Guide to getting a startup business loan in Singapore (2025)

What is a startup business loan?

A startup or SME business loan helps new and early-stage businesses secure the capital they need for growth, business operations, or international expansion.

Compared to regular business loans, which typically require a proven track record of financial stability, startup business loans offer greater flexibility and less stringent requirements. This makes it easier for new businesses to qualify for a loan.

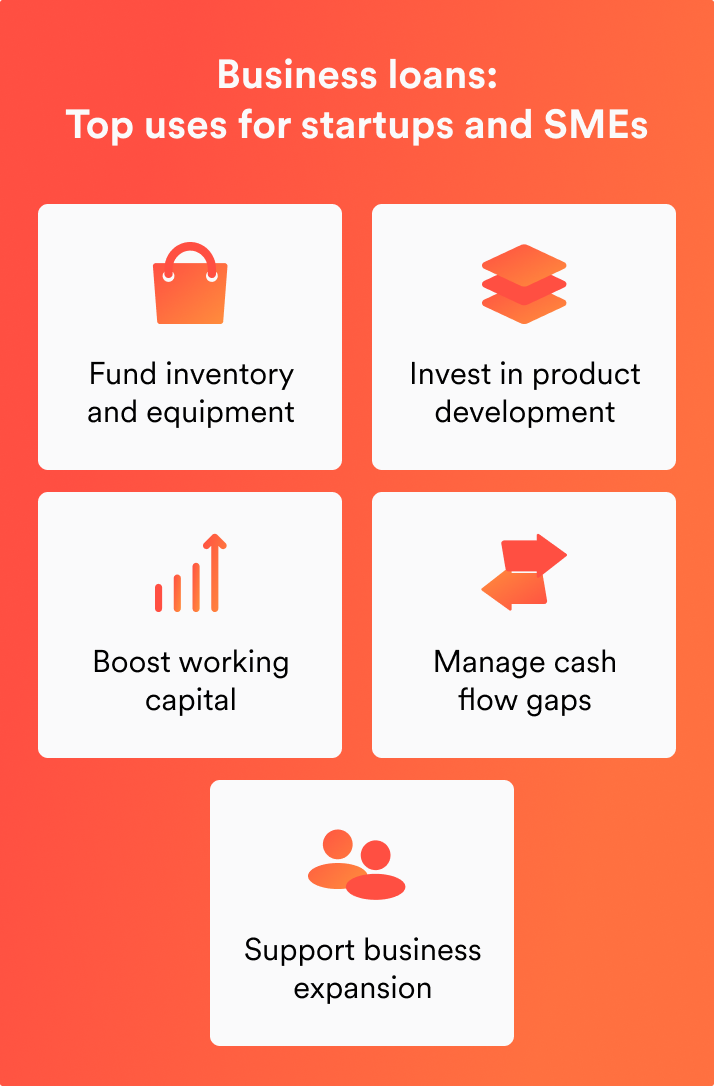

Common uses of startup and SME business loans include:

Covering inventory and equipment purchases

An SME loan can help you meet sudden demand spikes or maintain inventory during financial shortfalls. It also lets you invest in productivity-boosting equipment without straining your finances.

Investing in product development

Developing a new product involves market research, prototyping, testing, and manufacturing, which can be time-consuming and costly. Businesses also need to invest in management tools, cloud services, or AI-powered solutions to stay competitive. An SME business loan provides the resources needed to develop products, implement new technologies, and scale operations before generating revenue.

Increasing working capital for day-to-day operational expenses

In the early stages, your startup may experience low-revenue periods or sales slowdowns. An SME business loan provides a financial cushion to cover essential expenses like rent, payroll, and utilities, ensuring business continuity during cash flow fluctuations.

Managing cash flow gaps

Maintaining a healthy cash flow is essential for your business’s financial stability, especially in the early stages. Even profitable companies risk running into trouble if they struggle to meet short-term financial obligations. SME loans can bridge temporary cash flow gaps that arise caused by seasonal fluctuations or late customer payments.

Supporting business expansion

You’ll need a steady flow of funds to invest in strategic business activities. An SME business loan provides the capital needed to expand into new market segments, increase market penetration, and build strategic partnerships.

Ready to take your startup to the next level? Simplify financial operations with Airwallex.

