B2B cross-border remittance guide for SMEs in Singapore

- •What is a cross-border remittance?

- •How do cross-border remittance and payments work?

- •The growth of cross-border payments market and cross-border activities

- •5 international payment challenges faced by wholesale trade SMEs

- •Traditional cross-border remittance solutions vs fintech cross-border remittance solution

- •Why Airwallex is the best B2B cross-border payment service for Singapore SMEs

- •Grow your wholesale trade SME with Airwallex - create an account today!

Singapore has an established global reputation as a shipping centre and financial hub, but did you know that wholesale trade is actually the second largest sector of our economy?

The wholesale industry accounted for 18% of Singapore’s GDP in 2021, and its export value is expected to grow to S$1 trillion by 2030. Operating diligently behind the scenes are small-to-medium enterprises (SMEs) like yours. Though modest in size, SMEs make up 97% of the wholesale sector and are poised to drive its growth through overseas expansion.

Wholesale trade SMEs are going digital to maximise savings in high-cost areas like cross-border remittances. Read on to understand what cross-border remittances mean for your business and how to choose the best B2B payment method for your international customers.

What is a cross-border remittance?

A cross-border remittance (also known as cross-border payments or international money transfer), is the process of sending funds from one country to another. In the context of B2B dealings, it refers to international payments.

How do cross-border remittance and payments work?

Cross-border payments are commonly facilitated through banks, online payment platforms, or financial service providers.

The process begins with the payer initiating the transaction using their preferred payment method—be it via wire transfers, credit card transactions, or electronic fund transfers (EFTs). The financial institution handles currency conversions, if necessary, and ensures that the funds reach the recipient's account.

The growth of cross-border payments market and cross-border activities

Here are some examples of how Singapore’s wholesale trade industry uses cross-border payments:

Paying overseas suppliers. For firms that source raw materials or components from suppliers in China or neighbouring countries, cross-border remittances facilitate the payment process.

Receiving payments from overseas buyers. 91% of Singapore’s wholesale industry’s Q2 2023 revenue comes from foreign wholesale trade of services and products.

Licensing and royalties. If an SME licenses a trademark or technology from a business based overseas, international payments will be used to pay the royalties or licensing fees.

5 international payment challenges faced by wholesale trade SMEs

A recent Airwallex found that 7 in 10 SMEs are bracing for a recession in the next 2 years. Combined with the complexities of the global payment system, wholesale trade SMEs face significant challenges ahead.

Foreign exchange risk

It’s easier to get paid by overseas customers when you send invoices and receive payments in their local currency. However, you’re exposed to foreign exchange (forex) risk if your bank automatically converts incoming payments to the Singapore dollar.

High transaction fees

Large cross-border transactions often come with hidden fees that can catch businesses off guard. For example, when funds pass through multiple banks or financial intermediaries during international transfers, each entity may impose fees.

Some banks or payment providers may apply service charges for handling large transactions, which may not be explicitly disclosed upfront.

Transfer delays and limited transparency

Cross-border payments aren’t instantaneous. Compliance checks, time zone differences, and public holidays can influence the transaction speed, which take at least several business days. There is often no way to know exactly when the funds will reach your bank account. For SMEs, delays can lead to difficulty covering your operating expenses or losing timely opportunities.

Traditional cross-border remittance solutions vs fintech cross-border remittance solution

Given the current economic climate, SMEs can consider alternative payment methods like fintech firms. Here’s a quick guide on the differences between the two:

Using bank transfers for cross-border B2B payments

If you use your bank account to transfer funds or receive overseas payments, then you’ve experienced the strengths and weaknesses of wire transfers - a payment method facilitated by an electronic communications network called SWIFT (Society for Worldwide Interbank Financial Telecommunication).

Advantages

Trust. Banks have well-established brands that consumers know and trust, which make them the top-of-mind choice for retail cross-border payment service. It’s more convenient for business owners to use the same institution for wire transfers.

Accessibility. For customers who aren’t tech savvy or prefer face-to-face transactions, banks offer physical locations where they can initiate wire transfers in person.

Security and compliance. Banks operate under stringent regulatory guidelines and use various security protocols to verify transactions.

Disadvantages

High transfer fees. Due to the number of intermediary banks involved, wire transfers are one of the most expensive cross-border payment methods.

Automated conversions. Unless you are using a multi-currency account, incoming foreign currency payments get automatically converted to Singapore dollars.

Unfavourable foreign exchange rates and fees. Banks charge a markup for exchanging currencies, which can vary depending on the currency.

Slower speed. Wire transfers don’t move directly from one bank account to another. They take at least several business days to complete due to factors like time differences and number of intermediary banks involved.

