The global payments and financial platform for growing businesses

Over 200,000 companies around the world trust Airwallex to grow their revenue. Open global business accounts, accept payments, manage company spend, and much more - all on one unified platform.

Why Airwallex?

Powerful solutions engineered for global businesses

Whether you're a global business looking to save time and money as you scale, or a forward-thinking platform or marketplace that's ready to build your own financial products, Airwallex's leading technology can help you get there.

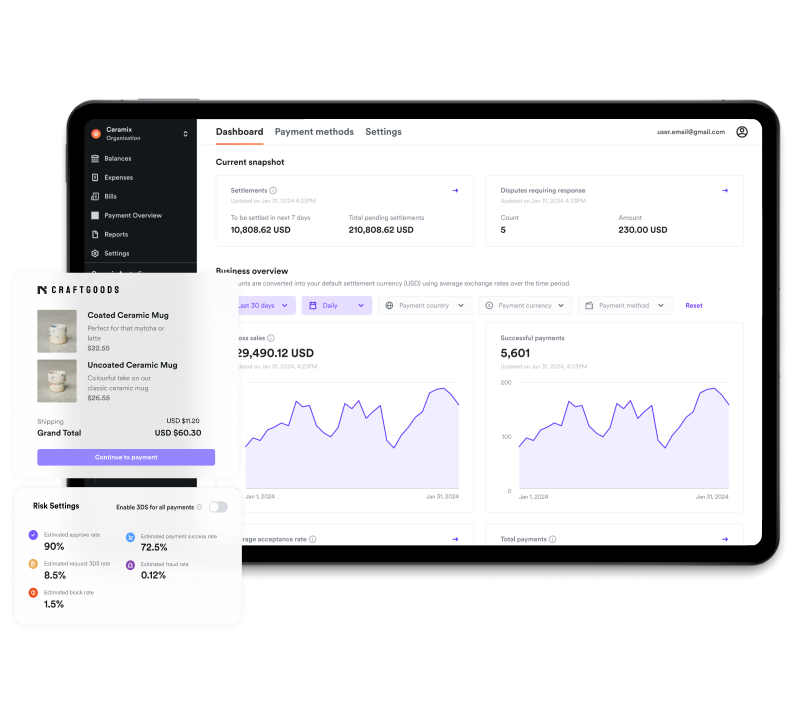

Your financial universe on one platform

Software and APIs to manage everything from business accounts, spend, and payments to embedded finance.

Business Accounts

A single account to manage your global payments and finances

Global Accounts

Open local currency accounts to receive funds in 20+ currencies

FX & Transfers

Make global transfers to 200+ countries at interbank rates

Corporate Cards

Issue multi-currency corporate cards instantly

Integrations

Connect Airwallex to other popular software platforms

Spend

Tools to control and track global business expenses

Corporate Cards

Issue multi-currency company and employee cards with customisable controls to limit spend

Expense Management

Track card expenses and reimburse employees globally

Bill Pay

Upload, manage, approve, and pay domestic and international bills from the same platform

Integrations

Sync all data and accounting information with QuickBooks, Xero, NetSuite, and more

Payments

Online payment acceptance to grow your international customer base

Billing

Maximise your global revenue with Billing

Invoicing

Generate invoices and digital payment links with over 160 local payment methods

Subscription Management

Manage simple and hybrid multi-frequency subscription pricing models

Usage-Based Billing - (Coming soon)

Track meter usage, calculate fees, and bill customers based on actual consumption

Platform APIs

APIs to build and monetise your own global financial products

Connected Accounts

Programmatic account creation & business onboarding

Payments

Global multi-currency payment acceptance

Accounts

Multi-currency account management, at scale

Transactional FX

Access interbank FX rates and intelligently manage currency risk

Payouts

Programmatically make cost effective, fast, and secure global payouts

Issuing

Issue cards at scale while reducing international transaction and FX fees

Global Accounts

Open local currency accounts to receive funds in 20+ currencies

FX & Transfers

Make global transfers to 200+ countries at interbank rates

Corporate Cards

Issue multi-currency corporate cards instantly

Integrations

Connect Airwallex to other popular software platforms

Learn more about our Business Accounts

Corporate Cards

Issue multi-currency company and employee cards with customisable controls to limit spend

