Remittance to Mainland China: guide to all methods, restrictions and fees

- •What are the restrictions on remittance to Mainland China?

- •Four common ways to remit to Mainland China

- •Option 1: Remittance through local banks

- •Option 2: Remitting to Mainland China with E-wallets

- •Option 3: Remitting to bank accounts in Mainland China with money changers

- •Option 4: Airwallex, the cross-border remittance platform

- •FAQ

Making a transfer to mainland China? This comprehensive guide offers a detailed overview of various methods, restrictions, fees, and security considerations when sending money in Chinese Yuan (CNY). Whether you're an individual or a business, you'll find the answers here. Learn how to transfer funds from Hong Kong to mainland China effortlessly with peace of mind.

What are the restrictions on remittance to Mainland China?

Due to the fact that the CNY is not freely convertible and transferable, there are distinct separations between commercial and personal remittances to Mainland China, with different restrictions on the remittance amounts and recipients.

For individuals, there is a daily limit of 80,000 CNY for remittance through banks and the remittance can only be credited to the bank account and card under the same name. In other words, if you need to transfer money to relatives or friends in Mainland China, wire transfers through banks are not possible. As for businesses, remittance can only be made to approved commercial accounts between the two regions. If a single remittance exceeds US Dollars (USD) $50,000, it must comply with the Guidelines for the Foreign Exchange Administration of Trade in Services, and the companies are required to provide with contracts, invoices, or other verification documents for processing.

Four common ways to remit to Mainland China

There are currently four common methods for remittance from Hong Kong to Mainland China. These include wire transfers through banks, e-wallets, money changers, and cross-border remittance platforms. Each method has different characteristics in terms of required documentation, fees, restrictions and risks. A detailed breakdown will be provided below.

Option 1: Remittance through local banks

The documents required for remittance through banks

Wire transferring with banks is a traditional and widely used method of remittance. It involves transferring funds from the remitter's bank account in Hong Kong to the recipient's bank account in Mainland China. The specific procedures and required information may vary slightly among banks, but generally speaking, the remitter needs to provide the recipient's bank's SWIFT code, account number, name, address, as well as the purpose of the remittance. Once all the necessary information is confirmed, the wire transfer can be processed.

SWIFT Codes are composed of 8 to 11 letters or numbers. It includes a 4-letter financial institution code, a 2-letter country code, a 2-digit city or location code, and a 3-digit bank branch code (if applicable).

Here are a list of SWIFT Codes for major banks for reference:

HSBC Bank: HSBCHKHHHKH

Bank of China (Hong Kong): BKCHHKHH

Hang Seng Bank: HASEHKHH

Standard Chartered Bank (Hong Kong): SCBLHKHH

China Construction Bank (Asia): CCBQHKAX

Industrial and Commercial Bank of China (Asia): UBHKHKHH

Information required for remittances to mainland China

Name and address of the receiving or remitting bank

SWIFT Code of the receiving or remitting bank

Account number of the receiving or remitting bank

Purpose of the remittance

Fees for Remittance through local banks to Mainland China

You can process remittance either by visiting a bank branch or via online banking. There is no difference in terms of processing time as funds can be credited as quickly as on the same day for both methods. However, the fees and processing time vary depending on the remittance channel and the type of account. In general, remitting through bank branches incurs higher transaction fees, of about HK$210 to $260, compared to online banking, amounting to nearly half or even two-third of the fees charged by online banking. Online banking also saves time by eliminating the need to wait in line at branches.

Things to note when remitting to banks in Mainland China: fees, exchange rates, and cutoff times

Remitters should be aware of the fees, exchange rates, and cutoff times when remitting to Mainland China through banks.

With third-party banks involved during the remittance process, there may be additional costs incurred that will be borne by the remitter or deducted from the remittance amount received by the beneficiary. It is also important to note that the exchange rate offered by the banks may vary and fluctuate. Additionally, banks have different cut-off times for remittances. If the remittance is processed after the cut-off, it will be processed on the next business day. Individuals should allow ample time for processing if same-day crediting is required. There might be delays if the remittance is sent to regions with different time zones than Hong Kong.

