How does Airwallex work?

Airwallex is a suite of powerful business finance products that are helping Australian businesses to go global, transform their financial operations, expand rapidly and so much more.

In the simplest terms, our mission is to create a global economic infrastructure that empowers businesses of all sizes to grow without borders. Our features are dynamic, secure and flexible – serving over 20,000 Australian (and over 100,000 global) businesses and their diverse needs.

But how do we do that exactly?

This article will break down exactly what Airwallex does, how our products work, and how a range of industries use us to drive success. Let’s go!

What kind of businesses use Airwallex?

Airwallex has a range of products that are purpose-built for both small to medium enterprises (SMEs) and large businesses. Whatever your business size – if you’re a sole trader running an emerging business, or a multinational corporate oration – you and your team can draw immense value from Airwallex products.

There are so many ways in which Airwallex products can be used, scaled and adapted. We’re passionate about serving everyone from Australia’s most iconic companies like Qantas, to expanding family businesses like fashion brand Poppy Lissman.

Scroll on to dive deeper into how different industries use Airwallex products, but for now, know – that no business is too big or small to realise its financial goals with Airwallex.

Is Airwallex safe?

Airwallex prioritises the security of your business and your businesses finances above all else.

To make sure that your money is secure, we take a four-part approach to security.

We hold your money with leading global financial institutions. Your funds are safeguarded in line with the local regulations where Airwallex operates.

Our advanced infrastructure allows us to implement best-in-class security controls which are monitored 24/7.

Airwallex meets the highest international security standards including PCI DSS, SOC1, and SOC2 compliance, in addition to our local regulatory requirements.

Airwallex holds an Australian Financial Services Licence (AFSL No. 487221) and is regulated by the Australian Securities and Investment Commission (ASIC), the Reserve Bank of Australia (RBA), and the Australian Transaction Reports and Analysis Centre (AUSTRAC). Airwallex protects your funds by arranging for major APRA-regulated bank(s) to provide bank guarantee(s) for an amount covering your entire wallet balance.

Is Airwallex a bank?

While Airwallex is not a digital bank, we are an ASIC-licensed payment institution that partners with local payment rails in different countries and economic territories. This gives us the ability to offer overseas transfers in local currencies.

How can I get started with Airwallex?

The best way to get started with us is to sign up for a borderless account. Just fill out a few simple details.

Once you’re signed up, you can open multiple domestic and foreign currency accounts in minutes. There are no opening fees or minimum transaction requirements.

If you’re from a business representing over 500 employees or more, contact our specialist team who can talk you through how Airwallex could be a good fit.

What does Airwallex do?

Airwallex provides a range of products and services to streamline financial operations and help Australian businesses of all sizes grow.

But how do our products work exactly? Let’s skip the tech mumbo jumbo and take a straightforward look at our powerful suite.

Get ready to explore Payment Links and Plugins, Global Accounts, FX and Transfers, Borderless Cards, Bill Pay, Expense Management, Yield, Software Integrations, Embedded Finance and our Core API.

How can Airwallex help businesses navigate global payments?

Do you dream of taking your homegrown business global, or doing business with global markets from right here in Aus? Setting up methods for rapid Global Payments is the critical first step towards your goal.

Airwallex makes it easy for you to securely take online payments from customers around the world, and get paid in your customers’ local currency, while saving on unnecessary fees. Integrate with popular global platforms to take payments or configure and share your own payment links.

How do you set up payment links?

If you’re not integrating with an existing platform, you can set up your own payment links. Don’t worry - no coding or fancy tech knowledge is required!

Create, customise, and share your links in just a few clicks over social media, email, and more. Then, from your Airwallex account, you can track payments in real time.

In the image below, you can see how it looks from the user end to set up a new payment link. On the left, you can see the details that the user needs to input to create their payment link, and then the payment link is generated – which you can see on the right – ready to send to the customer via email, social media, SMS, and more, or to be embedded into invoices.

You can then track your payments within Airwallex and get notified by email when you receive a successful payment.

Does the Airwallex payment platform accept Apple Pay?

Yes! Your customers can use Apple Pay to complete their payments in seconds. We also accept online payments from GooglePay and Paypal, plus popular card providers like Mastercard, Visa and Amex.

Beyond that, we accept over 160 methods for secure online payments! Your customers can pay however is best for them.

How can Airwallex help businesses open global accounts?

When you’re setting up a business bank account in another country, it can take hours of paperwork if you go with a local bank. With Airwallex, you bypass this excessive admin – open a Global Account in minutes and start collecting payments from your international customers.