Expense Management

Track card expenses and reimburse employees globally

Bill Pay

Upload, manage, approve, and pay domestic and international bills from the same platform

Integrations

Sync all data and accounting information with QuickBooks, Xero, NetSuite, and more

Invoicing

Generate invoices and digital payment links with over 160 local payment methods

Subscription Management

Manage simple and hybrid multi-frequency subscription pricing models

Usage-Based Billing - (Coming soon)

Track meter usage, calculate fees, and bill customers based on actual consumption

Connected Accounts

Programmatic account creation & business onboarding

Payments

Global multi-currency payment acceptance

Accounts

Multi-currency account management, at scale

Transactional FX

Access interbank FX rates and intelligently manage currency risk

Payouts

Programmatically make cost effective, fast, and secure global payouts

Issuing

Issue cards at scale while reducing international transaction and FX fees

Gain a competitive edge with Airwallex

Partner with a modern platform that removes friction and enables your business to realise its full potential. Wave goodbye to costly fees, slow outdated processes, and poor customer experiences. And, say hello to new opportunities, more revenue, and faster growth.

All you need to do business, locally and globally

Avoid the pain of managing payments and finances across multiple disconnected software providers. With Airwallex, you get a single unified platform, engineered with all the powerful features you need to streamline and future proof your business growth.

Radically save time and cost every single day

Experience remarkable speed and efficiency. Accept payments in local currencies, make high-speed transfers, and safeguard profits with like-for-like settlement, access to interbank FX rates, and no hidden charges on corporate expenses.

Automated workflows, enhanced by AI

Speed up your cash flow cycle and eliminate time-consuming manual processes. Automate common workflows and save hours each week on bookkeeping and reconciliation when you connect Airwallex with your accounting software.

Tap into the world’s local payments network

Airwallex’s proprietary local payments network offers you a faster, more cost-effective, and transparent alternative to legacy banking. Operate like a local business from anywhere in the world - open accounts with local bank details in minutes, accept payments in local currency to avoid costly forced conversion fees, hold funds in a multi-currency wallet, convert currencies at interbank rates, and make high-speed transfers around the world in a few clicks.

countries where you can collect funds like a local

countries to which you can make local transfers

global payments processed annually

countries from which you can accept payments

Trusted by 200,000+ businesses

Here’s what they say

“Having Airwallex as our global trusted partner means we can spend less time on the phone to the bank, and more time instead focusing on growing our business both domestically and internationally.”

“Airwallex’s reputation and product speaks for itself. I see a long future in our partnership with Airwallex, as they’ve proved time and time again that they’re the right solution for Karst Stone Paper.”

“Having all our global SaaS subscriptions in one place has streamlined our finance processes and enabled better tracking and control of expenses. It’s even better knowing that Airwallex isn’t hitting us with any international transaction fees.”

“Airwallex has allowed us to get things done at ten times the speed it used to happen. It means we could spend more time on our brand, our website and the customer experience. That’s what helped us to grow so much in a short span of time.”

“It is crazy to see that kind of technology...it's just one of those ideas where you think, why has this not been done before?”

“Airwallex has unlocked a much more efficient way of managing our money that we couldn’t do before. Our previous provider could not scale the way we needed it to. Now, our team is freed up to tackle the more important work on how ClipChamp expands globally.”

“Airwallex provides us with flexibility and cost savings in dealing internationally. We used Airwallex to receive our recent global fundraising round and pay international suppliers and are saving at least 5% per dollar transferred versus the big banks.”

“These small percentages here and there add up over time with a real bottom line impact. When I see the rates are good, I’ll convert my AUD into USD, knowing that I’ve saved money that I can re-invest into the business in the long-run.”