Types of loans for startup businesses in Singapore

1. SME working capital loans

These loans help fund operational expenses like supplier payments and marketing costs. These loans are designed to cover short-term expenditures, and aren’t intended to finance longer-term needs. Examples of working capital loans include business credit cards, merchant cash advances, and invoice financing.

2. Venture debt financing

Venture debt financing is a type of debt funding designed for startups and high-growth companies that may not have enough cash flow or collateral for traditional bank loans. It is often used alongside venture capital (VC) funding to extend a company’s runway without diluting equity.

Unlike equity funding, venture debt is a loan – so businesses need to repay the loan amount over a set period of time. Venture debt financing doesn’t require giving up equity, so founders can raise capital without giving up significant ownership of their business.

3. Trade loans

Trade loans are short-term financing solutions designed to help businesses manage cash flow while importing, exporting, or purchasing goods from suppliers. They can be used to fund a variety of trade transactions, such as purchasing goods, as well as covering the costs of manufacturing and shipping.

These loans have a repayment period of 30 to 180 days. Trade loans are structured as a revolving credit facility, so you can draw from the facility as and when you need to. This ensures that you’re able to pay your suppliers on time, even when customer payments are delayed.

4. Fixed-asset loans

Fixed-asset loans help fund investments in essential equipment or specialised machinery without depleting your cash flow, supporting long-term growth.

5. Merchant cash advance

A merchant cash advance isn’t technically a loan, but a flexible financing option based on your credit card transactions. Repayment is made through a percentage of daily or weekly sales, making it suitable for startups with variable revenue streams.

6. Invoice financing

Invoice financing is a type of short-term business funding where companies turn their unpaid invoices into immediate working capital to access cash before their customers pay. This option improves cash flow, helps you cover expenses, and supports growth without long payment cycles.

7. Business line of credit

Also known as a revolving credit, a business line of credit provides borrowers with access to a sum of capital that they can draw from when needed – instead of a fixed loan.

It helps to think of this as a credit card. You can draw from your line of credit whenever you need to, and interest is charged only on the loan amount that you have borrowed. Your credit limit reverts to the full amount once you have made a repayment.

8. Government-assisted loans

A range of Singapore government-backed loans are available to startups and SMEs across all stages of growth. These loans are administered by Enterprise Singapore and participating financial institutions (PFIs), which include banks and financial institutions.