The benefits are twofold. You can also spend the money you have received in the same currency – for example, when you’re paying local suppliers – skipping any unnecessary conversion fees. You have everything you need, including local bank details, to start making money move.

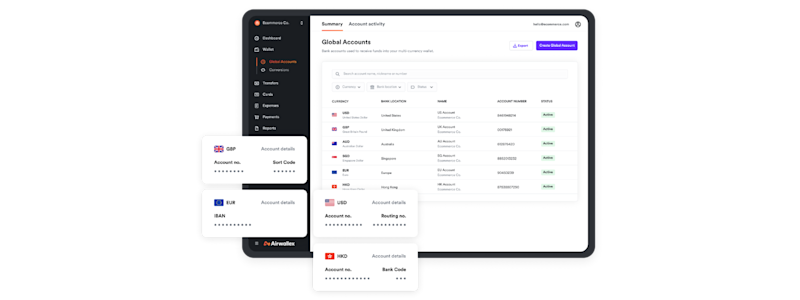

The image below gives you a sneak peak into the backend of the Airwallex platform, where you have a birds eye view of all of your accounts. Easily navigate between them, find account details and see transaction activity in a single view.

What’s even better, there are no:

Account opening fees

Monthly maintenance charges; or

Minimum transaction requirements.

It’s one of the easiest, cleanest and most efficient solutions on the market (and of course, we believe it’s the best!).

How can Airwallex help businesses manage FX and transfers?

When you’re trying to go global with your business, every dollar counts. When money is swallowed up by Foreign Exchange (FX), it feels like such a waste of essential funds that could be going towards your expansion.

Our founders had first-hand experience with this, and FX conversion woes actually motivated them to start Airwallex. After opening a cafe in Melbourne, they were frustrated at the time and cost of FX transfers when purchasing supplies for the business. Secure, rapid, and cost-effective money transfer was the answer.

Now, moving money has never been easier than with Airwallex FX and Transfers.

We offer FX to 150+ countries and regions, in 45+ currencies. And don’t worry, there are no hidden transaction fees.

Open Global Accounts in your required currencies to start converting. In the view below, you can see that our users get complete visibility over the process. You can see the money you’re transferring, an estimated delivery date, and the details of our bank-beating transfer rates (which refresh in real-time).

You can also set up Batch Transfers, and pay up to 1,000 recipients in different countries in one go. Now that’s productive!

How can Airwallex help businesses pay bills?

Every savvy business owner knows that it’s not just important to honour your customers, it’s critical to keep your suppliers and vendors happy. That can be challenging when you have bills and invoices flowing in from different entities, often in different countries.

Paying bills is never going to be fun, but at least it can be easy. That’s where Bill Pay comes in.

Free yourself from manual, time-consuming bill payments, automate your accounts payable and pay your invoices, all from one place.

You and your team can enjoy custom approval workflows and notifications, giving you greater visibility over company spending. Reduce manual data entry (and the human error that often comes with it), easily pay vendors across the globe (with our market-leading FX rates) and reconcile faster with our smart accounting software integrations (Xero, Netsuite, Quickbooks - we’ve got you covered).

How can Airwallex help businesses issue company cards?

Now more than ever, employees have a range of needs for business spending. Employee and company cards can also take time to set up – with employees often waiting weeks for their cards to be issued and arrive by snail mail. If you opt to go without them, you then face the even more frustrating process of manual reimbursements.

Airwallex’s Borderless Cards slash those weeks to seconds with virtual cards, and empower your team to make purchases in Australia and abroad without the stress of sneaky FX fees. Your team can use Apple Pay and Google Pay, and if you’re more into an old-school physical card, those are available too.

With our borderless cards the power is in your hands to:

Set spending limits and controls;

Create custom approval workflows; and

Instantly create, freeze, or cancel cards.

Of course, like with all Airwallex products, you have a real-time view of activity from your Airwallex dashboard. Nothing’s getting past you!

How does it look in action? Take a peek below at the back end of an employee card. The user can see the item purchased, the card which was used, and the current spend in the context of the set limit.

How can Airwallex help businesses manage expenses?

Finance teams need to keep track of all money matters, overseeing money flowing in and out – but also around – a business. That’s why Expense Management is a key part of Airwallex’s offering.

Gain visibility on both sides of the equation. Expense management solutions are built into our borderless cards, which sync to your employees’ and businesses Airwallex accounts.

