What is a virtual card? How do they work?

What is a virtual card?

A virtual card is similar to a traditional credit or debit card but exists solely in a digital format. It is primarily used for online purchases and subscription services, offering a convenient and secure alternative to physical payment methods.

Gartner predicts that 80% of B2B sales interactions between suppliers and buyers will occur through digital channels by 2025.1 As millennials ascend to key decision-making roles, a seller-free, virtual sales experience will become standard.

With the trend moving towards a digital-first approach and reduced face-to-face customer interaction, the significance of virtual cards as a payment method for B2B transactions is expected to increase. The business use of virtual cards already makes up 69% of the total market share2, with the virtual cards market expected to reach 1.3 trillion USD by 2023.3

If you’re thinking of getting virtual company cards for your business, keep reading to learn more about how they work and what to consider when choosing one.

In summary:

What is a virtual card? A virtual card is essentially a digital version of a physical credit or debit card, designed exclusively for online transactions and enhancing security measures.

How do virtual cards work? Virtual cards use technology to create unique card numbers for secure online payments, keeping your main account details private.

How do you get a virtual card? Virtual cards can be created online through banks and other financial institutions, such as Airwallex.

Are virtual cards safe? Virtual cards offer enhanced security features including the ability to set spending limits and restrict transactions by the type of merchant, and the capacity to instantly freeze or cancel the cards.

How do virtual cards work?

Each virtual card has its unique card number that links back to your main bank account or funding source. You can create multiple virtual cards and use them to transact in various currencies using funds available in your account. Some providers offer additional features, such as setting transaction limits and creating disposable cards that automatically expire after the intended payment has been made.

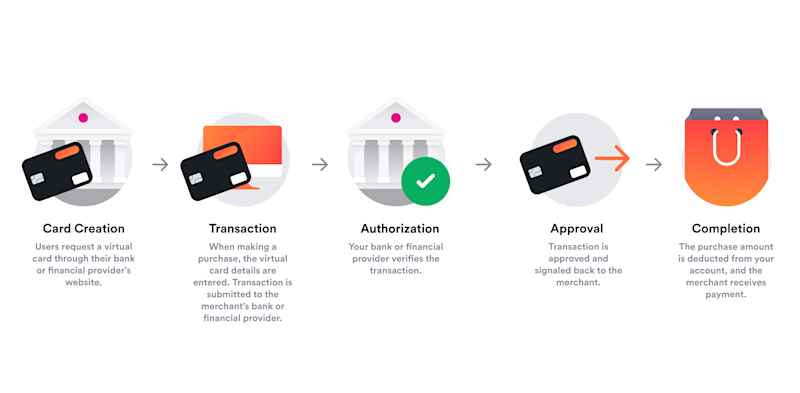

Now, let's take a closer look at how virtual cards work:

Card creation: Users can create a virtual card through their bank or financial provider's website. They will receive their virtual card details, including unique card numbers, expiration dates, and security codes. During this process, they may have the option to set specific spending limits or card expiration dates for added control.

Transaction: When making a purchase, the virtual card details are entered just like a traditional card. The transaction is encrypted and processed through secure payment gateways, ensuring the safety of your business's financial information.

Authorization: Your bank or financial provider then verifies the transaction, ensuring adequate funds are available and that the transaction parameters fit within any set limits. Approval is signaled back to the merchant without revealing any sensitive account information.

Completion: The purchase amount is deducted from your account, and the vendor receives payment. The transaction appears on your statement and is linked to the virtual card number, allowing for easy tracking and management.

Why use a virtual card in the US?

Virtual cards provide a convenient and safe way to make online transactions. Here are a few reasons why businesses should consider using them:

Ease of use

Virtual cards are easy to set up and use, and you can create multiple cards for different purposes.

Instant card creation: Businesses can easily issue virtual cards to new employees, contractors, or one-off purchases through their bank or financial provider's online platform. Virtual cards can be created in real time, giving businesses immediate purchasing power whenever needed. This eliminates the tedious application process and the hassle of waiting for physical cards to be delivered.

Multi-currency cards: Virtual cards can be used for transactions in multiple currencies, usually without incurring any foreign transaction fee. This provides businesses with a versatile payment option for their global purchasing needs, including paying for digital ad spending and SaaS subscriptions in currencies other than USD.

