How our security and compliance works to protect your transactions

By Jeanette Chan, Chief Legal, Compliance and Risk Officer at Airwallex

For businesses of all sizes - from startups to large-scale enterprises - the global pandemic has completely transformed how we do business in the modern digital economy. Consumers are now shopping online in record numbers, with a recent McKinsey report finding digital marketplaces like Amazon are expected to account for about 60% of digital-commerce volume in the next few years.

The rise in digital transactions has increased both adoption and trust in newer digital financial services. At Airwallex, we’ve seen a 50 per cent increase in our global customer base in the last two quarters of 2020.

However, this trust cannot be taken for granted. New opportunities also bring complex security challenges that governments, regulators and financial services organisations have to manage swiftly and effectively.

At Airwallex, we take our commitment to upholding and complying to legal and regulatory requirements very seriously. That’s why compliance remains at the heart of everything we do.

You may be thinking; what is compliance, and more importantly, how do you keep my transactions safe? Here, we want to answer these questions, and highlight how Airwallex ensures your transactions are fast, seamless and secure.

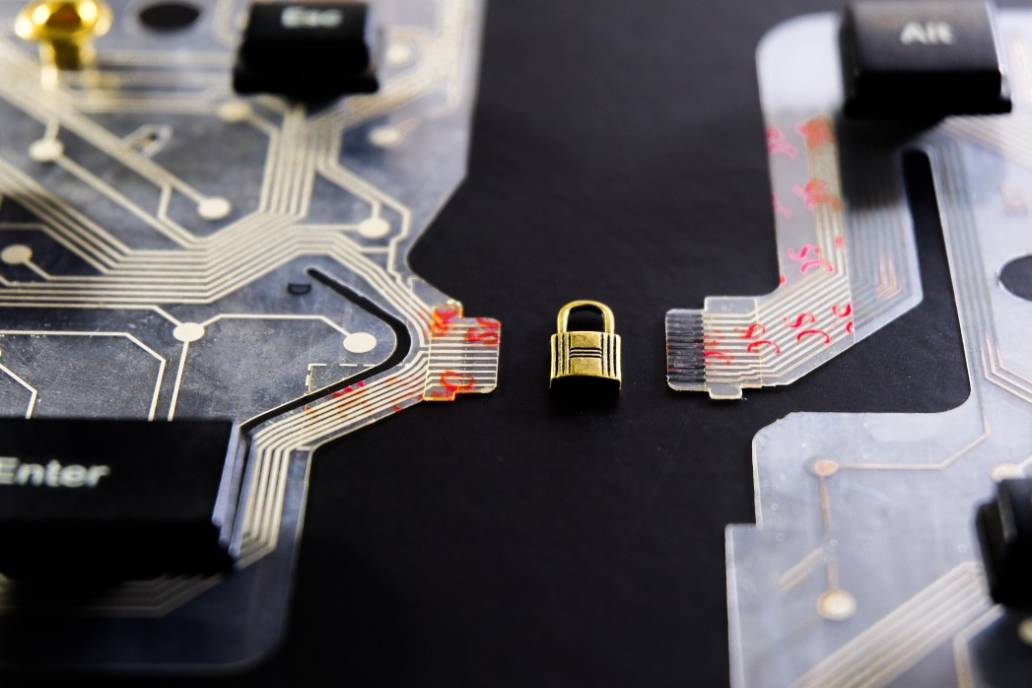

Unlock global growth

So, what is compliance and why is it important?

In one year, it’s estimated that financial crime costs the global economy between US$800 billion and US$2 trillion (2-5% of global GDP). To meet these challenges, compliance and operations teams - like the global teams at Airwallex - work to ensure the movement of money is transparent, fair and efficient through five key areas of responsibility: monitoring, detection, investigation, prevention and advisory.

In addition, regulators authorise and oversee the compliance laws for each region, changing and improving rules where necessary. These bodies work together to protect transactions and the integrity of the global financial system against crime like money laundering and terrorism financing as criminals and terrorist syndicates attempt to move illicit funds around the world.

How we protect our customers

Our approach to compliance has enhanced over the years. Since joining the company in 2019, I have endeavoured to build and lead a global legal and compliance team with the best combination of:

Comprehensive regulatory, compliance, risk and legal expertise and experience

Members with agile and adaptable mindsets to advise and manage rapid changes in financial products, services and technologies

Grounded on the core values required to always make the right decision

These values are central to the strength of our legal and compliance team. We promote a unified approach with all members working as one, sharing information and contributing to the growth of the Group as a whole.

For our customers, we are committed to providing agile and innovative solutions that grow alongside them and their businesses, while ensuring security and compliance remains at the centre of our services and infrastructure. Although Airwallex is not a bank, in many crucial aspects, we are regulated just like a bank. As such, there are a number of ways we protect our customers:

A deep compliance understanding in every region: Today, we have lawyers and compliance officers in every jurisdiction in which we operate, focusing on the regulatory and financial crime aspects of compliance. Our global teams work as an integrated unit to maintain the highest legal, regulatory and compliance standards.

Automated transaction monitoring: We use a data-driven transaction monitoring system which provides alerts based on customer behavior and account activity. Our monitoring can be tailored to new situations and compliance requirements quickly and efficiently.

Know Your Customer (KYC): All our customers are subject to our comprehensive KYC process where we collect the necessary information to understand account purposes and potential red flags.

Working with trusted partners: To be the global financial infrastructure of the digital economy, we work with trusted partners in the financial ecosystem, such as Visa and Mastercard. These organisations help us provide faster and more secure cross-border payments for our customers.

Training: Airwallex requires all employees to undergo risk and financial security training on at least an annual basis to ensure the appropriate level of awareness and knowledge within the organisation.

We believe the industry and all relevant stakeholders - including governments, regulators, banks and fintechs - must promote working together to improve security and compliance measures for businesses and consumers. As we enter into new markets, we will continue innovating and improving our compliance strategy to uphold the highest of regulatory and compliance standards at all times.

This underpins our core objective, to ensure we provide the most innovative global financial infrastructure to support our customers business needs, with security and compliance at the centre of each and every transaction.

Streamline your financial operations

Related article: Building a Culture of Compliance that Empowers Businesses to Grow Without Borders

Share

View this article in another region:Hong Kong SAR - EnglishHong Kong SAR - 繁體中文