The Best Payment Gateways for International eCommerce

- •What is a payment gateway?

- •Payment gateways are a relationship built on trust

- •What to look for in a good payment gateway

- •Choosing your eCommerce payment gateway

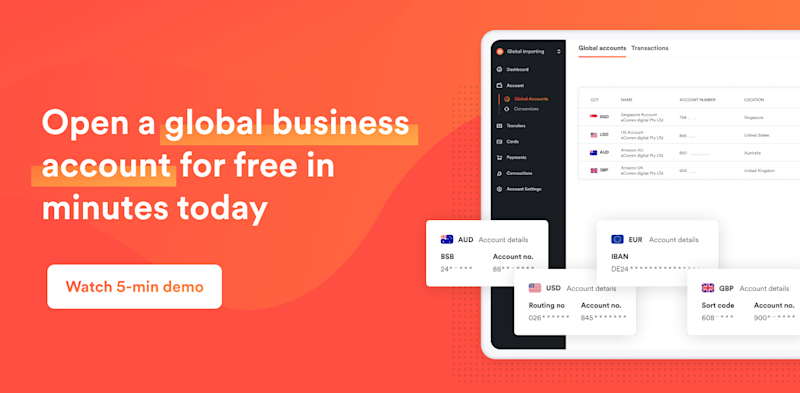

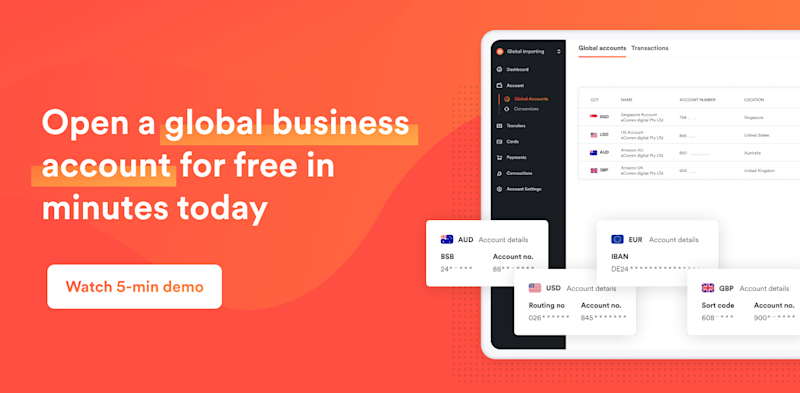

- •Airwallex

- •Choosing the right payment gateway depends on your eCommerce business’ needs

- •Airwallex helps your business make the most of international eCommerce

Choosing a payment gateway should be easy, right? Well, not quite, because no two payment gateways are the same. You’ll need a payment gateway that best meets your business needs, while also being aware of the different fees involved.

Picture this: Your inventory is ready to go. Your website is up and running. Now, it’s time to start getting paying customers. Which means your eCommerce payment gateway needs to be set up, so you can start accepting payments securely in Singapore and the rest of the world.

But remember: the payment gateway you use for sales in Singapore may not always be the best option when your business scales up and expands internationally. There are often additional fees when it comes to accepting payments in multiple currencies, which will quietly eat away at your profits.

In this blog, we’ll be taking a look at the best payment gateways for international eCommerce, and help you shortlist the best payment gateway for your business.

What is a payment gateway?

A payment gateway is the online payment platform that enables your customers to pay you. The payments software captures your customers’ credit card or bank account details, transfers this data to your bank account, securely validates their card details, and confirms that the transfer is good to go ahead.

It sounds simple, because in theory, it is. Your eCommerce payment gateway is the middleman between you, your customer, and your bank accounts. Your payment gateway is essentially an online version of a physical card transaction. As there’s no physical card to tap, the payment gateway facilitates this process for you.

Payment gateways are a relationship built on trust

Trust and security are where online payment platforms shine. Payment gateways handle the payment details within a highly secure environment, reducing the chances of card fraud and machine tampering. Payment gateways also check if users’ details are legitimate at the point of sale, ensure they’re using the right details, they are who they say they are, and if they have enough funds in their accounts.

The best payment gateways have built a high level of trust over time, and their names alone are bywords for safe online banking.

What to look for in a good payment gateway

There are a few key things that will help in choosing the right eCommerce payment gateway for your business.

Low fees

Much like a financial institution, you need to ensure that your selected payment gateway isn’t costing you an arm or leg for its services. Do check for the payment gateway’s monthly fees, cost per transaction, international exchange fees, and make sure you’re getting the best value for your use.

Payout in multiple currencies

If you’re operating an international eCommerce business, offering payments in multiple currencies makes it easier for your international customers to buy from you. Likewise, this means your payment gateway needs to accept and pay out in foreign currencies too.

Having a payment gateway that allows payouts in multiple currencies means you can send and receive payment from more countries, ensuring you’re able to receive funds in that currency, which you can then in turn use to transact with suppliers and merchants in that country.

Ease of implementation

You don’t want your payment gateway to become a recurring choke point for your business, so make sure it’s easy to set up, intuitive to use and suits your business’ needs.