Enhanced security

Virtual cards use advanced security features such as encryption and tokenization techniques to reduce the risk of fraud and unauthorized transactions. In addition to this, they also offer the following security features:

Freeze or cancel virtual cards: In the event of a fraudulent attempt or if a card is no longer needed, businesses can swiftly deactivate the unwanted virtual card without affecting their primary account or other virtual cards, ensuring ongoing transactions remain unaffected.

Virtual cards can't be lost or stolen: As virtual cards exist only in the digital space, they cannot be physically lost or stolen like traditional corporate cards. This eliminates the need for replacements, which may lead to delays and potential losses until the physical card is replaced.

Transaction limits: Virtual cards can have a predefined spending limit, offering an extra layer of security to avoid overspending or unauthorized transactions. Additionally, businesses can limit transactions using the virtual card to only certain types of merchants.

Real-time spend tracking: With virtual cards, businesses can track their expenses in real time through online platforms or mobile apps. This allows for immediate identification of any suspicious transactions and timely action.

Multi-layer approval workflows: You can set up multi-layer approval workflows for expense management software to ensure all virtual card transactions are thoroughly authorized. This minimizes the risk of unwanted or fraudulent spending.

Improved expense management

Virtual cards facilitate greater control over managing company spending, resulting in time and cost savings for businesses. Additionally, the centralized data and real-time tracking allow for better visibility over company expenses.

Simplified reconciliation: Virtual cards are linked to a central account, allowing for all transactions to be recorded in one place through real-time tracking. This eliminates the need for manual record-keeping and reconciling of multiple credit card statements. Generating expense reports also becomes a seamless process with a click of a few buttons.

Automated categorization: Virtual cards can be set up to automatically categorize various company expenses such as business travel, ad spending, and events. This also helps with more efficient budgeting and identifying areas where spending can be reduced.

Accounting software integration: Some virtual card providers integrate with popular accounting software like Xero, making it even easier for businesses to streamline their financials.

Budget control: Businesses can set spending limits for each virtual card, ensuring that spending aligns with the company budget. This can be particularly useful for companies with multiple departments or teams with varying budgets.

Save time on expense reimbursement: By assigning virtual cards to employees, companies eliminate the need for employees to pay out of pocket and submit expense reports for reimbursement later.

Lower fees

Many virtual cards do not charge annual or transaction fees, making them a more cost-effective option for businesses. Using Airwallex, businesses can create virtual cards and spend in multiple currencies with no domestic or international transaction fees and no hidden charges.

How do virtual cards differ from mobile wallets and payment apps?

Virtual cards, mobile wallets, and payment apps work together to facilitate seamless digital transactions without needing physical payment instruments. Virtual cards act as digital versions of physical credit or debit cards. On the other hand, mobile wallets and payment apps store digital forms of various payment options, including virtual cards.

Here are the key distinctions between the three:

Nature of the tool: For those who need a refresher on what a virtual card is, it is a digital-only payment tool that can be used for various transactions. It is similar to traditional debit or credit cards but without the physical plastic. In contrast, mobile wallets and payment apps are applications that store digital versions of credit or debit cards, just like your physical wallet. They allow users to make payments in-store by scanning a QR code or tapping their phone on a payment terminal. Examples include Apple Pay, Google Pay, AliPay, and WeChat Pay.

Usage scope: When you store your virtual cards in mobile wallets or link them with payment apps, you can use them for both online and in-store purchases. Mobile wallets and payment apps use tap-to-pay technology and QR codes to facilitate various transactions. Some also offer additional features such as peer-to-peer payments, bill splitting, and loyalty program integration.

Security features: Virtual cards offer a unique security feature by allowing users to generate a new card number for each transaction or merchant, enhancing fraud protection. Mobile wallets and payment apps secure transactions through encryption, tokenization, and biometric authentication, making it difficult for unauthorized users to access the virtual cards stored in them.

Purpose and customization: Virtual cards can be tailored for specific uses, such as restricting the merchant categories where they can be used or setting spending limits, catering mainly to businesses seeking to control expenses. Mobile wallets and payment apps offer convenience to the general consumer, allowing for a simplified and consolidated way to use multiple payment methods for various transactions, from in-store purchases to eCommerce payment solutions.

These distinctions highlight the complementary roles that virtual cards, mobile wallets, and payment apps play in payments. Virtual cards cater to businesses that need secure and controlled digital payment services, while mobile wallets and payment apps help extend the benefits offered by virtual cards to offline transactions.

