How to open a US business bank account from Singapore

- •3 benefits of a USA bank account for your business

- •How to open a US business bank account as a non-resident

- •2 additional barriers to opening a US business bank account as a non-resident

- •Why the Airwallex USD Business Account is your ticket to business in the USA and globally

- •How to open a USD Business Account with Airwallex in 3 easy steps

- •FAQ

The United States is a compelling destination for SMEs with global ambitions, and it's easy to see why. The USA’s mutually-beneficial relationship with Singapore means even small businesses get access to tariff-free trade, straightforward customs processes, and even an accelerator programme for tech startups. If you want to grab these opportunities, there’s plenty to consider and plan for.

As an important first step, you need to open a US business bank account so you can transact in USD with ease. Read on to learn how to open bank accounts in the USA from Singapore, what you’ll need to prepare, and why the Airwallex USD Business Account is a better alternative to a US bank.

3 benefits of a USA bank account for your business

Having a US business bank account streamlines transactions for Singapore SMEs receiving payments from US-based customers or trading with the global market in USD.

Here are the top 3 benefits for your business:

Ease of transactions in USD

Having a US bank account simplifies transactions in USD, which is helpful for SMEs who have frequent or high-volume transactions in the USA. You also avoid fees associated with currency conversion and international transaction charges, which can eat into your margins. Eliminating unnecessary currency conversion also means predictable cash inflow and avoiding the financial uncertainties associated with fluctuating forex rates.

Accounting benefits

When all US-based transactions are in USD, you simplify the recording and reconciliation of all your financial activities in the country. This eliminates the complexities and accounting errors associated with currency conversion. You also get accurate and straightforward financial reporting, budgeting, and forecasting in USD.

Access to financial and banking services in the USA

Banking in the USA means that you get financial services and credit options that might not be otherwise available to foreign businesses. These include business loans, credit lines, and other tools necessary for expansion and growth.

How to open a US business bank account as a non-resident

The good news is that you don’t have to be a green-card holder or US citizen to open a US corporate bank account. There are no laws that restrict foreigners from banking in the USA.

The bad news is that foreign entities aren’t allowed to open a US business account. This means you’ll need to register your company in the USA before the bank application process can begin.

Follow these steps to opening a US business account as a non-resident:

Register your company as an LLC and obtain your EIN

LLC stands for limited liability company, a company structure that shields its owners from company liabilities. You can open an LLC even if you are not a resident or a US citizen, and the process is fairly straightforward.

Choose a state. As a non-resident, you have the flexibility to choose which state you’d like to register the LLC in. This is important as each state has different fees, taxes, and benefits for foreign-owned companies.

Hire a registered agent who will perform correspondences on behalf of your LLC

Obtain business permits and other documents required by the state

Obtain your Federal Employer Identification Number (EIN), a 9-digit tax number provided by the IRS. Without an EIN, you won’t be able to open a business bank account in the USA. Learn more about how to get an EIN.

Choose your bank

Choosing the right financial institution impacts the efficiency of your financial operations. As a

business operating mainly from Singapore, it’s important to look for a bank who can understand the unique challenges and requirements of non-resident business owners. Consider other factors like fee structures, maintaining balances, the availability of international wire transfers at reasonable rates, and customer service for non-residents.

Prepare your documents needed to open a LLC account

Each bank will have their own list of documents and requirements, but you’ll always be asked for these following documents and requirements to open a US business account at most banks:

EIN number of your LLC

Valid IDs for all business owners in the application and individuals who own 25% or more of the business. You can submit passports, driving licenses, or your IC

Organizing documents filed with the state of your LLC. This can include Articles of Organization, Certificate of Organization, or Certificate of Formation.

Details of your business’s operations, such as the date of establishment, state of legal formation, state of primary business operation. You must be a business operating in the USA.

2 additional barriers to opening a US business bank account as a non-resident

Despite being a straightforward process, opening a US bank account from overseas can be challenging. Besides the paperwork and the fees involved in creating an LLC, you’ll also need to overcome these barriers:

Physical presence requirements

Most financial institutions require non-residents to visit the bank branch in person before opening an account. Although you can begin the application process from Singapore, you’ll have to make a trip to the US to submit your documents and verify your identity. This can be a significant barrier for international business owners, who may not have the time for a long-haul flight just to open a bank account.

SSN requirement for single member LLCs

If your US entity is a single-member LLC - an LLC with just one owner - you’ll need to provide a Social Security Number (SSN). Only USA citizens, permanent residents, and non-citizens who have working rights in the USA can obtain a SSN and open an LLC bank account online.

You may be able to use an Individual Taxpayer Identification Number instead of a SSN, but you’ll need to file a Form W-7 application and provide documentation about your foreign/alien status in order to obtain one.

