What’s an ACH payment and how does it work?

Key takeaways:

An ACH payment is an electronic funds transfer made through the ACH network and comes in two forms: debit (pulling funds) and credit (pushing funds).

They can be used for direct deposits, bill payments, and recurring transactions.

ACH payments are primarily used for domestic transactions within the US, but international ACH can also facilitate cross-border payments.

Automated Clearing House (ACH) payments are a reliable and low-cost way to electronically transfer funds within the United States.

Whether you’re paying your monthly suppliers or managing payroll for your team, understanding ACH payments and how they can benefit you can help you send and receive USD more cost-effectively, even if you don't have an entity there.

What is an ACH payment?

An ACH payment is an electronic transfer of funds between bank accounts, commonly used for monthly vendor payments and payroll.

"ACH transfers" is a broader term that encompasses the entire process of moving funds between bank accounts using the Automated Clearing House (ACH) network, whereas "ACH payments" typically refers to the individual transactions themselves, such as a specific bill payment or direct deposit.

ACH payments provide a faster, more cost-effective, and more reliable alternative to payment methods like domestic wire transfers or paper cheques. They simplify payment processes and reduce costs over time for businesses managing recurring payments.

Unlike old-fashioned cheques that can leave you hanging for days, ACH payments are quick and cost-effective. They're also more flexible as they can be initiated by either the payer or the payee, depending on the nature of the transaction. For example, when setting up a recurring rent payment, your landlord can initiate the ACH transfer to withdraw funds from your account on the agreed-upon date.

While the ACH network is primarily designed for domestic US transactions, businesses can now leverage its benefits for certain international payments through International ACH Transactions (IATs). These IATs enable payments from a US-based account to foreign accounts, often at a lower cost than traditional international wire transfers.

The demand for fast and cost-effective transfers has also spurred fintech platforms like ourselves to expand our capabilities to allow you to utilise these networks even if you don't have a physical entity in the US. With these fintechs, you can receive and transfer USD via ACH even if you don't have a US entity.

Receive and make payments like a local.

ACH payment vs. wire transfer

The biggest differences between ACH payments and domestic wire transfers come down to the following factors:

Speed: An ACH payment processing time can vary but typically takes 1-3 days to complete. Domestic wire transfers can be as fast as 24 hours or less, but this often comes at a higher price.

Cost: ACH payments are a cost-effective alternative to domestic and international wire transfers. Businesses can expect to pay around US$0.40 per ACH transaction,1 compared to up to US$35 for domestic wire transfers and as much as US$50 for international wire transfers.

Settlement: ACH credit can be reversed by the initiator within five business days, and ACH debit can be returned for reasons such as insufficient funds for up to two days. Domestic wire transfers are less flexible and can't be changed once the funds are cleared.

Types of ACH payments

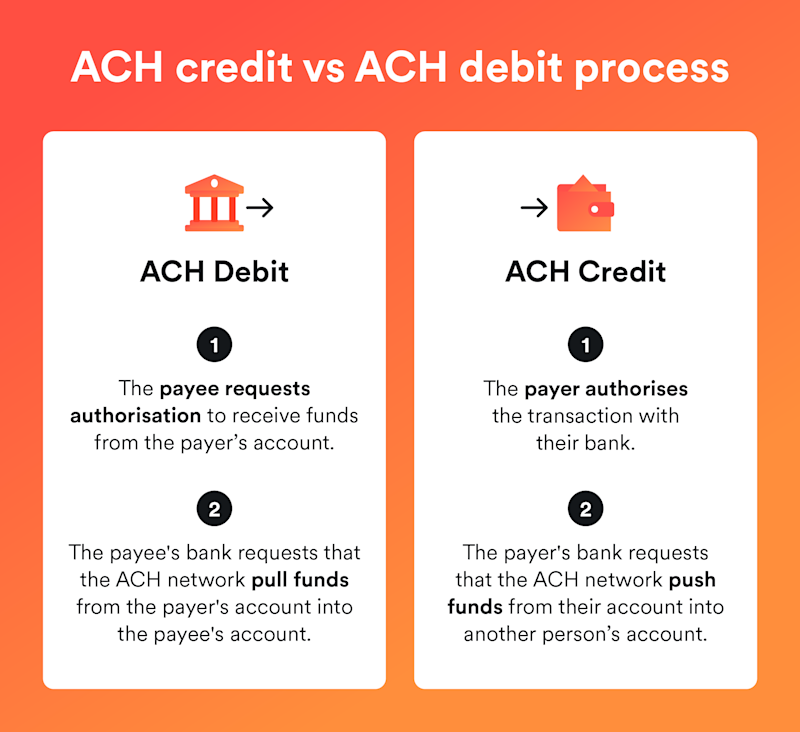

There are two primary types of ACH payments that you can leverage for efficient financial operations: debit and credit. Understanding the nuances of each can significantly impact your cash flow and operational efficiency.

ACH debit: ACH debit payments, also known as direct payments pull money from the payer’s bank account when a bill is due. This method is typically used for subscription and recurring payments.

