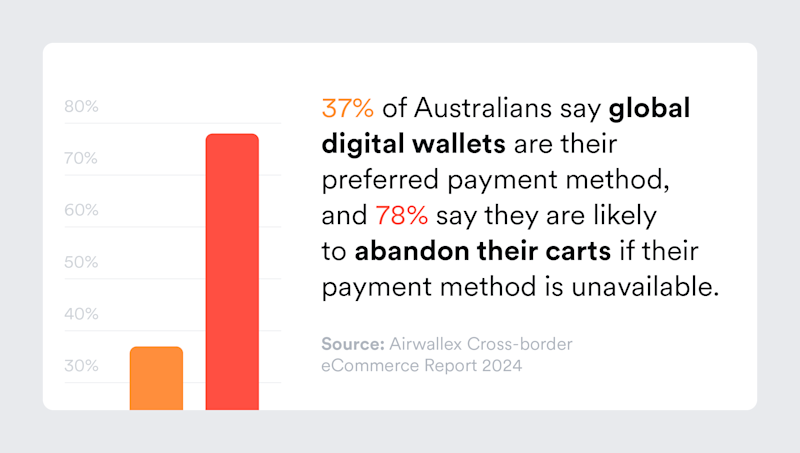

Set up the payment methods you want to accept, such as credit cards, digital wallets, or buy now, pay later options. In Australia, 37% of shoppers prefer to pay via global digital wallets, so offering multiple payment methods, such as credit cards, bank transfers, and digital wallets (like Apple Pay and Google Pay), is the most important step in setting up online payments. If you plan to expand internationally, look for a provider that offers international payments and multiple currencies.

Start accepting online payments with ease

Setting up online payments is simpler than ever with the right payment processing service. Airwallex offers a comprehensive solution that make it easy for businesses to accept global payments.

Airwallex Payments helps you accept payments from more than 130 countries in over 160 global and local payment methods including major schemes like Visa, Mastercard and Amex.

You can choose from several options to integrate payments into your business, from simple payment links that require no coding, low-code checkout solutions that are easy to embed, or payment plugins that integrate seamlessly with eCommerce platforms like Shopify, WooCommerce, and Magento. Each option caters to different levels of technical expertise and business needs.

Start accepting online payments with Airwallex and see how it can help simplify your payment processing while supporting your growth.

See how Airwallex’s payment processing stacks up.

How to set up online payments frequently asked questions

Below are some frequently asked questions related to how to set up online payments:

What’s the difference between a payment processor and a payment service provider?

A payment processor handles the transaction between the customer’s bank to the merchant’s bank, verifying payment details and facilitating the transfer of funds quickly and securely. A payment service provider (PSP) offers a more comprehensive solution beyond just processing, often including payment gateways, and additional solutions like fraud prevention. PSPs like Airwallex act as one-stop solutions, making it easy for businesses to accept and manage multiple payment methods.

How do I create a payment link for online payment?

You can create a payment link for online payments through your PSP. Log in and navigate to the payment link creation tool. Enter the amount, currency, and description of the item or service. Generate the payment link and share it with your customers via email, social media, or your website. This ensures a secure and user-friendly way to collect payments directly from customers.

How fast can my business get funds with online payments?

How fast your business can receive funds depends on your PSP you use. Most PSPs typically deposit funds within one to three days. Some services offer faster options, such as instant transfers, which can be available within the day but may come with additional fees.

Get started with online payments.

Disclaimer text: We wrote this article on 22 January 2025. We based the information on our own online research and were not able to manually test each tool or provider. The information is provided for educational purposes only, and a reader should consider the specific requirements of their business when evaluating providers. This research is reviewed every six months. If you would like to request an update, feel free to contact us at hello@airwallex.com.

Share

Vanessa is a business finance writer for Airwallex. With experience working at leading B2B technology companies, Vanessa is passionate about helping Aussie businesses, large and small, grow through cutting-edge tech. In her day-to-day, she breaks down complex tech jargon to help businesses streamline their end-to-end financial operations.

View this article in another region:Europe - EnglishEurope - NederlandsNew ZealandSingaporeUnited KingdomUnited StatesGlobal

Related Posts

eCommerce payment gateways: What are they and how do they work?

•12 minutes

Payment gateways: What are they and how do they work?

•5 minutes

Digital Payments: What are they and how do they work?

•6 minutes