Break even analysis: The #1 reason most eCommerce businesses in Hong Kong fail to scale

As consumers are increasingly turning to shopping online, eCommerce sales in Hong Kong are expected to grow at a compound annual growth rate of 8.3%, reaching HK$266 billion in 2024.

To tap into the immense growth potential in eCommerce, many people have started their own online business. However, this isn’t an easy journey with 9 out of 10 eCommerce businesses failing within the first 4 months.

When starting a new business, breaking even is an important milestone to aim for. Knowing your break even point helps you plan for your future. Without performing a break even analysis, your business may face the risk of running out of cash. Let’s go through how you can utilize break even analysis to map out your business’ pricing strategy and plan for success.

What is a break even analysis?

A break even analysis is used to determine the number of products that a business has to sell in order to cover its total costs. In other words, it’s a formula that can help you determine your total fixed business costs and the income goal you need to hit to cover these business costs completely.

At the break even point, your business isn’t losing or making any money. Once you’ve passed the break even point, your business becomes profitable.

By performing the break even analysis, you can figure out how much to price your product, what your fixed costs are, and set targets for your business revenue.

Why a break even analysis is critical for eCommerce businesses

It helps you set clear, logical goals

If you’re launching a new product or service and you’re not sure what to price your offering, break even analysis is a great tool to help you find out what your pricing strategy should be in order to run a profitable business.

Once you’ve identified what costs go into each unit of your stock and how many units you need to sell each month to cover your operating costs, then you’ll know how to set your sales targets and what you’re able to safely spend on acquisition so that you can build a profitable business.

You’ll make smarter plans for the future

When deciding on whether or not to launch a new sales avenue, you can first conduct a break even analysis. If your analysis indicates that the new strategy will fail to break even, you may find that it is not worth your time and energy to pursue it. On the other hand, knowing what your exact break even point is can give you a peace of mind to make informed business decisions such as starting a short-term pop-up location or moving your sales from your Instagram shop to a centralized website.

It also helps you reduce potential business risk. By undertaking a break even analysis before launching a new product, or pursuing a new business opportunity, you’ll be able to easily tell if it’s unlikely to be profitable, and you can avoid sinking your time and money into something that ultimately won’t work out.

From an investor’s perspective, it offers them valuable insights into whether or not to put money in a business. When a business has a clear break even point, it allows investors to identify at which point the business turns profitable and they can start collecting a return on their investment.

Ready to work out your break even point now? Download our free break even point calculator by clicking the button below.

How to perform a break even analysis

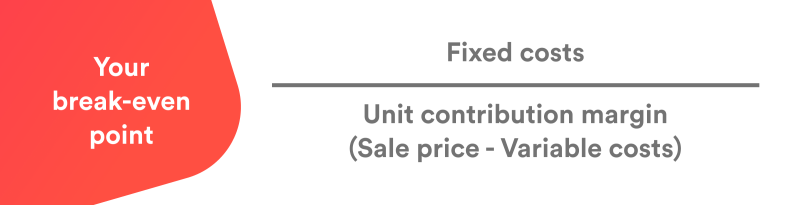

To calculate break even point based on units, divide your total fixed costs by the sale price per unit minus the variable cost per unit (margin).

In order to accurately find the break-even point, you first need to determine your business’ fixed costs and variable costs.

What is a fixed cost?

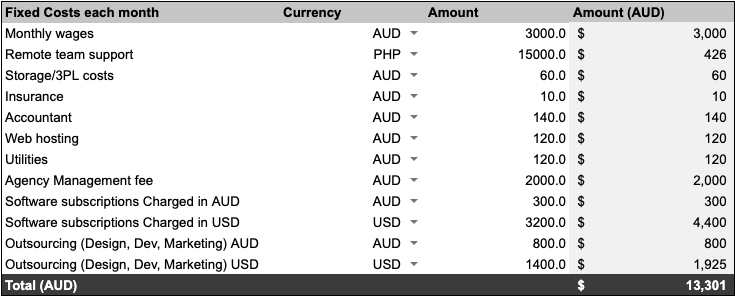

These are the costs that your business must pay each month, or year. They’re the costs that remain roughly the same, regardless of your business’ income.

This covers things like your rent or a mortgage, insurance, utility costs, product storage costs, and software subscriptions. Essentially, it’s what you spend on your business, rather than producing your stock. If you're using our break even template, fill out your business fixed costs in the currency you're charged into the table marked Step 1, just like below.

What is a variable cost?

