What’s the difference between a virtual credit card and a virtual debit card?

- •What is a virtual credit card?

- •The pros and cons of a virtual credit card

- •What’s the difference between a virtual card and a physical card?

- •What is a virtual debit card?

- •The pros and cons of a virtual debit card

- •Which virtual card is better for my business?

- •Airwallex Borderless Cards make it easy for you to manage your finances

Most virtual cards comply with the Payment Card Industry Data Security Standard (PCI-DSS) requirements, which provide added protection for your personal information and account data. Similar to physical cards, safety and security are top priorities when it comes to virtual cards.

Advancements in technology have revolutionised banking security, and now virtual payments offer a level of security that surpasses that of physical cards when purchasing goods and services online. An appealing bonus feature of virtual credit and debit cards is the max spend or charge limit option.

Virtual credit and debit cards are quickly becoming the preferred option for modern businesses all across Australia.

Let’s take a look at what each of these products actually are, the differences between these two types of cards and how each one can benefit your business.

What is a virtual credit card?

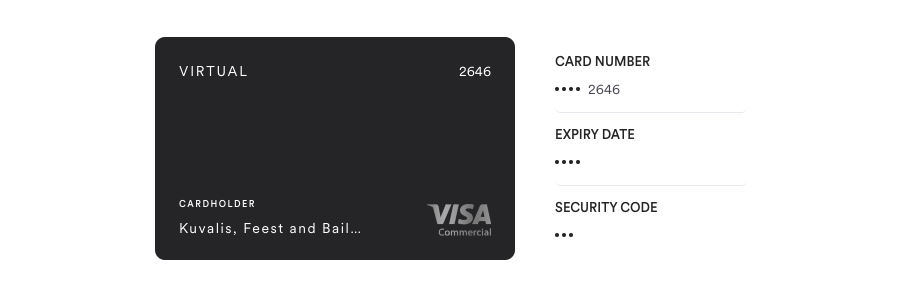

A virtual credit card exists entirely online but can be used in exactly the same way as your regular credit card. You receive a unique 16-digit string of numbers that acts as your credit card number, plus your expiry date and CVV. You can use it anywhere you would your normal credit card — over the phone, online and even in person (if you have the details).

Any charges made on your virtual credit card are routed back to your existing credit card, using your current line of credit.

The pros and cons of a virtual credit card

The pros

Virtual credit cards allow you to access funds using credit without the need for a physical credit card. They can be created online in seconds, providing you with a payment option when you need it.

Similar to credit cards, some virtual credit cards allow you to earn points on your purchases, which can then be used for travel, employee incentives and the like. They can be set for single use, meaning once the assigned fund amount is used, the card becomes void.

If your card gets compromised, it’s easy to cancel. Simply delete or remove the card details from your account, and it becomes void. You can then create a new card that you can start using immediately.

The cons

Virtual credit cards can come with high-interest rates and fees. You can typically expect to pay up to 3% on international transactions.

While they’re a safer option for online purchases, virtual credit cards still act like credit cards. So when compared to a virtual debit card, it’s still possible to incur credit debt beyond your team’s purchase limits. This poses a similar problem for any card hacking, too.

Your virtual credit card’s lifetime may become a drawback. For example, if you make a business purchase but then need to return the purchase for whatever reason — but your card details have since expired — you may be unable to return the item or receive a refund. If the card details don’t exist anymore, there’s no card to refund to

What’s the difference between a virtual card and a physical card?

In today’s technology-driven world filled with experienced hackers, no virtual or physical card is fully fraud-proof. However, virtual cards function using a temporary account number, which reduces your chances of being hacked.

Monitoring a virtual card is easier and more user-friendly than physical card issues, like a lost or stolen card and account management.

For security reasons, you can alter and create new card numbers for an added level of security. If you encounter fraudulent charges, virtual and physical cards offer similar protection plans. However, virtual cards offer less hassle in the recovery process.

What is a virtual debit card?

The same as with virtual credit cards, virtual debit cards are an entirely online product, with no physical form. You get your 16-digit card number and your expiry date.

The big difference with a virtual debit card is that it doesn’t work on credit. Any charges you make are drawn from your central account, with your 16-digit card number linked back to that account.

Virtual debit cards provide you with all the benefits of a virtual credit card, with a few extra ones, that make them a reduced-risk alternative.

The pros and cons of a virtual debit card

The Pros

As we’ve all experienced, cards are easy to lose, particularly if you share them between your team members. Issuing virtual debit cards means you’ll never have these issues again. Your card details are available online, so you don’t need to rummage around in your bag or desk draw to find your details every time you need to make a purchase.