What are the advantages of bank remittance?

Banks are trusted parties due to their credibility, security, and reliability. With their extensive branch networks and online platforms, they provide convenient options for remitters based on different circumstances. It is worth noting that if remitters need to inquire about the status or progress of their remittances, some banks offer free online access, while others may require remitters to submit a request at bank branches and fees might be charged.

Option 2: Remitting to Mainland China with E-wallets

Supported E-wallets in Hong Kong for remittance to Mainland China

E-wallets have become a popular mobile payment tool in recent years. Users can make purchases online and in physical stores with their smartphones and computers, and e-wallets offer diverse methods for topping up or adding funds, such as using credit cards, bank accounts, or even top-up services at specific merchants.

In addition to merchant transactions, e-wallets also support person-to-person (P2P) transfers, allowing users to transfer money to another person's e-wallet. Some e-wallets even have the functionality for cross-border remittances to Mainland China and allow fund transfers to accounts that are not under the same name. E-wallets also offer competitive remittance fees, ranging from a few tens to sometimes exempting fees depending on the remittance amount.

Using AlipayHK as an example, you can transfer funds to mainland China via Alipay and funds can be credited in real-time. No handling fee will be charged for the first remittance of new users, or if the amount exceeds CNY ¥3,500 for single transfers.

Remittance is a fairly straightforward process, provided that users have completed an intermediate to high-level authentication. Both intermediate and high-level users have a daily transaction limit of HKD $7,999, with annual limits of HKD $100,000 and HKD $300,000, respectively. However, for users who have completed identity verification through ID scanning and selfie authentication, the daily transaction limit is raised to HKD $15,000 with an annual limit remaining at HKD $300,000.

Once the authentication processes are completed, navigate towards the "Remittance" section in the AlipayHK app and click on the "Initiate Remittance" option. Then, select the intended destination, preferred method of payment for the recipient, and enter the desired amount and necessary recipient details for the remittance. Confirm all information to complete the transaction.

*As of 14 January 2024. Information provided is for reference only. Please refer to the official websites for the most up-to-date details.

The documents required for remitting with E-wallets

The documents required for E-wallets are relatively simple. In general, the following details are required:

An e-wallet account

Recipient information and payment method

Purpose of remittance

Things to note when remitting with e-wallets

Remitters should ensure that their account has sufficient funds and verify if their own and recipient's account meet the eligibility requirements before the remittance. For instance, some e-wallets may require specific authentication procedures to remit funds to personal and family accounts.

Additionally, e-wallets are not suitable for large remittances as they usually have lower daily remittance limits of around CNY ¥20,000 compared to bank wire transfers.

What are the advantages of e-wallets?

E-wallets serve as convenient payment tools for daily transactions and also offer cross-border remittances. With proper authentication in place, users can easily make remittances to their personal or family accounts in Mainland China anytime and anywhere using the mobile application. The funds are credited instantly, and the transaction fees are relatively affordable compared to traditional wire transfers, making them suitable for individuals who require small-scale remittance services.

Option 3: Remitting to bank accounts in Mainland China with money changers

Money changers in Hong Kong have a long-established presence, with shops being prevalent and well-known. In addition to offering currency exchange services, many money changers also provide remittance services.

The documents required and the procedures for remitting with money changers

The required information and documents are similar to those needed for bank wire transfers when remitting funds to Mainland China through money changers. These typically include the remitter's identification documents and address, a copy of the recipient's identification document, contact number, and account information.

The remittance process at a money changer is generally straightforward. As long as the remitter provides the required information and the remittance amount, the payment can proceed once the exchange rate is confirmed.

Money changers do not charge fees, but the exchange rate might be marked up

Many money changers do not charge any transaction fees or commissions. However, they may offer exchange rates with a certain markup. It is advisable to refer to the central parity rate to choose one with a lower premium.

