How to open a UK bank account from Singapore - A guide for businesses

- •Why do I need a UK business bank account?

- •3 common types of UK business accounts

- •How to open a UK business bank account as a non-resident foreigner

- •Prepare the required documents for opening a UK business account

- •3 challenges of opening a UK business account from Singapore

- •Why the Airwallex GBP Business Account is better for Singapore businesses

- •How to open a UK Business Account with Airwallex in 3 easy steps

If you’re establishing a UK branch or office in 2024, having a UK business bank account will be critical to your operations. The account opening process is fairly straightforward if you or your company directors are already based in the region. However, you may hit some roadblocks if you are opening the account from Singapore and are not a UK resident.

In this guide, we’ll cover the essential steps of opening a UK business account online from Singapore, the challenges you may encounter as a non-resident, and reliable alternatives to traditional corporate banks.

Why do I need a UK business bank account?

A UK business account is your gateway to operating in this economic hub, and is a legal requirement for limited companies - businesses that are separate legal entities from their owners.

Here are 3 other benefits of having a UK bank account:

Transact in GBP without transfer fees

The cost of doing business can fluctuate according to the movements of the foreign exchange market. A UK business account allows you to send and receive payments in GBP, which stabilises your costs and allows for accurate financial forecasting. Transacting with a UK account also reduces transfer fees and eliminates intermediary fees as they are local transfers facilitated through CHAPS or BACS - the local payment networks in the UK.

Streamlined accounting and Corporate Tax payments

Handling all transactions in GBP simplifies the accounting for your British entity and allows for straightforward preparations of financial statements. This will be critical for calculating your Corporation Taxes and avoiding the steep penalties that come with incorrect accounting.

With a local business account, your financial reports can accurately reflect your company’s economic activities in the UK and be 100% certain that your financial data aligns with UK tax requirements.

Access to UK financial services

UK business accounts offer a wide range of financial services, from corporate cards to business loans.

Before choosing a financial institution, it’s important to assess your business’s needs and objectives so that you can avail of the most relevant services.

3 common types of UK business accounts

There are 3 types of UK business accounts that you might need for your British entity. Each account type has its own features, benefits, and limitations, and it’s common for businesses to open several accounts for different aspects of their financial operations.

Business current account

The standard account for everyday business transactions, a current account lets you make deposits, withdrawals, send payments to suppliers, or receive payments from clients. It’s the equivalent of a corporate bank account in Singapore, and is offered by most banks in the UK. A business current account is suitable for all kinds of businesses, from sole traders to larger corporations.

Business savings account

If you’ve received a round of funding and want to earn interest on surplus funds, a UK business savings account may be a good choice. These accounts offer higher interest rates compared to current accounts, allowing businesses to grow their savings over time.

Features like interest rates, access terms, and balance requirements vary across banks, Some offer instant access to funds, while others have fixed-term deposits that lock in funds in exchange for higher interest rates.

Multi-currency business accounts

Multi-currency accounts are a specialised banking solution for businesses operating across different countries. This type of account lets you hold, manage, and transact in multiple currencies from a single account. It is particularly helpful for Singapore companies that deal with suppliers, customers, or partners in various markets outside the UK.

The Airwallex business account is an example of a multi-currency business account.

How to open a UK business bank account as a non-resident foreigner

Foreign business owners residing outside the UK can apply for a business account at a local branch. However, the process can be time-consuming because regulators enforce rigorous Anti-Money Laundering (AML) laws to verify the identity of non-resident applicants. Even if you meet the acceptance criteria, the final decision to accept or reject the application rests with the financial institution.

Here’s how to apply for a UK business account as a non-resident:

Prepare the required documents for opening a UK business account

While the exact document list can vary across banks, you’ll need to prepare these identity and business documents:

Valid proof of IDs for all owners or directors of the business, including recent home of addresses. Valid IDs include passports, driver’s licence, national identity cards, recent tax bill with address.

Business registration details, including your registered address in the UK and contact details

A business plan that shows why you need a UK bank account

Registered company number from the Companies House, which is the local equivalent of a Unique Entity Number (UEN) in Singapore

Contact the bank of your choice

Once you’ve chosen a bank, contact their central inward investment team in London and tell them that you need a UK business bank account. Do not apply through a local branch, call centre, or online, as they generally do not handle bank applications from non-residents.

During this call, the bank representative will provide more details about their account opening process. You’ll also be able to schedule an in-person visit.

Verify your identity in person

As part of the account opening process, the bank will need a face-to-face meeting with you or one of the business owners. You must bring a valid photo ID to verify your identity, and sign the bank mandate in person to open the account.

3 challenges of opening a UK business account from Singapore

Opening a business bank account in the UK from Singapore presents several challenges, particularly for Singaporean owners. Key difficulties include the following:

Due diligence and compliance concerns

Banks have become increasingly strict about their acceptance criteria due to the global crackdown on money laundering. UK banks, in particular, are especially cautious about companies with non-resident directors or Persons of Significant Control (PSC).

Conducting comprehensive background checks and Politically Exposed Persons (PEP) checks on foreign owners is a complex and time-consuming process. As a result, it is often easier for UK banks to decline an account application from a non-resident than it is to navigate these compliance requirements.

