How to open a Euro bank account from Singapore

- •4 benefits of having an Euro business account

- •How to open an EU business bank account as a non-resident

- •3 main challenges to opening a local EU business bank account from Singapore

- •Why the Airwallex Euro Business Account is your gateway to trade in the EU

- •How to open a Euro Business Account with Airwallex in 3 easy steps

- •FAQs

In today's global economy, Singapore SMEs are seizing opportunities in economic areas like the European Union (EU). Besides being one of the largest single markets in the world, the EU’s Free Trade Agreement (FTA) with Singapore makes it easy for local SMEs to do business in the region.

If your 2024 strategy involves working with partners in the EU, you’ll need to start planning how to open a local business bank account in Europe. Besides simplifying foreign currency transactions within the Eurozone, an Euro account helps you manage exchange rate fluctuations, minimise transaction fees, and foster smoother business relationships.

Keep reading to discover the benefits of having a Euro account, how to open one, and why the Airwallex EUR Business Account is a better alternative to traditional corporate banking.

4 benefits of having an Euro business account

Having a business account in Europe simplifies EUR transactions by enhancing efficiency and reducing costs. Here are 4 important ways your business will benefit from euro accounts:

Transact in EUR without unnecessary fees

A local Euro account lets you send and receive money in euros, eliminating the need for unnecessary currency conversion. This approach reduces the financial losses often associated with exchange rate fluctuations and conversion fees.

Your transactions within the Eurozone are also treated just like domestic transfers. It means you'll steer clear of expensive SWIFT payment network fees and hidden fees that come with cross-border transactions. Instead, you only have to deal with the local transfer fees, which are typically lower than international transfer fees.

Fast SEPA transactions

SEPA, or the Single Euro Payments Area, is a European Union initiative that standardizes electronic Euro payments across Europe, making them as straightforward and cost-effective as domestic payments. Transacting among SEPA’s 36 member countries is efficient, fast, and low-cost compared to SWIFT or international transfers.

Simplified financial management

A Euro business account brings clarity and consistency to your financial planning. Consolidating all euro transactions in one account simplifies accounting and financial reporting, as you won’t have to calculate foreign exchange rates for every transaction. This makes it easier to track revenue, manage cash flow, and assess financial performance within the EU context.

Streamlined accounting and tax filing

Taxation laws are set by each country’s government, but the basic principle remains the same. All businesses must pay a corporate income tax on their profits, and a value-added tax (VAT) is levied on all goods and services provided in the region.

Having a euro business account makes it easier for you to track your European entity’s revenues and calculate your tax obligations.

How to open an EU business bank account as a non-resident

Whether it is a personal current account or a business account, for non-residents, opening a European bank account is complex and time-consuming. You’ll need to go through rigorous Anti-Money Laundering (AML) checks, credit checks, and provide an explanation for why you need a local account.

Here’s a rough guide to the account opening process. Note that requirements vary across countries and banks, so treat this as a starting point:

Prepare your supporting documents

Non-residents need to navigate strict eligibility requirements and make a case for why they need a local business account. Documents include - but are not limited to - your company’s registration documents, proof of business address, and details about the company directors and shareholders. You also need to prepare personal official identity documents of all business owners and key stakeholders.

Compliance checks and AML screening

Banks in the EU are required to conduct compliance and AML checks as part of their due diligence. These checks are necessary to prevent financial crimes, and can include the following:

Business verification. Banks will need to know the nature of your business activities and your industry.

Source of funds. To prove that your funds come from legitimate sources, you’ll need to show a paper trail for the foreign currency deposits in the account.

Politically Exposed Persons (PEP) screening. Banks will also do rigorous screening to see if any business owners are politically exposed persons - individuals who hold prominent public positions, or who are closely related to PEPs. Additional scrutiny will be applied to assess the risk of corruption.

In-person bank visit

As part of the compliance checks, you need at least one in-person bank visit during the account opening process. During your visit, bank officials can authenticate supporting documents, ask detailed questions about your business operations, and assess the legitimacy of the directors.

Prepare fees and funds for initial deposit

Up-front fees vary by bank and by the type of business account being opened. Here are some general guidelines to consider:

Initial deposit. Many European banks require an initial foreign currency deposit to activate a business account. It can range from a few hundred euros to several thousands, depending on the bank and account type.

Account opening fees. Some banks charge a one-time fee for opening a new account.

Due diligence fees. You might also get charged due diligence fees for the bank to investigate all business owners. These fees are paid before the bank makes a final decision, and is not refunded if the bank decides against opening the account.

3 main challenges to opening a local EU business bank account from Singapore

As you may have seen from the account opening process, non-EU residents face significant barriers to acquiring a local business account. On top of the rigorous document requirements, you’ll face the following challenges:

Varied banking regulations. Despite being a single economic area, banking regulations vary greatly across European countries. You’ll need to research and understand these differences to identify the country most suitable for your banking needs.

Local business registration. Your business must have a registered entity in the Eurozone country where you plan on banking, and you must show plans for your business activities within the country.

No remote account opening. In many cases, you cannot open a corporate account from overseas if you or at least one person in the ownership structure is a non-resident. You’ll have to book an in-person appointment at the physical branch, and bring all required documents with you.

Why the Airwallex Euro Business Account is your gateway to trade in the EU

Having an EU business bank account brings clear advantages if you plan to do businesses within a specific member state. It makes it easier for you to calculate VAT, file corporate taxes, and obtain business loans. However, it may be a poor fit if your main operations lie outside Europe, as you’d need to register your business in an EU member state before you can open a local bank account.