Fintech payment specialists

Fintech payment specialists are financial services firms who use technology to streamline and simplify international payments. These services support cross-border transactions in partnership with local banks, and offer compelling benefits like lower fees, faster payments, and real-time tracking.

On top of cost savings, B2B-focused firms like Airwallex add value by providing multi-currency accounts, expense management systems, and automatic reconciliation through software integrations.

Advantages

Lower fees. Fintech firms like Airwallex let you choose local transfer methods, which means lower fees compared to SWIFT payments.

Competitive exchange rates. Fintech firms offer market-leading exchange regardless of transaction size, with no hidden additional fees.

Faster transfers. Firms like Airwallex work with local bank networks to facilitate transactions, enhancing cross-border payment efficiency.

Greater transparency. Fintech firms like Airwallex have a dashboard that lets you track transfers in real-time, and shows the exact amount your recipient will get. You also see fees up-front, so you can anticipate how much your transaction will cost.

Security. The best payment specialists adhere to high international security standards including PCI DSS, SOC1, and SOC2 compliance.

Compliance with local regulations. To operate in Singapore, fintech firms need to be licensed and regulated by the Monetary Authority of Singapore (MAS). This means your funds are safeguarded as required by the MAS.

Disadvantages

Lack of familiarity. Many business owners are less familiar with fintech compared to traditional banks.

Geographic limitations. Not all fintech firms are truly global; many are available in a handful of markets or support few currencies. Their usefulness is limited if they don’t support markets you do business with.

Customer support variability. Some payment specialists may not provide account managers or the dedicated support that business owners expect from banking partners.

Why Airwallex is the best B2B cross-border payment service for Singapore SMEs

Ready to grab more wholesale trade opportunities in the region? Let Airwallex take care of your B2B cross-border remittances and propel your SME to the global stage. Here’s why Airwallex is a better partner for sending and receiving international payments, compared to wire transfers:

Receive multiple currencies, with no forced conversions

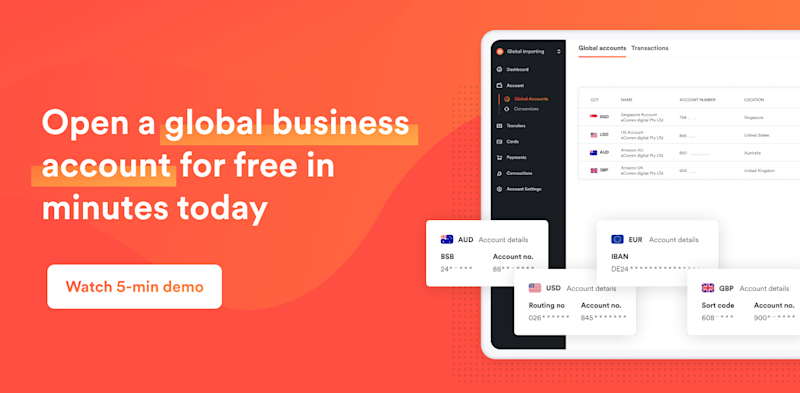

Unlike traditional wire transfers, Airwallex won’t automatically convert overseas payments to Singapore dollars. Instead, you receive your payments in a multi-currency Global Account that holds 12 major currencies including the US dollar, British pound and Chinese yuan.

This puts you in full control over when to convert the currencies you hold and helps you take advantage of favourable exchange rates.You can also use these proceeds to make payments in the same currency, which eliminates conversion fees.

Bank like a local with fast, low-cost transfers

The Global Account also lets you operate like you have a local bank account in multiple markets. You get an account in your SME’s name, with a local bank code branch code, and dedicated account number allowing you to receive payments.

Through this, your overseas payments are treated like domestic transfers, which means low transfer fees, S$0 fees on inbound transfers, and clearing times as fast as 1 business day.

Competitive exchange rates and low conversion fees

Once you’re ready to convert to Singapore dollars, you benefit from Airwallex’s market-leading rates regardless of the transaction size. Our exchange rates are significantly lower than banks and are 100% transparent - you’ll always see how much it costs before you convert your funds.

Global compliance and ring-fenced accounts

Airwallex operates in compliance with various regulatory standards, with over 50 licences and permits globally. In Singapore, we are licensed as a Major Payment Institution by the MAS, which means our security protocols protect your funds according to the rules set by MAS.

The funds in your Business Account are kept in a ring-fenced account held in trust on your behalf. Your money is kept separately from other accounts or third parties, and is available only to you.

Grow your wholesale trade SME with Airwallex - create an account today!

Share

Related Posts

How DTC eCommerce brand, Linjer, saved more than SGD$13,000 in FX...

•3 mins

Airwallex helps DigitSense on global market expansion with cash f...

•4 minutes