Reimbursement payouts funded by the platform's customers

In this model, payouts are funded directly by platform's customers, eliminating the need for the platform to fund reimbursement payouts thereby keeping the platform out of the funds flow.

Airwallex will perform KYC on the platform's customers, who will be onboarded and provided with connected accounts. Under this model, customers funds are held in their own name. This means that the platform is not required to hold customers' funds, thereby avoiding the need for the platform to obtain its own financial licenses.

Let’s imagine a fictitious platform named ReimbursementOS. One of their customers is BizCo and BizCo's employees incur travel expenses, which must be reimbursed.

| Platform | ReimbursementOS, a platform offering reimbursement services to its customers. |

| Customer | A company / employer who uses ReimbursementOS to process employee reimbursements. Example customers featured in this guide include BizCo and MarCo. |

| End User | A finance employee of BizCo / MarCo responsible for making payouts to employees through the ReimbursementOS platform. |

| Employee | An employee of BizCo / MarCo who submits expense requests and gets approved amounts refunded to their bank accounts. |

Specific requirements may apply based on the jurisdictions to which you want to deliver services. Always speak to a member of the Airwallex team if you are considering implementing our Global Treasury solution.

Funds flow

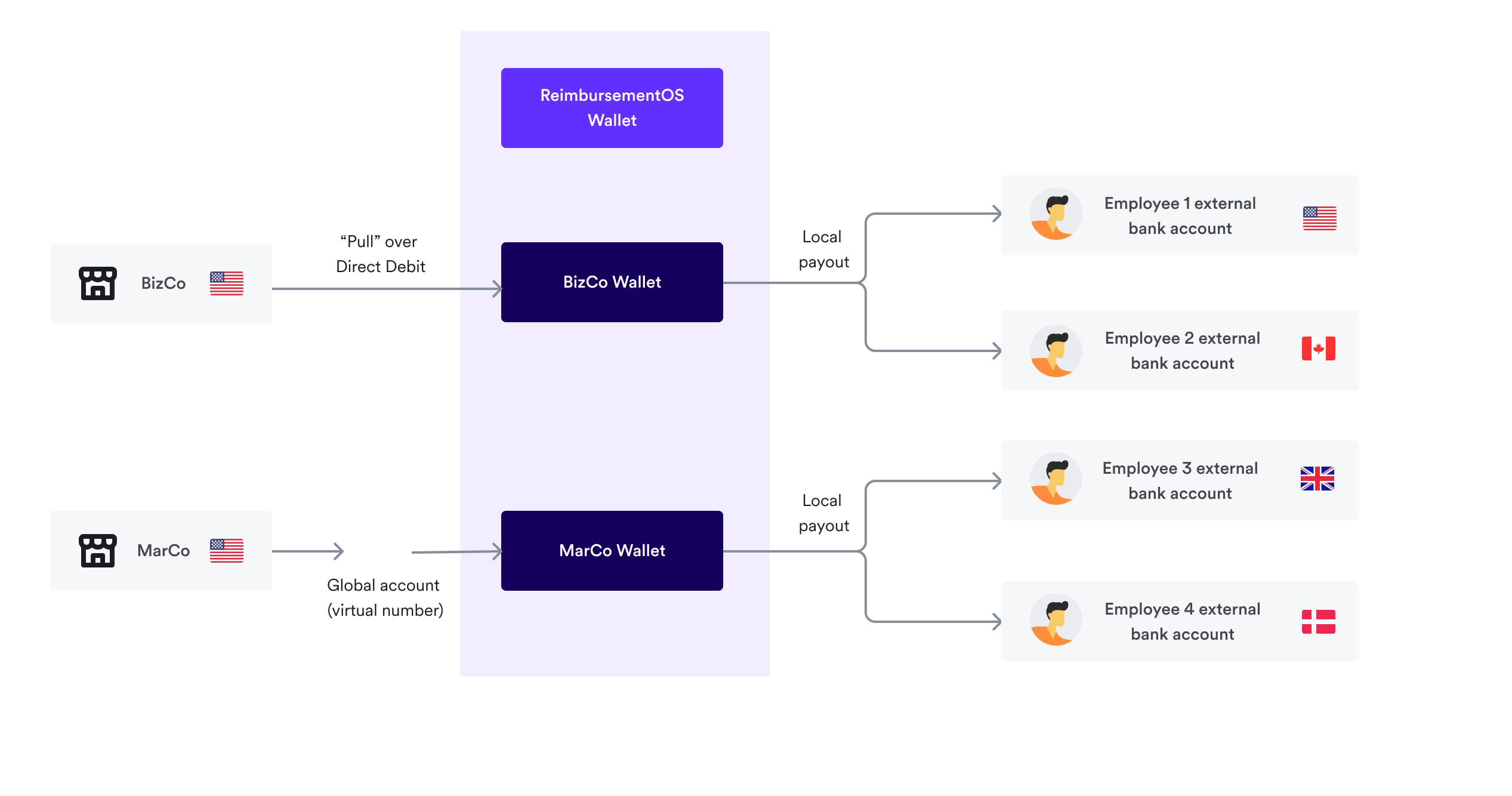

The diagram below shows the funds flow for a platform looking to integrate with Airwallex's Global Treasury solution for employee reimbursements.

The steps in the flow of funds are described in more detail below. Note that you can potentially initiate multiple operations at the same time - our teams will help you understand the options available in more detail.

Fund the Wallet

Each of customers’ connected accounts, e.g., BizCo's connected account, needs to be funded in order to power reimbursement payouts. This can be done through a number of different methods:

- Global Accounts and bank transfer: ReimbursementOS can create unique virtual account numbers in the name of BizCo for each currency BizCo operates in. BizCo can then send funds over local and SWIFT payment rails into the Wallet from their external bank. There are no limits to how often customers can fund their connected account Wallets in this way.

- Linked Accounts and direct debit: ReimbursementOS can complete a one-time linkage of BizCo’s external bank account to their connected account with Airwallex. This allows funds to be pulled in over direct debit, eliminating the need for BizCo to ‘push’ funds from their bank account to Airwallex. Please note that applicable limits are in place to mitigate the risk of direct debit recalls.

Process payouts

In this integration model where reimbursement payouts are funded by BizCo and other customers, funds will move from each of the customers’ connected accounts to the external bank accounts of the employees who are receiving the reimbursement, over Airwallex’s payout rails.

- Payouts: Trigger payouts to employees using Airwallex's Payout APIs. Airwallex's network of local clearing systems supports payouts to employees in multiple countries and currencies, with country-specific delivery time taken into consideration to ensure the payouts arrive in employees’ bank accounts in time.

- Batch payouts: This feature may be used to trigger multiple invoice payouts across currencies and countries as one instruction. Batch payouts can also be funded via Direct Debit.

- Beneficiaries: Airwallex offers the possibility to optionally save beneficiaries for future reference. Beneficiaries should be saved as soon as details become available, to facilitate name screening.