Is it safe to remit with money changers?

With the involvement of third-party intermediaries, there may be certain risks associated with money changers. To ensure security, remitters are suggested to choose licensed and reputable money changers with a larger scale of operations. It is also advisable to retain the receipts for each transaction in case of any delays or issues regarding incorrect crediting as the receipts will serve as evidence and facilitate the follow-up process.

What are the advantages of remitting with money changers?

Money changers offer favorable fees and exchange rates compared to banks. Some money changers even advertise that they do not charge any handling fees or commissions. Additionally, money changers often have longer operating hours, which makes it more convenient for individuals who need to exchange foreign currencies and remit outside of regular banking hours.

However, remittance through money changers might take longer (several days to one or two weeks) compared to online remittance services offered by banks or e-wallets. It is recommended for remitters to allow sufficient time for the process.

Option 4: Airwallex, the cross-border remittance platform

As mentioned previously, bank transfers to mainland China are only possible between accounts under the same name. Therefore, if a Hong Kong company wishes to remit CNY to a mainland company, the mainland company must be registered with its mainland settlement bank in the Cross-Border RMB Payment and Receipt Management Information System (RCPMIS). Hong Kong companies will also need to provide various information, including the recipient bank's address, purpose of the remittance, and the Proof of Receipt submitted by the mainland Company to mainland banks.

In addition to the aforementioned channels, cross-border remittance platforms have emerged as one of the fastest-growing options for corporate remittances in recent years. Airwallex is a professional remittance company used by businesses, allowing users to make transfers in over 46 currencies to more than 150 countries and regions, including Mainland China. Airwallex stands out as the preferred choice for corporates with competitive advantages in terms of cost, transparency, remittance processing time, restrictions, and management.

Fees for currency exchange with Airwallex

Airwallex offers real-time competitive exchange rates with fees as low as 0.2% above the interbank rate, without minimum transaction amount. Businesses can save on the cost for currency exchange fees.

Additionally, Airwallex is regulated by the Customs and Excise Department of the Government of the Hong Kong Special Administrative Region and holds a Money Service Operator license (MSO) (MSO License No. 16-09-01929). The company is also registered or authorised by regulatory bodies in countries like the United States, the United Kingdom, Australia, Canada, Malaysia, New Zealand, Singapore, and others.

The procedures and required information for cross-border remittance platform

The platform of Airwallex is user-friendly and straightforward. Businesses simply need to provide information such as the recipient's bank details, account number, currency, and remittance amount. You can easily process remittance with Airwallex by following the steps below.

