Embedded Finance: What it is and how it works

- •What is embedded finance?

- •How embedded finance works

- •What are some examples of embedded finance?

- •What are the different types of embedded finance?

- •The importance of embedded finance in 2025

- •Three examples of embedded finance companies

- •Why consider Airwallex for embedded finance solutions?

- •Embedded finance use cases

We live in an era of speed and convenience. As a result, customers today want – and expect – financial products and services to be built seamlessly into their everyday lives. 'Embedded finance' is the engine driving this shift, transforming how businesses and customers access and use financial services. But what exactly is it, and how does it work?

This guide will break it down for you, explaining the ways that embedded finance can be used to unlock revenue opportunities and transform how you interact with customers.

What is embedded finance?

Embedded finance is the seamless integration of financial services or tools within non-financial products, platforms, or services. Embedded finance allows businesses not primarily in the financial sector to offer banking, payment, lending, insurance, or investment services directly to their customers as part of their core product offering.

It leverages APIs (Application Programming Interfaces) to incorporate financial functionality into everyday products and services, often in nearly invisible ways to the consumer.

This integration improves the user experience, opens up new revenue streams for businesses, and provides valuable data insights. It offers convenience for consumers, providing financial services exactly when and where they're needed.

How embedded finance works

Embedded finance works through a combination of API-accessed infrastructure, licensing, and compliance services that integrate directly into non-financial platforms or products. There are several moving parts you need to be aware of, so let's break down the working components and processes that make embedded finance possible:

Technical infrastructure

API integration: API technology is at the heart of embedded finance. APIs allow different software systems to communicate and share data seamlessly.

Cloud computing: Cloud-based systems provide the scalability and flexibility to handle complex financial transactions and data storage and recall.

Licensing and compliance

Financial licensing: Businesses must ensure products built using embedded finance have the necessary financial licence. For most non-financial services businesses, they will use the licence of the embedded finance provider.

KYC and AML: Know Your Customer and Anti-Money Laundering checks are important components of embedded finance solutions.

Data protection: Strict adherence to data protection regulations like GDPR is essential when handling financial information.

PCI compliance: If debit or credit card data flows through your embedded finance payment solutions, the provider will need to be PCI compliant.

User experience

Seamless integration: Financial services are designed to blend naturally with the host product or platform to provide a white-labelled solution.

Intuitive interfaces: User-friendly designs make complex financial transactions accessible to all users.

Contextual offerings: Financial services are presented at relevant points in the user journey.

Data flow and management

Secure data sharing: Information is securely exchanged between the host platform, fintech provider, and financial institutions.

Real-time processing: Transactions and updates occur in real-time, providing instant feedback to users.

Data analytics: User data is analysed to improve services and offer personalised financial products.

Monetisation models

Transaction fees: Businesses may earn a percentage of each financial transaction processed.

Subscription models: Some embedded finance solutions operate on a subscription basis for access to services.

Data monetisation: Insights gained from financial data can be valuable for targeted upsell, marketing, and product development.

What are some examples of embedded finance?

To illustrate how embedded finance works, consider these two scenarios:

A traditional car sale:

A consumer wants to sell their car on a car marketplace that has market share of car dealerships/buyers.

Dealers bid for the car and the consumer selects their preferred choice, and arranges car collection.

The platform has no visibility over when the dealer will pay for the car or the final amount that was transferred.

A car sale 2.0 (with embedded finance):

A consumer wants to sell their car on a car marketplace that has market share of car dealerships/buyers.

The consumer creates an account with the marketplace, which provides them with a digital wallet.

Dealers sign up to the marketplace and open a money account to deposit funds. The account is provided by the embedded finance provider, but it's hosted within the car marketplace app.

Dealers bid for the car, and the consumer selects their preferred choice, and arranges car collection.

The dealer initiates a transfer of the funds to the consumer within the marketplace platform.

Through their software, the car marketplace can see if the money has left the dealer's account and if the consumer has received the funds.

The consumer receives a reassuring app notification to tell them the money has arrived in app – would they like to keep it in the app and receive a discount on their next car? Alternatively, they can withdraw the funds to a connected bank account.

This example demonstrates how embedded finance can enhance the user experience, potentially increase platform sales, and offer financial services in a contextually relevant manner.

What are the different types of embedded finance?

Embedded finance encompasses various financial services that can be integrated into non-financial platforms and products. Each type serves different needs and offers unique benefits to businesses and consumers.

🔸 Embedded payments are a widely recognised and a popular form of embedded finance. Key features include seamless checkout experiences, multiple payment options, real-time transaction processing, and recurring payment capabilities. Examples range from one-click purchasing on eCommerce platforms to in-app payments for ride-sharing services and automatic payments via IoT devices like smart fridges. For most embedded finance use cases, there's an element of embedded payments to move money on and off platform.

The benefits of embedded payments are significant, reducing cart abandonment rates for businesses, improving user experience and convenience for consumers, and enhancing security through tokenization and encryption.