An example would be managing travel and entertainment expenses. Employees on business trips can easily use their virtual corporate cards stored on their mobile wallets, such as Apple Pay or Google Pay, for in-person transactions, eliminating the need to carry physical cards. As virtual cards offer real-time expense tracking and the option of setting spending limits, businesses can also gain better control and visibility over their employees' expenses. Therefore, integrating virtual cards into mobile wallets and payment apps offers both convenience and a streamlined expense management solution for businesses.

Should you use a virtual card for your business?

Whether you're looking to mitigate fraud risks, streamline expenditure tracking, or enhance control over business spending, virtual cards offer a compelling solution for businesses of all sizes. Here are five reasons why you should consider using virtual cards for your business:

International transactions: If your business often incurs expenses in foreign currencies through international payments or travel, virtual cards present a cost-saving opportunity. Many virtual cards offer the advantage of 0% transaction fees on both domestic and international purchases, providing a convenient and efficient way to manage global spending.

Scalability and flexibility: As your team expands and the volume of expenses grows, the challenge of managing manual reimbursements becomes more daunting. Virtual cards present a scalable and flexible solution as they can be swiftly issued and managed for new hires, different departments, or specific projects without the complexity of traditional administrative procedures or the need for extra infrastructure.

Enhanced security: Disposable virtual cards reduce the risk of fraud and data breaches by giving you the ability to instantly freeze or cancel them when needed. You can immediately create a new card online without being interrupted by a tedious card replacement process.

Streamlined expense management: Virtual cards offer real-time visibility and control over business expenditures, allowing businesses to track expenses accurately and efficiently. With the option of customizable spending limits at the transaction level, businesses can ensure responsible spending practices within their organization.

Enhanced financial efficiency: If your business incurs regular monthly expenses such as software subscriptions, you can set up recurring payments using your virtual cards to ensure timely payments and avoid any late fees. Moreover, you can dedicate virtual cards to specific vendors, projects, or departmental functions, such as dedicating a card solely for marketing and advertising payments, to facilitate integrated budgeting and spending.

Why use the Airwallex Borderless Card

The Airwallex virtual Visa card helps businesses transact in multiple currencies without incurring any transaction fees. You can create virtual company cards, assigning different spending limits and dedicated use cases for each. This provides greater control over financial outflows by enabling real-time monitoring of employee expenses and fostering transparency in budget management across teams. Airwallex also prioritizes robust safety measures, including the instant ability to create, freeze, or cancel virtual cards, protecting businesses against the threat of card-related fraud.

Frequently asked questions

1. Are virtual cards safe?

Yes, virtual cards are considered highly safe and secure. They leverage advanced encryption technology and are able to generate unique card numbers for each transaction, making them significantly more secure against fraud and misuse than traditional physical cards. Additionally, most virtual cards come with customizable spending limits and expiration dates and can be locked or deleted instantly via mobile apps or online platforms. This level of control and security ensures that even if a virtual card’s details are compromised, the risk of financial loss is minimized, offering businesses and individuals a robust layer of protection for their financial transactions.

2. Why do businesses use virtual cards?

Businesses increasingly adopt virtual cards due to their enhanced security features, cost-effectiveness, and convenience. Virtual cards help streamline accounting processes, as they can be directly integrated with expense management systems like Xero, facilitating real-time monitoring and reporting. This integration improves operational efficiency and offers greater visibility into spending patterns. Additionally, the ability to set specific spending limits and expiration dates on virtual cards enables businesses to maintain tighter control over expenses, further enhancing their budgeting.

3. Can I withdraw cash from virtual cards?

Typically, virtual cards are designed primarily for electronic transactions and are not directly usable for withdrawing cash at ATMs or bank branches. However, certain financial institutions or card issuers may offer specific features that allow funds from a virtual card to be transferred to a linked account that a physical card can access, which could then potentially be used to withdraw cash.

Get the business account built for global growth

Sources & References

Share

Erin is a business finance writer at Airwallex, where she creates content that helps businesses across the Americas navigate the complexities of finance and payments. With nearly a decade of experience in corporate communications and content strategy for B2B enterprises and developer-focused startups, Erin brings a deep understanding of the SaaS landscape. Through her focus on thought leadership and storytelling, she helps businesses address their financial challenges with clear and impactful content.

View this article in another region:AustraliaCanada - EnglishCanada - FrançaisEurope - EnglishEurope - NederlandsHong Kong SAR - EnglishHong Kong SAR - 繁體中文MalaysiaNew ZealandSingaporeUnited KingdomGlobal

Related Posts

SaaS payment processing: how it works and which platforms to choo...

•15 minutes

Finance automation: What it is, how it works, and why it benefits...

•13 minutes