What is card issuing for businesses and how does it work?

Key takeaways:

Businesses typically issue virtual, debit, credit, and prepaid cards.

Launching a card program via card issuing can improve the stickiness of your product, unlock new revenue streams, reduce time to market, and offer insights into customer preferences.

Partnering with a card issuing platform that offers compliance support, flexible controls, and API integration options can help you efficiently create, launch, and scale a customizable card program.

Card payments – especially credit and debit cards – remain the top choice for global consumers making cross-border purchases. As demand grows, more businesses are launching private-label card programs to boost brand loyalty and customer engagement.

To meet this demand, modern fintech platforms have made it easier for your business to issue your own private-label cards, also known as white-label cards. With card issuing, you can create a custom card program that encourages customers to engage more deeply with your business and, ultimately, drive more revenue.

In this article, you’ll learn what card issuing is, how it can benefit your business, and what to look for in a card-issuing partner.

What is card issuing?

Card issuing is the process of creating and managing payment cards, such as debit, credit, or prepaid cards, for business or customer usage. These cards can be used for various purposes, including first and third-party use cases such as managing corporate expenses and employee spend, distributing payroll, or developing and monetizing your own card proposition.

Although developing a private-label card program was out of reach for many, modern fintechs have made card issuing more accessible. Driven by many advancements in fintech, improved payment processing technologies, and more accessible APIs, these innovations allow you to customize and issue your own branded cards. As a result, you can strengthen customer loyalty and unlock greater revenue by launching your own card program.

The combined number of general-purpose and private-label payment cards in circulation globally is projected to reach nearly 30 billion in 2028, with private-label cards making up an estimated 30% of this market, which accounts for nearly 8.5 billion cards. This anticipated surge in demand presents a valuable opportunity for your business to generate significant revenue by developing your own card proposition.

If you want to launch your own card programme but aren’t sure where to start and what resources are required, partnering with a card issuing platform can help. Doing so lets you skip the complexities and get your card to market faster. You’ll have full control over the design and features of your card, so you can tailor the card to your brand and customer needs, creating a more personalised experience.

Benefits of issuing cards for your company

Card issuing unlocks benefits that enable businesses from various industries to improve customer experience and brand loyalty, while opening new lines of revenue. By issuing your own cards, you can have greater control and flexibility – whether it’s deciding card features, setting spending limits, or customising rewards for customer card programmes. Here are some benefits of building a card proposition for your customers:

🟠 Create a stickier product

Card issuing can significantly enhance the stickiness of your product. A unique card program creates a more integrated experience for your customers and can attract and retain customers who value the added benefits. You can work with card issuers to configure your card program, such as offering cashback, points, or other incentives for every transaction. For example, you could build a card program with a points-based system that lets customers redeem points for goods or services, including yours. This encourages repeated engagement with your brand, increasing customer loyalty and strengthening brand recall.

🟠 Unlock new revenue streams

Through issuing cards, you can build additional revenue streams that can help diversify your business finances and improve cash flow management. For example, you may decide to charge annual fees, late fees, or renewal fees. If you have a global customer base, charging a small margin on foreign transaction fees could also become a new revenue stream. This additional revenue can improve your cash flow and be reinvested into your business – whether to improve operations or expand offerings.

🟠 Reduce time to market

Launching your own card program can also set you apart from your competitors. Being one of the first to launch a private-label card can help you capture market share before competitors react, establishing your business as an industry leader. Partnering with a card issuer that offers private-label issuing solutions can greatly reduce your time to market. Many fintechs offer plug-and-play solutions with pre-built APIs for integration, Know Your Customer (KYC) services, fraud detection, and customer support. With the necessary infrastructure and compliance support, you can accelerate the launch of your program and scale efficiently.

🟠 Gain insights into customer preferences

Card issuing can provide valuable transaction data that helps you better understand customer behavior, preferences, and spending patterns. You can use these insights to tailor your card program to better meet customer needs by offering personalized discounts or targeted offers, further improving the customer experience.

Issue and manage multi-currency cards at scale

Types of cards you can issue

Card issuers can help you with many different types of payment cards. Here are different types of cards that you can consider, depending on your needs:

🟠 Virtual card

Virtual cards are digital versions of traditional credit or debit cards. They are designed to be used for online transactions and can be generated instantly, often through a mobile app or a website. Virtual cards can be issued to your customers as part of their earnings or benefits. For example, you could issue freelancers and gig workers virtual cards to receive payments from their clients. Virtual cards have a reduced risk of fraud compared to physical cards since they can't be lost or stolen. If needed, your customers can freeze or cancel them instantly to prevent misuse.

