Offshore accounts 2025: how to open offshore business accounts

- •What is an offshore account?

- •Banking services for offshore accounts in Hong Kong

- •Banking services for offshore accounts in UK

- •Banking services for offshore accounts in the US

- •Banking services for offshore accounts in AU

- •Key features of offshore bank accounts

- •Key features of local bank accounts

- •Why use offshore accounts?

- •Benefits of offshore accounts

- •How do I open an offshore bank account?

- •Can overseas virtual bank accounts replace traditional overseas bank accounts?

- •Steps to opening a remote offshore account

- •Fees for an offshore account

- •What should you consider before opening an offshore account for your business?

- •Airwallex features and security measures

- •Benefits of opening an Airwallex Global Account

What is an offshore account?

Offshore bank accounts are specialised accounts opened in foreign banks or financial institutions. There are two types of offshore accounts: personal and business offshore accounts.

Personal offshore accounts are accounts opened in countries or regions outside of one's country of residence, and are solely for personal use. On the other hand, business offshore accounts are accounts opened in regions outside of the company's registered location.

Offshore accounts offer various benefits such as tax advantages, privacy protection, and capital mobility. However, they must comply with laws and regulations designed to combat money laundering and tax evasion. This article will give you a better understanding of offshore accounts by exploring their advantages, target users, and the steps to open such accounts.

Offshore account: services, features, and comparison*

Banking services for offshore accounts in Hong Kong

Local banks in Hong Kong offer offshore account services. As a valued customer, you can open an offshore account at these banks.

Depending on the bank's specific requirements, you may have the flexibility to open an offshore account online, through their International Banking Centre (IBC), or by visiting a branch.

Banking services for offshore accounts in UK

In addition to overseas branches of local banks, non-UK residents can also open accounts with local traditional banks. Most international bank accounts have straightforward requirements. Typically, customers must provide copies of their passport (verified by a professional), proof of address, proof of income, and other necessary documents, and deposit the funds within a specified period.

Banking services for offshore accounts in the US

You can open an US offshore account with the US branches of your local banks. Customers can either schedule a visit to the US branch with the assistance from Hong Kong staff or apply for a US bank account online. It's worth noting that local banks also offer offshore account opening services, albeit with specific minimum requirements.

Banking services for offshore accounts in AU

Some Australian banks allow online applications for offshore account opening. To apply, customers must provide their passport details, Taxpayer Identification Numbers (TIN), and an Australian address, and phone number. It is also mandatory for the customer to visit Australia within one year. Nevertheless, not all Australian banks offer online account opening. In such cases, customers are required to physically visit a branch upon arrival in Australia to start the process.

Please note that the offshore account services mentioned above are specific to personal offshore accounts. For details regarding business offshore accounts, please refer to the information below.

What are the differences between offshore bank accounts and local bank accounts?

Key features of offshore bank accounts

The key feature of offshore bank accounts is the potential to transfer funds internationally without the limitations by the home country's regulations (such as foreign exchange controls) depending on the jurisdiction. Moreover, once funds are transferred to an offshore account, whether for daily expenses, savings, or investments, these accounts can help reduce currency conversion losses and lower transaction fees.

Key features of local bank accounts

Local bank accounts offer significant advantages in terms of convenience. Customers can easily visit staff for any inquiries or issues. Additionally, many major local banks offer foreign currency accounts, allowing transactions and fund transfers in different currencies. It is important to be mindful of the supported currencies and associated transaction fees.

Features | Offshore bank accounts | Local bank accounts |

|---|---|---|

Account opening requirements | Visit your local branch, though some allow online account opening | Visit a branch or open an account online |

Deposit requirements | Varies depending on individual banks and account tiers, ranging from no minimum to several million Hong Kong dollars (HKD) | Varies depending on individual banks and account tiers |

Account services | Online banking, deposits and withdrawals, transfers, investments, credit and debit cards | Online banking, deposits and withdrawals, transfers, investments, credit and debit cards |

Deposit protection | Subject to local legislation | Protected by the Scheme of Hong Kong Deposit Protection Board, with a compensation up to a limit of HK$500,000 |

Why use offshore accounts?

