How Canadian eCommerce businesses can navigate new trade realities

Recent US trade policy proposals are introducing new considerations for Canadian eCommerce businesses. Goods and raw materials sourced from China that were previously duty-free may soon face new import tariffs — potentially as high as 25%. These changes could lead to higher costs and tighter margins for Canadian businesses exporting to the US, making adapting more important than ever.

A 30-day pause on proposed tariffs for Canada has been announced, providing temporary relief; however, businesses should stay prepared for potential shifts ahead.

While these shifts present challenges, they also create opportunities for businesses to enhance supply chain flexibility, explore new markets, and build long-term resilience. By proactively reassessing sourcing strategies, optimizing global trade operations, and leveraging financial solutions that reduce costs, Canadian eCommerce businesses can position themselves for sustainable growth — even in a changing policy landscape.

Solutions like Airwallex can help businesses streamline cross-border transactions, minimize FX fees, and improve cash flow management — key factors in staying competitive in evolving trade conditions.

The financial strain of tariffs on Canadian eCommerce businesses

For decades, free trade agreements have shaped cross-border commerce between Canada and the US. The North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA), have allowed businesses to trade goods with minimal tariffs, fostering economic integration.

However, recent policy proposals could alter this landscape. Alongside broader tariff increases, there is renewed scrutiny on duty-free exemptions, which have historically helped businesses reduce costs when shipping smaller-value goods.

Since 1938, Section 321 of the US Tariff Act has allowed Canadian businesses to export small shipments to the US duty-free. This provision, known as de minimis entry, helps streamline customs, accelerate deliveries, and lower costs, ultimately benefiting both businesses and consumers.

In 2016, the Trade Facilitation and Trade Enforcement Act (TFTEA) raised the duty-free threshold from $200 to $800 per shipment, making cross-border trade even more accessible.

Now, major trade policy shifts could impact large-scale trade under USMCA and smaller shipments under de minimis.

Proposed trade measures include:

A potential 25% tariff increase on Canadian and Mexican imports and a 10% tariff on Chinese imports.

A 2.5% to 20% universal tariff on all imports globally, particularly targeting industries like steel, pharmaceuticals, and energy.

A review of the $800 de minimis exemption, assessing potential revenue loss and concerns over counterfeit goods.

With these changes on the horizon, businesses must prepare for potential disruptions and cost adjustments. A Canadian Federation of Independent Business (CFIB) survey found that 82% of Canadian businesses could be affected by tariffs, and 65% of small businesses are already considering price adjustments to offset costs.

The importance of diversifying export markets

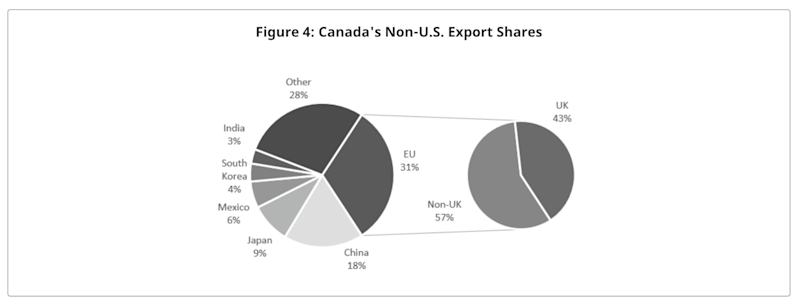

Historically, Canadian businesses have been heavily reliant on the US, which absorbs 76% of Canadian exports. In fact, only Kuwait, Bermuda, and Mexico have more concentrated export economies. Canada’s share of the global export market has fallen from 4.5% to just 2% over the past few decades, a trend partly due to the rise of emerging economies.

