How to start and grow your eCommerce business in Singapore (2025): a comprehensive guide

Online shopping among Singaporeans young and old is popular, thanks to the sustained development of eCommerce in Singapore. Even amidst recessionary fears in 2023, SMEs in the Lion City still prioritised expanding overseas.

Back in 2020, the COVID-19 pandemic accelerated eCommerce growth in Singapore and around the world as people chose to shop online more. Cross-border payments and transactions were made aplenty from that year onwards.

In a report by Statista, it highlighted that the total value of merchandise sold via eCommerce in 2023 grew to US$8 billion. As eCommerce platforms in Singapore become more user-friendly, getting your very own online store off the ground can be fast and seamless.

We’ll guide you through starting an online business, and showcase how you can optimise your sales via clever digital marketing tactics.

What drives Singapore's eCommerce success?

eCommerce has been successful in Singapore for several reasons, including folks adapting their shopping habits during the COVID-19 pandemic. These are:

1. A robust infrastructure

The US International Trade Administration has sung the praises of Singapore’s tech infrastructure. It stated that information and communications technology (ICT) here is ultra-high speed and trusted. What’s more, it noted the Singapore government’s “dedication to embracing the digital economy and achieving its goal of becoming a Smart Nation”.

2. Government support

Not only does the government support eCommerce growth in Singapore by keeping the ICT infrastructure here in shape, but through introducing grants and initiatives too. These include talent development programmes which boost the competency of professionals hunting for eCommerce jobs in Singapore.

3. The rise of digital banks and fintech providers

Digital banks and fintech companies contribute to the development of eCommerce in Singapore by streamlining companies’ financial operations. This is crucial as online businesses have tight schedules and strict fulfilment periods. One financial technology service provider in Singapore would be Airwallex, which operates fully digitally and allows accounts to be opened online instantly.

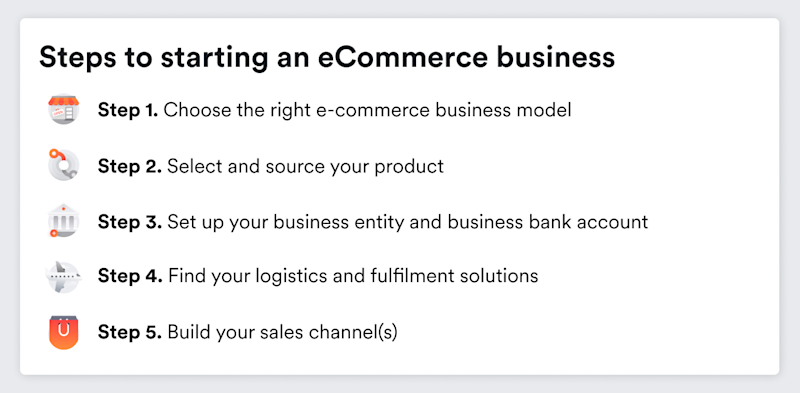

Step-by-step guide: How to set up your eCommerce business in Singapore

Step 1: Choose the right eCommerce business model

Business Model | Business to Consumer (B2C) | Business to Business (B2B) | Consumer to Consumer (C2C) | Consumer to Business (C2B) |

|---|---|---|---|---|

Details | A business selling goods or services directly to a consumer. | A business selling goods or services to another business. | A consumer selling goods or services to another consumer. | A consumer selling goods or services to a business. |

Example | A cafe selling coffee to a diner. | A distributor selling coffee beans to a cafe. | Someone selling a used coffee machine on social media. | A freelance designer creating a cafe’s menu. |

These eCommerce business models are the most common ones used by start-ups and SMEs today. An example of a successful B2C brand would be Hey! Chips, an award-winning Singaporean online firm selling fruit and vegetable chips. For B2C businesses, financial technology companies such as Airwallex helped greatly with their international expansion.

For Hey! Chips, Airwallex’s Global Account removed the hassle of having to register a business bank account in each nation they expanded to. There was no need to visit bank branches and manually submit documents.

No matter your business model, Airwallex’s wide transfer network supports payments to any supplier, vendor, or contractor. Don’t worry about creating a bank account in a specific country or high fees just to pay the bills.

One more thing you won’t need to worry about is double or triple conversion fees. Airwallex’s payment gateway allows you to receive payments and make deposits in more than 180 currencies. You can then use those very currencies to directly settle your business expenses.

Make your first transfer with an Airwallex Business Account.

Step 2: Select and source your product

After you’ve decided on a business model, you need to choose what product or service to sell. Out of the five steps here, this might take the most time and effort to get past.

Fortunately, there are two strategies to accelerate your progress:

Solve a pain point. In 2014, fashionistas had to decide between fast fashion and luxury. There was nothing in between. Linjer solved this by selling high-quality fashion products directly to consumers online without the usual luxury markups.

Choose products with higher profit margins. When you’re sourcing goods, factor in how much it takes to ship and store your inventory. Low-cost items have the potential for a higher return on investment, and lightweight products are usually cheaper to transport.