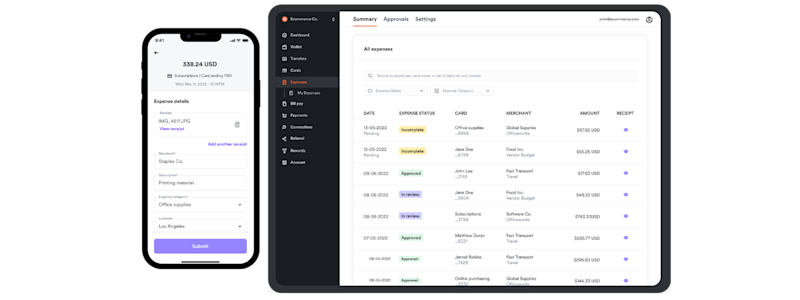

For employees; easily upload receipts and submit expenses on-the-go with the Airwallex app. On the left of the image below, you can see just how straightforward submitting the details of expenses is.

For administrators and finance teams; see spending in real time, easily source transaction details and instantly review and approve expenses from your desktop or mobile app. Design multi-level approval workflows and close your books faster every month by syncing to your accounting software. On the right of the image below, you can see the streamlined internal view of expenses.

How can Airwallex help businesses earn returns?

You’re working hard for your business, so your money should too. With Airwallex Yield, you can start generating competitive returns on your funds, making your business finances go further.

Currently, you can return 3.63%* on your AUD funds if you’re a wholesale client. *rates are subject to change

How do we make this happen? We give you the opportunity to securely generate returns on multiple currency balances via our investments into low-risk money market funds. These include JP Morgan Liquidity Funds and AAA rated money market funds with decades of strong performance.

We know you sometimes need access to your funds fast, so there are no lock-up periods for your money, unlike many regular term deposit accounts. Move funds between your Airwallex cash and Yield accounts at any time, with transfers generally settled in 1-2 business days.

And who doesn’t like seeing the money flow in? Returns are earned on a daily basis, so sit back and watch your progress in the Airwallex app.

Which software integrations does Airwallex offer?

Software integrations can save you time, reduce errors, and be a game-changer for your customer experience. At Airwallex, we love them! They make our products more powerful, which adds more value for you.

Our suite of integrations connect users to popular platforms across accounting services, productivity, eCommerce, sales and marketing. Whether you want to speed up reconciliation, improve speed of connections or streamline expense management, we have an integration to maximise your tech stack.

A few of our customers' favourites include Xero, Netsuite, Hubspot and Shopify. See our full list of Software Integrations here.

What is embedded finance?

Embedded finance tools allow businesses to create unique financial experiences for their customers. Embedded finance invites finance offerings into a business's customer journey; without the business needing to develop these services with software engineers, banks or other third parties.

Some classic examples of embedded finance include;

Supermarkets and airlines offering private-label credit cards; and

Car dealerships offering loans and financing.

These examples have often been backed by banks, but the next generation of embedded finance is more accessible.

Now, more enterprise businesses can access embedded finance tools to enhance their digital interfaces; whether that be with virtual wallets, loyalty programs or other consumer experiences. With white labelling available through Airwallex products, you can apply your own branding to our financial products – making them look entirely your own.

What are Airwallex’s embedded finance tools?

Airwallex is incredibly proud of our world-class infrastructure, which allows businesses to unlock new revenue streams and create better customer experiences by offering global financial services.

There are three powerful components that make up our embedded finance offering…

Global Treasury

With our global treasury infrastructure, you can enable your customers to collect, store, and disburse funds worldwide.

Global Treasury can help you tap into flexible monetisation models, including earning from markups on FX and payouts, per transaction fees, and more.

Banking as a Service API (“Baas API”)

Imagine how much you could expand your business if you could offer customers financial services, directly delivered from your business?

Leverage Airwallex’s tools and infrastructure to create financial services of your very own. With our Baas API features you can offer;

Global accounts; Your customers can open accounts in minutes and start sending money around the world

Held balances; with the ability to hold over 45 currencies

Physical and virtual cards; featuring your own business branding of course

Lending; extend credit while intelligently managing credit risk on an ongoing basis

Payments for Platforms

You want your platform to deliver a seamless experience for your customers; which means that your payments process needs to be as frictionless as possible.

Our embedded Payments for Platforms tools will help you programmatically create connected accounts, automatically split funds, and enable a frictionless global pay-in and payout experience for your customers.

Just a few of the benefits of using our Payments for Platforms features include;

The ability to monetise secure online payments on your platform, by bundling payments with other paid premium features or charging a transaction fee for each payment you process on your platform

Streamlining global compliance, helping you manage fund flows compliantly without requiring PayFac registration for you or your customers

Minimising FX risk, maximising revenue, by collecting and settle in the same currency to eliminate the costly FX fees normally involved in multi-party global transactions.