They can be set up as single-use, or for a specific time period, so your money is only available to be accessed during this time. This means that should the details fall into the wrong hands there’s less chance for your funds to be spent without your knowledge.

The Cons

The security of your virtual debit card can turn into a negative, in the wrong circumstances. If there aren’t enough funds in the connected account, then your virtual debit card payment won’t go through. So while it’s a great little safety feature, it does mean that you’ve got to pay attention to your overall budget availability.

Which virtual card is better for my business?

As a business, you’ll typically use the same payment details for every online purchase and payment that you make, so either product will do the trick. Determining which virtual card is best for your business is really a matter of your needs.

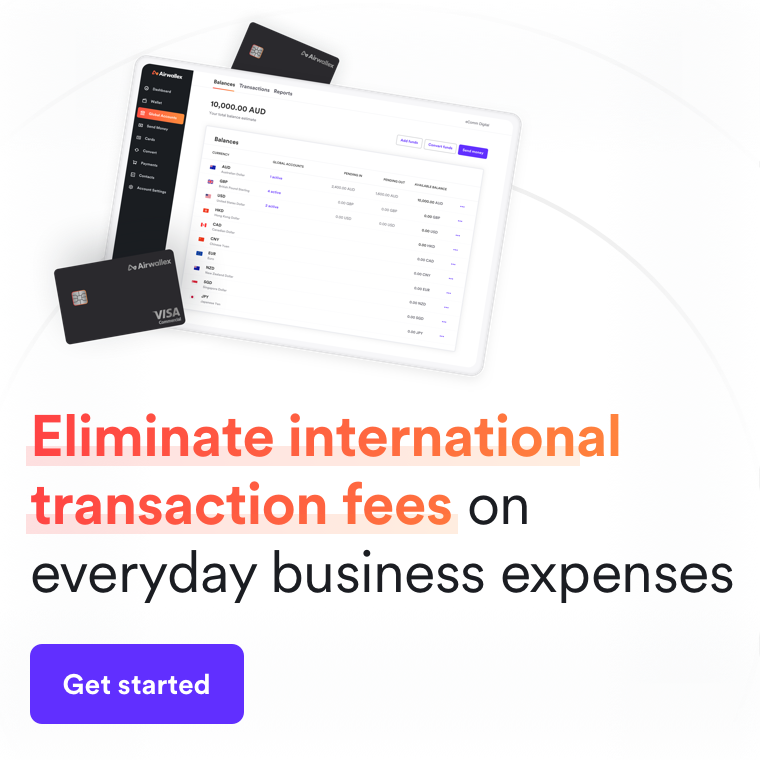

Virtual debit cards regularly provide products without international transaction fees, meaning there’s an easy way to shave up to 3% off all your foreign transactions from purchasing to ongoing software subscriptions.

Both types of cards are just as secure as each other, so online safety isn’t a concern. One area where virtual debit cards make more sense is in relation to the control you have over your funds. If you like to run a tight ship, and always know where and how your money is being spent, then a virtual debit card may be a better option.

When using a virtual debit card, you’re always only spending money that you have, and not racking up credit card debt. You’ll never have to worry about going over any spending limits, or not paying off your monthly balance.

So if debt is a concern, it’s best to choose a virtual debit card for your business needs.

Airwallex Borderless Cards make it easy for you to manage your finances

Airwallex Borderless Cards provide all the benefits and security of a virtual debit card and give you enhanced control over your business’ funds.

They’re easy to set up, and you can get started using your virtual card immediately once it’s up and running. If you need to add extra cards to your account, you can do this instantly, meaning your team members are always empowered to make purchases on behalf of your business.

You get complete control over your cards. You can set their lifecycle and spend limit, and register card details against specific payment codes. Each time you make a payment using that card, the information is logged using pre-set information, so you always stay on top of your budget and spend tracking.

They’re easy for reconciliation too, as they integrate seamlessly with Xero, so your purchase details are logged directly to your account. You can also track approvals digitally, so you always know who signs off on payments, without having to ask around.

Airwallex Borderless Cards are designed to be the best of both worlds, so we can help you streamline your finances. Book a free online demo with an Airwallex Specialist today to see how Borderless Cards can empower your business to thrive.

Related article: The benefits of virtual debit & credit cards

Our products and services in Australia are provided by Airwallex Pty Ltd ABN 37 609 653 312 who holds AFSL 487221. Any information provided is for general information purposes only and does not take into account your objectives, financial situation or needs. You should consider the appropriateness of the information in light of your own objectives, financial situation or needs. Please read and consider the Product Disclosure Statement available on our website before using our service.

Share

Related Posts

When is the best time to use a virtual payment card?

•4 minutes

How to choose the right virtual debit card for your business

•5 minutes