Introducing Batch Transfers: Pay up to 1000 recipients in different countries and in different currencies in one go

In today’s landscape of global business, the expansion of international teams, collaboration with contractors worldwide, and engagement with a diverse network of suppliers has become commonplace. In fact, 75% of US SMBs said they were planning to increase their international employee headcount to accelerate their expansion plans in 2023, according to Gusto. However, this means more burden put on finance teams to execute a large number of payments efficiently and on time across the world.

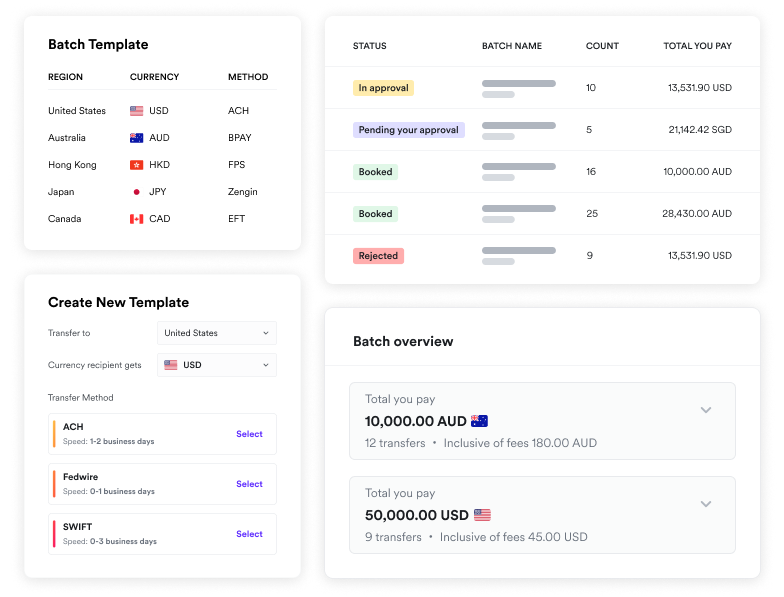

Airwallex’s new Batch Transfers feature allows businesses to significantly simplify the process of making a large number of payments to recipients in different countries and in different currencies. Instead of creating individual transfers and adding recipients one by one, Batch Transfers allows users to make all the payments in one go by consolidating payment information into an intuitive template that comes with error checks prior to executing.

Challenges of paying out to multiple recipients across the world include:

Tedious processes: Keeping track of a large number of recipients’ payment amounts, banking details, and currencies, and transferring the information accurately to a banking portal can be a very laborious and error-prone process.

Inaccurate transfer amounts: Due to FX fluctuations and banking fees, the final amount a recipient receives can be less than originally agreed, causing dissatisfaction and requiring additional communication to amend mistakes.

Bounced or missed payments: When there are a large number of payments, it’s hard to stay on top of each individual one. A payer may only realise that a payment did not succeed after receiving a recipient’s complaint, and will then have to spend hours retracing where the payment failed.

High, intransparent costs: With many destinations and currencies involved, having full visibility into FX rates and transfer costs across multiple payments is difficult to track.

Airwallex’s Batch Transfers feature is built to overcome these challenges, helping businesses and their finance teams simplify payment processes and save on cost.

Pay 1,000 recipients in one go.

Pay multiple recipients globally in minutes

Instead of making payments to recipients one at a time, users can simply enter payment details across payments into an intuitive template. Once uploaded, Airwallex can make up to 1000 payments in one go.

To generate the excel template, you simply select payment destinations, currencies, and the preferred payment method for each currency. The downloaded template will guide you with all the required fields. You can then migrate payment information from your ERP, HR software, or any files you maintain in one go by copy-and-pasting in bulk or matching the columns with a simple VLOOKUP, significantly reducing the potential for error in manual entry.

For an even faster process, customers making payouts domestically in Australia can directly upload an ABA file exported from their ERP or payroll software to Airwallex. We are also working on support for SEPA, Bacs, and Giro batch payment files and will be making them available soon.

As batch payments are often high-value, multi-layer approval flows can also be set up for added security. The batch of payments will only be sent after being reviewed by all the relevant stakeholders.

No currency calculations needed

Calculating how much you must pay in your local currency so that your recipients receive the exact amount in each of their local currencies requires a lot of upfront work.

Batch Transfers does the math for you to ensure accurate amounts in either your currency or your recipient’s currency with the option to choose between “currency you pay” and “currency recipient gets”. In the latter case, you simply need to indicate how much the recipient needs to receive, Airwallex will automatically make the conversions and deduct transfer fees from your balance so that the recipient receives the full amount in their local currency.

Stay on top of each transfer

Realising that many payments have failed and having to chase them down adds unnecessary hours for your team. Airwallex has numerous features to help you improve the success rates of your payments and stay on top of their status.

As you upload the completed batch transfer template, the system will validate each field and return a file with clear error messages on fields that failed validation, helping to prevent failed payments.

You can also proceed with a batch of transfers while putting aside invalid entries to get back to later, thereby ensuring time-sensitive processes such as payroll can still be executed. Airwallex sends you real-time notifications on the status of your payments, so even if there are failed payments, you can manage them in your own time.

Access local payment rails and market-leading FX rates

Batch Transfers is integrated into Airwallex’s Transfers product which gives you access to a network of local payment rails across 120+ countries that significantly reduces the time that funds are in transit. 85% of funds arrive within a few hours/same day*. You will also be shown a competitive FX rate and transfer fee by currency before a batch of payments is submitted, giving you full transparency over costs.

Get started with Batch Transfers today

Whether you are executing payroll for a remote workforce or leveraging a large network of vendors in multiple countries, Batch Transfers enables you to send a large number of international payments fast, cost-effectively, and securely all via a simple, streamlined workflow. If you’re an Airwallex customer, try Batch Transfers today. If you’re not an Airwallex customer yet, sign up online.

*This metric is calculated based on Airwallex’s 2023 Q3 YTD transaction activities

Pay out faster, more securely.

Share

View this article in another region:AustraliaCanada - EnglishCanada - undefinedEuropeHong Kong SAR - EnglishHong Kong SAR - 繁體中文New ZealandUnited KingdomUnited StatesGlobal