What is Airwallex’s Core API?

Warning, tech jargon ahead! Built for tech-forward global businesses, and with developers front-of-mind, Airwallex’s Core API makes it easy for you to programmatically manage your global payments and financial operations. Access high-quality developer tools, straightforward documentation, and cloud native solutions that easily integrate with your existing workflows.

Our Core API in numbers;

99.9% system availability

54m+ API requests handled per day

180+ countries from which you can accept payments

150+ countries to which you can make transfers

35+ countries that support card issuing

How does the eCommerce industry use Airwallex?

It’s no secret that Australian eCommerce businesses love using Airwallex. Airwallex’s products can streamline your customer experience and internal finance processes. The time and cost savings can be astronomical.

Whatever the size of your eCommerce business, and whatever your offering, you can drive value with Airwallex. By leveraging our Global Accounts, Transfers and FX, and Cards, Australian wine retailer Vinomofo has experienced an 11% decrease in conversion costs and is saving tens of thousands on transaction fees. Learn more about their journey with Airwallex.

How does the travel industry use Airwallex?

The team at Airwallex are driven by a mission to help businesses become truly borderless, which is why we love helping our friends in the travel industry. Aussies love to travel, and we also love to welcome visitors; but costly FX conversion fees and global money movement limitations have traditionally been a pain point for the travel industry. Airwallex is changing that.

By engaging with Airwallex’s Transfers and FX, Global Accounts and Cards features, travel social networking app Travello have removed unnecessary currency conversions, and are saving AUD$25,000 in transfer fees. Learn more about how they’re winning with Airwallex.

How does the tech industry use Airwallex?

Tech loves tech. Innovative technology companies from around Australia have found massive value in Airwallex, especially when it comes to expanding their services globally. Airwallex easily fits into any sophisticated tech stack, and with smart integrations and flexible uses; we’re a great fit for Australia’s most innovative businesses.

Learn about how Airwallex helped Australian tech business Mr Yum issue more than 30 cards in just a few clicks, launch in the UK rapidly, and save more than $50,000 on international transaction and FX related fees. Read the success story.

How do small businesses use Airwallex?

We’re passionate about empowering SMEs to grow their businesses. Whether you’re running an eCommerce, travel, tech, property, design – or any other kind of business, our flexible Business Account can help you save time, drive revenue and expand in ways you never thought possible.

Best of all, Airwallex is incredibly easy to use. You don’t need a technology team to get incredible value out of our products. Get started today by signing up for your borderless account.

How do enterprise businesses use Airwallex?

Airwallex is delighted to be providing advanced solutions for enterprise businesses, and we’re honoured to call some of Australia’s biggest brands – like Qantas and Afterpay – our users.

Companies love our Core API and whitelabel Embedded Finance features. They allow you to leverage our world-class financial services tools, and package them up as your own.

Our team is there to help you every step of the way with outstanding support. Together, we can build you a solution that is tailored to even the most sophisticated business needs.

What if business finance could feel like walking on air?

Congratulations! If you’ve made it to the end of the article – you’re now a fully fledged expert on Airwallex. You’ll know that all of our products are designed to help businesses become truly borderless; we want scaling your business’ finance operations to feel as smooth as walking on air.

Are you ready to get started with us? Sign up for your account today.

Disclaimer: This information doesn’t take into account your objectives, financial situation, or needs. If you are a customer of Airwallex Pty Ltd (AFSL No. 487221) it is important for you to read the Product Disclosure Statement (PDS) for the Direct Services, which is available here. If you are a customer of Airwallex Capital Pty Ltd (AFSL No. 549026), it is important for you to read the Product Disclosure Statement (PDS) for Airwallex Yield, which will be made available to you at the time of onboarding. Airwallex Yield is brought to you by Airwallex Capital Pty Ltd (AFSL No. 549026). All investments carry risk. *Target returns are after fees and accurate and updated as at 9 April, 2024 (AEDT).

Share

Izzy is a business finance writer for Airwallex, specialising in thought leadership that empowers businesses to grow without boundaries. Izzy has more than four years of experience working alongside Aussie startups and SMEs, having previously worked at one of the country’s leading HR tech companies. Izzy’s diverse experience across business operations, from people to finance, brings a unique perspective to her current role.

View this article in another region:New Zealand

Related Posts

Payment gateway fees: What businesses need to know

•12 minutes