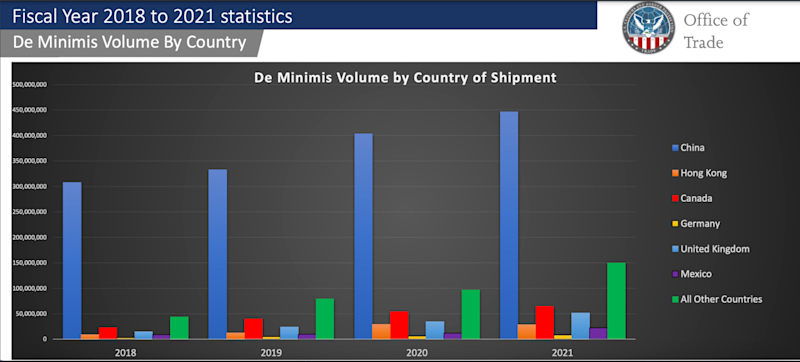

China accounted for 58% of the 2.3 billion duty-free shipments into the US in 2021, significantly outpacing Canada’s 8% and the UK’s 7% shares.

However, enormous growth opportunities lie beyond Canada’s front doorstep. At present, just 3% of Canadian eCommerce revenue comes from cross-border sales. While Canada's eCommerce market reached $65.5 billion last year, the US generated over $1.2 trillion — a market size nearly 18 times larger. This contrast underscores the untapped potential for Canadian businesses to expand internationally, especially in fast-growing emerging markets. Currently, only 9% of Canadian exports go to developing countries like India, Mexico, and China, whereas nations like Germany, the US, and Australia send 20-40%.

Steps Canadian businesses can take to explore new markets

Expanding into new markets may seem complex, but it presents tremendous growth opportunities for Canadian businesses.

Canadian eCommerce businesses can get started by:

Leveraging trade agreements: Canada has 15 trade agreements, including CUSMA, CPTPP, and CETA, offering preferential market access and reduced tariffs. The Tariff Finder tool can help businesses identify low-barrier markets.

Adapting to local market needs: Understanding regional preferences and tailoring products accordingly can give businesses a competitive edge. Canadian trade commissioners in 160+ cities worldwide provide market intelligence and facilitate connections.

Accessing government resources: Programs like CanExport offer funding for trade expansion, while Export Development Canada (EDC) provides financing and insurance solutions for global operations.

Optimizing cross-border transactions: Expanding internationally requires seamless, cost-effective financial solutions to manage revenue and supplier payments efficiently. This is where Airwallex helps businesses expand efficiently, reducing financial friction and simplifying global operations.

How Airwallex supports Canadian businesses expanding globally

Managing cross-border transactions and currency exchange is a key challenge for Canadian businesses expanding into new markets. Differences in exchange rates, payment processing times, and transaction costs can impact profitability and cash flow.

That’s why more than 150,000 businesses worldwide rely on Airwallex to streamline global money movement.

✔ Multi-currency accounts: Open accounts with local bank details in 60+ countries to avoid unnecessary conversion fees.

✔ Faster, cost-effective FX transfers: Convert and send money internationally with rates as low as 0.5% above interbank rates.

✔ Seamless supplier and operational payments: Pay vendors and employees in their local currencies, improving efficiency and reducing conversion losses.

How Dalstrong reduced FX costs and improved efficiency

Toronto-based kitchenware brand Dalstrong faced foreign exchange challenges when managing USD, CAD, GBP, AUD, and EUR transactions. After expanding its Amazon store in 2019, the company was hit with FX fees both when accepting payments and paying suppliers.

By using Airwallex, Dalstrong eliminated Amazon’s 2.5% FX fee — saving $40,000 annually — and cut transaction processing time from six to two hours per week.

New markets are within reach with the right support

The evolving tariff and trade landscape presents undeniable challenges for Canadian eCommerce businesses, but those willing to adapt can unlock new growth opportunities. Canadian businesses can thrive by diversifying export markets, optimizing payment processes, and leveraging Airwallex’s multi-currency accounts and cross-border solutions.

Unlock global growth opportunities — get started with Airwallex.

Share

Erin is a business finance writer at Airwallex, where she creates content that helps businesses across the Americas navigate the complexities of finance and payments. With nearly a decade of experience in corporate communications and content strategy for B2B enterprises and developer-focused startups, Erin brings a deep understanding of the SaaS landscape. Through her focus on thought leadership and storytelling, she helps businesses address their financial challenges with clear and impactful content.

View this article in another region:Canada - undefined

Related Posts

How eComm businesses can avoid the conversion trap

•3 minutes

How to use Airwallex for automated insurance payouts

•5 minutes