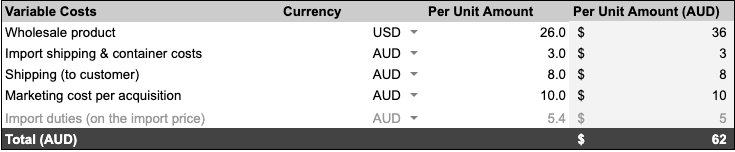

Variable costs are the individual costs that go into making or selling one unit of your stock, which are subject to change for any reason.

Say, for example, you sell something like magnetic bottle openers painted in football team colours, that you source from Vietnam. You’ve got your individual costs for the materials. There are costs for labour to paint them. There are costs for packaging, postage, and even payment processing fees for transferring money internationally to your supplier.

Add these into the Variable Costs table within your break even analysis tool to find your break even point.

How to calculate your break even point

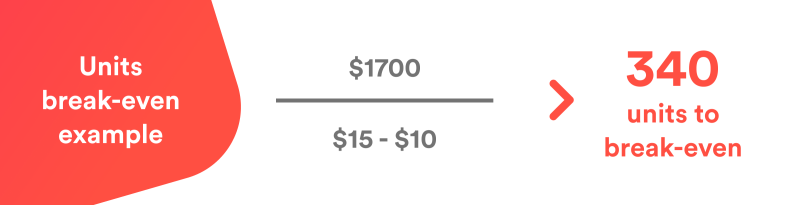

Now that you've determined your fixed and variable costs, it's time to calculate your break even point in units. This is the magic number of how many units you need to sell in a given period, in this case, a month, in order to break even.

To calculate your unit break even point, divide your total fixed costs by your sale price minus your variable costs to land at your break even number.

Example: break even units

You sell your magnetic bottle openers for HK$80 each. Sourcing, labour, packaging, posting, and everything else comes to HK$55 per item.

Your total fixed costs for your storage space, office rent, subscriptions to your creative tools, and your utilities, comes to $11,000.

Example: break even point in sales dollars

This follows a similar process, but involves the product’s contribution margin in your calculations.

The contribution margin is the percentage of your product’s sales cost that’s left after all the product costs are paid for—so the percentage of the sales price that contributes to your profit.

Our free break even tool can calculate all this for you automatically. Click the Try now button below to get your free copy.

2 levers for improving your unit economics

The seemingly obvious way to lower your break even point is to raise the prices of your product.

But it’s not that easy. Customers are sensitive to price increases. They don’t like change. This can backfire, and cause a drop in your customer base.

So if this method looks like it could price you out of the market, it’s better to look at your costs instead.

1. Lower your fixed costs

You’ve mapped out all your fixed costs, so now find the unnecessary ones that you can remove.

It might be looking at better-priced storage options, finding a cheaper internet provider, or seeing if you can negotiate a rent reduction. It might mean stopping spending on some aspects altogether.

Or, it can be as simple as switching from a bank account with a monthly fee to a fee-free account.

This is where Airwallex can help you out. You pay no fees on your business accounts – ever, and you can open global accounts in 11 currencies, so you won’t have to pay international transfer fees either. This one easy change means you can permanently reduce banking costs for your business.

It might sound small, but these add up quickly.

2. Lower your variable costs

Lowering your variable takes a little more effort.

This can include finding new suppliers that offer lower prices for your raw materials, or have better bulk rates. You can find a manufacturer with better economies of scale or a shipping company with better deals to help cut down on your logistics costs.

Maybe your gift box doesn’t need that piece of decorative tissue paper, or you can stop adding print-outs and freebies to all your packages.

Another way is looking at the fees you pay on your banking. For example, if you source your products outside of Hong Kong, you’re likely paying international transaction fees.

Both Airwallex Multi Currency Cards and Global Accounts help you cut out international transaction fees altogether. You’ll also receive a foreign exchange rate that’s up to 90% better than what any of the big banks can offer. Here’s how one of our customers is able to save up to 90% in exchange rates and transaction fees with our global account.

You’ll be able to reduce your spending costs, reduce your fees, and lower your break even point all at the same time.

Airwallex is the smarter way to do your business banking

Now that you understand your business’ break even point, it’s time to start making it as cost-effective as possible.

So if you’re looking to reduce your expenses, get the best price on your international payments, and say goodbye to bank fees for good, get in touch with Airwallex today. You can book a free online demo with a product specialist by clicking here to find a time slot that suits you.

You don't need a bank to run your business

Share

View this article in another region:Hong Kong SAR - 繁體中文

Related Posts

Opening a mainland China bank account for Hong Kong businesses: p...

•10 min

Five popular eCommerce platforms in Hong Kong: pricing, features,...

•10 min