Offshore accounts are becoming more popular among individuals and businesses looking for financial advantages beyond their home countries. Here are a few reasons why you should consider opening an offshore account.

You are currently or planned to live, work and retire abroad

You are an international assignee who frequently travels or relocates for work

You get paid in foreign currencies

You own foreign assets, like investments or property

You provide financial support to family members abroad, such as covering a child's school fees.

Benefits of offshore accounts

Speed up international trades

Engaging in international business with overseas suppliers, customers, and employees often involves fund transfers that can take half a day or more, leading to considerable inconvenience. By using local bank transfers, funds can be promptly transferred to the accounts of suppliers and employees.

Reduce costs related to international trade

With international remittance, both the banks of the payee and the payer impose fees. For instance, wire transfers to the UK or the US carry a transfer fee of tens of dollars, whereas local bank transfers typically have no transaction fees.

Diversified financial services

Companies with international operations can benefit from a range of financial services such as foreign currency hedging, investments, or even borrowing in foreign currency. To access these services, it is often advantageous to have an offshore bank account.

Benefits of offshore account to wholesalers

Offshore accounts empower wholesalers with significant advantages, including tax optimisation, asset protection, streamlined international transactions, confidentiality, and access to diverse financial services. They enable tax efficiency through favourable jurisdictions, shield assets from legal risks, simplify cross-border payments, ensure privacy for sensitive transactions, and offer a broad spectrum of financial tools and investment options. These accounts play a pivotal role in enhancing financial strategies, minimising risks, and fostering growth opportunities for wholesalers in the dynamic global marketplace.

How do I open an offshore bank account?

Companies have the options to open offshore bank accounts directly with overseas banks or through local banks that have offshore branches.

Requirements and procedures for opening an offshore account with local bank assistance

While it is relatively convenient to open an account through local banks, not all banks offer offshore account services to corporate clients. Additionally, customers should consider whether the bank's branch network supports their overseas business operations.

While banks may assist with setting up offshore bank accounts, companies are still obliged to submit the necessary documents to meet local government and bank regulations for account opening.

Requirements and procedures for setting up an offshore account independently

Typically, securing an offshore account requires applying under the name of a locally registered or offshore company, such as those registered in the British Virgin Islands, Cayman Islands, or the Bahamas. To open a corporate bank account in the UK, two main criteria generally apply: the applicant must be either a registered UK company or an offshore company. Furthermore, the applicant should be a local tax resident, except for those based in the Channel Islands and the Isle of Man.

Applicants can choose to visit local branches or contact the bank's corporate banking division. In response to the pandemic, some banks now offer online account opening services.

Required documentations

Applicants must provide company details, including the company address with postal code, and contact details such as a landline number, mobile number, and email address. For limited companies and partnerships, a Companies House registration number (CRN) is needed, along with the estimated annual turnover. Personal information of shareholders and directors is also required, including their full names, date of birth, phone number, email address, and current residential address (plus previous addresses if they have lived at the current one for less than three years). For HSBC customers, an account number is necessary, along with credit and debit card information.

Can overseas virtual bank accounts replace traditional overseas bank accounts?

The definition of virtual banks and its features

Virtual banks, unlike traditional banks, have no physical branches. They rely on the internet to provide a range of financial services such as account opening, transfers, deposits, withdrawals, and bill payments. This means virtual banks can operate round the clock, offering lower fees and higher deposit rates than traditional banks. Additionally, virtual banks are still regulated by the local government and therefore enjoy the same deposit insurance protection as traditional banks.

Overseas virtual bank accounts

Similar to traditional banks, most virtual banks only accept applications from locally registered companies. Almost all virtual banks require the applicant or the significant controller of the company to be a local or tax resident, which may not be suitable for businesses and residents in Hong Kong.

Steps to opening a remote offshore account

Virtual banks offer remote account opening services to cater to individuals who cannot physically visit a local branch. While the procedures may differ slightly across virtual banks, the general steps and required documents are as follows:

Begin by selecting the option to open a business account on the virtual bank's website.

Fill out a brief online application form, including the applicant's full name, address, and date of birth.