Lack of business track record in the UK

Banks prefer prospective clients with a verifiable financial track record within the country. A Singaporean company without financial records in the UK will have difficulty getting a bank account because of the complex vetting process.

On top of verifying identities of company owners, the bank needs to understand the nature of your business, its source of funds, and the legitimacy of your operations. This lack of a local financial history makes it difficult for banks to assess and mitigate potential risks associated with your business, which makes them unlikely to extend their banking services.

Apostille certification for foreign documents

Before you can submit foreign documents like your Singapore IC and ACRA certificates, they need to go through a process called apostille certification. This is an international method of authenticating documents, and ensures that documents issued in Singapore are legally recognized and accepted in the UK.

For SMEs, obtaining apostille certification for documents means navigating another bureaucratic layer, which can be time consuming and costly if you employ an apostille document service.

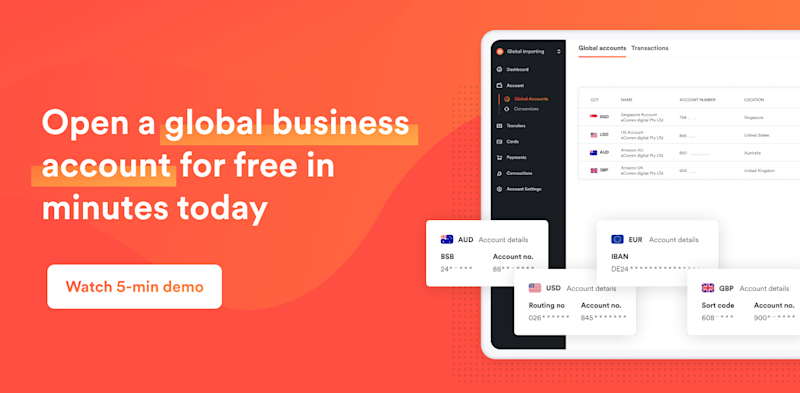

Why the Airwallex GBP Business Account is better for Singapore businesses

Don’t let the complexity of opening a UK bank account stop your expansion plans. If your business needs a simple way to send, receive, or hold payments in GBP, open an Airwallex GBP Business Account instead. It’s the fastest and simplest way to get a UK business account that’s 100% compliant with AML regulations.

Here’s how else you can benefit from an Airwallex account:

Send and receive payments like a local

Your GBP Business Account works just like a UK bank account, which means you can send, receive, and hold GBP as though you were a local. You avoid international transaction fees and fluctuating exchange rates in your business dealings in the UK.

You also get paid faster. The Business Account also comes with local bank details, including a dedicated account number and bank code, which you can add to your invoices. This makes it easier for UK-based customers to send payments. Because it’s essentially a local transfer, you can get your payments as quickly as 1 business day.

Transact in GBP without unnecessary conversion fees

With the GBP Business Account, you also avoid unnecessary foreign exchange fees. Holding and transacting directly in GBP eliminates the need to convert from SGD to GBP and prevents losses that come from fluctuating exchange rates.

Ease of account opening

Unlike UK banks, Airwallex doesn’t require apostille certifications for your documents or an in-person visit. Simply scan and upload your documents, and your UK business account will be ready within one business day. The ability to open an account and transact in GBP immediately saves you the bureaucratic trouble, so you can focus on expanding your business.

No sign up fees, no minimum balance

An Airwallex business account is free to open and does not require a minimum maintaining balance or monthly fees. The only fees you’ll pay are small transaction fees when you convert GBP to SGD.

Multi-currency support

Airwallex allows businesses to hold and manage various currencies, including EUR, SGD, and USD. This feature is critical if you work with suppliers or offshore teams outside of the UK because it lets you avoid unnecessary conversion fees. Airwallex also lets you convert currencies at interbank rates, which maximises the value of every dollar received from your global operations.

Financial services for streamlined operations

On top of basic GBP transactions, Airwallex also offers financial services for smoother day-to-day operations:

Corporate cards. Airwallex lets you instantly create Borderless Cards, our corporate debit card that runs on the Visa network. With the Borderless Card, you can manage business expenses in real-time and set spending limits to curb the risk of misuse.

Expense management system that lets your team upload receipts and approve business expenses. This feature reduces your finance team’s administrative tasks while allowing for efficient expense reconciliation and real-time tracking of company expenditures.

Integration with accounting software like Xero and Quickbooks, enabling real-time updates of account balances.

Ecommerce integration with Amazon, Shopify, Woocommerce, and other ecommerce platforms, so you can streamline orders and sales data from various platforms.

How to open a UK Business Account with Airwallex in 3 easy steps

Ready to embrace the efficiency and simplicity of an Airwallex UK business account? Here’s how to open one in 3 easy steps:

Step 1: Create a free Airwallex business account

Step 2: Upload the required documents and verify your business in Singapore

Step 3: Add funds to your Airwallex account and start using it

Don't let geographical boundaries limit your business’s growth. Open an Airwallex GBP account today.

Related articles about managing your business operations:

Share

Related Posts

Best business bank accounts in Singapore 2025 | How to choose

•10 min