🔸 Embedded credit and loan products provide various financing options at the point of need. Key features include instant credit decisions, flexible loan terms, and alternative credit scoring methods. Examples include Buy Now, Pay Later (BNPL) options in online stores, financing within B2B platforms, and microloans for small businesses via eCommerce dashboards.

🔸 Embedded insurance offers contextually relevant insurance products during the purchase journey of related goods or services. Key features include instant quotes and policy issuance, customised coverage based on user data, seamless claims processes, and usage-based insurance options. Examples include travel insurance during flight bookings, product protection plans for electronics, and pay-per-mile car insurance through connected vehicle apps.

🔸 Embedded investments integrate wealth management services into various platforms, making investing more accessible. Key features include fractional investing, robo-advisory services, automated savings tools, and access to diverse asset classes. Examples include round-up investing in personal finance apps, stock trading on social media, and crypto investing within payment apps. Embedded investments usually need some form of embedded payments to allow for account creation and fund top-up/withdrawal.

🔸 Embedded foreign exchange (FX) solutions offer currency conversion and international payment capabilities directly within platforms. Key features include real-time currency conversion, multi-currency wallets, international payment processing, and FX risk management tools. Examples include currency conversion in travel booking platforms, multi-currency accounts for eCommerce sellers, and integrated FX for payroll systems.

🔸 Embedded compliance is essential for enabling embedded finance by ensuring regulatory adherence. Key features include automated KYC processes, AML screening, transaction monitoring, and regulatory reporting tools. Examples include identity verification for account opening, automated sanctions screening for international transactions, and real-time transaction monitoring.

🔸 Embedded payroll integrates salary processing into broader business management platforms. Key features include automated salary calculations, tax withholding, employee self-service portals, and integration with time tracking and HR systems. Examples include payroll processing in accounting software, gig economy platforms with integrated payment systems, and embedded payroll in small business management apps.

Implementing these various embedded finance solutions requires careful consideration of regulatory requirements, technological capabilities, and user needs. When looking to leverage embedded finance, you should assess which type aligns with your strategic goals and customer demands, and start with one or two key areas before expanding offerings over time.

The importance of embedded finance in 2025

Embedded finance is gaining traction for many reasons:

Advancements in technology

Increasing collaboration between fintechs, traditional banks, and non-financial entities is democratising embedded finance solutions and providing more competitive products in the market. Technology development has also made it more cost-effective to integrate financial services.

Evolving consumer expectations

Consumers expect seamless, integrated experiences across all aspects of their lives. They want to be able to manage their finances, make purchases, and access services without the need to navigate multiple platforms. Embedded finance enables tailored financial products based on user behaviour and context.

Expanding market opportunities

Embedded finance enables businesses to enter new territories, markets, and segments quickly, and differentiate themselves through unique financial offerings. Non-financial companies can tap into financial services revenue. This is particularly valuable for established digital platforms who need new ways to drive lifetime value from customers.

Improved financial inclusion

Embedded finance brings financial services to underserved populations, by democratising access to financial features for the underlying businesses. Simplified access to payments, credit, and investments provides convenience within the experience of trusted brands.

Data-driven insights

The data from financial products used in-platform provides deeper insights into customer behaviour. Better data improves risk assessment and forecasting for commercial trends, and can be used to drive the creation of more relevant financial products or even the upsell of new personalised offers.

Regulatory landscape evolution

Governments and regulatory bodies are becoming more supportive of embedded finance, recognising its potential to improve financial inclusion and innovation.

Competition and innovation

Competition = innovation. Embedded finance enables rapid adaptation to market changes and customer needs. Integrated financial services boost loyalty and increase the lifetime value of the customer, as unique financial offerings set businesses apart from competitors.

Three examples of embedded finance companies

Embedded finance companies come in all shapes and sizes. They'll often specialise in different areas. Here are three:

Airwallex

Airwallex is a global financial platform that offers embedded finance solutions across borders.

Key offerings:

Global infrastructure: Financial licences in 60+ countries to support global businesses and enable expansion to new markets.

Payments for Platforms: To programmatically create connected accounts, automatically split funds, and enable a frictionless global pay-in and payout experience for customers.

Global Treasury: Multi-currency virtual accounts for collecting, holding, and sending money domestically and internationally with a competitive FX engine.

Banking as a Service: Non-financial businesses can offer full-featured financial services, including accounts and card issuing.

Customised experience: Businesses can retain their own UI and customise Airwallex components into their websites and apps.

Streamlined onboarding and compliance: Outsource KYC, AML, sanctions screening and identity verification requirements to Airwallex.

Stripe

Stripe is known for its online payments gateway but has expanded to offer embedded finance capabilities.

Key offerings:

Stripe Connect: Platform for marketplaces and platforms to manage multi-party payments.

Stripe Issuing: API for creating and managing virtual and physical payment cards.

Stripe Capital: Embedded lending solutions for platforms to offer financing to their users.

Stripe Treasury: Banking-as-a-Service offering for platforms to embed financial services.

Plaid

Plaid is an open banking provider, giving secure access to financial and identification data needed to onboard new customers and fund accounts.

