Break-Even Analysis: Formula to Calculate the Break-Even Point

Nobody ever starts their business with the goal of simply breaking even. You want to make a profit. However, finding a path to profitability isn’t easy, with 9 out of 10 e-Commerce businesses failing within the first 4 months—even in Singapore.

That’s why breaking even remains an important milestone for every eCommerce business to aim for and to celebrate. Knowing your break-even point helps you plan for your future. And to get there, you’ll need a break-even analysis, which will be crucial in mapping out your business’ pricing strategy.

What is a break-even analysis?

A break-even analysis is a tool that businesses use to determine when their business will break even and start to turn a profit. It allows you to determine your total fixed business costs and how much product you need to sell (or how much income you need to make) in order to cover these expenses.

And while performing a break-even analysis is important to provide you with this break-even point, it can also be a helpful learning tool that sheds light on your business’s financials.

Why a break-even analysis is critical for eCommerce businesses

It helps you set clear, logical goals

Break-even analysis uses unit volumes, which lets you see exactly what costs go into each unit of your stock, and how many units you need to sell each month to cover your operating costs. With these numbers, you can create a clear pricing strategy for your products and identify which sales tactics need to be finetuned.

This also shapes how you set your sales targets and how much you’re able to safely spend on acquisition, so that you can build a profitable business.

You’ll make smarter future plans

Performing a break-even analysis can help you determine if a new sales avenue is going to be profitable. You’ll have greater peace of mind—whether it’s migrating all your Amazon sales to your own website or determining if it’s worth the time and effort to operate a short-term pop-up.

Break-even analysis also helps you reduce potential business risk. Undertaking a break-even analysis before launching a new product or pursuing a new business opportunity will help you quickly identify if it’s unlikely to be profitable. This means you can avoid sinking your time and money into something that ultimately won’t work out.

From a growth point of view, it provides you with a tangible tool you can use when applying for finance or enticing investors. By providing a clear break-even point for your business, you can demonstrate that you’ve mapped out your business’ cash flow and are planning for the future.

How to perform a break-even analysis

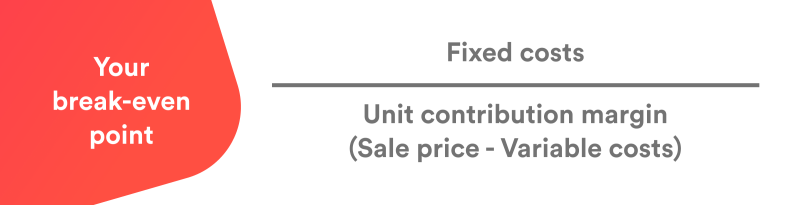

To calculate your break-even point based on units, divide your total fixed costs by the sale price per unit minus the variable cost per unit (margin).

In order to accurately find the break-even point, you first need to determine your business’ fixed costs and variable costs.

What is a fixed cost?

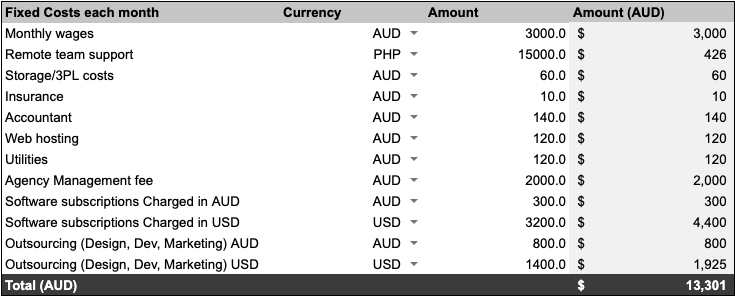

These are the costs that your business must pay each month, or year. They’re costs that remain roughly the same, regardless of your business’ income.

This covers things like your rent, insurance, utility costs, product storage costs, and software subscriptions. Essentially, it’s what you spend on your business, other than producing your stock. If you're using our break-even template, fill out your business’ fixed costs in the currency you're charged, into the table marked Step 1, like the example below.

What is a variable cost?

