Choosing an international banking account for your business: comparison and factors

- •What is an international banking account?

- •What types of international banking accounts for business are there?

- •Traditional vs. virtual bank accounts

- •Choosing the right international banking account

- •Factors to consider when choosing an international banking account

- •Why do SMEs and start-ups struggle to open bank accounts?

- •What makes Airwallex Business Account stand out?

What is an international banking account?

An international banking account, also known as a corporate bank account, is designed exclusively for companies and registered under the entity's name rather than an individual. International banking accounts go beyond the basics, offering advanced features designed to streamline and support business operations. From multi-currency management to corporate credit cards and tailored financing solutions, these accounts cater to the unique needs of businesses, improving their financial agility and operational efficiency.

Opening an international business banking account can involve more stringent requirements than personal accounts. Banks typically require extensive documentation, longer approval processes, and may impose higher fees. Small to medium-sized enterprises (SMEs) and start-ups often face challenges when applying for these accounts, with some being denied due to various reasons.

What types of international banking accounts for business are there?

Businesses today often span industries and borders, necessitating transactions in a wide range of currencies, including HKD, USD, GBP, and many others. An international banking account tailored to meet different needs – whether domestic, overseas, or global – is vital for international trade. An international banking account enables smooth transactions, helps mitigate currency risks, and supports streamlined financial operations.

Local Business Accounts: Perfect for companies operating within Hong Kong, these accounts support transactions in the local currency while offering essential services such as payroll management and customer support via physical branches or online banking.

Overseas Accounts: International banking accounts can be set up through local banks operating abroad or directly with foreign banks. They enable payments and receipts in the local currency, reducing currency conversion fees and exchange rate risks. These accounts often operate independently of the regulatory frameworks in the company’s home country.

Global Accounts: Combining the strengths of local and overseas accounts, global accounts empower businesses to handle multi-currency transactions and cross-border operations with ease. For example, HSBC’s Global Account simplifies financial management through free intra-bank transfers, while Citibank’s ‘Global View of Accounts’ provides a unified platform to consolidate accounts from multiple regions, ensuring streamlined operations.

Traditional vs. virtual bank accounts

The rise of fintech has introduced virtual banking options, offering an alternative to traditional banks. Here’s how they compare:

| Traditional bank account | Virtual bank account |

|---|---|---|

Account opening process | Complex onboarding, often requiring in-person meetings | Fully digital, with quick and convenient setup |

Fees | Higher fees | Lower fees, often with more affordable options |

Minimum deposit requirement | Often requires a minimum deposit | Lower or no minimum deposit requirement |

Provision of international services | Extensive cross-border networks | Depend on partner networks for international services |

Choosing the right international banking account

Selecting the right account depends on a business’s size, needs, and stage of development:

Start-ups: Focus on low-cost, flexible accounts with straightforward onboarding. Since start-ups often operate with limited cash flow, they need accounts that minimise monthly and transaction fees. Quick and easy account opening is essential for swiftly launching operations and managing finances efficiently.

SMEs: Aim to balance affordability with essential features. With established business models, they still need to manage operational expenses prudently. Accounts that offer a blend of comprehensive yet practical services – such as flexible financing options, overdraft facilities, business loans, and a variety of payment methods – are ideal for managing cash flow and supporting ongoing growth.

Large corporates: Require more advanced and tailored financial solutions to support their complex global operations. These accounts should offer a comprehensive range of services, such as robust cash management tools, international trade support, and sophisticated risk management solutions. They may also need to have access to special advice and help with expanding their business around the world.

Factors to consider when choosing an international banking account

When selecting a business account, companies should carefully evaluate the practicality and cost-effectiveness of the services offered, including fees, minimum deposit requirements, and the account opening process. The bank’s reputation, security standards, and the extent of its service network are equally important considerations.

With the growth of fintech, traditional banks, virtual banks, and third-party financial platforms are continually innovating and refining their services. Businesses should stay up-to-date with market trends to choose an account that suits both their current needs and future growth.

Why do SMEs and start-ups struggle to open bank accounts?

According to the Hong Kong Monetary Authority (HKMA), banks must conduct Customer Due Diligence (CDD) and risk assessments before offering account services to comply with anti-money laundering and terrorism financing laws. The process's duration may hinge on the completeness of the applicant's submitted information.

SMEs and start-ups often encounter significant challenges when opening bank accounts due to their limited operational history and financial documentation. Traditional banks can find it difficult to evaluate innovative business models that do not fit established norms. Combined with stringent documentation requirements, these factors often result in account application rejections, posing a substantial barrier to growth for emerging businesses.

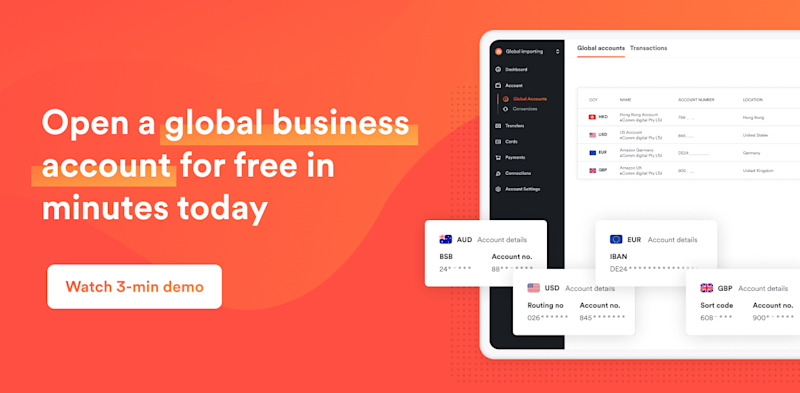

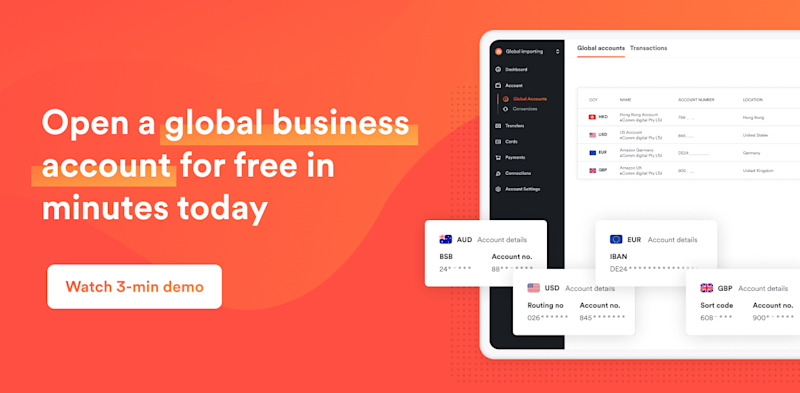

What makes Airwallex Business Account stand out?

Airwallex is an all-in-one financial platform offering businesses a seamless solution for global operations. With zero setup and monthly fees, companies can open accounts online and manage local accounts across 23+ regions under their company name, complete with local banking details. Funds from around the world can be received into the Airwallex global account, enabling efficient cash flow management while avoiding exchange rate risks.

Airwallex supports payments in 60+ currencies across 150+ countries and offers competitive exchange rates at only +0.2% above interbank rates. Airwallex’s local payment network ensures 90% of transfers are settled within the same day, and 50% even instantly – offering speed, security, and cost-efficiency for supplier payments and customer refunds.

Also, advanced API integration automates payment workflows, reducing errors while improving cost management and operational efficiency. Sign up for an Airwallex Business Account today.

Share

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

View this article in another region:Hong Kong SAR - 繁體中文