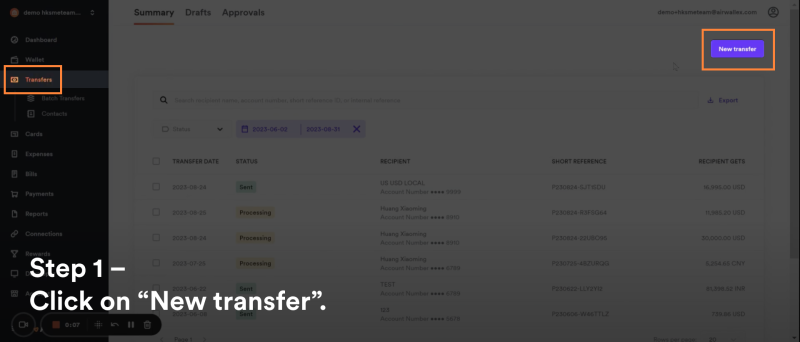

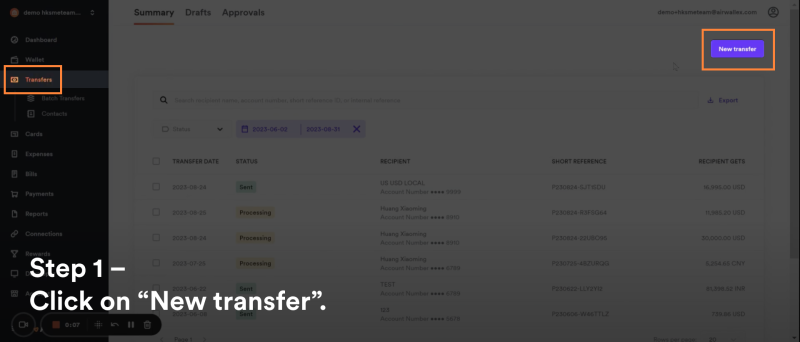

Click on "New transfer": Under "Who are you transferring to?", choose between "Existing recipient" or "Someone new."

Fill in the remittance details: This includes the remittance amount, currency, recipient's location, and remittance method.

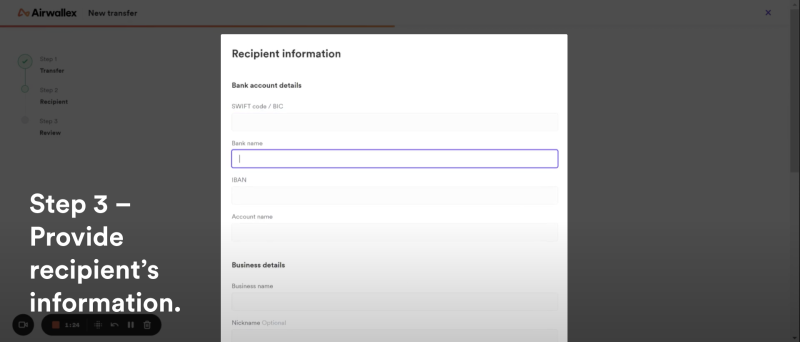

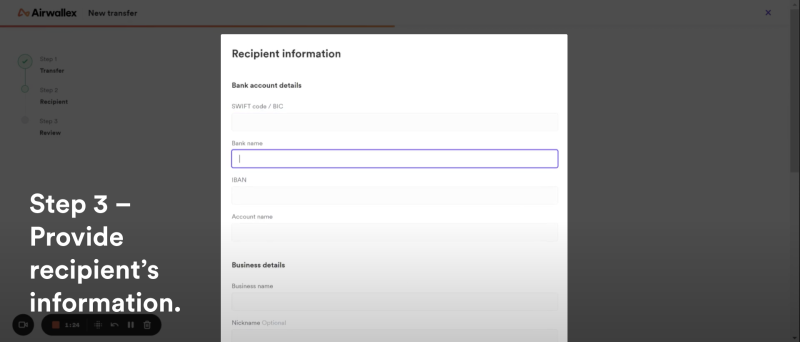

Provide recipient's information: This includes the SWIFT code, bank name, and account name.

What are the advantages for remittance platforms?

With Airwallex, businesses can benefit from competitive exchange rates and affordable fees for cross-border remittances. The remittance process is generally completed within 3 to 5 business days, and the funds can be credited as quickly as the same day. Additionally, there are no monthly fees or hidden charges for business accounts, and Airwallex supports transfers in over 46 currencies to more than 150 countries and regions. You can manage your fund flows on a single platform for maximum operational efficiency.

FAQ

Does Airwallex support remittance from Mainland China to Hong Kong?

Yes. As a professional remittance company, Airwallex supports remittance from Mainland China to Hong Kong, along with over 40 currencies for transfers to more than 150 countries and regions. Supported currencies include USD, British Pounds (GBP), CNY, Euros (EUR), Japanese Yen (JPY), Korean Won (KRW), and more. Funds can be credited as quickly as within one business day, and customers can enjoy favorable exchange rates compared to banks. With Airwallex, you can make fast single or recurring international transfers in multiple currencies, making remittance faster, simpler, and more secure.

Does Airwallex provide personal account services?

No. Airwallex only offers remittance and payment services for corporate clients and does not support individual users at the moment.

Share

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

View this article in another region:Hong Kong SAR - 繁體中文