Look at the integrations

Does your online payment platform integrate with your CMS or eCommerce store? Choose one that integrates seamlessly, with an API that fluidly connects with your site and grants you flexibility as you grow your business.

Choosing your eCommerce payment gateway

Let’s take a look at some of the biggest names on the market.

Airwallex

Airwallex offers a groundbreaking payment gateway solution for global businesses. With easy to use payment flows for customers in Singapore and the rest of the world, smooth and fast checkouts are always available to businesses of all sizes.

Airwallex is also one of the first online payment processors to allow flexible settlement in up to 11 different major currencies. This means customers can pay in their local currency, like USD, and you can receive and hold in USD without being forced to convert it back into SGD. This lets you receive and hold multiple currencies without being subjected to exorbitant currency conversion fees. You now have the flexibility to payout in foreign currencies or convert when the time is right.

The integration methods are also incredibly flexible; businesses can integrate into their existing checkout or payment flows via an API, embedded payment fields, a simple drop-in method or a complete customer checkout journey fully hosted by Airwallex—the options are endless. Pricing is also incredibly competitive, with fees as low as IC++ 0.6% (Interchange fee + Scheme fee + acquirer fee) 0.6% for Visa and Mastercard payments.

PayPal

PayPal is almost ubiquitous as a payment gateway. As the original payment gateway, it has had the time and opportunities to perfect its offering, so they clearly understand the pain points of both businesses and consumers. It has built-up brand equity so much so that users barely give it a second thought during use.

Supported in over 203 countries, PayPal is a wide-reaching, flexible eCommerce payment gateway solution that integrates with most platforms.

PayPal is also one of the few payment gateways that offer payouts in multiple currencies for Singapore-based businesses.

PayPal excels in its ease of use and name recognition—which come at a cost. Its big drawbacks are the fees and its speed. You can expect delays of up to 3-5 days when withdrawing funds to your bank account.

For fees, you can expect to pay the following:

Domestic sales: 3.9% + a fixed $0.50 fee

International sales: 4.4% + a fixed $0.50 fee

Micropayments: 5-6% + a fixed $0.08 fee

Currency conversion: 4%

Withdrawing USD to a nominated USD account: 3%

Stripe

Stripe is hot on PayPal’s heels and with the added benefit of existing in the physical realm too. It’s highly flexible and allows API access to build a custom solution, including one-click checkout. It’s quick too, with funds able to be directly deposited into your nominated bank account.

The one main downside to this payment platform is that it only allows you to withdraw in SGD if you have a Singapore account. You can’t withdraw USD from an SGD account, so you’re at the mercy of Stripe’s FX fees and charges. These are:

Domestic and international sales: 3.4% + a $0.50 fixed fee

Shopify Payments

Shopify Payments is the pre-integrated platform for Shopify sites, so by nature, it’s easy to configure and to get started. It’s designed to get your Shopify store up ASAP.

A benefit of this payment platform is that it enables foreign currency accounts for your withdrawals, reducing your banking fees. It also accepts a range of credit and debit cards and there are no transaction fees for Shopify users.

Their fees start at:

Domestic payments: 3-3.2% + a $0.50 fixed fee

International payments and AMEX cards: 3.4-3.6% + a $0.50 fixed fee

Square

Square started off as an innovative, eye-catching POS system for small businesses, and has since grown into the online payment gateway we know today. Its strength is in its ability to connect the online and offline world. Another big plus is its adaptability; Square features native integration with WooCommerce, Wix, Magento, BigCommerce, and more.

While your money is typically delivered the next day, one drawback is that you can only withdraw in SGD.

Square’s fees vary depending on the type of transaction you make, so you can expect to pay between 2.6%—3.5% per transaction. On the plus side, it comes with the cool POS system we’ve grown to love.

Choosing the right payment gateway depends on your eCommerce business’ needs

Choosing the best payment gateway for your business will largely be driven by your website’s CMS, and which platform natively integrates into it. If you’ve got the know-how and the budget, we recommend opting for an international payment platform that can integrate using API, as this provides a much smoother experience.

And as a business looking to grow your international customer base, you should choose a flexible platform that allows you to settle in multiple currencies.

But keep an eye on their fees. These start to build up, and can easily eat away at your profit margin.

Airwallex helps your business make the most of international eCommerce

Airwallex Foreign Currency Accounts were designed with international eCommerce businesses like yours in mind.

Our Business Accounts are built to integrate seamlessly with payment gateways like Shopify and Paypal, allowing you to collect funds in local currencies. You can open multiple currency accounts, allowing you to hold, spend, and withdraw in these currencies without needing to exchange any money. This means you eliminate unnecessary conversion fees and reduce the investment and operational overhead of entering these new markets.

With zero international transaction fees and access to our interbank exchange rates, our Global Accounts are made to maximise your international eCommerce profits. Get started with Airwallex for free today.

Related article: 6 Surprising Reasons Behind Why Your Bank Transfer Is Delayed

Share

View this article in another region:Global

Related Posts

A business owner’s guide to credit card processing: what you need...

•11 minutes