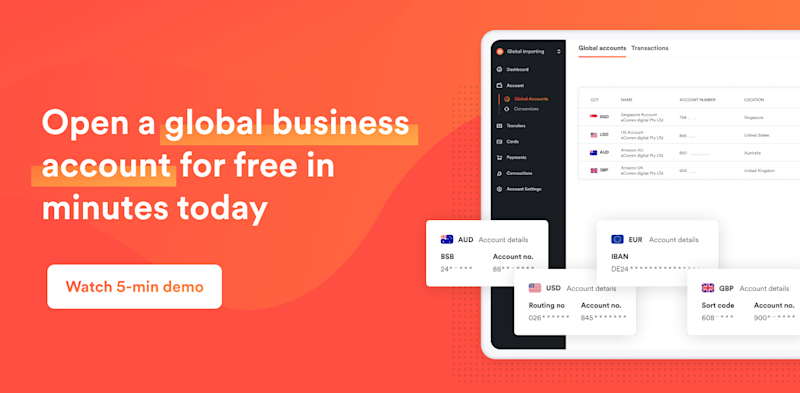

Why the Airwallex USD Business Account is your ticket to business in the USA and globally

Don’t let the complexities of banking requirements stop your expansion plans into the USA. While the Airwallex USD business account is not a savings account, If all you need is a cost-effective way to send and receive USD, we can be a better alternative to a bank. You can open an account online and send money to the US within the same day, without going through the LLC registration process!

Here are some more ways your SME can benefit from Airwallex:

Send and receive payments like a local

Your USD Business Account lets you send, receive, and hold USD as though you were a US-based business. Transactions are processed via direct bank transfers, which means none of the delays associated with cross-border payments.

The Business Account also comes with local bank account details, including a dedicated account number and bank code, which you can add to your invoices. This makes it easier for US-based clients or customers to send payments, and you’ll get the funds within 1 business day.

Transact in USD without unnecessary conversion fees

The Airwallex USD Business account eliminates the need for constant currency conversion, which can be costly and time-consuming.You can receive USD from global clients and avoid the fluctuating exchange rates and transaction fees typically associated with international payments.

Ease of account opening

Unlike banks, Airwallex doesn’t require your business to be registered in the USA. We won’t ask for a Social Security number or require an in-person visit, either. Simply scan and upload your Singapore business documents, and your USD business account will be ready within one business day.

No monthly fees, no minimum balance requirement

An Airwallex business account is free to open and does not require a minimum deposit amount, maintaining minimum balances, or any monthly fee. The only fees you’ll pay are small transaction fees when you convert USD to SGD.

Multi-currency support

Airwallex allows your SME to hold and manage various currencies, including EUR, GBP, and SGD. This feature is critical if you work with suppliers or offshore teams outside of the USA because it lets you avoid unnecessary conversion fees. Airwallex also lets you convert multiple currencies at interbank rates, which maximises the value of every dollar received from your global operations.

Integration with eCommerce marketplaces

You can also integrate your Airwallex Business Account with payment gateways and eCommerce ecosystems that operate primarily in the USA, such as Amazon and Shopify. This means enhanced operational efficiency when dealing with US-centric platforms, and enhances the customer experience, as they can make payments using the method they prefer.

How to open a USD Business Account with Airwallex in 3 easy steps

Don’t let banking limitations slow your growth. Get the Airwallex USD Business Account today and take the first step towards seamless global operations.

Here’s how to open one in 3 easy steps:

Step 1: Create a free Airwallex business account

Step 2: Upload the required documents and verify your business in Singapore

Step 3: Add funds into your Airwallex account and start using it

With Airwallex, you get more than a USD account; you get a gateway to global growth.

FAQ

Q: Can I open a US business bank account online?

A: In short, yes, you can open a US bank account online—but only if you have a US-registered company. Otherwise, you won’t be able to open a business bank account from Singapore. The Bank of America requires one to first be eligible and submit verification documents before opening an account.

No time to register your business in the US? You may want to get the Airwallex USD business account instead. Simply have your Singapore business registration documents ready, and you can start transacting in USD as quickly as 1 business day.

Q: Can I open a US business bank account from overseas?

A: Yes, you can begin the bank application process and prepare your documents from Singapore. However, the entire account process cannot be completed overseas. You’ll need to make an in-person visit to the US bank branch to submit your documents and verify your identity.

If all you need is a straightforward way to transact in USD, consider the Airwallex USD Business Account instead. The entire account opening process can be done online, wherever you are in the world. Simply have your Singapore business registration documents ready, and you can start transacting in USD as quickly as 1 business day.

Q: Can a Singapore company have a US bank account?

A: Yes, a Singapore company can have a US bank account if they have a US-registered company or LLC and an EIN. If your business is a foreign entity without any of these, you will not be able to open a business account in the USA.

No time to register your business in the US? You may want to get the Airwallex USD Business Account instead. Simply have your Singapore business registration documents ready, and you can start transacting in USD as quickly as 1 business day.

Q: Can I open a US business checking account, even if I don’t live in the USA?

A: Yes, non-residents can open a business bank account in the USA. However, you’ll need a US-registered company and EIN to do so.

No time to register your business in the US? You may want to get the Airwallex USD Business Account instead. Simply have your Singapore business license and registration documents ready, and you can start transacting in USD as quickly as 1 business day.

Related articles about managing your business operations:

Compare the best business bank accounts in Singapore for 2024

Cross-border payments & transactions: What is it & how does it work in Singapore?

Share

Related Posts

How to get an EIN from outside the United States

•3 minutes

Payment gateway fees: What businesses need to know

•15 minutes