Regardless of how you decide on a product, Airwallex can be a big asset in settling payments with your overseas suppliers or vendors. You can pay your bills directly to over 150 countries at market-leading FX rates. The best part? There’s no need to manually enter their payment details.

Step 3: Set up your business entity and business bank account

As you can see, registering your online business in Singapore is straightforward. However, ensure your documents are prepared beforehand and perhaps more importantly, your business partners agree with every step of the way. For a detailed guide on launching your eCommerce venture, consider our comprehensive article on how to start a business in Singapore. The article offers valuable insights into choosing the right business structure and provides step-by-step instructions to streamline the registration process, setting a solid foundation for your business.

Once you’ve cleared the first four stages, you’ll be glad to know opening a corporate bank account in Singapore is also a fairly smooth process. And if you opt for a digital bank or a fintech provider like Airwallex instead of a traditional bank in Singapore, here’s what you’ll gain:

No unnecessary charges. Say goodbye to account opening fees, monthly maintenance charges, and more.

Optimised international fund transfers. Whether you’re a small business or a large corporation, Airwallex grants you access to market-leading FX rates and batch transfers.

Multi-currency cards for your employees with in-built expense management. Manual reimbursements for business expenses will be a thing of the past. You can set spending limits and controls via your dashboard too.

Speaking about multi-currency, Airwallex’s world-class payment gateway, often considered one of the best payment gateways, lets your business receive payments in more than 180 currencies and 160 payment methods. This removes any extra hurdles for your customers, no matter where they’re based.

Step 4: Find your logistics and fulfilment solutions

Logistics and fulfilment solutions are aplenty in Singapore and vital for eCommerce businesses. With that said, compare price quotes and chat with fellow business owners before deciding on one. This is akin to what you’d do when sourcing your products.

As you set up your online business, you will notice the number of expenses to track. Airwallex helps you manage this by reconciling everything in one menu. What’s more, you can sync expenses in Airwallex with your company’s accounting software (Xero, NetSuite, and Zoho Books, etc.) to supercharge your finance department’s operations.

Step 5: Build your sales channel(s)

Lastly, you need a sales channel for customers to transact on. There are two approaches you can adopt:

Build an eCommerce website

Think of building an eCommerce site as creating a regular website. A user interface that’s easy to understand for your target audience is crucial, so is a user experience that’s simple to grasp. You’d do well to integrate multiple payment methods too, like credit cards and bank transfers or local payment methods like Grabpay, Paynow in Singapore or Klarna in the US.

For online retailers, you can integrate Airwallex’s payment gateway with commerce sites like Shopify or WooCommerce to collect payments or deposits. You can also create payment links for your customers without any additional coding.

Set up an eCommerce store on online marketplaces

Alternatively, you can set up shop on an online marketplace like Lazada or Shopee. Other digital markets include Amazon, eBay, and Qoo10. There are category-specific commerce sites as well, like ZALORA for fashion and COURTS for consumer electronics.

To begin, simply register for a business account and list your products or services. Do note the commission fees these eCommerce platforms in Singapore charge and whether they’ll eat too much into your bottom line.

Even if you choose an online marketplace to be your sales channel for eCommerce in Singapore, Airwallex’s suite of solutions will simplify the bookkeeping process for you. To be precise, you can streamline order and sales data by first integrating Airwallex with the marketplace itself to receive payments.

Then, you can integrate your Airwallex account with your preferred accounting software (think Xero, NetSuite, and Zoho Books) for Expense Management.

How to scale, promote, and maximise your sales online through digital marketing

Digital marketing is essential to growing your online business and sustaining it. Here are three low-cost methods you can use as your company takes its first steps. These are crucial tools to help you continue scaling, promoting your brand and products, and maximising your sales even when business takes off.

1. Search engine optimisation (SEO)

Half the battle is won when your business ranks highly for your desired keywords on Google. Fewer steps are needed for potential customers to seek out your company, which boosts the potential for sales. When your company grows, SEO is still vital as you’ll compete with other businesses offering similar products or services.

2. User-generated content

This is the online version of “word of mouth”. When you post actual positive user reviews and publish case studies of satisfied customers, it increases your online business’ credibility. Additionally, it lowers the barrier to entry for potential customers as they see evidence of how effective your products or services are.

3. Social media

Being active on social media lets you market both your offerings and brand. Furthermore, the data you gain from each platform’s analytics tools enhances your overall marketing efforts. For example, you can adjust your copywriting and visuals based on the demographic most drawn to your pages.

Future trends of eCommerce in Singapore

Although the world has navigated past the COVID-19 crisis, online purchases are still growing quickly. According to Statista, the projected compound annual growth rate from 2024 to 2028 for retail eCommerce sales globally is 9.83%. Locally, there’s no sign of online retailers shuttering either.

1. Multiple sales channels

People want choices and having your offerings on multiple sales channels has the potential to boost conversions. Folks may be loyal to an eCommerce platform in Singapore for their reasons, and having a presence there reduces the extra step they need to shop directly on your website.

Several popular commerce sites in Singapore include Amazon, Lazada, Qoo10, and Shopee.

