Interchange fees explained

- •What are interchange fees?

- •How interchange works

- •How much are interchange fees?

- •How are interchange fees determined?

- •How much are interchange fees?

- •Interchange pricing models

- •Interchange++ versus Blended pricing

- •Additional fees that global merchants should be aware of

- •How interchange fees affect businesses

- •Collect international payments with lower fees

What are interchange fees?

Interchange fees are transaction fees that merchants are charged when accepting card payments from customers, whether it's online or in-store payments.

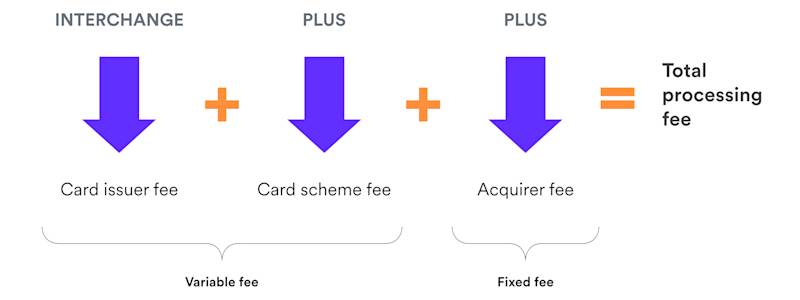

While many think of interchange as a single per-transaction fee, it consists of charges from:

The card issuer: the customer’s bank or credit card company

The card network (e.g. Visa, Mastercard, Discover, American Express)

The acquirer: the merchant’s bank or payment facilitator

Interchange fees are charged based on various factors, such as the type of card the customer uses, the country of card issuance, and whether the transaction happens online or in person.

Let’s examine how interchange works and the processing fees you can expect when you accept debit or credit payments from customers. We’ll also look at the various pricing models that determine interchange fees, and how you can reduce interchange fees for your business.

How interchange works

Let’s take a look at what happens when a customer pays by debit or credit card during an in-store purchase:

The acquirer sends the transaction data to the customer’s card network.

The card network forwards the transaction data to the card issuer.

The card issuer will perform a number of checks (mainly to confirm that the customer has sufficient funds) before telling the card network whether the transaction is approved or declined.

The card network passes this information to the acquirer.

The acquirer processes the transaction.

The card issuer deposits funds into the acquiring account.

Note: Acquirer refers to the acquiring bank that processes card payments for the merchant. It's connected to a card issuing bank by a card network.

The acquirer incurs an interchange fee during this process. Each time a transaction is processed, the acquirer pays a fee to both the card issuer and the card network. The merchant will then have to pay this interchange fee to the acquirer, plus a markup to cover the handling cost.

The bulk of this payment processing fee goes to the card issuer to cover the credit and fraud risks. A portion of the fees also go to the card network. Interchange fees are generally charged as a percentage of the transaction value plus a fixed fee.

How much are interchange fees?

Interchange rates vary based on several factors, which we’ll address in the next section. Generally, you can expect to pay an average rate of 1.3-3.5% of the transaction value, plus a small fixed fee (usually US$0.2 per transaction).

For example, a customer makes a US$150 credit card purchase for a pair of wireless earbuds at a local electronics store. The merchant’s acquiring bank sends the transaction details to the card issuer, which approves or rejects the transaction. After the transaction is approved and processed, the merchant incurs a processing fee for this transaction, which includes the interchange fee. If the interchange rate is 1.5% of the transaction amount, the merchant would pay US$2.25.

From that fee, US$0.30 might go to the acquiring bank, US$0.20 to the credit card network, and US$1.75 to the card issuer. After these deductions, the merchant keeps US$147.75 from the US$150 sale. The customer would typically not notice these charges, as it would be included in the displayed price.

Process payments faster, at low cost

How are interchange fees determined?

The amount charged for each card transaction varies based on several factors:

Card-present (CP) versus card-not-present (CNP)

Merchant Category Code (MCC)

Card scheme

Card type: credit versus debit

Place of card issuance

Security

Consumer cards versus commercial cards

Transaction location

How much are interchange fees?

Interchange rates vary depending on a number of factors, but generally speaking, you can expect to pay an average rate of 1.3% – 3.5% of the transaction value plus a small fixed fee (usually US$0.2 per transaction). Some regions have introduced legislation to cap the cost of interchange.

