Why every business needs user access management for purchases

Any SME owner will understand the frustrations of an ineffective expense approval process. Business growth can come hard and fast, and companies experiencing this kind of rapid growth often fail to make their expense approval process airtight.

Expense approval is the process of verifying and validating payments made by your team members. It is necessary for businesses who need to delegate funds to team members in order to make timely purchases.

However, the role of expense approver is often ill-defined, and the role then typically falls back onto the company accountant. Whilst this may sound fine (isn’t that an accountant's job?), a company experiencing exponential growth has to be ready to make payments in real-time, on-the-go, without waiting for one person to review and approve the payment.

What’s more, having one person managing all company expenses leaves the enterprise open to employee expense fraud, a crime that accounts for 21% of fraud in small business.

By granting specific user roles and permissions, your company will streamline the approval process and experience enhanced visibility and control over spending, an imperative for rapidly growing SMEs.

Why small businesses need to define their expense approval and management process

SMEs experiencing unprecedented growth cannot wait around to make timely purchases. For example, you may be the head web developer of a digital agency and have been tasked with hiring more developers to handle the influx of work coming in.

You’ve gone through the hiring process and found two or three amazing new developers. However, your request to purchase the new team’s technology and software licenses are still pending approval with the accountant (who is tied up in a backlog of reports).

When the accountant finally gets around to the expense request, they decide that the magnitude of it requires approval from the CEO, which delays the approval process even further. By this point, you have already had to ask the new team to start a week later, and this has wasted valuable company time and money.

Why? Because when employees are provided access to corporate cards, the purchases add up, burying the accounts team under a mountain of receipts. Unfortunately, employees around the world are wise to this fact, and this is why employee expense fraud costs American employers alone $2.8 billion a year.

Employee expense fraud is nothing more than a by-product of an outdated system, a system that can be easily rectified with an advanced accounting platform. Business owners and selected team members have the ability to delegate funds to team members when they actually need them, and this alleviates the possibility of fudged expenses slipping under the radar.

Payment gatekeeper or empowered team access?

There are two distinctive ways business owners choose to control their finances: with a payment gatekeeper or user access management. The benefits of user access management far outweigh those of a payment gatekeeper, as user access management empowers a team to make timely purchases with greater visibility of what has been bought.

Payment gatekeeper

Business owners may want to keep a singular payment gatekeeper. This is fine for teams of up to (say) five people, but for SMEs experiencing rapid growth, the system should be quickly discarded.

The limitations far outweigh the benefits.

Benefits:

Full visibility and control of all payments for the account gatekeeper

Limitations:

Slowed or bottlenecked processes at both the approval stage, and even at the payment stage after approval.

Disempowered teams from making faster decisions to get what they need done, and limited visibility of payment status and timing.

Strain supplier relationships when payments and invoices take too long to process.

User access management

User access management enables a multi-level expense management process to meet the demands of a rapidly growing business.

Our multi-user feature allows businesses to give access to specified funds to employees to make timely purchases either through bank transfer or a virtual debit card. The delegator can create multiple, dedicated cards with the right spend limits to make purchases in minutes, instead of days.

An added benefit of providing your employees with the right access is the enhanced visibility and control both the employee and business owner. Your team can login and track their own card spend to the set spending limits. Gone are the days of shared company credit cards where business owners had to audit each line and chase up their employees on who bought what.

As you will see, and as opposed to the limitations provided by payment gatekeepers, its benefits eclipse its limitations.

Benefits:

Empowered teams with greater ownership of their card spend budget and better visibility on their spend and payment status.

Empower team members to make timely money transfers to international suppliers.

Retained control of business funds with the right access, separated approval roles and card spending limits.

Faster payments without bottlenecks on senior people need to set up the payment details.

Limitations:

Upfront set up cost and training for the team to learn the business account platform.

Steps to defining your expense approval and management workflow

A defined expense approval process makes company expenditure airtight. This occurs by taking care of the following steps:

Define the right processes, policies, roles and technology for your business’s needs.

Set your team up with the right training, access and employee cards needed.

Enforce your expense policies so that expense claims are correctly approved or flagged

Review and adjust your processes as your business continues to grow

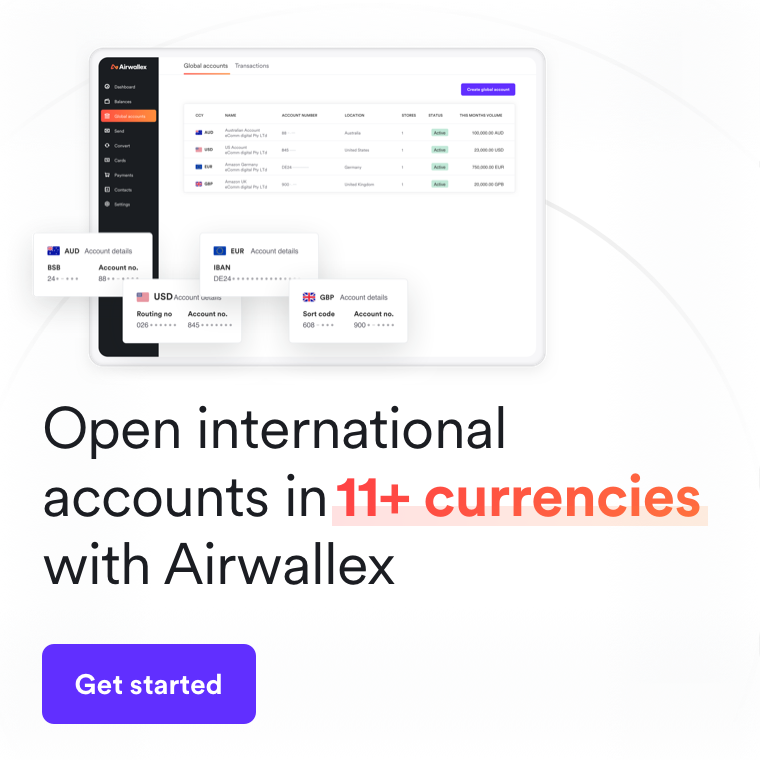

Airwallex, your global business account with powerful user access management features

Regardless of the size of your team, Airwallex’s global business account is designed to scale with your business and streamline user roles and permissions. Our platform ensures fully visible expense approvals as well as secure visibility to business transactions whether you’re an analyst, PA, team leader, accountant or CEO.

What’s more, for SMEs hiring overseas staff, our virtual cards provide new international employees with the funds they need to make purchases in real-time, and not in the weeks it can take to set up international corporate cards.

This all comes through a single account that can be easily managed for both local and international employees. Get started with zero setup or monthly fees. Book a demo with one of Airwallex’s Product Specialists to see how you can empower your team with multi-user account management.

Related article: How To Put Your Business Expense Management on Autopilot