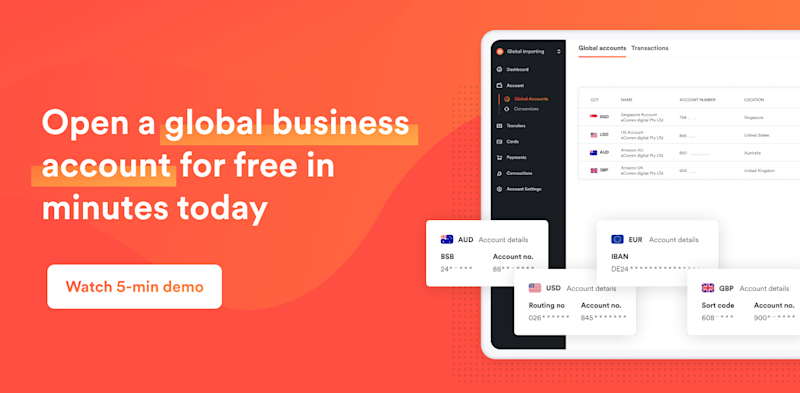

If all you need is a fast, cost-effective and safe way to transact in EUR, the Airwallex Euro Business Account is a better alternative for all your banking needs in Europe. You can open the account online from Singapore by submitting soft copies of your Singapore business registration documents and valid IDs.

It is important also to note that your funds are always safeguarded in line with the local regulations where Airwallex operates. We meet the highest international security standards including PCI DSS, SOC1, and SOC2 compliance, in addition to our local regulatory requirements.Here are some more ways your SME can benefit from Airwallex:

Transact in EUR like an EU-based business

Your business account lets you send, receive, and hold EUR as though you are operating from the Eurozone. You’ll get local bank details, including a dedicated account number and bank code, for seamless transactions with your EU partners. You can also open local currency business accounts like:

Enjoy same-day payments, convenience, and S$0 fees when sending EUR, GBP, CHF, and DKK internationally from Singapore.

Avoid unnecessary conversion fees

The Airwallex EUR Business account eliminates the need for unnecessary currency conversion. Transactions can be done directly in EUR, avoiding fluctuating exchange rates and high transfer fees that come with cross-border payments. These fees can add up and eat into your margins, especially if you're dealing with frequent or large transactions. If you do need to convert your Singapore dollar or any other currency to Euros, Airwallex charges market-leading exchange rates.

Ease of account opening

Unlike traditional banks, we won’t ask for extensive business plans or require an in-person visit, either. Simply scan and upload your Singapore business documents, and your Euro business account will be ready within one business day.

No sign-up fees, no minimum balance

An Airwallex business account is free to open and does not require a minimum maintaining balance or monthly fees. The only fees you’ll pay are small transaction fees when you convert EUR to SGD.

Multi-currency support

The Airwallex business account functions like a foreign currency account. While it is not a bank savings account with interest rates, you can expect savings in international transaction fees and conversion fees. It allows your SME to hold funds and transact in other currencies such as the US dollar, Australian dollar, Japanese yen, Indonesian rupiah, Hong Kong dollar, New Zealand dollar and more. For a global business, this feature is critical for transactions outside the Eurozone.

Financial services for streamlined operations

Besides EUR transactions, Airwallex also offers financial services for smoother day-to-day operations:

Multi-currency corporate cards. Airwallex lets you instantly create virtual cards, our corporate Visa card that help you manage business expenses in real-time and set spending limits to curb the risk of misuse.

Expense management system that lets your team upload receipts and approve business expenses. This feature reduces your finance team’s administrative tasks while allowing for efficient expense reconciliation and real-time tracking of company expenditures.

Integration with accounting software like Xero, enabling real-time updates of account balances.

How to open a Euro Business Account with Airwallex in 3 easy steps

Say goodbye to traditional banking constraints and hello to fast, cost-effective transactions in EUR and other foreign currencies. Open an Airwallex EUR Business Account in 3 easy steps:

Step 1: Sign up for a free Airwallex business account

Step 2: Upload the required documents and verify your business in Singapore

Step 3: Create a EUR global account and get local bank details to send funds to. Add funds into your account and start using it.

Open an Airwallex EUR account instantly and unlock your business’s full global potential.

FAQs

Q: What is the easiest European country to open a business bank account in?

A: There is no simple answer to this question, as banking regulations and requirements vary significantly across the Eurozone. Each country has its own set of rules and processes, which can differ based on the type of business. Additionally, the ease of opening an account depends on the specific bank and the type of business account you need.

If all you need is a way to transact in euro, sterling pound, and more, the Airwallex EUR Business Account is the easiest one to get. It can be opened online from Singapore, with no in-person visit required.

Q: Can I open a European corporate bank account online?

A: If you are a resident in the EU, you can open an EUR bank account online. However, non-residents need to make an in-person visit to an EU bank branch to open the account. You’d also need to have a registered business in the country you’d like to bank with.

If all you need is a straightforward way to transact in EUR, consider the Airwallex EUR Business Account instead. The entire account opening process can be done online.

Q: Can a non-EU citizen open a business bank account in the EU?

A: Yes, a non-EU citizen can open one if they are residents in the EU and have a registered business in their country of residence. For non-resident foreigners, banking in the EU is a complex process that involves extensive paperwork.

Q: Can a Singapore company have a business account in the EU?

A: Yes, a Singapore company can open a Euro business bank account, provided that the owner is an EU resident. Non-EU residents can also open EUR accounts at traditional banks in Europe, but will need to prepare extensive supporting documents.

If all you need is a straightforward way to transact in EUR, consider the Airwallex EUR Business Account instead. The entire account opening process can be done online, even while you’re in Singapore.

Expanding to new markets? Instantly create accounts in 60+ countries.

Related articles about managing your business operations:

Share

Related Posts

Payment gateway fees: What businesses need to know

•15 minutes