The benefits of virtual debit and credit cards in 2023

Virtual payment cards can revolutionalise the way your businesses manage and make payments, saving teams around the world hours in admin as well as excessive fees. Let's review the core benefits of the virtual card and the impact using virtual cards can have on your business.

What are virtual credit cards?

Simply put, virtual credit cards are actual finance cards that function entirely online.

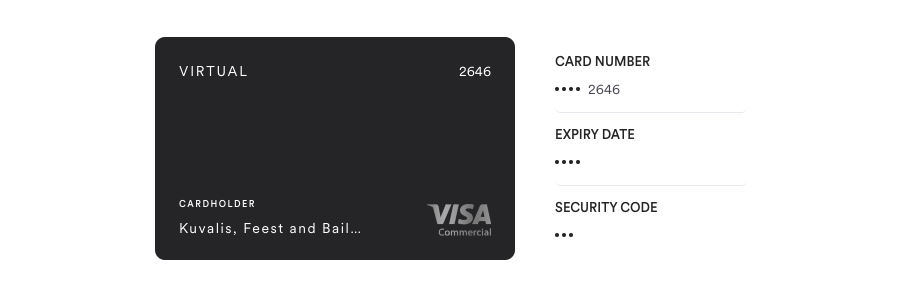

Randomly generated 16-digit numbers, complete with a card verification number and expiry date, these virtual credit and debit cards act in the same way traditional credit cards do — without the need for a physical card. Accepted anywhere credit cards are used, virtual credit cards are issued by Mastercard, Visa or American Express.

But the difference in these cards is how they operate with ease compared to actual credit and debit cards.

Most importantly, instead of relying on your bank, you’re in control. You’re able to choose the currency you need, set a spending limit for the card and define the merchant types where the card can be used.

Virtual payment cards are streamlining the way payments are made for both suppliers and vendors, and there are a number of compelling benefits for your business.

Reasons why you should use a virtual credit card

Pros:

Virtual credit cards authorise access to your credit quickly and without using a physical card.

Some virtual cards even offer point-earning rewards and are a safer alternative when making online purchases.

If your card is compromised, virtual credit cards can be voided easily and quickly.

Cons:

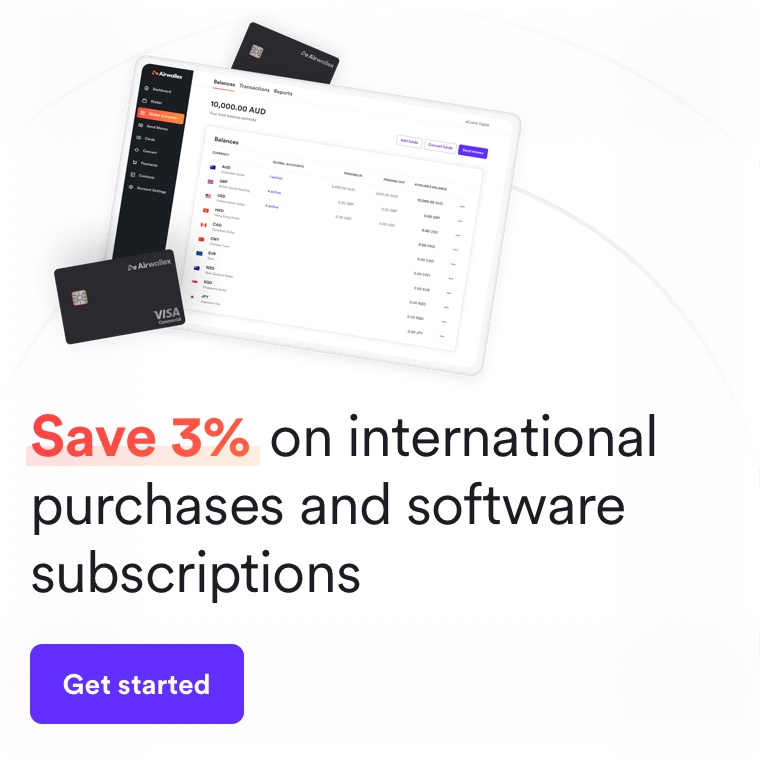

Virtual credit cards can have high fees and interest rates. International transactions can add 3% on average to your purchase.

Card-hacking is a real dilemma for both virtual and physical cards, especially with online purchases.

Expiration dates can cause trouble with past purchases. If the card is expired, refund processes can be difficult.

What are virtual debit cards?

Virtual debit cards are comparable to virtual credit cards in most ways except for funding the virtual debit card. A central bank account is required to cover any costs of purchases without the cushion of credit options. After a short online application, you’ll receive a 16-digit number with an expiration date.

Reasons why you should use virtual debit cards

Pros:

Ideally, virtual debit cards are an excellent reduced-risk option to avoid troublesome occurrences such as card loss, theft, hacking or temporary misplacement.

You get protected online storage for your virtual debit card details. Keeping up with a physical card can be a challenge.

Virtual debit cards can function as short-term or long-term financial solutions.

Cons:

As with any debit card, your account must have the funds necessary to cover the transaction.

Managing your budget demands some attention before making purchases with a virtual debit card.

Similar to virtual credit cards, virtual debit cards have an expiration date that can be troublesome when attempting to return purchases.

Benefits of virtual payments

You get increased security in an online environment rife with hackers attempting to compromise your account.

In the event of compromised security, virtual payment cards provide reconciliation support with integrity.

You can access virtual credit and debit cards instantly.

You can create a new account with ease and reliability.

Virtual payment cards can empow

er your business and employees.

Virtual cards can be issued to multiple team members who are required to make payments for their business on a daily basis. So instead of hounding your manager or accounts department for access to one single physical card to make a payment (or going through the onerous paperwork to get a corporate card yourself), staff can be issued individual virtual payment cards that are unique to them.

As a manager, you can set the spending limits on each virtual debit card and virtual credit card, which means you keep a firm hold on your budget when making business payments, and your teams know exactly how much they have available to spend.

Eliminating payment bottlenecks means your business can move at a much faster pace by allowing the purchasing of new software and equipment without delays.

When executed correctly, purchase requests no longer need to sit in pending for weeks while your staff sits idle awaiting the green light to make the purchase. With their own virtual payment card, they can do so instantly, while you maintain full control.

Try Airwallex virtual cards for your business

Airwallex is an Australian fintech that gives everyday businesses access to these virtual cards (and more). Best of all, Airwallex’s multi-currency cards also have zero international transaction fees, so you can use these for all types of payments. There are no monthly fees and a business account can be set up online in a matter of minutes. Open an account today to create your first virtual cards for your business.

Related article: Differences Between Virtual Credit & Debit Cards

Our products and services in Australia are provided by Airwallex Pty Ltd ABN 37 609 653 312 who holds AFSL 487221. Any information provided is for general information purposes only and does not take into account your objectives, financial situation or needs. You should consider the appropriateness of the information in light of your own objectives, financial situation or needs. Please read and consider the Product Disclosure Statement available on our website before using our service.

Share

Joe Romeo is responsible for scaling our Airwallex's product adoption in the UK and the world. An all-around growth enthusiast, Joe's speciality lies in SEO, organic acquisition and making lasagna.

Related Posts

What’s the difference between a virtual credit card and a virtual...

•5 minutes

How to choose the right virtual debit card for your business

•5 minutes

When is the best time to use a virtual payment card?

•4 minutes