How eComm businesses can avoid the conversion trap

As an eCommerce store, you might think FX rates don’t really affect how you do business — it only affects large corporations, right? Unfortunately, that’s not the case. The conversion trap can sting any size company.

Canadian eCommerce businesses conducting cross-border transactions — 34% of which are international — often face significant FX costs. Traditional banks typically charge 2% to 3.5% in hidden FX fees, which can quickly erode profit margins. These fees add up, limiting the funds available for reinvestment and growth.

This blog is for you if you deal with customers and/or suppliers outside Canada. We’re showing you how to avoid the double currency conversion trap, save money, and manage money internationally without the need for additional resources.

P.S. We’ve helped many eCommerce stores efficiently manage their global payments while making FX cost savings in the process, so you’re in safe hands!

The problem you’re facing

It’s exciting when you start buying and selling inventory overseas. It means your business is accessing new and exciting audiences — which means growth. But you could be paying over the odds for FX rates, ultimately impacting your bottom line.

Suddenly, you’re accepting and sending money in various currencies. You’re probably using household names like Stripe and PayPal to manage your international transactions because they’re market leaders. But you’re getting charged unnecessarily for holding money, accepting and sending payments cross-border. You’re trapped in a conversion nightmare.

So, what is the conversion trap?

You could be paying double currency conversions if you have suppliers and customers outside your country.

Here's an example:

You’re a Canadian company (the merchant). Your customer is based in the US, and your supplier is based in Vietnam, but they accept USD.

Your US customer checks out in USD.

Your Canadian company then uses an acquirer/card network (e.g., Visa/Mastercard/Stripe/Worldpay) to auto-convert USD funds to CAD.

The acquirer pays out to your Canadian company in CAD. This is the FIRST CONVERSION.

Your Canadian company then needs to pay suppliers in Vietnam in USD.

To do this, you must convert CAD to USD to pay the supplier. This is the SECOND CONVERSION.

These two conversions can cost you up to 3-4%. Double currency conversions are not efficient. They impact your bottom line and drain internal resources. But here’s the thing: the conversion trap and double currency conversion are completely avoidable.

How to avoid the conversion trap

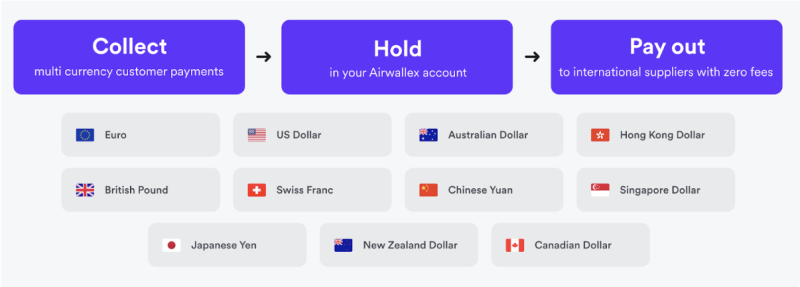

Avoiding conversion traps is surprisingly simple — you need a solution that allows you to collect and hold multiple currencies without being subject to FX fees and spend the currencies as and when required.

Historically, the way to get around this was by setting up a legal entity and business account in each market, which is lengthy and time-intensive — sometimes taking as long as six months. Then, there’ll be all kinds of red tape to get tangled up in, i.e., regulatory requirements.

But now, you don’t have to set up local entities in every country you want to trade in to avoid the trap.

Setting up an Airwallex Global Account helps you avoid those substantial FX rates you get with platforms like Stripe and PayPal. Instead, you can enter a new market in minutes, benefiting from low FX fees and seamless integrations with online marketplaces like eBay, Amazon, and Shopify — with Airwallex.

How does an Airwallex Global Account work?

There’s nothing more long-winded than having to create multiple accounts for multiple locations and currencies. You’re a small eCommerce business — who has time for that?

By using Airwallex, you can quickly open business accounts in multiple markets and currencies, making it easier to do business with suppliers, customers, and partners no matter where they’re based.

Your Airwallex account lets you collect card payments from platforms and other domestic payment methods without getting hit with high FX rates. Instead, you can keep more money in your business.

And more working capital means healthier cash flow, which ultimately means growth potential.

You can re-invest in your business with your spare cash — fund marketing initiatives, take risks, and explore new markets and product opportunities. Don’t waste your money paying double currency conversions.

Dalstrong saves $40,000 CAD annually in collection costs

Dalstrong, a global culinary tools brand, struggled with high costs from double currency conversions when managing international payments. The company, which collects payments in multiple currencies (USD, CAD, EUR), was hit with fees both when converting customer payments and when paying international suppliers. For example, Amazon charged Dalstrong a 2.5% FX fee for converting CAD and EUR payments into USD, significantly impacting the company’s bottom line.

By switching to an Airwallex Global Account, Dalstrong bypassed these double conversion fees. The company opened multiple foreign currency accounts, such as CAD and EUR, directly connected to its Amazon seller account. This allowed Dalstrong to hold funds in those currencies and pay international suppliers directly without converting them into USD and then back again.

With Airwallex, Dalstrong now saves 2.5% on collections costs, amounting to $40,000 annually, and has reduced the accounts payable team's FX preparation time from six hours per week to two. This streamlined approach has helped Dalstrong manage its international growth efficiently while reducing operational costs.

Why set up an Airwallex global account?

Here are a few reasons why Canadian businesses should consider a Global Account:

Improve your bottom line: Reduce FX and international transaction fees to increase profit margins. Airwallex charges a small FX margin of 0.5% to 1%, significantly lower than the typical fees charged by major Canadian banks. For instance, banks like TD and RBC often impose FX margins between 2% and 3.5% on foreign currency transactions.

Simplify global funds management: Seamlessly expand into new countries by holding and managing multiple currencies in one place without needing multiple bank accounts or providers.

Lower conversion fees: Unlike traditional Canadian banks, Airwallex offers competitive rates and like-for-like settlement options, allowing you to collect and settle funds in the same currency, avoiding costly double conversions.

Ready to take your eCommerce business to the next level?

Put Airwallex to the test. Try us for free.

Share

Erin is a business finance writer at Airwallex, where she creates content that helps businesses across the Americas navigate the complexities of finance and payments. With nearly a decade of experience in corporate communications and content strategy for B2B enterprises and developer-focused startups, Erin brings a deep understanding of the SaaS landscape. Through her focus on thought leadership and storytelling, she helps businesses address their financial challenges with clear and impactful content.

View this article in another region:Canada - undefinedEuropeFrance - EnglishFrance - FrançaisUnited KingdomUnited States

Related Posts

How to use Airwallex for automated insurance payouts

•5 minutes

BIN sponsorship | How it can help your business

•9 minutes