How to use Airwallex for automated insurance payouts

As technological advances sweep across the financial services industry, the insurance sector is busy keeping pace. Many insurance businesses are moving all or large parts of their operations online and replacing legacy systems with streamlined, digitally enabled platforms and processes.

Driving this shift are tech-savvy customers who have turned to online channels in growing numbers to handle their finances. Armed with more information and insight than ever before, they can easily shop around, compare a range of products and prices, and find the most suitable provider in a few clicks.

When it comes to insurance, they want solutions with obvious benefits – including comprehensive, transparent and personalised policies, and fast and hassle-free claims processing.

Technology is transforming the insurance industry

Given the challenges and changes in the industry, insurers are recognising that sticking to outdated methods might be risky, especially for those with a strong online presence.

As recent research shows, 64% of e-commerce users who have a less than favourable online experience are willing to jump ship and take their business elsewhere. For insurance customers, limited policy choices, complicated application procedures, and lengthy claims processes are turn-offs that can push them to choose more agile and customer-focused competitors.

In the race to modernise and digitise their offerings, coordinating a strong network of embedded insurance arrangements and ecosystems of partnered offerings is becoming more crucial for insurance companies. And for those willing to embrace a digitally-enabled future, the payoff is often clear. According to a report by McKinsey, not only can insurers benefit from increased customer satisfaction, but automation can reduce the cost of a claims journey by as much as 30%.

With these developments underway, insurance companies are honing in on claims settlement as a key focus area, prompting them to seek out quicker, more streamlined payout methods.

Why insurance claims are ripe for an overhaul

Insurance companies face the following challenges as they work to solve common claims pain points:

Heavier workloads. Traditional ways of processing claims come with a significant amount of administrative work, leading to increased operational costs and slower turnaround times.

Risk of fraud. Methods like physical cheques or electronic transfers are more vulnerable to fraud. The need for advanced security measures adds additional layers of cost and complexity.

Customer dissatisfaction. When payouts drag on or lack transparency, customer loyalty and satisfaction can take a hit, which can have a knock-on reputational effect and be damaging for business.

For claimants, issues include:

Waiting for payments. Long processing times for claims can be a major source of frustration, potentially putting financial strain on claimants, especially in the case of a loss of property or a medical emergency.

Hassles with cheques and electronic clearances. The process of getting and depositing a cheque, requiring the extra effort of a bank visit, is an inconvenience many would prefer to avoid. Waiting for funds to clear can be similarly frustrating.

Limited choices. Traditional payout methods don't offer much flexibility on how or where funds can be accessed, making financial management harder for the recipients. In the case of cross-border payments, higher fees can leave claimants with less.

How Airwallex helps simplify insurance payouts

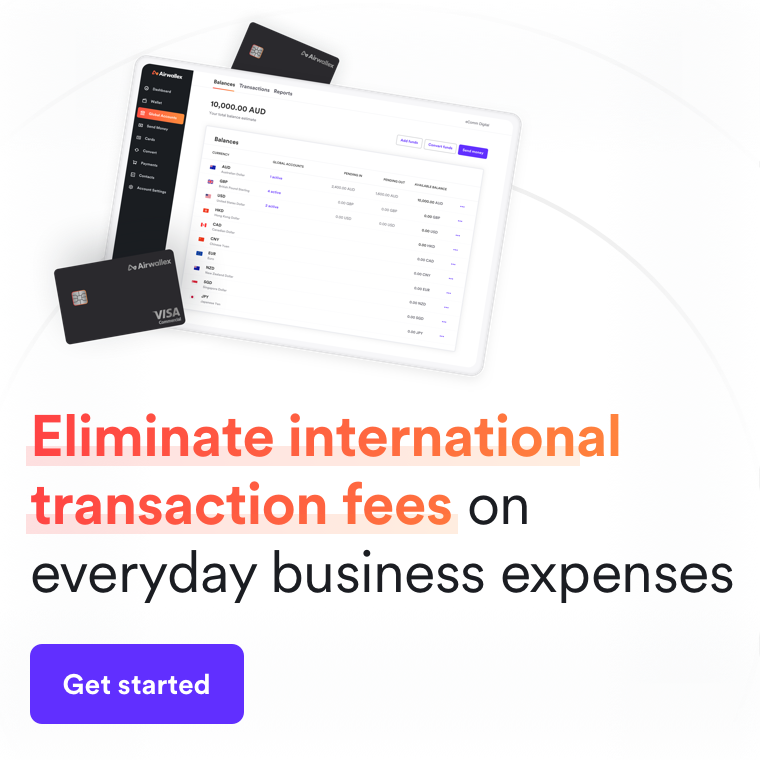

Using Airwallex, online insurers can take advantage of advanced transfer technologies that help with quicker payouts, smoother customer service and improved back-office operations.

Here’s how Airwallex Issuing works to tackle common claims challenges:

When an insurance claim is approved, the insurer can connect to their account on the Airwallex Issuing platform and request a single-use or multi-use virtual card to payout the policyholder.

Airwallex instantly generates a virtual card for the relevant amount, currency and merchant type via the Airwallex API and sends the PAN back to the system via an API response.

Virtual cards are activated and issued to the claimant via their mobile application – making the transaction process seamless.

The claimant uses the virtual card details to make payments to relevant providers. They can use the services of any provider who can take card payments (either online or POS).

Metadata associated with cards can be used to simplify reconciliation and make transaction reports available to the insurer's system.

Conveniently, multi-currency capabilities allow the solution to be rolled out in a single country or across a global insurer's entire network.

Benefits of virtual cards for insurers and their customers

Virtual cards simplify things for insurance teams by doing away with the hefty costs and hassle of producing, processing and sending cheques, and making other kinds of electronic payments.

They tackle several hurdles that come with handling claims online, offering these perks for both insurance companies and their clients:

Streamlining and savings. Moving to virtual cards means less paperwork and lower costs, allowing insurers to benefit from reduced payment cycle times and giving claimants control over how they use their funds.

Better security. Top-notch encryption and customisable usage settings mean that virtual cards significantly reduce the chance of fraud.

Happy customers. Fast payouts through virtual cards mean customers get funds more swiftly and without the need for physical banking, leading to greater satisfaction and allowing you to stay competitive.

Transform your financial operations.

Tap into the power of automated payouts

As an insurer, finding the best ways to integrate new technologies should be a top priority for keeping existing policyholders happy and growing your business.

Making the switch to virtual cards for insurance payouts is a smart move in a digital-first age where convenience and customer service are king.

To find out more, sign up or get in touch with our team today.

Disclaimer: This information doesn’t take into account your objectives, financial situation, or needs. If you are a customer of Airwallex Pty Ltd (AFSL No. 487221) it is important for you to read the Product Disclosure Statement (PDS) for the Direct Services, which is available here.

Share

Izzy is a business finance writer for Airwallex, specialising in thought leadership that empowers businesses to grow without boundaries. Izzy has more than four years of experience working alongside Aussie startups and SMEs, having previously worked at one of the country’s leading HR tech companies. Izzy’s diverse experience across business operations, from people to finance, brings a unique perspective to her current role.

View this article in another region:Canada - EnglishCanada - undefinedUnited States

Related Posts

How to use Airwallex to manage your gig economy payroll

•5 minutes

How can Airwallex supercharge growth for startups?

•5 mins

How the mining services industry can transform its finance operat...

•5 mins