Adyen vs Airwallex: compare on fees, features and benefits

In the fast-paced world, the fees, speed, and accuracy of international transfers and foreign exchange can make or break a cross-border business. Here, we delve into the two leading global payment and financial solutions – Adyen and Airwallex – to help you make better decisions and accelerate your business growth.

What is Adyen?

Adyen is a global payments platform that allows businesses to accept payments online, on mobile, and at the point of sale. The company was founded in 2006 in Amsterdam by a team of entrepreneurs, including current CEO Pieter van der Does and former CTO Arnout Schuijff.

The initial focus was providing advanced analytics tools to help businesses optimise their payment processes. However, Adyen soon recognised an opportunity to build a full-stack payment platform from the ground up, leveraging modern technology to overcome the limitations of legacy systems.

Over the years, Adyen has expanded its product suite and geographical footprint, obtaining licenses to operate as a payment institution across Europe, North America, Latin America and Asia Pacific. However, some of their financial products, such as business accounts, cards and global payouts that streamline global operations, are only available in Europe, the US, and the UK.

Adyen's key aspects include:

Online payments: Accept major card schemes, mobile wallets, and local payment methods in a single integration.

Unified commerce: Capture payments across online, in-app, and in-store channels with centralised reporting and management.

Payment optimisation: Access data-driven tools to enhance authorisation rates, prevent fraud, and reduce chargebacks.

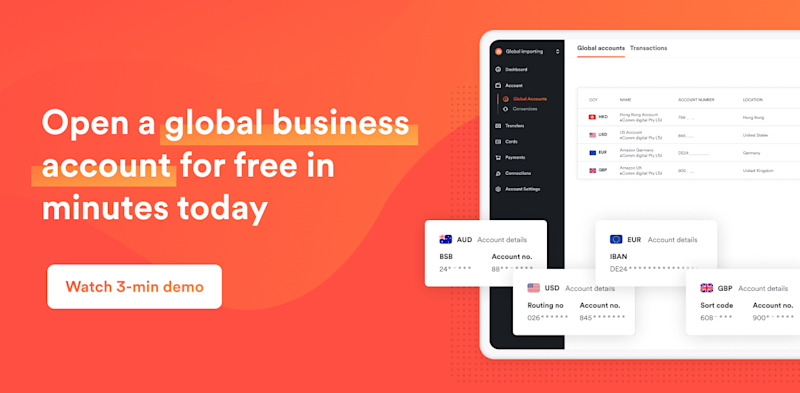

What is Airwallex?

Founded in 2015, Airwallex is a one-stop payment and financial solution designed for growth-stage businesses and enterprises across multiple geographies. It is a fintech platform enabling businesses to seamlessly manage cross-border payments, collections, and finances.

Purpose-built for digital businesses, Airwallex’s end-to-end financial stack helps companies scale globally across commerce, payouts, spend management and more. Core elements include:

Global Accounts: Create accounts in 23+ currencies and 60+ countries, including GBP, USD, EUR, AUD, CAD, CNY, etc. Every currency account is assigned unique account details for local and international payments.

Online Payments: Accept payments from 180+ countries in 180+ currencies and 160+ local payment methods. Integrate via hosted checkout, API, payment links, or partner plugins. Maximise global acceptance with smart 3DS engine and reduce chargebacks with built-in fraud prevention.

Transfers & FX: Make rapid, no-fee payments to more than 120 countries through local payment rails and avoid costly cross-border fees. Send 60+ currencies at the interbank rates to save 80% on FX fees. 85% of transactions are same-day payouts, and 50% of which are instant.

Multi-currency Borderless Cards: Issue Visa corporate and employee cards with custom spend controls in just a few clicks. Use Airwallex Borderless Cards in-store or online.

Bill Pay: Send invoices across entities, currencies, and countries. Attach payment links to collect funds faster. Airwallex can automate batch payments of up to 1,000 across currencies and countries.