How to get a business loan for startups in Singapore

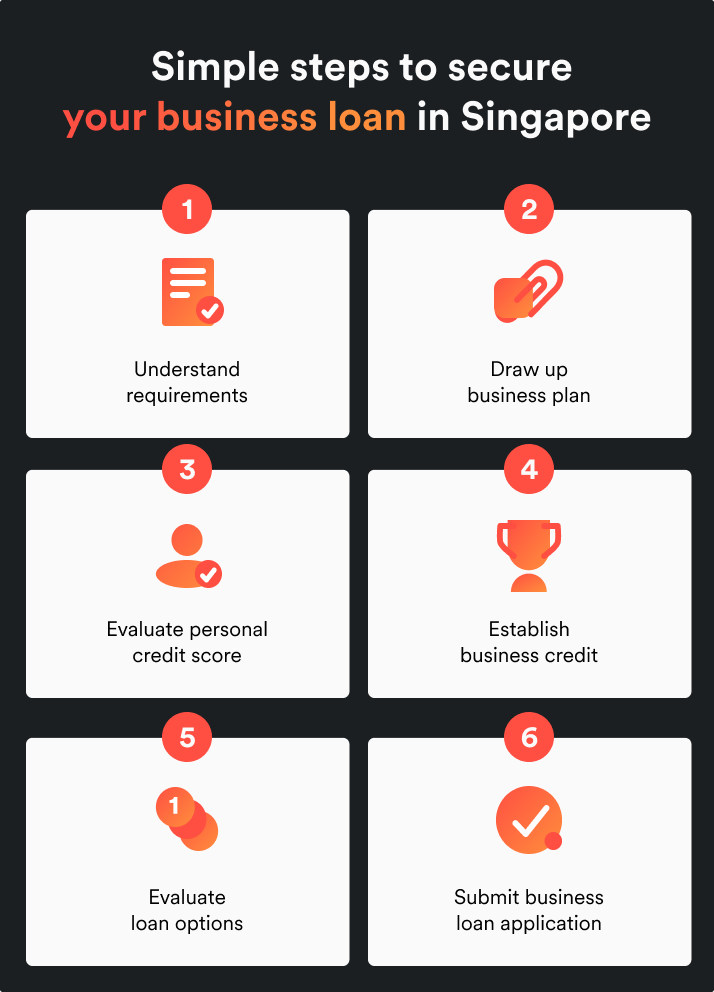

1. Understand loan requirements

The requirements for startup or SME loans vary depending on the lender. Financial institutions like banks typically require a strong credit history, financial statements, and collateral, with stricter eligibility criteria. In contrast, alternative lenders, including fintech companies and peer-to-peer platforms, often have more flexible requirements, focusing on cash flow or business potential, and offer faster approvals with fewer documents.

The eligibility requirements that generally apply include:

Your business must be registered and operating in Singapore, with at least 30% local shareholding. This applies to both Singapore Citizens and Permanent Residents (PRs).1

Your startup should have a minimum operational history of six months to qualify for a loan.2 Certain banks and lenders offer loans designed for startups and SMEs with an operational history of six months to two years.

Your startup needs to meet minimum financial health criteria, in terms of revenue and group employment size.

As a small business owner, having a good credit score establishes credibility. This is particularly important for founders who are obtaining a loan to fund a newly established venture.

2. Draw up a business plan

A well-drafted business plan demonstrates your growth strategy and gives lenders a clear vision of your startup’s future direction. Detail your current activities, past successes, and how the loan will drive future growth.

Consider addressing these questions in your business plan:

What growth activities am I implementing right now?

What strategies have worked well for my startup recently?

How do I plan to use the loan to further these successes?

3. Evaluate your personal credit score

Your personal credit score can impact your loan application. Assessing a business owner’s personal credit score can be a key factor of consideration for lenders, particularly if the founder is obtaining a loan for a new company without a strong financial history.

When a business owner has a good credit score, this demonstrates that he or she will be able to manage their business finances responsibly, and be prompt and consistent with their loan repayments.

4. Build business credit

Having a strong business credit profile increases your chances of getting your loan approved, and securing more favourable loan terms.

Steps you can take to build business credit include separating personal and business financial transactions with a dedicated business bank account, limiting hard inquiries within a short time frame, and monitoring your credit report regularly.

5. Evaluate your loan options

To narrow down your business loan options, consider key features such as:

Repayment Terms: interest rates, repayment frequency, and loan tenure

Collateral requirements

Other eligibility criteria

Reputation and credibility of the lender

Next, put together a list of questions to ask potential lenders. The following questions can help to guide your decision-making process:

What is the best loan structure for my current business needs?

What is your track record for providing loans to businesses in my industry?

Are there alternative loan options that could be a better fit for my company?

Are there ways I can reduce the interest rate I need to pay?

Will you provide ongoing customer support if my loan or business needs change?

6. Submit your business loan application

Here comes the final step: submitting your loan application.

This process can vary depending on the lender you’re applying to, and the application may be submitted online or in person. In general, you need to:

Look for prospective lenders. If you’re applying through a financial institution, you may have the option to apply online or in person. In some cases, you may need to follow up with a loan officer through one or two rounds of callbacks to complete the application. For alternative lenders, the loan application process is usually completed online.

Prepare for your loan submission. Start by checking if your lender uses Myinfo Business, a digital service by the Singapore government that speeds up the loan application process. Myinfo Business automatically retrieves and verifies your company’s registered details, reducing the need for manual input and physical documents. If your lender has integrated this service, you can use it for your loan application. However, be prepared to provide additional supporting documents, as requirements may vary depending on the lender and the approved loan amount.

Await the results of your loan application. If your application has been approved, you'll be presented with a letter of offer. The approved loan amount will be disbursed upon acceptance of the offer.

7. What are the key factors I need to consider when applying for a startup business loan in Singapore?

We've covered most of the key factors of consideration – such as having a comprehensive business plan, a pristine credit history, and understanding the repayment terms and eligibility criteria – in the previous sections.

On top of these factors, it’s critical that you:

Know your numbers

Beyond your financial projections, such as your cash flow and sales forecast, you need to be ready to explain your revenue stream, ongoing operational expenses, and financial contributions to your business.

Be prepared to dive into the details. For example, if your business experiences seasonal fluctuations, prospective lenders may ask you about your strategies for managing them.