2. Subscriptions

Depending on what you’re selling, this might not be viable. However, given that there are even subscriptions for wristwatches, don’t dismiss it immediately. A subscription represents convenience and cost-effectiveness for your customers. It also grants you an opportunity to introduce them to other similar products.

As you latch onto these trends, Airwallex’s tools are there to help you simplify your business and financial operations. For example, if you decide to trial sales via social media, you can create reusable and secure payment links for your customers. No additional websites or coding is required.

3. Internationalisation

Singaporeans and consumers around the world are open to purchasing from brands based overseas because of competitive pricing and sheer variety on offer. These brands might even offer a high level of personalisation, whether it’s their customer service or the products they carry.

Therefore, it’s important for your online business to diversify your supplier list and expand overseas. Airwallex offers extensive global coverage without borders, making it a suitable platform for assisting high-growth eCommerce sellers and aggregators in their efforts to expand internationally.

Conclusion

Because of rock-solid infrastructure, convenience, and other factors, eCommerce in Singapore has only grown in popularity through the years. It’s highly unlikely that shopping online will go out of favour, and businesses will have to adapt or take advantage of this trend.

With Airwallex and its advanced enterprise and financial solutions, you too can get your own online business going as smoothly as possible. One platform is all you need to access a multi-currency account, rapid international fund transfers, online payments, and more.

Avoid sneaky fees and increase your margins

Frequently asked questions

1. Which eCommerce platform is best in Singapore?

This depends on what you need to purchase and if the platform has what you need. However, based on the Singapore Department of Statistics’ latest data in 2022, folks appear to believe Shopee and Lazada are the best. They have the most monthly visits, at 14.9 million and 7.1 million respectively.

2. Is Shopee or Lazada more popular?

Shopee appears to be more popular than Lazada. According to the Singapore Department of Statistics, it has more than double the monthly visits compared to Lazada.

3. How can eCommerce startups in Singapore leverage digital banking for international transactions?

As eCommerce startups can operate nimbly, the solutions from digital banks and financial technology companies like Airwallex are best suited for their needs. This is especially true for Airwallex’s all-in-one business account.

For instance, you can save on double currency conversion fees via our leading payment gateway. Essentially, your customers can pay you in their preferred currency and method. You can then hold that very currency in your Airwallex account to directly settle business expenses down the road.

4. What are the latest eCommerce fraud prevention strategies in Singapore?

The latest strategies include setting limits on order quantities, using secure payment gateways, regular website audits, and deploying address and card verification.

5. How do I choose the best payment gateway for my eCommerce website in Singapore?

The most important considerations here are whether the payment gateway supports multiple payment methods, and if it can seamlessly integrate with eCommerce platforms. Airwallex’s payment gateway solution allows you to do that, supporting over 160 payment methods across more than 180 currencies worldwide.

6. What are the relevant eCommerce laws and regulations in Singapore?

These laws and regulations fall under the The Electronic Transactions Act 2010. Additionally, it was amended in 2021 to adopt the UNCITRAL Model Law on Electronic Transferable Records. Finally, Singapore introduced the Guidelines for eCommerce Transactions in 2020 to enhance the transparency of online shopping here.

7. What are the best practices for integrating social media platforms with my eCommerce site?

One best practice that’s easy to adopt would be utilising social media plugins. Most eCommerce platforms today boast plugins or extensions which allow you to showcase your offerings on your company’s social media profiles or individual posts.

This removes one hurdle for potential customers because there’s no need for them to take additional steps to visit your website, and potentially drop off from making a purchase.

8. How should I select an eCommerce platform for selling consumer electronics and other products?

You’ll need to pick the right eCommerce platform in Singapore if you want your online business to succeed. Every platform has a different commission fee schedule, features, and perks. Therefore, picking one that’s incompatible with your company is equivalent to wasting an opportunity.

Ensure the online marketplace you choose is secure, has SEO capabilities, is responsive, features an integrated shipping system or multiple shipping partners and lastly, allows your business to scale.

Sources and references

1. https://www.imda.gov.sg/regulations-and-licensing-listing/electronic-transactions-act-and-regulations

2. https://www.imda.gov.sg/-/media/imda/files/regulation-licensing-and-consultations/acts-regulations/imda-eta-infographic.pdf

3. https://www.mha.gov.sg/mediaroom/press-releases/introduction-of-e-commerce-marketplace-transaction-safety-ratings-and-revised-technical-reference-76-on-e-commerce-transactions/

4. https://www.mordorintelligence.com/industry-reports/singapore-ecommerce-market

Share

Shermaine spearheads the development and execution of content strategy for businesses in Singapore and the SEA region at Airwallex. Leveraging her extensive experience in eCommerce, digital payment solutions, business banking, and the cross-border industry, she provides invaluable insights that guide businesses through the complexities of global commerce. Specialising in crafting relevant and engaging content that resonates with business owners, her work is designed to drive growth and innovation within the fintech and business economy space.

Related Posts

A business owner’s guide to credit card processing: what you need...

•11 minutes