🟠 Debit card

A debit card accesses funds directly from a linked bank account. This card type provides real-time deduction, where spending is limited to the available balance in the linked account. For example, a global payroll platform can issue business debit cards to remote workers, giving them easy access to their earnings and the ability to spend or withdraw funds directly, streamlining financial management and enhancing convenience.

🟠 Credit card

Credit cards provide a line of credit to the cardholder, who can only spend up to a pre-set limit and has to repay the balance within a specific period of time. For example, marketplaces could issue their own credit card programmes that offer customers exclusive rewards to build customer loyalty. This can help drive sales and repeat purchases, incentivising customers to spend on their platform.

🟠 Prepaid card

A prepaid card is a payment card funded with a preloaded balance that can be used as a physical or virtual card. Spending is limited to the available balance, which prevents overspending and misuse. For example, a ride-hailing company can issue prepaid cards to gig workers to immediately pay fares, tips, and expenses, ensuring quick access to funds and reducing the need for cash transactions.

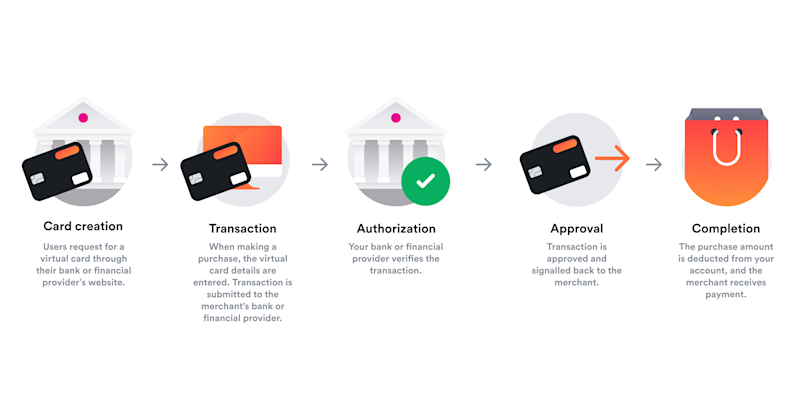

Key steps in the card issuing process

Issuing private-label cards for your card program involves several steps, from defining program objectives to setting card features and integrating the program with your existing systems. The card issuing process typically looks like this:

1. Define your objectives and customer needs

Identify the purpose of your card program – is it to increase customer loyalty, generate additional revenue, or enhance brand visibility? Understanding your customer base can also help fine-tune your card program. Segment your customers and identify any patterns in spending habits. This alignment will help you design a card program that resonates with your customers.

2. Choose a card issuing partner

Research and compare card-issuing platforms that offer white-label solutions. Consider the costs involved, their capabilities, and the support level they can provide. Some card issuing platforms handle regulatory compliance for your business, which is especially important for global companies. A strong card issuing partner will offer a comprehensive suite of solutions that help you manage everything – from credit checks to transaction monitoring, fraud prevention, and customer support.

3. Design your card and set up your card program

When designing your card, align the colors, logos, and fonts with your brand guidelines. Specify features like contactless payment, chip technology, and card benefits, such as cashback or loyalty points. Determine the fees and pricing structure, such as annual, late, renewal, and foreign transaction fees. To tighten your program, you can also set parameters like spending limits and merchant category restrictions. To prevent fraud, customize your risk threshold and set security checks. For example, you can set 3D Secure authentication to be triggered when there’s a suspicious transaction (e.g., a high-value purchase or transaction from an unfamiliar location).

4. Integrate card program with existing systems

To monitor and manage issued cards efficiently, it's essential to integrate the card program with your existing systems. This may involve connecting with your accounting and customer relationship management (CRM) software and more. A card-issuing platform that provides APIs and other integration options to make this a seamless process will significantly reduce the time and resources required, freeing up time for you to manage other aspects of your business.

5. Launch and manage your card program

Before launching your card program, conduct testing to ensure everything works as expected. Once the program is live, monitor and evaluate its performance. Customer feedback and usage patterns can provide valuable insights that help you refine your program to become more attractive to your customers. For example, if usage patterns show that many customers often hit their spending limits and you receive feedback that frustrates them, you could introduce higher or tiered limits based on customer spending history and creditworthiness.

