How eComm businesses can avoid the conversion trap

As an eCommerce store, you might think FX rates don’t really affect how you do business — it only affects large corporations, right? Unfortunately, that’s not the case. Any size company can get stung by the conversion trap.

And if you’ve lost money from FX rates, you’re not alone. Research shows banks took £3.6bn in often hidden FX fees from small and medium sized businesses in 2022. This is money you could be using in your business, fueling growth efforts.

If you deal with overseas customers and/or suppliers, this blog is for you. We’re showing you how to avoid the conversion trap, save money, and manage money internationally without the need for additional resources.

P.s. We’ve helped many eCommerce stores efficiently manage their global payments while making FX cost savings in the process, so you’re in safe hands!

The problem you’re facing

It’s exciting when you start buying and selling inventory overseas; it means your business is accessing new and exciting audiences — which means growth. But you could be paying over the odds for FX rates, ultimately impacting your bottom line.

Suddenly, you’re accepting and sending money in various currencies; you’re probably using household names like Stripe and PayPal to manage your international transactions because they’re market leaders. But you’re getting charged unnecessarily for holding money, accepting and sending payments cross-border. You’re trapped in a conversion nightmare.

So, what is the conversion trap?

If you have suppliers and customers outside your country, you could be paying double currency conversions.

Here's an example:

You’re a Dutch company (the merchant), your customer is based in the US and your supplier is based in Vietnam but accepts USD.

Your US customer checks out in USD.

Your Dutch company then uses an acquirer/card network (e.g. Visa/Mastercard/Stripe/Worldpay) to auto-convert USD funds to EUR.

The acquirer pays out to your Dutch company in EUR. This is the FIRST CONVERSION

Your Dutch company then needs to pay suppliers in Vietnam in USD.

To do this, you must convert EUR to USD to pay the supplier. This is the SECOND CONVERSION

These two conversions can cost you up to 3-4%. Double currency conversions are not efficient. They impact your bottom line and drain internal resources. But here’s the thing, the conversion trap and double currency conversion are completely avoidable.

How to avoid the conversion trap

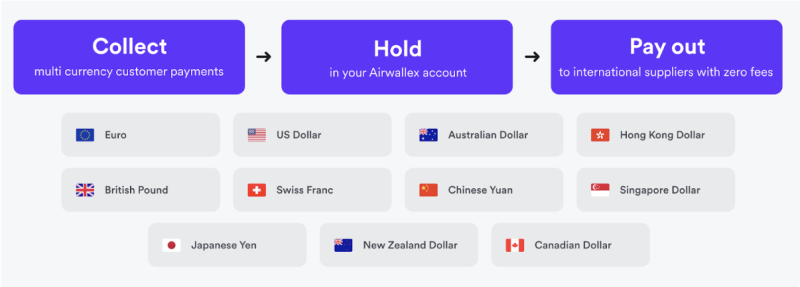

Avoiding conversion traps is surprisingly simple — you need a solution that allows you to collect and hold multiple currencies without being subject to FX fees and spend the currencies as and when required.

Historically, the way to get around this was by setting up a legal entity and business account in each market, which is lengthy and time-intensive — sometimes taking as long as six months. Then, there’ll be all kinds of red tape to get tangled up in, i.e. regulatory requirements.

But now, you don’t have to set up local entities in every country you want to trade in to avoid the trap.

Setting up an Airwallex Global Account helps you avoid those substantial FX rates you get with platforms like Stripe and PayPal. Instead, you can enter a new market in minutes, benefit from low FX fees and seamless integrations with online marketplaces like eBay, Amazon, and Shopify — with Airwallex.

How does an Airwallex Global Account work?

There’s nothing more long-winded than having to create multiple accounts for multiple locations and currencies. You’re a small eCommerce business — who has time for that?

By using Airwallex, you can quickly open business accounts in multiple markets and currencies, making it easier to do business with suppliers, customers and partners no matter where they’re based.

Your Airwallex account lets you collect card payments from platforms and other domestic payment methods without getting hit with high FX rates. Instead, you can keep more money in your business.

And more working capital means healthier cash flow, which ultimately means growth potential.

You can re-invest in your business with your spare cash — fund marketing initiatives, take risks and explore new markets and product opportunities. Don’t waste your money paying double currency conversions.

Coconut Bowls boosted their profit margins by 3%

Coconut Bowls, a high growth eco-friendly brand based in Australia, utilised their Airwallex Global Account to improve their margins and streamline their global financial processes.

Before Airwallex, Coconut Bowls was forced to convert foreign currency to AUD within 72 hours using their previous FX provider. They would then have to frequently convert these funds back into USD to pay their overseas suppliers and contractors.

When they discovered Airwallex, Coconut Bowls were able to quickly shift to managing their international finances in a way that meant they weren’t losing a portion of their funds each time they conducted a global transaction. By using the Airwallex Global Account, they were able to boost their profit margins by 3%, eliminating unnecessary foreign exchange fees while also being able to collect, hold and pay with multiple major currencies like USD, GBP, EUR and AUD.

Why set up an Airwallex global account?

Here are a handful of reasons you should consider setting up a Global Account:

Improve your bottom line: Improve margins by paying lower FX and international fees. We only charge a small FX margin from 0.5 - 1% (80% cheaper than UK high street bank FX fees).

Simplify global funds and expand easily: using Airwallex means expanding into new countries is simple; you can keep your funds in one place without managing multiple providers.

Like-for-like settlement. With Airwallex, you can collect and settle funds in the same currency. This means you avoid the initial conversion cost

Ready to take your eCommerce business to the next level?

Share

Chris is the SaaS and eComm payments specialist for Airwallex EMEA. Chris helps businesses optimise operations in the world of international payments.

View this article in another region:Canada - EnglishCanada - undefinedFrance - EnglishFrance - FrançaisUnited KingdomUnited States

Related Posts

Q&A: How Airwallex solves the treasurer’s historic headache

•5 minutes

Invoice like a pro: How to master the process

•9 minutes

The real cost of payment gateways for businesses

•12 minutes