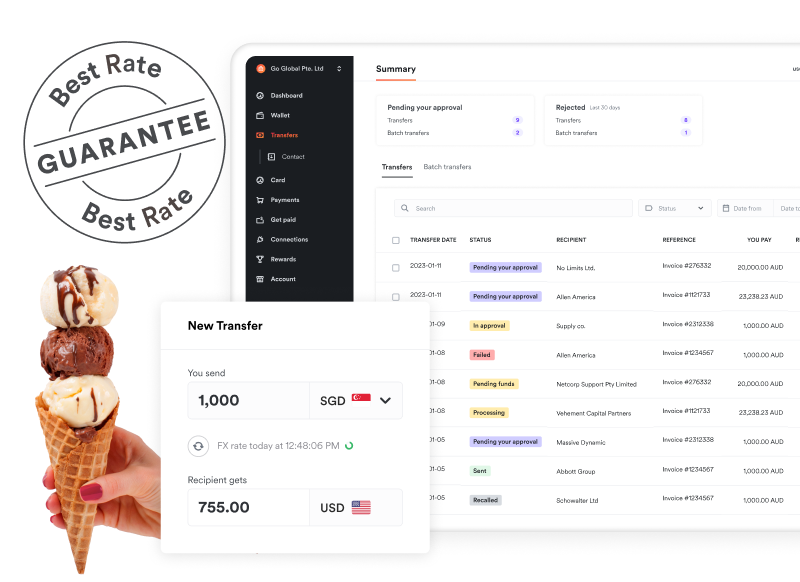

SCOOP BETTER FX RATES

Limited Time Offer: Secure an exchange rate discount for your business today

We're promising to beat your business' existing FX rates. Simply request to beat your FX rate and we'll guarantee you a discount. Redeem this offer today!

*The offer ends on 31 December 2024 and is only applicable to new Airwallex customers. See promotional terms here.

*The offer ends on 31 December 2024 and is only applicable to new Airwallex customers. See promotional terms here.

Regulated by MAS

Airwallex (Singapore) Pte. Ltd. is licensed in Singapore as a Major Payment Institution and is regulated by the Monetary Authority of Singapore (License No. PS20200541)

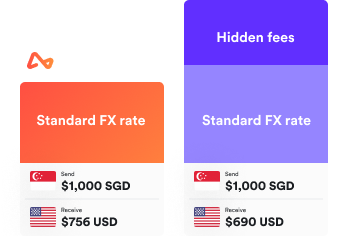

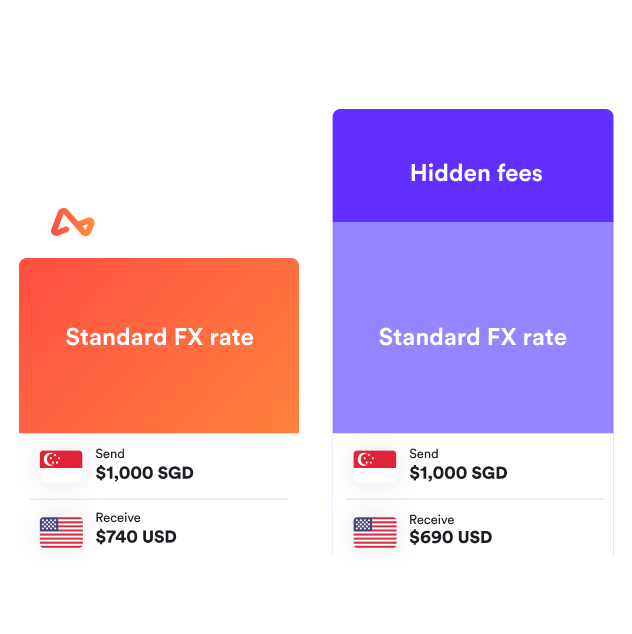

Check before you transfer to vendors - and save money

How often do hidden bank fees eat into your profits? There’s the SWIFT fee, FX fee, and all the other hidden fees that gets deducted even before your transfer reaches your recipient. Want to avoid that? Learn more about how you can save more money and maximise profits with Airwallex.

150+ countries and regions, 60+ currencies

Have payments received in as little as one business day with the full amount on delivery guaranteed.

Access interbank exchange rates

Enjoy access to bank-beating rates no matter the transaction size and avoid hidden transaction fees.

Work smarter, not harder

Use batch transfers to send funds in one go to multiple recipients around the world, each with a specified amount.

CASE STUDY

Saturday Club Benefits from Better FX Rates with Airwallex

Access our global transfer method network

Airwallex offers you a wide array of local and global transfer options to make sure you get the fastest and most cost-effective solution.

Explore our growing network of 150+ payout countries and regions

Explore our growing network of 150+ payout countries and regions

Batch Transfers

Simplify your workflow with batch transfers

No-code payouts to multiple parties in one go

Streamline multiple payments to global suppliers and employees without ever having to write a single line of code.

Flexibility to meet your specific needs

Make batch transfers to up to 1,000 recipients across countries, currencies, and transfer methods.

Intuitive and dynamic templates to guide you

Simply download and complete the template that best meets your requirements, upload it to Airwallex, and book your transfer.

Approval Workflows

Manage your operational risks

Multi-layered approval workflows

Customise approval workflows for your business based on specific transfer amounts.

User permissions

Set individual permissions for employees and third parties, including ‘view only’ access.

Added security

Verify each transfer with multi-factor authentication for added security and peace of mind.

Payouts

Automate transfers with our Platform API

Businesses rely on our API to handle their most complex requirements. Programmatically make high-volume global transfers, access interbank FX rates, intelligently manage currency risk, and more.

Global Accounts

Operate like a local with Global Accounts

Airwallex makes collection of your global payments seamless, secure, and cost-effective. With our Global Accounts, you can open local currency accounts around the world in just minutes and receive payments from global customers in their preferred currency. Say goodbye to costly conversion fees.

Frequently asked questions

What is an international money transfer?

An international money transfer is a money transfer to a recipient bank outside of your domestic country. You don’t need to open a business account with a bank in a foreign country to send a payment overseas. With Airwallex, you can easily make fast one-time or recurring international transfers in multiple currencies at bank-beating FX rates.

What is the fastest way to transfer money internationally?

With Airwallex, you no longer have to wait several business days for your funds to reach a foreign destination. Thanks to our proprietary local payment network, you'll be able to make one-time or recurring high-speed, cost-effective international transfers. The majority of transfers made via Airwallex arrive within the same day, meaning your global suppliers and employees get paid faster than if you were to use legacy offerings.