Rates

Our Rates product allows you to create conversions from one currency to another at the prevailing market rate via one of our panel of global liquidity providers. Rates pricing is provided 24 hours a day, every day of the year to ensure you are always able to transact when you need to.

Rates is best suited to customers who are highly transactional and need to be booking many transactions in a short period of time at the best possible rate at the point of conversion. Typical Rates customers may be managing FX market risk separately, or be less sensitive to FX market risk. Rates is also a simpler integration than Quotes, with no additional need to retrieve and manage quotes.

Transaction flow

The Rates transaction flow can be broken down into its component parts:

- (Optional) Retrieve the current rate: Not all customers will need to retrieve the current rate before placing a conversion request or a payout request with an underlying conversion. For those that do, you must call Retrieve a current rate API.

- Book a conversion request: After you retrieve the current rate, you can choose to book a conversion request.

You can also specify a conversion date on which the conversion will be settled to and from your Wallet. If you do not specify a date, Airwallex determines the default based on your funding mode (see settlement timing).

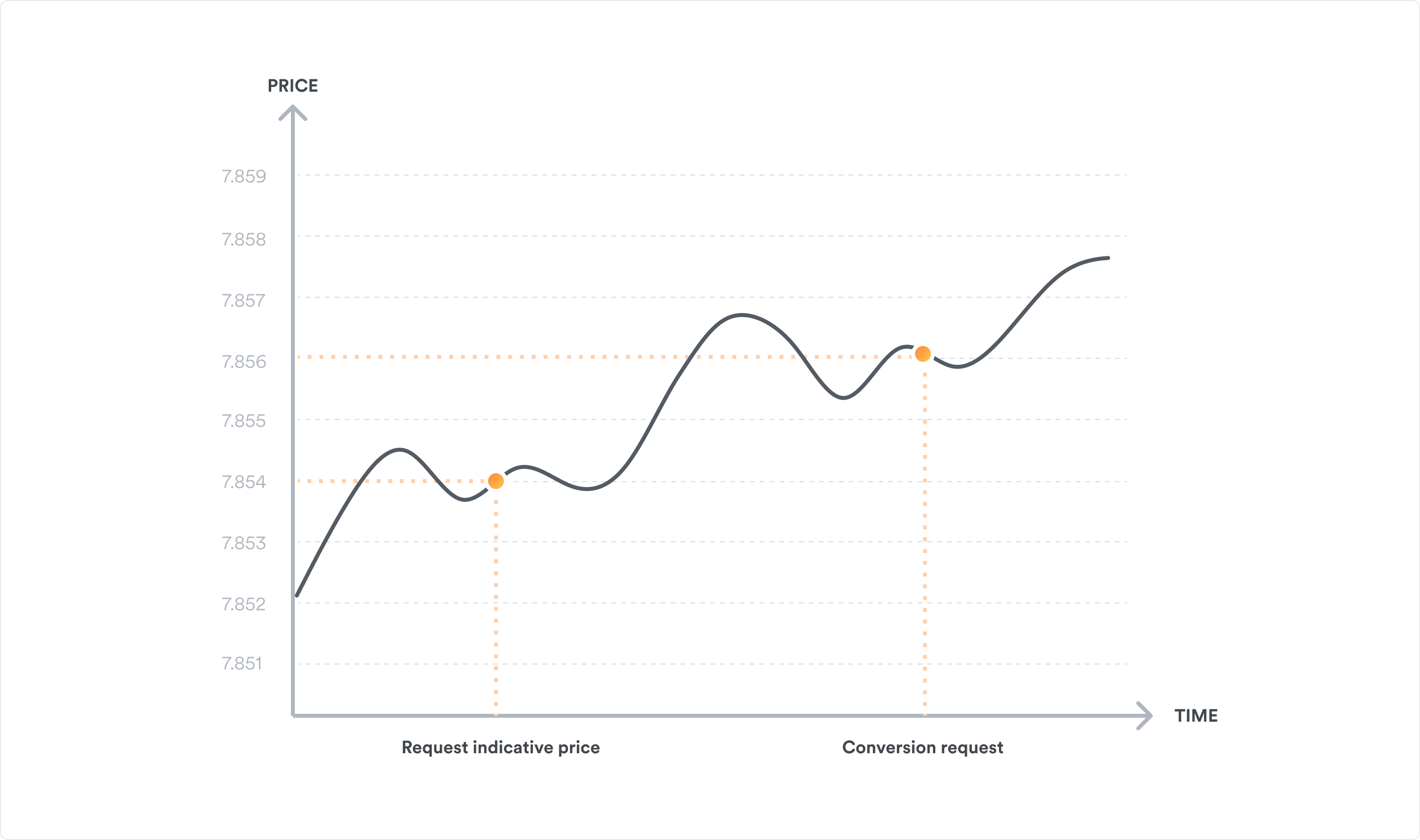

The variance between the price you get executed at and the current rate initially returned will be determined by the following criteria:

- Market conditions

- The amount of time you wait between calling for the current rate and requesting a conversion

Pricing

Airwallex has integrated with several global and regional banks that provide pricing in both freely traded pairs and in currencies with additional capital controls. Our proprietary Rates pricing engine blends prices from across our panel of banks to generate highly available and stable FX prices accessible by clients 24 hours a day, 7 days a week.

Airwallex’s Rates pricing algorithm is designed to deliver the best possible price to clients at the time of execution, taking into account a wide variety of factors which may include, but not limited to, current market volatility, available liquidity in the market, the size of the transaction and the selected date you wish to settle the transaction. Any additional agreed margin will be applied on top of the price produced by our Rates pricing engine.