Gain clarity on your financing needs

Are you obtaining a loan to finance short-term or long-term business expenditures? Clarity on this can help you avoid selecting the wrong financing solution for your startup.

For instance, a working capital loan is designed to finance short-term obligations, such as day-to-day operational costs, inventory purchases, and short-term growth activities. These loans often have higher interest rates compared to long-term loans, so using a working capital loan to fund long-term expenditures could lead to cash flow issues.

How Airwallex simplifies financial operations for startups

As a startup founder, you’re constantly juggling multiple roles. Airwallex’s suite of powerful financial tools is designed to streamline your end-to-end operations and support your global growth.

Our Expense Management system gives you real-time visibility and simplifies global reimbursements in multiple currencies, saving you time and effort. Managing finances across different markets gets easier with Airwallex’s multi-entity management platform. Instead of switching between multiple dashboards, you get a unified view of your global finances, making investor reporting seamless.

Endowus is a case in point. As the company experienced rapid growth and expanded to multiple markets, managing payments became increasingly complex for its lean finance team.

With Airwallex, Endowus centralised its financial operations, streamlining expense management and international transactions. By using Airwallex Corporate Cards and FX & Transfers, they saved up to 90% on international transaction fees and earned over S$30,000 in cashback rewards. Beyond cost savings, Airwallex provided Endowus with enhanced financial visibility, empowering them to report confidently to investors.

Airwallex simplifies global payments with an all-in-one financial solution that includes multi-currency accounts, international transfers, Corporate Cards, Expense Management, and more.

Setting up an Airwallex business account is fast and hassle-free. Unlike traditional banks, there’s no need for queues or tedious paperwork. Open local currency accounts in over 60 countries within minutes. Airwallex empowers your startup to manage finances efficiently, so you can focus on growth.

Accelerate your growth with an Airwallex Business Account.

Frequently asked questions (FAQs)

1. How long does a startup business loan application process typically take?

The time taken for a loan application process may range from one working day, up to a couple of weeks.

2. Am I able to obtain a loan for starting a business?

Most lenders require startups to have a minimum operational history of six months to two years for a loan application. You may have to turn to other financing options if you’re seeking extra funds to launch a company from the ground up.

3. Is it possible to obtain a startup business loan in Singapore without collateral?

Yes, it is possible to obtain startup business loans without collateral. These are termed unsecured loans, which are not backed up by any form of collateral.

With unsecured loans, business owners are assessed based on factors such as their business credit score and financial health. As these loans present a higher risk for lenders, they often come with higher interest rates, or additional requirements, such as personal guarantees or liens.

4. What steps can I take if my startup business loan application has been rejected?

There are various steps you can take if your loan application has been rejected:

Understand the reason for rejection. Review your application again to check for possible mistakes or missing information. Reach out to your lender to get specific feedback on areas that need improvement.

Work on improving your business credit score: This can increase your credit score and chances of succeeding with future loan applications.

Explore alternative lenders or other financing options. Consider other sources of funding, such as SME grants, personal loans, or crowdfunding.

Sources:

https://www.ocbc.com/business-banking/smes/loans/business-first-loan?qualtric=faq

https://www.lendingpot.sg/blog/how-to-apply-for-a-business-loan-in-singapore#:~:text=The%20fifth%20document%20you'll%20need%20to%20apply,in%20the%20account%20when%20the%20month%20ends

This publication does not constitute legal, tax, or professional advice from Airwallex, nor does it substitute seeking such advice, and makes no express or implied representations / warranties / guarantees regarding content accuracy, completeness, or currency. If you would like to request an update, feel free to contact us at [[email protected]]. Airwallex (Singapore) Pte. Ltd. (201626561Z) is licensed as a Major Payment Institution and regulated by the Monetary Authority of Singapore.

Share

Shermaine spearheads the development and execution of content strategy for businesses in Singapore and the SEA region at Airwallex. Leveraging her extensive experience in eCommerce, digital payment solutions, business banking, and the cross-border industry, she provides invaluable insights that guide businesses through the complexities of global commerce. Specialising in crafting relevant and engaging content that resonates with business owners, her work is designed to drive growth and innovation within the fintech and business economy space.

Related Posts

A business owner’s guide to credit card processing: what you need...

•11 minutes