Choosing the right card issuing partner

Selecting the right card issuing partner is critical to launching a successful card program. As mentioned, the card issuing platform must offer capabilities to meet your objectives and customers’ needs. Here are some key considerations when it comes to choosing a card issuing platform:

🟠 Technology and integration capabilities

Does the card issuing platform offer APIs that integrate with your existing financial tools and systems? For example, an integration that syncs card transactions directly with your accounting software can save hours of manual data entry and reduce costly errors.

🟠 Scalability

Does the card issuing platform offer capabilities that can adapt to your evolving needs, such as multi-currency support, global issuing capabilities, issuance of different card types, and flexible card program? For example, a business might issue virtual cards initially and require physical cards later as it scales internationally.

🟠 Compliance and security

Does the card issuing platform adhere to global compliance standards (e.g., PCI DSS) and have robust security and fraud prevention mechanisms in place?

🟠 Customer support and onboarding

Does the card issuing platform offer comprehensive onboarding and dedicated support during setup and beyond, such as a responsive support team and FAQ resources?

Say you’re deciding whether to go with traditional banks or modern fintechs. While traditional banks have a long history of adhering to financial regulations and maintaining high security standards, they may require more development work to integrate their systems with your business due to legacy infrastructure. This results in limited integration and scalability compared to modern fintechs with robust API integrations, which can better support companies looking to launch a card program rapidly.

Future trends in card issuing

As technology advances and consumer expectations shift, the future of card issuing will continue to be technology-driven. With growing customer preferences for contactless payments and digital wallets, it's clear that customers will continue to demand payment services that are easy, intuitive, and secure. To keep pace, financial institutions need to integrate new technologies that can issue virtual cards instantly and support digital wallet compatibility. Traditional financial institutions with legacy payment infrastructure may struggle to adapt to the real-time needs of modern businesses, where speed matters.

In fact, by 2027, it is expected that 1.3 billion cards will be issued via digital platforms and driven by APIs. This means you'll have greater access to flexible, agile, and secure card-issuing solutions. However, the increasing reliance on APIs also introduces security risks, exposing financial institutions to potential data breaches and fraud. As a result, regulations will continue to evolve to ensure consumer data privacy and fraud prevention. For example, the US Consumer Financial Protection Bureau (CFPB) announced it would extend bank-level scrutiny to major payment providers processing over 13 billion transactions annually through digital wallets and payment apps, including Apple Wallet, Google Pay, and Venmo.

Notable data breaches, such as the 2024 cyberattack on Evolve Bank that affected its partners and customers, highlight the need for financial institutions to continue investing in security and fraud prevention. While fintech and card networks are already implementing artificial intelligence (AI)- powered fraud detection, there's still room to explore next-generation solutions like biometric authentication and blockchain technology to safeguard transactions further.

Issue customizable, multi-currency cards without the heavy lift

With modern fintech solutions, it’s now easier for businesses to set up your own card programme. The question now is, how do you do so while staying ahead of the competition?

Partner with Airwallex to launch your own private-label card proposition and unlock new revenue lines. Our global card issuing solution lets you issue physical and digital multi-currency Visa cards across 40+ countries. Customize card features, spend limits, and rewards to build a card program tailored to your business needs and customers’ preferences.

Airwallex works closely with you from configuration to launch to perform end-to-end testing, ensuring your card program works exactly as you intended. With our built-in compliance support, you can launch and scale your card program quickly, giving you a competitive edge.

Issue and manage multi-currency cards at scale

1 https://www.airwallex.com/ecommerce-campaign-2024

2 https://www.statista.com/statistics/283578/payment-card-growth-trend-global/

3 https://www.reuters.com/business/finance/visa-teams-up-with-affirm-launch-card-flexible-payments-us-2024-11-12/

4 https://virtual-pay.io/the-future-of-card-issuing-trends-and-innovations-in-the-industry/

5 https://www.reuters.com/technology/us-watchdog-issues-final-rule-supervise-big-tech-payments-digital-wallets-2024-11-21/

6 https://therecord.media/affirm-lender-data-breach-evolve-bank-cyberattack

Share

Erin is a business finance writer at Airwallex, where she creates content that helps businesses across the Americas navigate the complexities of finance and payments. With nearly a decade of experience in corporate communications and content strategy for B2B enterprises and developer-focused startups, Erin brings a deep understanding of the SaaS landscape. Through her focus on thought leadership and storytelling, she helps businesses address their financial challenges with clear and impactful content.

View this article in another region:AustraliaCanada - EnglishCanada - undefinedEurope - EnglishEurope - NederlandsNew ZealandSingaporeUnited KingdomGlobal

Related Posts

Wallets, cards, and the flywheel effect: the formula for marketpl...

•6 minutes