How to switch your business bank account in the UK

Back in the day, companies had few options when it came to choosing a business bank account. High street banks ruled the roost and charged extortionate fees for account management, domestic transactions and international transfers.

Today, the rise of challenger banks and FinTechs mean companies have more choice in how they manage their finances. Switching accounts has never been easier, and could save you a lot of money and stress.

If you’re tired of clunky, outdated systems, poor customer service and unnecessary charges, it might be time to switch.

Why switch your business bank account?

Running a business comes with many challenges, but managing your business account shouldn’t be one of them. Here are some of the top gripes businesses have when it comes to their account provider.

Poor customer service

When you have a query about your business account, the last thing you want is to be placed in a call queue. In a recent Which? survey, 65% of banks scored just three out of five stars for communication, proving that most providers are failing when it comes to customer service.

FinTechs and challenger banks know that customer service is a key way to undercut traditional banks, and have invested in ensuring their customers have the best experience. So if you’re tired of listening to hold music, choose a business account that provides you with a dedicated account manager who will answer emails quickly and jump on a call when you need.

Hidden fees

Do you scrutinise your bank statements? You should, because a lot of traditional business accounts have hidden fees. These include monthly account fees, transaction fees when you receive and deposit money, and additional charges for foreign currency transfers and CHAPs payments.

It’s worth shopping around for a business account that doesn’t charge account or transaction fees. Not all providers are upfront about their fees, so make sure you read the small print.

Limited card options

CFOs are generally time-poor, and having just one company card can create bottlenecks that slow progress.

By switching to a business account that offers multiple payment cards, you can empower your team to make independent purchasing decisions and free your CFO from constantly signing off expenses.

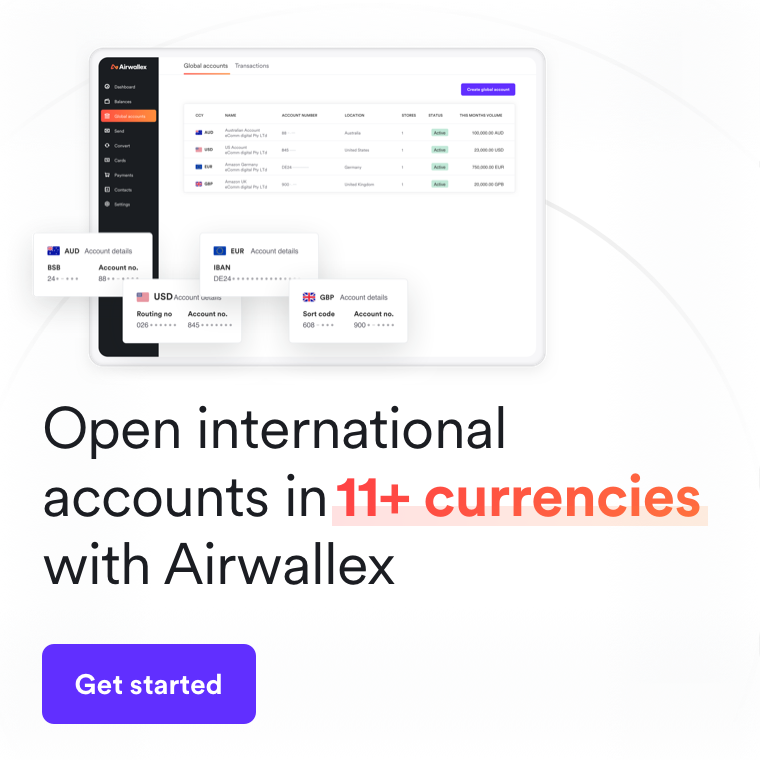

No multi-currency options

A recent Airwallex survey showed that 77% of UK businesses plan to expand internationally in 2022, but two-thirds of decision-makers view international transaction fees as a “necessary evil”.

In actual fact, businesses can avoid transfer fees quite easily by opening a multi-currency business account. As the name suggests, multi-currency accounts allow you to receive, hold and spend money in multiple currencies, so you can bypass currency conversion fees when paying international suppliers or collecting money from customers who live outside the UK.

What’s the process for switching business bank accounts?

Switching business accounts has never been easier. Gone are the days when you had to book an in-branch meeting with your bank manager, you can now complete the process from the comfort of your home or office.

1. Apply for a new business account

Once you’ve chosen the account that’s right for you, you can apply online. Business account providers will run identity checks before you open an account. It should take 3-5 working days for your account to be up and running.

When you apply online, you will need to upload some documentation. This will include:

Proof of identity, such as a picture of your passport or driving license.

Proof of address, such as a bill or bank statement (if you’re a sole trader or freelancer).

Certificate of incorporation, memorandum and articles of association (if you’re a limited company).

You may also be asked a few questions about your company, such as the industry you are in and the countries where you operate.

2. Update your collections process

Make sure that customers start paying into your new account. If you’re an eCommerce business, that means updating the details in your payment gateway (i.e Shopify or Stripe).

If your customers pay by bank transfer, let them know that you’ve changed your account provider and update the payment details on your invoices. You should also update PayPal if you use it.

3. Update your subscriptions

It’s worth doing a quick audit of your direct debits before you switch, to ensure all your subscriptions are updated. Monthly outgoings will include online ad payments, software services and employee benefits.

4. Move funds across

Moving funds from one business account to another is free for some providers, but others do charge a fee.

Login to your old online banking service and select ‘external transfer’. You’ll need your new business account number and sort code, so keep this handy.

Your previous provider may want to verify that you are the owner of the new account. You can do this by transferring a small amount (i.e. £0.01) from your new account to your old one. Once you’ve completed this verification, you can simply transfer your money across.

5. Close your old account

There’s no pressure to close your old business account when you set up a new one, and many companies choose to keep more than one account running. But be careful, some providers will continue to charge account fees even if you don’t hold money in them.

In order to close your old account, you will need to fill out an account closure form, which can be downloaded from your provider’s website. Once you’ve emailed or posted your account closure form, your account will be closed within 5-10 working days.

After you’ve closed your account, your statements will no longer be available online. If they don’t do so automatically, ask your previous account provider to send you your transaction history covering the past five years.

Switch to an Airwallex business account and pay zero account fees or transaction charges

Airwallex was designed to help businesses manage their money in the cheapest and most efficient way possible.

We don’t charge any account or set up fees, and we won’t charge you any transaction fees when you send or receive money in the UK or internationally. No matter how much you’re sending or how many transactions you make. You’ll pay just 0.5 - 1% above the interbank rate for international currency exchange, considerably less than traditional banks.

We also provide up to 200 virtual debit cards per business, so you can empower your teams to make independent purchasing decisions. You can set monthly spend limits for each card and track expenditure in real-time, so you’ll always know where your budget is going.

When you sign up for an account with us, you’ll be assigned a dedicated account manager, who will help you get set up and always be on hand whenever you have a question.

If you’re looking for an alternative to pricey, outdated business accounts, apply online today or get in touch with our team for a demo.

Related article: How to Open a Business Bank Account in the UK

Share

Tilly manages the content strategy for Airwallex. She specialises in content that supports businesses in their growth trajectory.