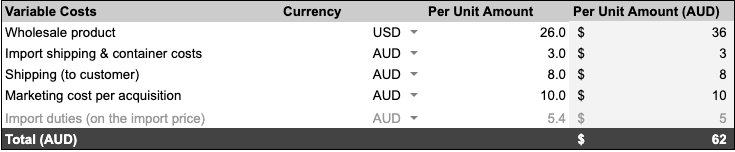

Variable costs are the individual costs that go into making or selling one unit of your stock, which are subject to change for any reason.

For example, you sell wireless handphone chargers in different colours, all of which are sourced from China. You’ve got your individual costs for the materials and colours. There are costs for packaging, postage, and even payment processing fees for transferring money internationally to your supplier.

Add these into the Variable Costs table within our break-even analysis tool to find your break-even point.

How to calculate your break-even point

Now that you've determined your fixed and variable costs, it's time to calculate your break-even point in units. This is the magic number of how many units you need to sell in a given period — in this case, a month — in order to break even.

To calculate your unit break-even point, divide your total fixed costs by your sale price minus your variable costs to land at your break-even number.

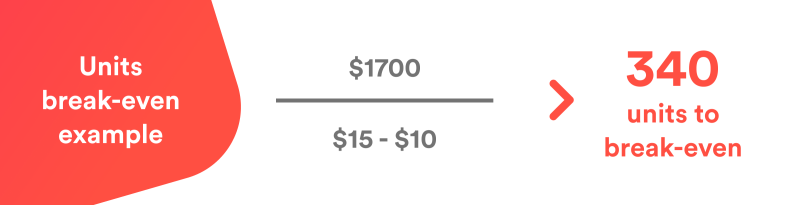

Example: break-even units

You sell your wireless handphone chargers for $15 each. Sourcing, labour, packaging, posting, and everything else comes to $10 per item.

Your total fixed costs for your storage space, office rent, subscriptions to your creative tools, and your utilities, adds up to $1,700.

Example: break-even point in sales dollars

This follows a similar process, but involves the product’s contribution margin in your calculations.

The contribution margin is the percentage of your product’s sales cost that’s left after all the product costs are paid for — so the percentage of the sales price that contributes to your profit.

Two ways to improve your unit economics

The seemingly obvious way to lower your break-even point is to raise the prices of your products.

But it’s not that easy. Customers are sensitive to price increases. They don’t like change. This can backfire and cause a drop in your customer base.

So if this method looks like it could price you out of the market, it’s better to look at your costs instead.

1. Lower your fixed costs

You’ve listed down all your fixed costs, so now find the unnecessary ones that you can remove.

It might be looking at better-priced storage options, finding a cheaper internet provider, or seeing if you can negotiate a rent reduction. It might mean stopping spending on some aspects altogether.

Or, it can be as simple as switching from a bank account with a monthly fee to a fee-free account.

This is where Airwallex can help you out. You’ll never pay fees on your business accounts and you can open global accounts in 11 currencies, so you won’t have to pay international transfer fees either. This one easy change means you can permanently reduce banking costs for your business.

It might sound small, but these add up quickly, especially in Singapore.

2. Lower your variable costs

Lowering your variable costs takes a little more effort.

It can include searching for suppliers who offer more competitive rates on your stock or better bulk rates. You may be able to find a production plant with cheaper labor costs, or a courier that offers better prices.

You could streamline your processes. Perhaps your packaging doesn’t need that added layer of wrapping, or you might stop including bonus stickers and postcards in all your packages.

Another way is looking at the fees you pay on your banking. For example, if you source your products internationally, you’re likely paying international transaction fees.

Both Airwallex Multi Currency Cards and Foreign Currency Accounts help you cut out international transaction fees altogether. You’ll also receive a foreign exchange rate that’s up to 90% better than what any of the big banks can offer.

You’ll be able to reduce your spending costs, reduce your fees, and lower your break-even point all at the same time.

Airwallex is a better way to do your business banking

Now that you understand your business’ break-even point, it’s time to start making it as cost-effective as possible.

So if you’re looking to reduce your expenses, get the best price on your international payments, and say goodbye to bank fees for good, get in touch with Airwallex today. You can book a free online demo with a product specialist by clicking here to find a time slot that suits you.

You don't need a bank to run your business

Related article: How to Calculate ROI Using This Simple ROI Formula

Share

View this article in another region:AustraliaUnited StatesGlobal