In the European Economic Area (EEA), interchange fees are capped at 0.3% of the transaction amount for consumer credit cards and 0.2% of the transaction amount for consumer debit cards. Interregional card transactions have been capped at 1.15% for debit cards and 1.5% for credit cards. There's no cap on commercial cards. In Australia, interchange fees are capped at 0.8% for credit cards and 0.2% for debit cards. In the US, interchange rates on credit cards aren't capped, and fees average 2% of the transaction value. However, following the Durbin Amendment in 2010, debit card and prepaid card fees were capped at US$0.22 and five basis points multiplied by the value of the transaction.

Interchange pricing models

Interchange fees are set by card networks like Visa, Mastercard, Amex, and Discover. They vary based on the type of card, transaction method, MCC code, transaction size, and processing details. Each network publishes its fees twice a year, making the calculation complex.

Interchange++ versus Blended pricing

There are two main pricing models for interchange fees that merchants can choose from, Blended and Interchange++. Each model has its own benefits:

Interchange++

Transparency: If you choose the Interchange++ pricing model, you will see a breakdown of the fees you have been charged from the card issuer, card network and acquirer for each transaction.

Variable rates: You will be charged the “real” card network fee, so the amount you pay for each transaction will vary depending on the factors listed above. This means you will pay less for consumer card payments, for example, than you would for commercial card payments.

Blended

Consistency: If you choose the Blended pricing model, you will be charged a flat rate for each transaction. These fees will typically be a percentage of the transaction value plus a fixed cost. Your acquirer may charge varying rates depending on a handful of factors, such as whether a card transaction is domestic or international. The Blended model makes it easier for merchants to forecast how much they will pay in interchange fees each month.

Potential savings: This benefit works both ways. As fees are fixed, you may save money on transactions where the card network and issuer rates are higher. The flip side is that you may pay more for transactions where these rates are lower. Blended fees are designed to offer merchants a fair average rate per transaction, so the amount you pay should balance out.

Additional fees that global merchants should be aware of

Businesses that operate internationally should be aware of additional foreign exchange charges when collecting payments from overseas customers. Some payment processors charge upwards of 2% per transaction for currency conversion.

Airwallex was designed to help merchants eliminate these fees. Plug Airwallex into your eCommerce store and enjoy a more cost-effective multi-currency checkout. With an Airwallex global account, you can collect multiple currencies directly into your multi-currency account without being subject to currency conversions, and save a significant amount on each international transaction.

How interchange fees affect businesses

Interchange fees can impact various aspects of your business, especially if you handle a large volume of card transactions. These areas include:

Operating costs: Interchange fees can significantly impact your bottom line, especially at high volumes or with tight margins.

Pricing strategy: Consider adjusting prices or setting minimum charges for card payments to offset interchange fees, but this may affect customer satisfaction.

Cash flow: Interchange fees are deducted from transactions before funds are deposited, impacting cash flow management and forecasting.

Business model: Interchange fees may lead businesses to encourage cash or debit card payments to reduce costs.

Payment processor: Businesses may select payment processors based on interchange fees, which can influence customer decisions.

Besides interchange fees, businesses that operate internationally should be mindful of additional foreign exchange charges for cross-border transactions. Some payment processors charge upwards of 2% per transaction for currency conversion.

Collect international payments with lower fees

Don’t let interchange fees eat into your profits. Airwallex offers a simple blended pricing model with a transparent fee schedule that lets you forecast the cost of collecting payments easily. Interchange++ pricing is also available for businesses that require it.

Businesses can collect payments locally at lower fees with Airwallex Payment Links and Plugins. These no-code solutions let you customise your Payment Links and integrate with popular marketplaces such as Shopify, WooCommerce, and Magento. Offer 160+ global payment methods at your checkout, including PayPal, Klarna, and WeChat Pay. Accept payments in 130+ currencies while avoiding unnecessary fees from forced conversions.

Revolutionise payment experiences

Share

David manages the content for Airwallex. He specialises in content that helps EMEA businesses navigate global and local payments and banking.

View this article in another region:AustraliaCanada - EnglishCanada - undefinedEurope - EnglishEurope - NederlandsFrance - EnglishFrance - FrançaisNew ZealandSingaporeUnited StatesGlobal

Related Posts

What is Interchange++?

•1 minute

Q&A: How Airwallex solves the treasurer’s historic headache

•5 minutes