Get your first $20,000 of foreign exchange free

That's $0 fees and 0% margin on your first $20,000 AUD in FX conversions (or equivalent)*. Simply get in touch with your account manager to activate this promotion.

*Speak with your account manager to activate. The FX fee and margin waiver will expire on the earlier of 1 month from when it's applied or when $20,000 AUD equivalent of FX currency conversions is reached. Note that payments made via SWIFT network will incur fees from $10 AUD. See promotional terms here

*Speak with your account manager to activate. The FX fee and margin waiver will expire on the earlier of 1 month from when it's applied or when $20,000 AUD equivalent of FX currency conversions is reached. Note that payments made via SWIFT network will incur fees from $10 AUD. See promotional terms here

“Massively simplifies the challenge of doing business overseas”

“Enables businesses to manage cross-border payments easily and cheaply”

“Australia’s fastest growing $1 billion dollar start up”

“Airwallex is the highest ranked Australian firm at #32” - Top Global 100 Fintech

We're not a bank, we're better.

Multi-currency business account

Collect and hold money in over 12+ currencies. Avoid double conversions and hedge against currency fluctuations.

Borderless cards

Create physical or virtual debit cards in seconds, set spending limits and controls, and see all employee expenses, in one place, in real-time.

Transfers

Save on everyday business expenses, with zero international fees¹ and market-leading exchange rates².

Xero integration

Automatically sync your multi-currency transactions to Xero. Ensure your books are always up to date.

¹Other fees and charges apply. ²The above estimations are calculated using published rates for the Big Four banks, and using our rates that apply to new customers from 17 October 2022. You can find more information on how we calculated our savings here.

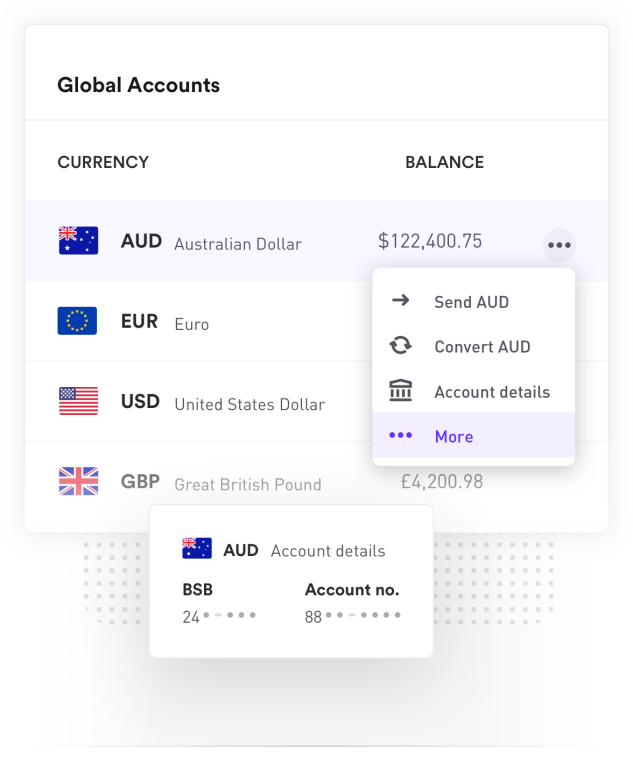

Global Accounts

Take the hassle out of growing your business internationally

Open and manage Global Accounts in 11 currencies

Invoice overseas customers in their preferred currency.

Integrate with online stores

Easily connect your currency accounts with popular platforms like eBay, Shopify and PayPal.

Zero transaction fees

Hold and pay in foreign currency, or convert and bring your money back with market-leading conversion rates².

²The above estimations are calculated using published rates for the Big Four banks, and using our rates that apply to new customers from 17 October 2022. You can find more information on how we calculated our savings here.

Transfers & FX

Transfer funds across the globe, cost effectively and fast

Spend less on FX fees, more on growth

We charge 0.5% or 1.0% above the interbank rate depending on the currency. You're always getting the best rates, no matter the amount.

Global coverage

Transfer funds in 45+ currencies into over 130 countries and counting.

Time better spent

Save time by making batch payments, especially when regularly paying international employees.

Borderless Cards

Empower employees with corporate cards

Create dedicated company and employee cards

Give power back to your team to manage expenses without creating overhead. Say goodbye to sharing corporate cards.

Stay in control of team expenses

Track receipts, review expense approvals and set monthly card limits so you can stay ahead of your budget.

Save on global expenses

Unlock 0% international card transaction fees. Better yet, pay directly with your multi-currency wallet balance to eliminate unnecessary FX conversion fees.

Xero Integration

Make bookkeeping a breeze

Quick and easy integration

Link your Airwallex and Xero accounts in just a few clicks.

Multi-currency transaction syncing

Sync your multi-currency Airwallex transactions to Xero, including who made the transaction and where.

Syncs hourly

Ensure your Xero transaction records are up to date for your accountant or bookkeeper.

Airwallex Rewards

Unlock rewards simply for being an Airwallex customer

Score $20,000 worth of great offers from the leading business tools, handpicked to help accelerate your business.

See how our customers are finding Airwallex

"Airwallex solves the problem of creating currency accounts almost instantly. I can click one button to create a UK account. We haven’t looked back since day one."

Peter Park

Business Improvement Manager, Deliciou

“Airwallex is what the new face of managing finances should really look like. First thing I did when I walked into Mr Yum was move all our subscriptions off a big 4 debit card and onto Airwallex. I reckon it saved us close to $50,000 this year in our FX fees.”

Corey Payne

Financial Controller, Mr Yum

“Like many high growth businesses, you’re dealing with multiple currencies. Now, with Airwallex we’re using the one platform to make multiple currency payments.”

Hai Trang

Virtual CFO, Orbitkey

“Airwallex is so easy to use. It’s allowed my team to self-serve which suits our growing business and teams. Whether it’s getting payment approvals, or giving a virtual card for a new employee – it gives us the visibility and control we need.”

Tristan Cheal

Financial Controller, Clipchamp

Security is at our core

Protected

Your money is held securely in a ring-fenced account. You can access your funds whenever you like as they're never invested or lent to anyone else.

Highest standards

Airwallex meets the highest international security standards including PCI DSS, SOC1, and SOC2 compliance, in addition to our local regulatory requirements.

Security first

Our modern infrastructure allows us to implement best-in-class security controls which are monitored 24/7 to keep your account safe.

Compliant

Airwallex is registered with AUSTRAC and regulated by ASIC under an Australian Financial Services License.