Key offerings:

Account linking: APIs that allow apps to connect with users' bank accounts securely.

Transaction data: Access financial transaction data for analysis and insights.

Identity verification: Tools for verifying user identities and account ownership.

Balance checking: Real-time account balance information for various financial products.

Income verification: Income verification solutions for lending decisions.

Why consider Airwallex for embedded finance solutions?

The early exploration of embedded finance has largely remained in domestic markets. For this reason, many embedded finance providers have focused only on providing their services to their domestic market. As more and more businesses – especially those operating at scale – begin embedding finance into their products, they'll quickly need a solution that spans markets.

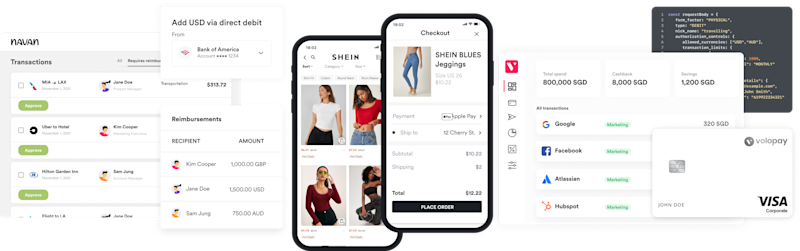

Airwallex's financial infrastructure has extensive global coverage, with financial licences in 60+ markets. Businesses such as Brex, Navan and SHEIN, are choosing to build with us for our global-by-default embedded finance. This means they only need to work with one provider for all of their markets, and can retain product consistency globally. They're also future-proofed if they wish to expand to new markets.

Our embedded finance solutions fall into three categories:

Global Treasury

This solution enables a platform’s customers to collect, store, and disburse funds worldwide. By tapping into fast, cost-effective local collections via 160+ payment methods, businesses can extend their platform to multiple geographies for customer ease and convenience. Likewise, our payout network allows their customers to send funds to 150+ countries. By bringing payments in-house, platforms can offer a convenient service which can be monetised by charging transaction fees or markups for FX and payouts.

Payments for Platforms

Programmatically create connected accounts with merchants or customers, automatically split funds, and offer a frictionless global payment acceptance and payouts. For the most part, this means embedding Airwallex Payments solutions into the checkout process to take advantage of our extensive currency and payment method acceptance. If a platform uses multiple payment service providers (PSP), we can easily work alongside or as a holding/settlement account to receive funds from multiple PSPs.

Banking as a Service

This service allows platforms to natively embed any traditional banking products such as accounts, cards, and borrowing within their products. Businesses who opt for this service range from trading platforms like Stake, to multi-currency funding platforms like TradeBridge, and corporate card solutions like Volopay.

Embedded finance use cases

Navan: streamlining global reimbursements

Challenge: Navan, offering a corporate travel and expense solution, needed a global partner to manage and accelerate global payouts to their customers' employees worldwide.

Solution: Through Airwallex's Global Treasury solution, Navan efficiently manages employee reimbursements for multinational customers at scale. A single API integration streamlined local top-ups, managed FX risk, and used local payment rails to quickly and cost-effectively disburse reimbursements globally.

Stake: facilitating global share trading

Challenge: Digital trading platform Stake needed a reliable global technology partner to support global share trading, hold funds in multiple jurisdictions, and make timely programmatic payouts.

Solution: Stake used Airwallex's Embedded Finance solution to collect, hold, convert, and pay out funds in multiple currencies through a single API deployment. This product enabled customers to share trades in new markets, quickly implemented new functionality, and easily tracked real-time high-volume money movement and balances.

SHEIN: managing end-to-end marketplace payments

Challenge: Global fashion e-retailer SHEIN needed an end-to-end global payments solution that would support its global business growth by handling payment acceptance, currency conversion, and payouts across multiple geographies.

Solution: Airwallex's Payments for Platforms solution allowed SHEIN to collect online payments globally via multiple currencies and payment methods, eliminate costly conversion fees via like-for-like settlement, and streamline payouts to its global seller base. This comprehensive solution accelerated SHEIN's worldwide growth.

By choosing Airwallex for embedded finance services, you'll leverage our powerful, flexible, and globally oriented financial infrastructure. This lets you focus on your core competencies while offering sophisticated financial services to your customers in an intuitive way.

Tap into new revenue streams. Build your own global financial products.

Disclaimer: This information doesn’t take into account your objectives, financial situation, or needs. If you are a customer of Airwallex Pty Ltd (AFSL No. 487221) read the Product Disclosure Statement (PDS) for the Direct Services available here.

Share

David manages the content for Airwallex. He specialises in content that helps EMEA businesses navigate global and local payments and banking.

View this article in another region:Canada - EnglishCanada - undefinedNew ZealandSingaporeUnited KingdomUnited StatesGlobal

Related Posts

How businesses are using embedded finance to stay one step ahead

•5 minutes

Art of the payments possible: 9 Embedded Finance use cases

•6 minutes

Australia may never have a super app, but with embedded finance y...

•5 minutes