How to get an EIN from outside the United States

As a Singaporean business owner, there are some business acronyms that we all innately know. UEN, TIN, IRAS, GST; the list goes on.

But if you’re looking to sell your products in the United States, there’s a whole new set of acronyms and business processes to learn, and tax regulations that you need to get your head around.

And before you can sell anything within the US, you’ll need to know about your EIN.

What’s that, you ask? Let’s have a look.

What is an EIN?

An EIN, Employer Identification Number, is a unique nine-digit tax number that’s issued to businesses in the US by the Internal Revenue Service (IRS). It’s the identification number that your business uses when paying taxes.

Do I need one?

If you have a business that’s registered within the US, that’s operating within the US, and you plan to pay taxes in the US (which as a US-registered business, you should) then yes, you will need an EIN.

And if you import goods into the US, but you’re still registered outside the US, you’ll need an EIN as well.

How much does an EIN cost?

Much like a Singaporean tax file number or your UEN, an EIN is a service that comes at no cost to you or your business.

This is important to know, as if you’re considering setting up an EIN and you see websites charging to set one up for you, it’s best to avoid these. After all, you wouldn’t pay someone to set up your UEN for you, would you? Go directly to the IRS instead and set yours up for free.

How to get an EIN from outside the US

Admittedly, getting an EIN from outside the US isn’t as easy as we’d like it to be—but it’s possible.

The issue for businesses outside the US is that your EIN can’t be lodged online. Online applications are only available to businesses whose principal locations are within the US.

For international businesses, you’re going to have to make a phone call directly to the IRS. This can take a while, so it’s safest to set aside an hour of your time for this.

Here’s how to do it.

Head to the IRS website and fill out an SS-4 form, which is the application form for your Employer Identification Number. This goes through a series of questions about your business, including your address, business type, your employees, and similar, which will help you when answering questions later.

If you’re authorising someone in the US to receive your EIN for you, you can fill out the Third-Party Designee section of the SS-4. This means that they will receive your official EIN documentation once it’s prepared. If not, leave it blank. But be sure to provide your signature, otherwise, the application will be invalid, and you’ll have to go through the process again.

Make an international call to the IRS. But be aware that you’re making an international call, so you’ll be charged an international fee. You can reach them at: 267-941-1099, 6am - 11pm (Eastern Time) Monday through Friday. Listen to the phone menu and follow the prompts until you reach their EIN service. From here, you’ll speak with a representative who will guide you through the EIN process. They’ll run you through a series of questions to fill out your information.

Once you’ve answered all their questions satisfactorily, you’ll then be issued with your EIN. You can start using this straight away.

Be sure to take careful note of this number, as your physical EIN form is being mailed to you, so it may take a few weeks to arrive. Typically, this will be sent to your registered US address, but if you don’t have one, make sure to ask if they can post internationally—or even if they can do it by email.

And that’s it, you’ve got an EIN for your business. You can now start paying taxes in the US.

Do I need to pay taxes each year?

In short, yes. When you run a business within the US, you’re required to pay taxes to the US government. Your EIN is what enables you to pay taxes in the US.

In more detail, there are a few specific situations in which your business will need to pay taxes:

You have employees, or you withhold taxes on income that’s paid to non-residents

You operate as a corporation or a partnership

You’re self-employed and have a tax-deferred pension (known as a Keogh plan)

You’re in the finance, real estate, or the not-for-profit sector

You file a tax return for: Tobacco, Firearms, Alcohol, Employment, or Excise

You import goods into the US to sell on platforms like Amazon

How do I pay taxes?

Unlike setting up your EIN, paying your taxes is quite straightforward. The IRS has an online tax portal, allowing you to pay your taxes online.

Simply head to their portal, click the ‘Make Payment’ button, and follow the prompts.

If you don’t have a US bank account, you can pay by credit or with debit card. However, this will incur associated international transfers and currency conversion fees.

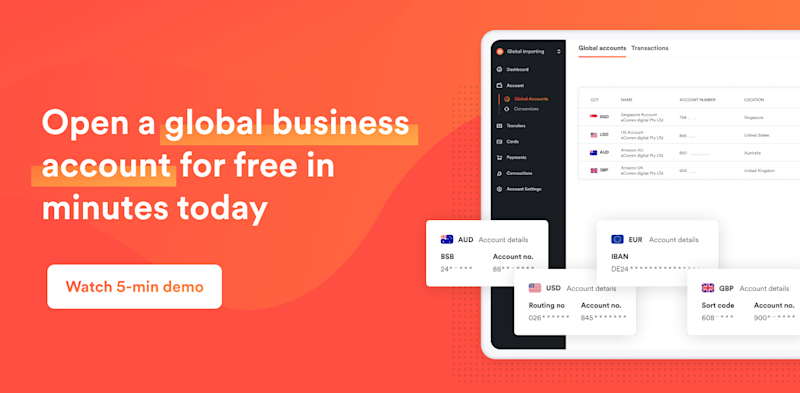

Airwallex makes paying your US taxes a breeze

You shouldn’t be slugged with extra fees just for doing the right thing and paying your taxes.

An Airwallex Foreign Currency Account lets you avoid any unnecessary conversion fees. All you need to do is set up a USD Global Account and you can neatly sidestep this process. You can effectively create a US bank account without the paperwork, the waiting times, and endless red tape.

Simply set up your Global Account with us and you can start sending and receiving USD immediately. You’re able to avoid any conversion fees and make same-day transfers, without any monthly fees.

It’s the easy way to pay your US taxes from outside the United States.

So, if you’re looking for a better way to send and receive money in the US, or you want to know more about how we can support you in growing your business internationally, get in touch with us today for a free demo to see how Airwallex can help your business thrive.

Share

View this article in another region:Global

Related Posts

What is a multi-currency account? Growth benefits for business

•5 minutes

A business owner’s guide to credit card processing: what you need...

•11 minutes