Integrations: Sync data in real-time with Xero, NetSuite, WooCommerce and other ecosystem tools.

Adyen features and fees explained

For each transaction, Adyen charges a fixed processing fee and a fixed fee determined by the payment method.

Here are some representative Adyen fees:

Visa/Mastercard: US$0.13 per transaction + 0.60% + Interchange fee

American Express: US$0.13 per transaction + 3.95% (US$0.10 + 3.3% for transactions in North America)

Adyen provides point-of-sale (POS) terminals for in-store payments that support contactless, chip and PIN, and swipe cards. These terminals have upfront and/or rental costs in addition to transaction fees.

Adyen also offers issuing capabilities like physical/virtual cards (to enterprise customers), although not available in Hong Kong. In addition, pricing is opaque, and limited public data is available.

Airwallex features and fees explained

Airwallex uses a simple pricing model for card acceptance:

3.30% + HK$2.35 for domestic cards

3.6% + HK$2.35 for international cards

This covers all major card networks and payment methods like Visa, Mastercard, American Express, Apple Pay, and Google Pay.

Airwallex also offers more transparent and affordable FX pricing. Businesses can:

Collect funds in 23+ currencies with unique local bank details at no extra cost

Access interbank FX rates for 60+ trade currencies

Bypass SWIFT fees for 120+ countries leveraging local rails

Airwallex provides free physical and virtual Visa cards for companies to pay business expenses in multiple currencies. For tracking spending in real time, expense management is offered at HK$40 per cardholder per month.

Adyen vs Airwallex additional capabilities

Beyond core payments, Adyen and Airwallex provide supplementary tools to help companies transact globally:

APIs and integrations

Adyen offers API endpoints and plugins for leading eCommerce platforms, ERP and POS systems

Airwallex supports direct integrations with Shopify, WooCommerce, Magento, Xero, NetSuite and more

Risk management

Adyen’s RevenueProtect tool leverages data across its network to block fraud and minimise chargebacks in real-time

Airwallex allows setting velocity limits, blocklists and purchase restrictions to catch suspicious activity early

Support

Adyen follows a premium onboarding and technical account management model for enterprise clients

Airwallex offers customer support to all customers and dedicated account managers to eligible customers

Final thoughts

Adyen delivers a powerful solution for a small number of enterprise companies processing massive payment volumes across in-store and digital channels. Its single platform for unified commerce is attractive to high-GMV (gross merchandise volume) brands.

On the other hand, for businesses of all sizes that are rapidly expanding worldwide, Airwallex offers more flexible and affordable global payment capabilities.

These include:

Local collection methods in 180+ countries settle directly into multi-currency digital accounts

Convert and payout at superior FX rates via local payment rails

Manage international expenses and achieve one-click reconciliation from an integrated platform

By bundling payment acceptance with cross-border money movement, FX and finance automation, Airwallex empowers digital businesses to scale internationally with fewer constraints.

Transparent usage-based pricing with minimal upfront investment means predictable costs even as transaction volumes fluctuate. So while Adyen remains a compelling enterprise-grade payments provider, Airwallex is uniquely positioned to help digital-first businesses grow globally without friction.

Sign up today to unlock your global growth.

Sources:

Information on Adyen was retrieved as of July 2024, from below sources. Information provided is for reference only. Please refer to the official website of Adyen for the most up-to-date details

https://www.adyen.com/online-payments

https://www.adyen.com/pricing

https://docs.adyen.com/api-explorer/

Disclaimer: The information was based on our own online research and we were not able to manually test each tool or provider. The information is provided for educational purposes only and a reader should consider the specific requirements of their business when evaluating providers. This research is reviewed every 6 months. If you would like to request an update, feel free to contact us at [email protected].

Share

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

View this article in another region:AustraliaHong Kong SAR - 繁體中文SingaporeUnited Kingdom

Related Posts

Opening a mainland China bank account for Hong Kong businesses: p...

•10 min

Five popular eCommerce platforms in Hong Kong: pricing, features,...

•10 min