Provide company and business details, such as the registered name, registration number, and trade name (if applicable) of the company

Some virtual banks may request submission of the company's registration certificate or other registration documents.

Provide the names, addresses, dates of birth, and address proof for shareholders and directors.

Wait for the bank to process the application.

Fees for an offshore account

Overseas virtual banks offer a range of account tiers with varying monthly fees. The basic company account is usually free of charge, and supports local real-time transfers and cash deposits at ATMs. However, for international SWIFT transfers, a transaction fee of less than 1% is usually applicable across all corporate account tiers.

What should you consider before opening an offshore account for your business?

It is important to consider the following factors when opening an offshore account for your business.

Consider your specific needs

For example, consider whether you need to make international payments to suppliers or employees. This clarity will help streamline the process and avoid unnecessary remittance fees.

Make sure you are eligible

Review the account opening requirements, along with the legal and tax regulations of the target country or region. Some banks only accept applications from local tax residents and registered companies so those might have to be ruled out.

Legal regulations and security

Evaluate the level of legal protection and asset security provided in the local jurisdiction, including the bank's reputation, geopolitical situation, and any deposit protection limitations.

Costs

Consider the financial and time costs associated with opening an offshore account. Certain banks may have complex processes, require in-person visits, or impose service fees and minimum deposit requirements. Applicants should weigh the costs against the potential business value.

Airwallex: the innovative platform as an alternative to offshore accounts

Since quite a number of offshore bank accounts exclusively allow registrations from local registered companies or local tax residents, this poses challenges for foreign companies seeking to open an account from abroad. For small and medium-sized enterprises, registering a company in another country or region can be a complex process, requiring additional resources, manpower, and tax-related concerns.

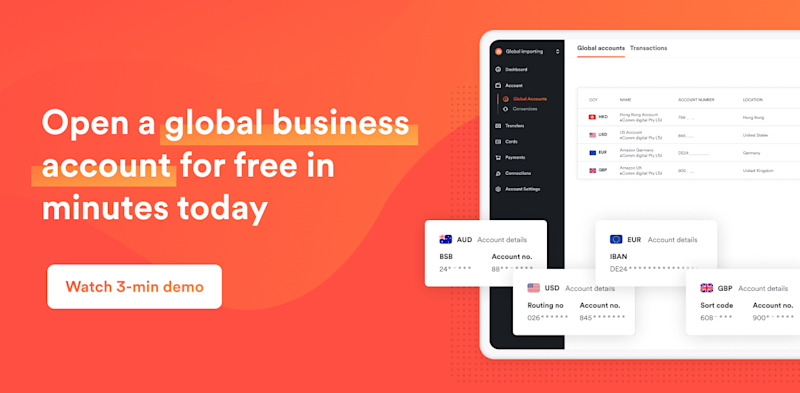

In comparison, Airwallex Global Accounts serves as a viable alternative to offshore bank accounts.

Airwallex features and security measures

Airwallex Global Accounts are available in more than 60 countries, allowing you to operate in your registered company's local currency. The Global Accounts come with local bank and branch codes and dedicated account numbers, allowing for local receipts in over 180 countries and transfers to over 150 countries. Funds can be credited as fast as the same day.

With Airwallex, you can effortlessly open accounts in multiple currencies online, eliminating the need for local company registration or cumbersome on-site procedures. Enjoy the convenience of corporate accounts for seamless transfers, international transactions, and efficient management of global funds. Airwallex has implemented commercially reasonable administrative and technical measures to protect the funds collected for or received from customers in connection with our services.

Benefits of opening an Airwallex Global Account

Opening a global account with Airwallex is not only convenient but also incredibly fast. For instance, you can open an Australian dollar account with local bank details online, with 90% of transactions arriving within a few hours or the same day, all without transaction limits. Sign up to grow your business beyond borders.

*Information as of January 2025. Please refer to the official websites of banks and payment platforms for the most up-to-date information.

Share

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

View this article in another region:Hong Kong SAR - 繁體中文

Related Posts

Top tips to ensure your Airwallex transfers go smoothly

•10 min

Guide to applying for Hong Kong Business Registration Certificate...

•10 min