ACH credit: ACH credit payments, also known as direct deposits, involve the sender pushing funds into the recipient’s bank account. This method is used for payroll and vendor or supplier payments.

Both ACH debit and credit payments are processed through the secure and reliable ACH network, offering businesses a cost-effective and efficient way to manage electronic transactions.

How do these ACH payments work?

Rather than relying on paper checks or card payments, businesses can use ACH transfers to move funds efficiently. Each transaction follows a structured process, whether it’s an ACH debit pulling funds from an account or an ACH credit pushing payments to recipients.

In an ACH debit payment, the payee submits a request to the ACH network to transfer funds from the payer’s account to their own. This method is ideal for subscription services, recurring invoices, and automated bill payments. Here’s how they work:

Authorisation: The payer grants permission to the ACH network to withdraw a specific amount from their account. This step helps reduce manual invoicing and minimises late payments.

Processing: The payer’s bank forwards the request to the ACH network. This automated process minimises manual intervention and reduces administrative overhead.

Settlement: The funds are pulled from the payer’s account to the payee’s account, completing the transaction. This enables timely receipt of payments, improving your cash flow and financial stability.

In contrast, in an ACH credit payment, the payer initiates the transaction by submitting a payment request to their bank, giving the payer full control over payment timing. This method is ideal for payroll. Here’s how they work:

Authorisation: The sender ensures that the recipient has provided the necessary bank account information and has authorised the transaction. This step allows the bank to verify the accuracy and legitimacy of the payment.

Processing: The bank forwards the request to the ACH network to process the transaction. This reduces the risk of errors associated with manual payment processing.

Settlement: Funds are “pushed” from the payer’s account to the payee’s account. This strengthens relationships and enhances your business's reputation.

The key distinction lies in initiation ACH debit is initiated by the payee (your business, for collections), while ACH credit is initiated by the payer (your business, for disbursements).

When dealing with international ACH transactions (IATs), the process is similar, but settlement occurs through the clearing house in the recipient's country, adding a layer of complexity for cross-border payments.

Benefits of ACH payments

Using ACH payments for domestic transactions offers numerous benefits. Here are a few ways they can benefit you:

Cost efficiency

ACH payments are more affordable than domestic wire transfers, especially for businesses that receive or transfer frequently to and from the US. Businesses can have significant savings on transaction fees, particularly if the payment is recurring like payroll.

Convenience

ACH payments can be set up for regular vendor payments, which simplifies the payment process and reduces the risk of error. This eliminates the need for manual payment processing, and reduces administrative burden, saving time and effort.

In recent years, fintech companies have made it possible for global businesses to use local payment networks like ACH without a physical presence in the country. For example, Airwallex can provide access to local payment systems through its platform, allowing you to receive and send money as if you were operating from that country.

How to receive ACH payments

Receiving ACH payments is a straightforward process, but there are a few steps to take before you can get started.

Open a business bank account: To use ACH, you’ll need a US bank account. This'll serve as a destination for your incoming ACH credits or the source for outgoing ACH debits. However, opening a US bank account requires your business to be registered in the US. Alternatives like Airwallex’s Business Account let you open currency accounts, including a US dollar account, which you can use to manage ACH transactions without the need to register your business in the US.

Provide your US account details: Share your account details, including your account number and ACH routing number with the payer. Fintech solutions like ours will also allow you to process ACH payments either through payment links, payment plug-ins for existing eCommerce platforms like Shopify, or through customisable checkout solutions.

Set up payment schedules (if needed): For recurring payments, establish a clear payment schedule and ensure the customer agrees to the terms. This minimises disputes and ensures timely transfers.

Simplify your payments with Airwallex

ACH payments help businesses receive and transfer US dollars efficiently. While ACH payments are widely available to US-registered businesses with US bank accounts, modern solutions like Airwallex now make it possible for non-US-registered businesses to benefit from the speed and cost-efficiencies of ACH payments.

With Airwallex, you can open a USD account and transact like a local, saving you time and money. Airwallex also lets you open multiple Global Accounts in different currencies, helping you overcome common pain points such as high international transaction fees and complex currency conversions. This streamlined approach ensures smoother financial operations and better control over your global transactions.

Take your payments to the next level with Airwallex

Frequently asked questions about ACH payments

How long does an ACH payment take?

An ACH payment can take one to three days to process and complete. For an additional fee, some institutions may offer same-day processing.

When should I use ACH payments?

ACH payments can be used to receive and make domestic transfers.

Businesses looking to save money should use ACH payments since they are much cheaper than domestic wire transfers or credit card processing fees.

Are there risks associated with ACH transactions?

ACH transactions can involve risks such as fraud, insufficient funds, processing delays, and compliance issues. To mitigate these, use strong security measures, verify information, and monitor transactions regularly.

How much are ACH transfer fees?

ACH transfer fees are typically low, ranging from $0.25 to $2.00 per transaction for domestic transfers. Always check with your provider for specific fees.

Share

Airwallex’s Editorial Team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. With deep expertise spanning finance, technology, payments, startups, and SMEs, the team collaborates closely with experts, including the Airwallex Product team and industry leaders to produce this content.

View this article in another region:United KingdomUnited States